MLA-2015-Jones-Act-presentation-USCG

advertisement

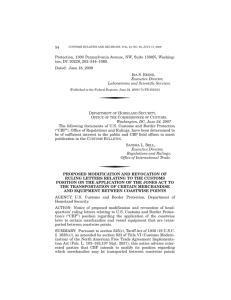

U.S. CITIZENSHIP REQUIREMENTS FOR THE COASTWISE TRADE Captain Patrick J. McGuire Office of Maritime & International Law U.S. Coast Guard 100 Hundred Years of the Jones Act • The Shipping Act of 1916 (39 Stat 728 (1916)) established a standard for U.S. entity citizenship in section 2 of the Act. • Section 2, as modified subsequently by the Merchant Marine Act, 1920 (41 Stat 988 (1920)) – established the 75% U.S. citizen equity ownership requirement – remains the standard today – Codified, as amended, at 46 U.S.C. § 50501 Statutory Framework • 46 U.S.C. § 50501 a corporation, partnership, or association is deemed a US citizen operating a vessel in the coastwise trade, at least 75 percent of the interest must be owned by U.S. citizens Additional corporate requirements Determining Controlling corporate interest Determining 75% interest by U.S. citizens Statutory Framework • 46 U.S.C. § 12103 a vessel COD may be issued only if the vessel is: Wholly owned by one or more eligible individuals or entities; At least 5 net tons as measured under part J; and Not documented under the laws of a foreign country. Eligible Owners a U.S. citizen; An association, trust, joint venture, or other entity if— A partnership if— each general partner is a U.S. citizen controlling interest in the partnership is owned by U.S. citizens A corporation if— incorporated under U.S. laws or State law; CEO and Board Chairman are U.S. citizens; and No more of its directors are noncitizens than a minority of the number necessary to constitute a quorum Statutory Framework • 46 U.S.C. § 12112 A coastwise endorsement may be issued for a vessel thatSatisfies the requirements of section 12103 Built in the U.S. Limited exceptions for vessels not built in the U.S. Otherwise qualifies under the laws of the United States to engage in the coastwise trade. Statutory Framework • 46 U.S.C. § 12139 For vessels engaged in the coastwise trade Owners, masters, charterers, and mortgagees of documented vessels may be required to submit reports to the Coast Guard to ensure compliance with The Jones Act. 46 C.F.R. Part 67 Statutory Framework • 46 U.S.C. § 12140 Authority to conduct investigations and inspections to ensure compliance Subpoenas may be issued For witnesses For the production of documents or other evidence Subpoenas enforced through the District Court Regulatory Framework • 46 C.F.R. § 67.31 Stock or equity interest requirements to support U.S. citizenship requirements For an entity comprised, in whole or in part, of other entities which are not individuals each entity contributing to the stock or equity interest qualifications of the entity holding title must be a U.S. citizen eligible to document vessels in its own right with the trade endorsement sought. Regulatory Framework • 46 C.F.R. § 67.39 A corporation meets U.S. citizenship requirements if – incorporated under U.S. laws or State law; CEO, by whatever title, is a U.S. citizen; Chairman of the Board is a U.S. citizen; and No more of its directors are non-citizens than a minority of the number necessary to constitute a quorum. 75 percent of the stock interest in the corporation is owned by U.S. citizens Regulatory Framework • 46 C.F.R. § 67.43 a properly completed original Application for Initial Issue, Exchange, or Replacement of Certificate of Documentation; or Redocumentation (form CG-1258) establishes a rebuttable presumption that the applicant is a U.S. citizen. Publicly Traded Corporations • Burden on the company to employ and administer mechanisms to establish and demonstrate compliance with the law • Positive consideration given to a company’s diligent and good faith efforts See NVDC Federal Register notice Nov 26, 2012 (77 FR 70452) Publicly Traded Corporations Mechanisms used to monitor and determine compliance: • Use of the Depository Trust Company segregated account (or ‘‘SEG–100’’) system; • Monitoring SEC filings re: 5% holders (Schedules 13D, 13G, Form 13F) and follow-up requests for information from filers; • Use of protective provisions in organizational documents in order to guard against and rectify the possibility of what are referred to as excess shares; • Communications with Non-Objecting Beneficial Owners (or‘‘NOBOs’’) • Analysis of registered stockholders; and • Use of dual stock certificates. See NVDC Federal Register notice Nov 26, 2012 (77 FR 70452) Questions? Point of Contact National Vessel Documentation Center Doug Cameron (304) 271-2506