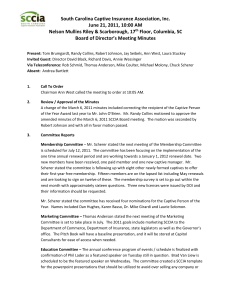

IMAC-CaptiveBasics-Week-4-Regulation and Industry Developments

advertisement

Regulation and Industry Developments James Trundle – CIMA Ron Sulisz - SRS Linda Haddleton – Kane Agenda James Trundle - CIMA • Goals of Insurance Regulation • Risk-Based Regulation • Corporate Governance & the Rule on Risk Management 2 The Goals of Insurance Regulation • Insurance Core Principles (ICP) issued by IAIS – ICP 1 section 1.3 states: “the principal objectives of supervision promote the maintenance of a fair, safe, and stable insurance sector for the benefit and protection of policyholders.” 3 The Goals of Insurance Regulation • Insurance Core Principles (ICP) issued by IAIS – ICP 1 section 1.3.1 states: “all insurance supervisors are charged with the objective of protecting the interests of policyholders.” How? 4 The Goals of Insurance Regulation • • • • • • Laws and Regulations Ongoing monitoring and supervision Solvency standards Corporate governance Risk management Intervention 5 Approaches to Insurance Regulation Compliance Based Regulation • Application of the Law regardless of the material risk of the licensee • Focus on insurance, market and credit risk • Resource Intensive • Does not easily incorporate non-prudential risk e.g. operational • Easy to administer 6 Approaches to Insurance Regulation Risk Based Regulation • Adoption of “proportionality” i.e. size, nature and complexity. • Resource Efficient • Requires constant reassessment of risk • Encompasses all risk including operational risk Solvency II ??? 7 Corporate Governance • Revised ICPs now available: http://www.iaisweb.org/ICP-material-adopted-in-2011-795 • Corporate Governance is now ICP 7 rather than ICP 9 “The supervisor requires insurers to establish and implement a corporate governance framework which provides for sound and prudent management and oversight of the insurer’s business and adequately recognises and protects the interests of policyholders.” 8 The Rule on Risk Management • Companies already consider their risk environments but CIMA want licensees to document their processes to evidence: – Board Strategy – Risk Appetite – Appropriate Controls • Not interested in necessarily reducing risk. Taking risk is acceptable as long as it’s monitored and controlled. 9 The Rule on Risk Management • Rule and risk management framework should be a useful tool for captive boards and management to assess and management captive’s risk • Focus of Rule and risk management framework follows range of risk management issues identified in ICP 16 - Enterprise Risk Management for Solvency Purposes “The supervisor establishes enterprise risk management requirements for solvency purposes that require insurers to address all relevant and material risks.” 10 The Rule on Risk Management • All insurance companies have adopted a RMF appropriate to their size and complexity that will be made available to CIMA at their request. • Key words: – Size – Complexity 11 The Rule on Risk Management • For Class B insurers writing the risks of their parent or parents: 1. The Board to discuss and minute their tolerance for risk. 2. The Board to make a statement…… to be minuted……. that “given the size and complexity of their Company, the Board do not feel that any further formal documented process is required”. For Class B insurers writing unrelated party risks: 1. CIMA will be expecting the Board of Directors to ensure that protocols on key risks are implemented effectively and can be periodically reviewed by CIMA. This includes the process of discussing the Boards tolerance for risk, quantification of risk and processes to identify, assess, mitigate and monitor risk. 12 The Rule on Risk Management • Key risks to be considered: – – – – – – – – Credit risk Insurance underwriting and reinsurance risk Investment risk (including use of derivatives) Market risk (including liquidity risk) Strategic and tactical risks from the business plan Concentration risk Compliance risk Operational risk 13 The Rule on Risk Management • RMF must be appropriate having regard to the size and complexity of the insured, and the nature of its risk exposure (section 5.1.2) • RMF must include identification and adherence to appropriate tolerance level or risk limit for material sources of risk (section 5.1.5) • Depending upon size and complexity of insurer and nature of exposures, RMF should include periodic qualitative and quantitative analyses (e.g., stress tests) (section 5.1.7) 14 The Rule on Risk Management • RMF must include regular surveillance of market environment to identify and respond to changes in operating environment that may adversely impact insurer’s business (section 5.1.6) • RMF must include effective and comprehensive review by independent functions, e.g., auditors, actuaries, risk and compliance services and insurance managers (section 5.2) 15 Agenda Ron Sulisz - SRS • Captive Investment Policy – An Overview • The Competition – Global Captive Market Statistics, Comparative Differences and Niche Markets • Developments in the Cayman Captive Industry 16 Captive Investment Policy • CIMA Statement of Guidance (SOG) “Asset Management & Investment Strategy For Insurance Companies” • General Guidance • Accounting Issues – Unrealized Losses 17 Statement of Guidance • www.cimoney.com.ky – Regulatory Framework • Index of Regulatory Measures – Insurance – Index of Measures • Rules, Statements of Guidance (SOG), Regulatory Policy (RPY), Regulatory Procedures (PRP) and Forms (F). • Subheadings for Licensing, Business Conduct, Prudential Standards, Reporting and Anti Money Laundering 18 Statement of Guidance • • • • • • • • Statement of Objectives Asset and Liability Management Segregation of Assets The Investment Process The Investment Strategy Operational Issues Monitoring and Control Audit 19 Statement of Guidance • The Investment Strategy – 5.1 – Asset mix – 5.2 – Any limits on geographical area, markets, sectors, counter-parties and currency. – 5.3 – Overall approach to the selection of individual securities; and consideration to risk profile of Company and its liquidity needs. – 5.4 – Any restrictions on assets. – 5.5 – Details of any derivatives and/or structured products. – 5.6 – If actively managed, the scope of investment flexibility through quantitative asset exposure limits. 20 Statement of Guidance • The Investment Strategy – 5.1 – Asset mix • In general, no more than 20% of the actuarially determined reserves should be invested in equities without prior approval. • In addition, no P&C insurer should cover their technical reserves with short-term liquid assets. 21 General Guidance Balance Sheet Investments $10 million Actuarial Reserves $ 7 million Net Worth $ 3 million 20% of $7 million = $1.4 equities 100% of $3 million = $3.0 equities TOTAL $4.4 equities 22 General Guidance • The Investment Strategy – Asset mix The Board of Directors has adopted a formal investment policy which maintains a strategy which utilizes short term, intermediate term and longer-term investment components consistent with the liability profile developed in the annual actuarial report. The investment guidelines and asset allocation, which allows for “30% equities with a range of + and – 5%”; under the condition that no more that 20% of the actuarial reserves will be invested in equities. 23 Accounting Issues – Unrealized Losses • At times accounting net worth has been less than the minimum net worth regulatory net worth. • CIMA takes into consideration more than just balance sheet net worth into consideration for regulatory net worth. Other considerations include: – Retrospective provisions in the program; and – Confidence level funding of reserves. insurance 24 Accounting Issues – Unrealized Losses Balance Sheet Investments (at market) $ 6 million Total Reserves $ 7 million Net Worth $ (1) million * Retrospective insurance program doesn’t include the unrealized gains or losses on investments so a $4 million receivable can not be booked; however CIMA knows that when investment gains or loss are realized the premium will be collected from the Shareholder/Insured. Also Shareholder/Insured has ability to pay $4 million assessment. 25 Accounting Issues – Unrealized Losses Balance Sheet Investments (at market) $ 6 million Total Reserves (at 90% c.l.) $ 7 million Net Worth $ (1) million Not a retrospective insurance program but: Reserve @ 90% c.l. = $7.0 Reserve @ expected c.l.= $5.0 Difference $2.0 26 The Competition – the Global Captive Market • Estimated over 5,000 captive worldwide. • Use the database of Business Insurance for 7 years for our analysis today which had 5,390 captives for the calendar year ending 2009. 27 Introduction • Breakdown the global captive statistics by geographical areas – Caribbean & Bermuda, USA and Rest of World. • Explain niche markets in certain domiciles. • Illustrate recent trends. 28 Statistics - Overall • What Country is the largest captive domicile? 29 Statistics - Overall • What Country is the largest captive domicile? • However, each state has its own captive legislation, therefore each should be evaluated independently as they are domicile in their own right. 30 Statistics - Overall Caribbean & Bermuda – 2,629 or 49% USA – 1,666 or 31% Rest of World 1,095 or 20% 31 Statistics – Largest Domiciles Bermuda – 885 Cayman Islands – 780 Vermont - 560 (Top 3 Represent 41% of Global Market) 32 Bermuda – Brief History • Largest International Domicile. • Established in the 1950’s when US companies needed to create more capacity than the commercial marketplace had available. • Reiss conceived wholly-owed insurance company. • Companies also found they could: – Reduce their net premium costs for property insurance and other tariff rated coverages, – Offer coverages that were not available in the commercial marketplace and – Enjoy the freedom of a regulatory environment that welcomed the captive structure. 33 Cayman Islands - Brief History • Second largest International Domicile • In the 1970s, when litigation exploded and jury awards became increasingly more onerous, coverage availability for medical malpractice became more difficult to obtain. It was during this time that the Cayman Islands established itself as a captive domicile by accepting Harvard's medical-malpractice captive. • The Cayman Islands has since become the largest domicile in the world for healthcare captives with 266 medical malpractice captives as of June 30, 2010. • 2nd niche is CAT Bonds and 3rd Group captives. Statistics – Caribbean & Bermuda (From Business Insurance Published March 2010) Domiciles 2003 2004 2005 2006 2007 2008 2009 Bermuda 1,150 1,000 987 989 958 960 885 Cayman Islands 644 694 733 740 765 777 780 British Virgin Islands 307 350 380 400 409 332 285 Barbados 248 290 242 235 219 230 225 Anguilla N/A N/A N/A N/A N/A 200 209 Turks & Caicos 159 164 166 169 173 182 203 Bahamas 18 19 22 26 28 16 15 Netherlands Antilles 18 18 16 17 15 15 14 Panama 8 3 4 4 4 5 5 Puerto Rico 0 0 1 0 0 0 5 U.S. Virgin Islands 7 7 9 6 6 3 3 2,559 2,545 2,560 2,586 2,577 2,720 2,629 -0.55% 0.59% 1.02% -0.35% 5.55% -3.35% Total Year to Year Growth Excluded Nevis estimated 60+ and Tortula estimated 60+. 3% ↑ since 2003 Bermuda was 25% of world market in 2003. In 2009 only 16%. Statistics – Caribbean & Bermuda (From Business Insurance Published March 2010) Domiciles 2003 2004 2005 2006 2007 2008 2009 Bermuda 1,150 1,000 987 989 958 960 885 -13.04% -1.30% 0.20% -3.13% 0.21% -7.81% 694 733 740 765 777 780 7.76% 5.62% 0.95% 3.38% 1.57% 0.39% 350 380 400 409 332 285 14.01% 8.57% 5.26% 2.25% -18.83% -14.16% Year to Year Mvmt Cayman Islands 644 Year to Year Mvmt British Virgin Islands Year to Year Mvmt 307 In the 6 years there was a decrease of 23% in Bermuda and a decease of 7% in BVI; while the Cayman Islands saw an increase of 21%. Statistics – Caribbean & Bermuda • Fourth largest – Barbados – 225 – Historical tax treaty with Canada however recent TIEA’s with other domiciles in the region (i.e. Bermuda, Cayman Islands, others) with no tax environments. – Other domiciles in region will try to compete on service levels and geographical advantages. • Fifth largest – Anguilla – 209 – Grown at the expense of BVI. – Mainly 832(b) captives. • Sixth largest – Turks and Caicos – 203 – Known for niche hybrid reinsurance companies (PORC’s) – Auto dealer warranty captive. Vermont – Brief History • The largest USA captive domicile and 3rd largest in the world • In 1981, the Vermont Legislature passed the Special Insurer Act which was designed to provide a unique and attractive statutory framework for captive formation. These landmark regulations had become the model of captive regulation in USA . • The captive insurance industry has received universal and enthusiastic support from the governors and state legislators. • Vermont's Infrastructure. 38 Statistics – USA Domiciles Vermont Hawaii South Carolina Utah Nevada District of Columbia Kentucky Arizona Delaware Montana New York Georgia Colorado Missouri Alabama Tennessee Michigan Arkansas Illinois Kansas Oklahoma South Dakota Rhode Island Connecticut Louisiana Maine Virginia West Virginia Total USA Year to Year Growth (From Business Insurance Published March 2010) 2003 507 122 67 2 19 2004 524 147 106 2 39 2005 542 158 122 15 58 2006 563 160 146 30 95 2007 567 163 158 92 108 2008 557 165 156 122 123 2009 560 162 161 148 126 20 0 18 4 9 18 16 11 N/A 0 4 N/A 1 3 0 0 1 1 N/A N/A N/A N/A N/A 823 40 5 39 5 10 28 14 10 N/A 0 4 N/A 1 3 1 0 1 0 N/A N/A N/A N/A N/A 979 59 6 53 5 13 33 15 9 N/A 0 3 N/A 1 3 1 1 1 0 N/A N/A N/A N/A N/A 1,098 70 10 83 6 21 39 17 8 N/A 1 3 N/A 1 3 1 1 1 0 N/A N/A N/A N/A N/A 1,259 77 31 94 18 30 44 14 6 N/A 2 3 N/A 1 2 1 1 1 0 N/A N/A N/A N/A N/A 1,413 90 67 106 41 35 50 14 6 3 3 3 1 1 1 1 1 1 N/A N/A N/A N/A N/A N/A 1,547 116 105 99 49 47 47 18 6 6 5 4 2 1 1 1 1 1 N/A N/A N/A N/A N/A N/A 1,666 18.96% 12.16% 14.66% 12.23% 9.48% 7.69% 102% ↑ since 2003 Statistics USA Vermont - 560 Hawaii - 162 South Carolina – 161 Utah – 148 Nevada – 126 DC – 116 Kentucky - 105 Arizona - 99 40 Statistics USA West East Vermont - 560 Hawaii - 162 South Carolina – 161 Utah – 148 Nevada – 126 DC – 116 Kentucky - 105 Arizona - 99 41 Statistics – USA (From US Captive magazine 2010 Edition) Domiciles Niche Details by Sector 2009 Legislation Group captives Vermont 560 1981 42 of Fortune 100 / RRG's Manufacturing 107 / Healthcare 89 21% Hawaii 162 1986 Japanese/West Coast USA Construction 47 / Healthcare 28 10% South Carolina 161 2000 RRG's Utah 148 2003 831b's Real Estate / Property Mgmt / Const 0% Nevada 126 1999 Group Captives Healthcare / Construction 56% District of Columbia 116 2000 n/a Healthcare 31% Kentucky 105 2000 n/a Diverse 11% Arizona 99 2001 n/a Health 31 / Construction 22 22% 25% Statistics – Rest of World (From Business Insurance Published March 2010) Domiciles Guernsey Luxembourg Isle of Man Dublin Singapore 2003 383 216 173 205 49 2004 379 219 175 214 57 2005 382 208 165 154 60 2006 381 208 161 154 60 2007 368 210 155 131 62 2008 370 262 156 131 63 2009 355 251 145 114 63 Switzerland Labuan New Zealand British Columbia Gibraltar Mauritius Vanuatu Malta Jersey Hong Kong Guam 34 21 N/A 12 12 13 N/A 1 15 2 1 1,137 50 21 N/A 13 12 13 N/A 0 13 2 1 1,169 48 29 N/A 15 14 13 N/A 8 15 2 1 1,114 48 26 N/A 18 14 13 N/A 5 15 2 1 1,106 48 31 N/A 20 19 13 N/A 5 5 2 1 1,070 42 30 20 17 19 13 16 7 5 2 N/A 1,153 42 32 22 18 17 12 10 9 3 2 N/A 1,095 2.81% -4.70% -0.72% -3.25% 7.76% -5.03% Year to Year Growth Of the largest 4 European domiciles, Luxembourg is the only one that has grown since 2003, and the major reason was the good year in 2008 (42 new captives). Statistics Rest of World Guernsey – 355 Luxembourg – 251 Isle of Man – 145 Dublin - 114 44 Statistics – Overall (From Business Insurance Published March 2010) Domiciles 2004 2005 2006 2007 2008 2009 World Carribbean & Bda Carribbean w/o Bda 3.85% 1.68% 3.75% 2.20% 7.11% -0.55% -0.55% 0.59% 1.02% -0.35% 5.55% -3.35% 9.65% 1.81% 1.53% 1.38% 8.71% -0.91% USA 18.96% 12.16% 14.66% 12.23% 9.48% 7.69% Rest of World 2.81% -4.70% -0.72% -3.25% 7.76% -5.03% USA (102% 6 year growth) is growing at a faster pace than Caribbean & Bermuda (3% 6 year growth) as well as the Rest of World (-4% 6 year growth). Statistics – Overall – Insurance Managers Manager Captives Under Mgmt % Cum % Aon 1,222 23% 23% Marsh * 1,120 21% 43% Willis 298 6% 49% USA Risk Group 234 4% 53% International Advisory Services * 200 4% 57% HSBC Insurance Management 194 4% 61% Atlas Insurance Management 170 3% 64% Alta 130 2% 66% Beecher Carlson 104 2% 68% AMS 100 2% 70% Tribeca Strategic Advisors 97 2% 72% Strategic Risk Solutions 95 2% 74% Chartis Insurance Management 87 2% 75% R&Q Quest Management 83 2% 77% Global Captive Management 79 1% 78% JLT Insurance Management 78 1% 80% Wealth Management Solutions 75 1% 81% Artex Risk Solutions 60 1% 82% Utah Captive Insurance 58 1% 83% Alternative Risk Management 52 1% 84% Risk Services 50 1% 85% Statistics – Overall – Insurance Managers • In 7 of the top 10 domiciles, all but BVI Marsh and Aon are of a significant presence. • The broker affiliated managers tend to be in multiple jurisdictions. • Of the independent managers only USA Risk Group, HSBC, and Strategic Risk Solutions are in more than one jurisdiction with a significant percentage of their presence in the top 3 jurisdictions. Overall Positive Observations • International innovation. Domiciles provide value by supporting – Segregated Cell Companies started in Guernsey – Catastrophe Bonds started in Cayman Islands – Sidecars started in Bermuda • Captive Consultants favour International Domiciles when recommending third-party risk coverages due to their flexibility. • International Domiciles provide an opportunity to operate in a more cost-effective environment (i.e. no premium taxes). Overall Positive Observations • International Domiciles have strong infrastructures for captive insurance with immense intellectual talent, that will continue to be as innovative in the future as they were in the past. Overall Negative Observations • International Domiciles are receiving negative press. • Political pressure from state authorities to domicile a captive in the US. Cayman Developments • Insurance Law 2010 • Regulation on Capital and Solvency • Insurance Business Symposium 2010 – Ten Recommendations 51 Insurance Law 2010 • www.cimoney.com.ky – Regulatory Framework • Laws and Regulations – Insurance Law (2008 Revision) – Insurance Law, 2010 – Insurance (Forms) Regulations (2003 Revision) – Insurance (Variations of Fees) Regulations, 2009 • Published with Gazette No. 21 on 11 October 2010 but is not “in force”. • Transitional provisions in the Schedule for Section 42(1). 52 Regulation on Capital and Solvency • “Soon Come”. • Split between Class A, B, C and D. – A – Domestic Insurance Company – B – Captive Insurance Company – C – Special Purpose Insurer – D – Open Market Reinsurance Company 53 IBS 2010 – Top Recommendations Consider Incorporated Cell Legislation. Industry “Fact Sheet”. www.imac.ky – Members – Cayman Islands Captive Industry Development of a Comparison Model. Statistical Domicile www.imac.ky – Members – Domicile Comparison Expand Captive Owners to new geographical and industry segments. Attendance at CRIMS in September 2011 54