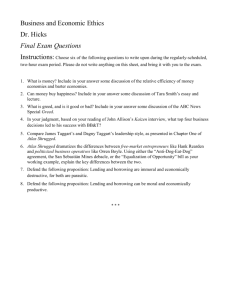

trade imbalance

advertisement

Trade Balance 7-1 National Income Accounting • Y=C+I+G+NX (Income-expenditure identity) Y=GDP (gross domestic product) NX=EX-IM=net exports of goods & services • S=I+CA, where CA=NX+NFP CA=current account balance NFP=net factor payments from abroad • If S<I, then CA=S-I<0 If a country saves less than it invests, it must run a current account surplus. 7-2 National Income Accounting • Spvt=I+(-Sgovt)+CA (Use-of-saving identity) When CA is lowered, o.t.s being equal, Spvt is lowered too. (trade deficit and low private saving rate) When –Sgovt is more positive, o.t.s. being equal, CA becomes lower (more severe gov deficit and worsened trade deficit) • Ignore NFP, focus on NX • Why NX is already zero in our course? 7-3 Textbook treatment of NX food • Assumed one-shot interaction • A nation always consumes up its value of production (because every agent does) • No reason to consume less • unable to consume more D Q Iso-value line cloth 7-4 Textbook Treatment of NX • • • • Value of production = pCQC+pFQF Value of consumption=pCDC+pFDF pCQC+pFQF=pCDC+pFDF Suppose C is exportable good; F is importable good • pC(QC-DC) - pF(DF-QF)=0 • Hence, NX=0 7-5 International Borrowing and Lending • International capital mobility refers to mobility of financial assets, or capital, across countries. Financial capital is a source of funds used to build physical capital (ex., factories and equipment). • International capital mobility can be interpreted as intertemporal trade: trade of goods consumed today by borrowers in return for goods consumed in the future by lenders. 7-6 International Borrowing and Lending (cont.) • For any economy, there is a trade-off (opportunity cost) between consuming today and saving for the future: resources can either be consumed or saved. To save and invest more today typically means that economies need to consume less today. • We represent this concept by drawing a special kind of production possibility frontier, an intertemporal production possibility frontier. 7-7 Fig. 7-5: The Intertemporal Production Possibility Frontier 7-8 International Borrowing and Lending • Some countries will have a comparative advantage in spending current output/income (in current consumption). • Others will have one in saving current output/ income (in future consumption). • A comparative advantage in current consumption would mean a lower opportunity cost of spending current income. would be reflected in an intertemporal PPF that is biased toward current consumption. 7-9 International Borrowing and Lending (cont.) • Suppose that the domestic country has a comparative advantage in (bias towards) current consumption, while the foreign country has a comparative advantage (bias towards) future consumption. • In the absence of international borrowing and lending, the relative price of current consumption should be lower in the domestic country. • But what is the relative price of current consumption? 7-10 International Borrowing and Lending (cont.) • The price of borrowing 1 unit of output/income to consume today is the output/income that needs to be repaid in the future: principal + interest = 1+r, where r is the interest rate The price of current consumption relative to future consumption is 1/(1+r) • The opportunity cost of consuming 1 unit of output/ income today is the output/income that could be earned by saving it: principal + interest = 1+r, where r is the interest rate The opportunity cost of current consumption relative to future consumption is 1/(1+r) 7-11 International Borrowing and Lending (cont.) • If international borrowing and lending are allowed, the domestic country will “export” current consumption (that is, borrow). The domestic country initially has a lower relative price of current consumption 1/(1+r) The domestic country initially has a higher interest rate r. A higher interest rate r implies a higher return to consumption and investment in production processes: they are highly desirable and profitable so that the domestic country should borrow from foreign lenders. 7-12 Fig. 7A2-1: Determining Home’s Intertemporal Production Pattern 7-13 Fig. 7A2-2: Determining Home’s Intertemporal Consumption Pattern 7-14 Fig. 7A2-3: Determining Foreign’s Intertemporal Production and Consumption Patterns 7-15 Fig. 7A2-2: Determining Home’s Intertemporal Consumption Pattern 7-16 Demography: Life cycle consideration • Life cycle consideration • A country is likened to a person: save when young & working, de-save when old • Hence, when ageing, a country runs a trade surplus first, followed by a trade deficit 7-17 A hypothetical example • Suppose each agent lives two periods: young (working) and old (retiring). • Suppose a small country in which all residents are young but they do not decide to have children. • Suppose only one, non-storable good is produced. But one foreign asset is available (call it US treasury bond, with constant interest rate r) • Time 1: all residents are young; trade surplus • Time 2; all residents are old; trade deficit • Time 3: the country disappears; NX=0 7-18 A hypothetical example Trade balance Trade surplus Period 2 Period 1 Trade deficit Period 3 time 7-19 A hypothetical example • CA=S-I • Demography explains S. In case I is unrelated to demography or less responsive to it, then the change in S will reveal itself in CA • In China, weak financial markets prevent channeling of savings to those who have good business ideas 7-20 Median age: China versus US Median Age 50 45 40 35 30 25 20 15 10 5 0 50 55 60 65 70 75 80 85 90 95 China Median age (Years) Medium variant 0 5 10 15 20 25 30 35 40 45 50 U.S.A. Median Age (Years) Medium variant 7-21 Total Dependency Ratio: China versus US Total Dependency Ratio 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 50 55 60 65 70 75 80 85 90 USA: Total Dependency Ratio 95 0 5 10 15 20 25 30 35 40 45 50 China: Total (Young+Old)dependency ratio 7-22 Dependence ratio: China 7-23 Difficulty • The example predicts CA be negative some day. For Germany and Japan, whose populations have aged for a long time, still there is no sign their CA will become negative. • Way out: to look at richer demography that allows for richer dynamic of CA change 7-24 Demography Sex ratio in China (males per 100 females) year At birth Population aged 0-4 1953 104.9 107.3 1964 103.8 106.5 1982 107.6 107.0 1990 111.8 109.8 1995 116.6 118.8 2000 117.8 120.8 2005 122.0 120.0 2010 -- 121.0 (estimated) 7-25 Demography • Sexual Imbalance (missing women) • one child policy + son preferences • Parents and their single sons save more to increase competitiveness in the marriage market • Evidence: counties with more skewed sex ratio have higher saving rates • It is argued that sexual imbalance may account of up to ½ of the China’s trade surplus with the US. 7-26 Data/mis-measurement problem • “Dark Matters in China’s Current Account” by Zhiwei Zhang, a staff member of HKMA • One bias due to under-estimated returns on foreign investments in China • all earnings for foreign investments should be recorded in current account as a negative item, regardless if the earnings are re-invested in China or repatriated out • Official CA statistics; official stock of FI by end of 2006 is US$1.03T; FI earnings US$57.3B in 2007 => hence, ROR 5.5% • The author’s estimate: FI earnings ~ US$109.6B • Evidence: ROR should be higher (OECD studies found 14.3%). 7-27 Data/mis-measurement problem • 60% of China’s exports are actually made by foreign funded firms • China has been top exporter of cell phones and notebook computers, but the cell phones are mostly made by Nokia and Motorola, and notebooks by Dell and HP. • The importance of foreign capital is asymmetrically reflected in China’s current account the explosive growth of exports (largely due to foreign firms moving production bases into China) are well recorded, But the profits foreign firms made into China are substantially under-recorded. 7-28 Data/mis-measurement problem • Another source of bias: capital inflows misreported as trade surplus. • The expectation for RMB appreciation heightened in mid 2004, and made one-way bet for RMB a profitable arbitrage opportunity. • Firms in China can over-report their exports and under-report their imports. • China’s current account surplus is over-estimated, and capital account surplus is under-estimated. • Misreported capital flows through the trade channel amounts to 1.9% of GDP in 2007. 7-29 Data/mis-measurement problem • Accounting for Growth in China’s Exports by Firm Ownership Stateowned Foreignfunded Collective Private 2002 16% 62% 8% 14% 2003 13% 62% 6% 19% 2004 10% 63% 4% 22% 2005 9% 63% 3% 26% 2006 11% 58% 2% 29% 2007 13% 53% 2% 31% 7-30 Other explanations • S=I+CA • It is China, stupid! Currency manipulation (RMB undervalued) Mercantilism (export is good, import is bad) Saving rate too high (culture?) Poor financial market • It is US, stupid! Saving rate too low (culture?) Developed financial market • J.M. Keynes: “If I owe you a little money and I don’t repay, I have trouble. If I owe you a lot of money and don’t repay, you have trouble!” 7-31 Prognosis: China as a transformative /de-stabilizing factor • Increasing economic power Education attainment • 2000: 1 million college students graduated • 2010: more than 6 million college students graduated (c.w. 3.5 million first year students in US in 2008) • Now 22% of the cohort go to college Rate of return of capital has no sign to slow down • Destabilizing the global order • But growth will slow down one day… • Income inequality 7-32 Prognosis: China as a transformative /de-stabilizing factor • Sexual imbalance 1.7 million un-marriageable boys being borne each year =5 times of the total girls borne a year in Canada (around 330K) =50 times of the total girls borne a year in HK (around 30K) • • • • • Lack of non-material ideals Communist Party an effective autocracy forever? 1949-1978: passion 1979-2008: interest 2009-2039: ?? 7-33 Topics • • • • • • • • Trade balance & capital flows Textbook case Data problem Demography Lack of investment opportunity Undeveloped financial market Exchange manipulation Culture—saving glut 7-34