prefrential issue 2

advertisement

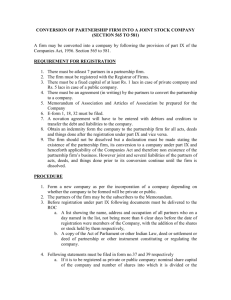

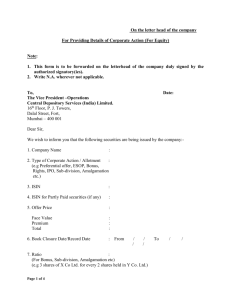

What is preferential issue? Preferential issue means issuance of equity shares to the promoters, promoter group or selected group of persons or any investor(s) on private placement basis. Thus if offer is made to1. Persons ,who are not members of Company 2. Selected members of Company 3. members in disproportionate manner(not pro rata) Such an offer shall be called Preferential issue. Who can be Investors? Institutional Investor Private equity investors High net worth individuals or Companies Regulatory Framework 1. 2. 3. 4. 5. For making a preferential issue, listed companies shall be governed by the provisions contained in Chapter XIII and Chapter XIII-A of the SEBI (Discloser and Investor Protection ) Guidelines,2000. certain provisions of:Securities Contracts(regulation) Act, 1956 Listing Agreement Indian Stamp Act 1899 Companies Issue of Share Certificate) Rules 1960 SEBI(Substantial Acquisition of shares and Takeover) Regulations 1997 In-Principle approval from Stock Exchange Clause 24(a) of the listing agreement says prior to the preferential issue of shares, the Company shall obtain an ‘In-Principle’ approval from BSE for grant of ‘in principal’ approval, Stock Exchange insist upon production of specific identity of the proposed allottees Authorization in the Articles & Resolution requirement A company shall be authorized by its Article to issue shares on preferential basis. A Company can offer further shares to any person, whether they are shareholder or not, if a special resolution to that effect has been passed in the general meeting. If company fails in getting Special Resolution but get Ordinery resolution then C.G approval shall also be required. Allotment Allotment by the Board pursuant to any resolution passed at a meeting of shareholder of a Company granting consent for preferential issues of any financial instrument, shall be completed within a period of fifteen days from the date of passing of the resolution. Where the allotment on preferential basis is pending for want of any approval for such allotment by CG, the allotment shall be completed within 15 days from such approval Restriction on number of offerees Offer or invitation of preferential issue can’t be made to 50 persons or more. Section 67 of the Act prescribes that private placement made by companies , other than non- banking financial companies and public financial institutions, to 50 persons or more will be deemed to the public issue. However ,Shares issued to certain category of person under Employee Stock option Scheme or Employee Stock Purchase Scheme or Sweat Equity Shares shall not be reckoned for calculating this limit. Pricing of the issue at a price higher of the following Avg weekly high / low closing prices of shares quoted in STX during 6 months preceding the relevant date OR Avg weekly high / low closing prices of shares quoted in STX during 2 weeks preceding the relevant date Explanation "relevant date" means the date 30 days prior to the date on which the meeting of general body of shareholders is held, in terms of Section 81(1A) to consider the proposed issue. A listed company shall not make any preferential issue unless it has obtained the PAN of the proposed allottees. Example of Pricing Date of meeting : 31st Oct2009 Relevant date :1st Oct 2009 Average of weekly high & low of closing price During preceding 6 During preceding month of relevant date 2 weeks of relevant date Case 1 Case 2 15 26 19 24 Price (Rs.) 19 26 Lock-in period for promoter/s The instruments allotted on a preferential basis to the promoter / promoter group, shall be subject to lock-in of 3 years from the date of their allotment In any case, not more than 20% of the total capital of the company, including capital brought in by way of preferential issue, shall be subject to lock-in of three years from the date of allotment. In addition to the requirements for lock in of instruments allotted on preferential basis to promoters/ promoter group the instruments allotted on preferential basis to any person including promoters/promoters group shall be locked-in for a period of 1 year from the date of their allotment Auditor’s Certification In case of every issue of shares or other financial instruments having conversion option, the statutory auditors of the issuer company shall certify that the issue of said instruments is being made in accordance with the requirements contained in these guidelines Copies of the auditors certificate shall also be laid before the meeting of the shareholders convened to consider the proposed issue If shares are issued for consideration other than cash valuation of the assets in consideration for which the shares are proposed to be issued shall be done by an independent qualified valuer and the valuation report shall be submitted to the BSE ‘Valuer” means C.A or merchant banker appointed to determine the value of intellectual property rights or other value addition. Proceed from issue The details of all monies utilised out of preferential issue proceeds shall be disclosed under appropriate heads in B/S indicating the purpose for which such monies have been utilised. The details of un utilised monies shall also be disclosed under a separate head in the B/S indicating the form in which such unutilised monies have been invested. Details can be given in the notes to accounts Clause 43(a)of listing agreement Every Company shall furnish on a quarterly basis statement to the Exchange indicating the variation between projected utilisation of funds and/or projected profitability statement made by it in its object/s stated in the explanatory statement to the notice for the general meeting for considering preferential issue of shares and the actual utilisation of funds and/ or actual profitability. Clause 43(b) of listing agreement The statement referred to above shall be given for each of the years for which projections are provided in its object/s stated in explanatory statement to the notice for considering preferential issue of shares and shall published in newspapers with the unaudited /audited financial result as required under clause 41 . Clause 43 (C ) of listing agreement If there are material variation between the projections and the actual utilisation/profitability ,the Company shall furnish an explanation therefor in the advertisement and shall also provide the same in the Director’s Report. 49(IV) (D) of the listing agreement Every company shall disclose to the Audit committee, the uses applications of fund by major category ,quarterly Further on annual basis ,the Company shall prepare a statement of funds utilised for the purposes other than those stated in the notice and place it before audit committee shall make appropriate recommendation to the board to take up steps in this matter. This statement shall be certified by the Statutory auditors of the Company. SEBI (substantial Acquisition of shares and takeover regulation) Any new acquirer who is allotted shares having voting rights on a Preferential basis shall make a Public Announcement under reg.11 in case shares allotted to him to exercise 15% or more but less than 55% of total voting right either himself or together with person acting in concert, or in case of beyond 55% of paid up post preferential equity If preferential issue is made to QIBs Equity share shall be: 1. Of the same class and listed on stock exchange 2. In compliance with the prescribed minimum public shareholding requirement of the listing agreement. Note: Shares issued under QIP are not subjected to lockin. QIBs means Public financial Institution as defined in 4A of the Act Scheduled Commercial bank Mutual fund Foreign Institutional Investor registered With SEBI Multilateral and bilateral development financial Institution Venture Capital fund with SEBI Foreign Venture Capital registered with SEBI State industrial development corportions Insurance companies registered with IRDA Providend funds with minimum corpus Rs 25 crore Pension Fund with minimum corpus of Rs. 25 crore Public financial Institution u/s 4A ICICI IFCI IDBI LIC UTI IDFC Placement Document is mandatory to be provide to select investors through serially numbered copies. The placement document shall contain all material information It should also be posted on website of BSE and of company with disclaimer to the effect that it is in connection with an issue to QIBs and that no offer is being made to public or to any other category of Investors. A copy of placement document shall be filed with SEBI with in 30 days of the allotment Resolution & Allotment Requirements A company can make a preferential issue to QIBs if a special resolution to that effect has been passed. The placement made pursuant to authority of same shareholder's resolution shall be separated by at least six months between each placement. Allotment shall be completed in within 12 months from the date of passing of the resolution Allotment to mutual Funds Mutual fund shall be alloted a minimum of 10 % of specified securities. If no mutual fund is agreeable to take up the minimum portion or any part then such minimum portion may be allotted to other QIBs Restriction on allotment No allotment shall be made ,either directly or indirectly, to any QIB being a promoter or any person related to promoter/s QIBs who has all over or any of the following rights shall be deemed to be related 1. Rights under a shareholder’s agreement or voting agreement entered in to with promoters 2. Veto right 3. Right to appoint any nominee director Note :- A QIB who does not hold any shares in the issuer and who has acquired the aforesaid rights in the capacity of a lender shall not be deemed to be a person related to promoter/s Number of allottees 2 where the issue size is less than o equal to Rs.250 crore, 5, where the issue size is greater than 250 crore. No single allottee shall be allotted 50 % of the issue size. QIBs under the samegroup shall be single allottee. Investors shall not allowed to withdraw their bids after the closure of issue. Obligations of Merchant Banker Any issue and allotment to QIBs shall be managed by Merchant Banker(s) registered with SEBI. The M.B shall give due diligence certificate to BSE M.B shall also furnish any document ,undertaking etc required for the purpose of seeking In principal approval and final permission from BSE Restrictions on amount raised The aggregate of the proposed placement and all previous placement made in the same financial year to QIBs shall not exceed five times the networth of issuer as per audited balance sheet of previous financial year.