OPIC Overview Presentation

advertisement

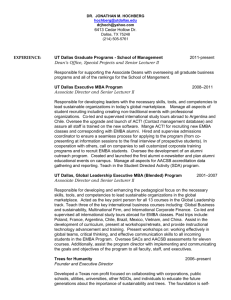

Overseas Private Investment Corporation OPIC Overview Presentation ESKOM CSP & SOLAR AUGMENTATION CONFERENCE August 26, 2013 John F. Moran, VP – Insurance, OPIC Our Organization As the U.S. Government’s development finance institution, OPIC mobilizes U. S. private capital to help solve critical development challenges and in doing so, advances U.S. foreign policy. Shading denotes OPIC-eligible countries OPIC currently manages a $16.4B portfolio of projects in 103 countries and operates on a self-sustaining basis at no net cost to the American taxpayer. The U.S. Government’s Development Finance Institution 2 Administration Development Priorities OPIC is uniquely positioned to support the administration’s new development strategy. OPIC’s Unique Position Foreign Policy Development OPIC Administration Priorities “We’re changing how we define development…we need to harness all the tools at our disposal—from our diplomacy to our trade and investment policies.” ~President Obama, 9/22/10 • Support broad-based, sustainable economic growth • Proactively target specific countries, regions, sectors, and technologies US Business • Mobilize private sector investment • Elevate development as a central pillar of national security policy The U.S. Government’s Development Finance Institution 3 Our Solutions OPIC offers innovative financial solutions to support private investors including debt financing, insurance, and support for private equity investment funds. Current Portfolio* Products OPIC operates under a $29B Statutory Capacity Investment Finance ― Limited recourse, long-term finance for private sector, commercial projects ― Loan amounts up to $250M per project ― Specific programs for providing finance to small-andmedium-sized enterprises Political Risk Insurance ― Protection against currency inconvertibility, expropriation and political violence, including terrorism ― Policy coverage up to $250M per project, up to 20 year term ― Fixed premium, cancellable only by insured Investment Funds ― Senior debt for private equity funds selected by competitive process ― Investment decisions made independently by selected fund managers ― Provide up to $250M with bullet repayment, zero coupon structure $18 $16.4 Billion $16 $3.1 Insurance $2.6 Investment Funds $10.7 Investment Finance $14 $12 $10 $8 $6 $4 $2 $- Total Exposure *As of September 30, 2012 The U.S. Government’s Development Finance Institution 4 Our Clients and Alliances OPIC coordinates with other U.S. government agencies and international partners to provide financing and risk mitigation products to a wide range of clients. Strategic Alliances Current Clients • Multinationals and Small/Medium Businesses U.S. Government • • • Nonprofits and Impact Investors Development Finance Institutions • • • • Other Partners The U.S. Government’s Development Finance Institution • • • Departments of State, Commerce, and Treasury USAID & USTDA Ex-Im Bank and SBA Millennium Challenge IFC and MIGA Regional Development Banks (IDB, ADB, AfDB, EBRD) Other Bilaterals (CDC, FMO, DEG) Chambers of Commerce AmChams NGOs Financial Institutions 5 Our Policy Standards Investors and project proposals must satisfy certain policy criteria to receive OPIC financing and insurance. Policy Standards for Projects Eligibility Criteria for Investors To be eligible for OPIC financing and insurance, applicants must: OPIC supported projects must: Contribute to sustainable development goals Be located in one of our ~160 eligible countries Comply with international environmental standards Support international human rights and worker rights regulations Cause no loss of U.S. jobs or adverse impact on the U.S. economy Have a commercially viable business plan and successful track record Involve the U.S. private sector in a meaningful way in the project seeking OPIC support Maintain private sector control (<50% government ownership) The U.S. Government’s Development Finance Institution 6 U.S. Connections in OPIC-Supported Projects OPIC policy requires that finance and direct insurance projects have a meaningful connection to the U.S. private sector. How Does OPIC Define U.S.? • A U.S.-organized entity generally must be at least 25% U.S.-owned. • A foreign organized entity generally must be at least majority U.S.-owned. How Does OPIC Measure U.S. Involvement? • OPIC requires U.S. involvement in the project company in an amount that is equivalent to 25% of the project company’s equity, which may be met with equity, long-term debt or other U.S. contracts or, by combining these types of involvement. • OPIC will support investment funds if the fund has raised U.S. equity equal to 25% of OPIC’s loan support or if the fund is managed by a U.S. manager. How Does OPIC Measure the Duration of U.S. Involvement? • For an ongoing project, U.S. entities need to retain a 25% interest in the project through final disbursement of the OPIC loan. In the case of a start-up or ‘greenfield’ project, the U.S. entities need to retain a 25% interest through physical completion of the project. • OPIC must approve any proposed transferee of the interest. How Does OPIC Define U.S. Small Business? • For OPIC to finance a project with a direct loan, the US involvement must come from US small business. A “small” business includes: a business with annual revenues during the last fiscal year of less than $400M; entities/individuals without revenues, net worth of less than $100M. • Consistent with the U.S. Small Business Administration, OPIC also considers a business with 500 or fewer employees as “small.” The U.S. Government’s Development Finance Institution 7 OPIC: Investment Finance OPIC provides a range of flexible, responsive finance to investments in developing markets • Characteristics of OPIC finance: Limited recourse, long-term finance for private sector, commercial projects Fixed rate terms for up to 20 years Loan amounts up to $250 million Flexible project structures that generally require only 25% U.S. equity • Can co-finance with IFC, Regional Multilateral Banks (ADB, AfDB, IADB, EBRD), other DFIs, ECAs (EXIM), and private financial institutions The U.S. Government’s Development Finance Institution OPIC’s Products: Investment Insurance OPIC has provided a range of Political Risk Insurance since 1971 Since 1971 through FY 2012, OPIC has issued insurance for 3,271 projects, at a total coverage amount of $43.9 billion In that time, OPIC has made 286 insurance claim settlements, totaling $969.6 million OPIC’s total recoveries are $892.1 million, or 92% of total claim settlements. Currency Inconvertibility Expropriation Political Violence, including Terrorism coverage Policy terms: o up to 20 years o Premium rates are locked in o May be canceled by insured, but not by OPIC o Up to $250 million in coverage available per project; no lower limit The U.S. Government’s Development Finance Institution OPIC’s Products: Investment Funds OPIC’s Investment Funds represent an innovative use of OPIC support • OPIC may not take equity in projects but provides “equity-like” senior debt • Managed by private Fund managers selected by OPIC in “Calls” • Fund managers selected make investment decisions without OPIC approval • Do not require US investor in project • OPIC policy criteria apply The U.S. Government’s Development Finance Institution Structure of OPIC Support OPIC Insurance OPIC Loan U.S. Banks U.S. Sponsor OPIC Fund Project Company Local Financing Project Local Sponsor Our Impact Over the past 41 years OPIC has supported over $200 billion of investment in developing markets that is projected to support over 277,000 U.S. jobs. Success Stories OPIC By the Numbers* Total Investment Supported Total Projects Financed $50 $100 $150 India: $750,000 in financing for Husk Power for small generators that provide clean power to rural Indians from discarded rice husks. Iraq: $26M in financing to Claremont Erbil for affordable housing hundreds of families in need. Ghana: $180M in political risk insurance to Belstar for a project that will increase clean water access and make the country’s water treatment plants more efficient. $200 4,000 0 1,000 2,000 3,000 4,000 5,000 $75 billion $0 U.S. Jobs Supported (Projected) $50 $100 277,000 0 *Since 1971 Haiti: $6 million loan to Haiti 360 to produce high-quality concrete to rebuild homes and other infrastructure destroyed in the 2010 earthquake. $200 billion $0 U.S. Exports Supported (Projected) 200,000 400,000 ^ [photo: Soma Vatsa/for NPR] The U.S. Government’s Development Finance Institution 12 OPIC’s Strategic Priorities OPIC: Financing solutions for sustainable prosperity Renewable Resources • OPIC has a strong track record of supporting renewable energy and clean technology projects in emerging markets • Renewable resources includes not just energy, but projects that foster more efficient use of existing resources across the board – such as water, fuel, fiber and food • From food security to agriculture and water, OPIC seeks to expand its reach to support innovate technologies to increase efficiency, increase sources and ensure access The U.S. Government’s Development Finance Institution 13 OPIC support for USG Global Climate Change commitments OPIC committed nearly $1.6B in financing to renewable resources projects in emerging markets during FY2012, an increase of almost half a billion dollars over the previous year. • OPIC is helping bring cleaner, sustainable energy to developing countries around the world, with renewable resource commitments covering a broad range of sectors & geographic regions. • OPIC’S renewable resources commitments have grown from under $10M in 2008 to nearly $1.6B in 2012 - representing more than one-third of OPIC’s total 2012 portfolio. • Focus on supporting projects in every sector – wind, solar, hydro, geothermal, biomass, energy efficiency and clean tech. • OPIC has made robust contributions to USG Fast Start Financing commitments with a $1 billion in FY11 commitments and an additional $721 million in FSF eligible commitments in 2012. OPIC is the USG’s most efficient tool in leveraging climate change financing in order to meet its commitment to help developing countries combat climate change The U.S. Government’s Development Finance Institution 14 OPIC Support for Economic Opportunities in Strategic Priority Countries: Sub-Saharan Africa OPIC has significantly expanded its portfolio in Sub-Saharan Africa under the Obama Administration. Since 2009, OPIC’s portfolio has grown by 48%, increasing from $2.5B in 2009 to $3.74B in 2012. OPIC Portfolio in Sub-Saharan Africa: OPIC’s portfolio in Sub-Saharan Africa currently totals $3.74 billion across 112 projects, including: . West Africa – Over $1.839 billion for projects in OPIC Commitments in Sub-Saharan Africa West African countries, including: (in millions of USD) • Energy Efficiency (Nigeria) – $37.8M in 1200 insurance to support the construction of three Combined Heat and Power generation plants 963.3 1000 907 for the Nigeria Bottling Company, an affiliate of a Coca-Cola distribution company. These 743.5 800 projects will promote energy efficiency, lowering carbon emissions, while supporting 600 local economic development. 339.2 400 • Health Care (Ghana) – $246M in insurance to Belstar to support the provision of medical 126 164.6 200 110 equipment and personnel training at up to 100 hospitals. By increasing the availability of 0 mobile specialized clinics in all 10 administrative regions, the project will also benefit low- and middle-income Ghanaian residents. The project is expected to generate approximately $147M in US exports. The U.S. Government’s Development Finance Institution 15 OPIC Support for Economic Opportunities in Strategic Priority Countries: Sub-Saharan Africa While Sub-Saharan Africa comprised only 4% of OPIC's global portfolio of loans, guarantees and . insurance in 2001, today it represents a full 23% of OPIC's total portfolio. Central Africa – Over $85 million for projects in Central African countries, including: • Manufacturing (Congo and the DRC) – $45M in insurance for Seaboard Corporation to construct and expand flour mills in both Congo and the Democratic Republic of Congo. The project also includes work on animal feed facilities in Congo and a cargo handling facility in the DRC. The facilities are increasing the countries’ food producing capacities and domestic food security. The cargo handling facility is an important contribution to the infrastructure that will be important for the DRC’s economic growth. • Water and Sanitation (Cameroon) – $800,000 in financing for a water bottling facility in Cameroon. The project will allow for the transfer of management and industrial skills while producing much needed safe drinking water. The project is expected be a boon to public health, human capital, employment, and economic growth. East Africa – Over $449M for projects in East African countries, including: • Microfinance (Tanzania) – $12M in financing for BRAC-owned microfinance institutions in Tanzania. By providing capital to those who would otherwise be unable to obtain credit from mainstream banks, these MFIs are an engine for income generation in Tanzania. • Agriculture (Rwanda) – $7M in insurance to support the expansion of tea processing facilities at the Sorwathe factory in Rwanda. Tea Importers, the U.S. company that owns Sorwathe, currently purchases tea leaves from about 5,000 small landholders, making the factory a critical source of employment and income in Rwanda. • Renewable Energy (Kenya) – Up to $310M for a project that will double the generating capacity of a geothermal plant in Kenya, adding 52 MW to the existing 48 MW of capacity. The expansion will incorporate environmentallyfriendly American technology, and create jobs in America and Kenya. Southern Africa – Over $418M for projects in Southern African countries, including: • Services (Botswana) – $219,000 in insurance to a firm providing development consulting services in Botswana. *Data current as of September 30, 2012. The U.S. Government’s Development Finance Institution 16 Conclusion OPIC can be a unique partner to the U.S. business sector, private investors and other institutions • • • • Catalyzing investment flows to developing countries Outstanding record mobilizing investment capital -- FDI and domestic – and supporting USG foreign and development policy Enhanced cooperation with other Development Finance Institutions, USG agencies, and local officials and private sector to assist OPIC in identifying opportunities and addressing challenges Improve information flow and strengthen OPIC’s impact with host country, international community and private sector The U.S. Government’s Development Finance Institution Next Steps OPIC is actively looking for new initiatives, partners and transactions For additional information please contact OPIC: • Website: www.opic.gov • Direct Contact for Information: email: Info@opic.gov OPIC Main Phone: 202-336-8400 • Direct Contact for Insurance email: John.Moran@opic.gov Phone: 202-336-8674 • Direct Contact for Investment Development email: Alison.Gatchev@opic.gov Phone: 202-336-8651 The U.S. Government’s Development Finance Institution