The Balanced Scorecard

advertisement

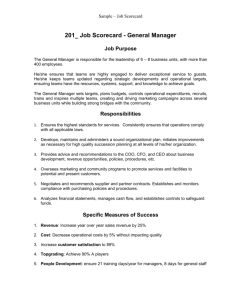

Metrics and Balanced Scorecards at Bristol-Myers Squibb Peter M. Fasolo, Ph.D. October, 2003 1 Content Company Introduction Metrics at BMS Examples Employee Preference Survey Retention Scorecard Americas Region Scorecard Executive Committee Scorecard What’s Next 2 Bristol-Myers Squibb’s Mission Our company’s mission is to extend and enhance human life by providing the highest- quality pharmaceutical and related health care products. 3 Our Businesses % of 2001 Global Sales* Worldwide Medicines .....….….. 86% Prescription Pharmaceuticals Consumer Medicines Healthcare Products ...……... 10% ……....…...………….. 4% Mead Johnson Nutritionals ConvaTec (ostomy & modern wound care) Medical Imaging* * Excludes DuPont Pharma sales 4 Sales by Geographic Area % of 2001 Global Sales United States 68% Europe, Mid-East & Africa 19% Other Western Hemisphere 6% Pacific 7% 5 Bristol-Myers Squibb Organizational Context New Chairman and CEO with Bold Transformation Plan Focus on Core Rx Business Rebuild Executive Team Divest and Spin-off Businesses Focus on Core Acquisitions, In-Licensing and Partnerships Recent Product Launches Abilify Reyataz Pravigard Promising Late-Stage Pipeline Erbitux Entecavir Factor XA Dual PPAR CTLA4Ig 6 BMS Employer of Choice Why Bristol-Myers Squibb? - External Confirmations America’s Most Admired Pharmaceutical Company-2001 One Of The Top 10 Best Companies for Working Mothers Hope, Triumph, and the Miracle of Medicine Money Magazine Top 500 Companies No. 3 in Best in Using Technology Company Benefits And More >> http://www.bms.com/aboutbms/awards/data/index.html Survey 2001 7 Relentless Focus on Performance at Bristol-Myers Squibb A Balanced Scorecard Strategy Supports the Enterprise Direction of Objective Performance Assessment, Alignment and Personal Accountability 8 Phases of Metrics Development Descriptive Prescriptive Diagnostic/Strategic/Consultative 9 Metrics Journey Diagnostic/ Strategic/ Consultative HR Metrics Laboratory Turnover Analysis Prescriptive EPS I Americas Region Scorecard Retention Scorecard Exit Survey Descriptive 2000 2001 2002 Executive Committee Scorecard Metrics/ Survey COE 2003 10 Example 1: Employee Preference Survey 11 Based on Employment Data from 2001 . . . the following US employees voluntarily departed Worldwide Medicines 1 of 10 Worldwide Medicines Employees (10%) 1 of 6 US Medicines Employees* (16%) 1 of 6 US Sales Employees (16%) 1 of 4 US Marketing Employees (24%) *HQ, SP&A, Global Marketing, PC, BMSOV 12 Worldwide Medicines US Turnover - 2001 (including Puerto Rico) Population on 1/1/2001: 15,176 Terminations: 2,624 = 17% Voluntary: 1,484 = 10% of total population 13 Worldwide Medicines Direct Costs Associated with 2000 Staffing Advertising Sign on Bonuses Full Year Bonus Guarantees Referral Bonuses Relocation $ 85,000 3,272,000 400,000 20,000 35,204,000 (US 17,800,000) Agency Fees (6 mos. actual 2001) 2,461,000 Training 9,000,000 $ 50,442,000 14 Key Data Points - Examples Value Skyline 15 Key Data Points - Examples Employee Retention Index Overall 0.47 0.42 Benchmark 0.48 Females Males 0.46 0.44 Managers Professionals 0.48 Sales 0.48 Marketing ERI Level No intention to leave Strong intention to stay Moderate intention to stay Neutral Moderate intention to leave Strong intention to leave Intention to leave, job search underway 0.31 Termination Analysis: 0.45 HIPOs 0.00 Index Value 1 0.67 0.33 0 -0.33 -0.67 -1 0.33 0.67 ERI Index Values 1.00 In August 2001, survey scores of individuals who voluntarily terminated were compared with employees who remained with the Company. An analysis of ERI scores revealed its predictiveness. Employees with lower ERI scores actually left the company at a much greater rate. 16 Example 2: Retention Scorecard 17 Retention Scorecard Goals and Objectives Significantly reduce voluntary turnover across the organization Focus managers on the primary means of retaining talent Put emphasis on reasonable actions managers can take to broaden the talent mix Communicate and emphasize organizational priorities 18 Retention Scorecard Field Study Design Scorecard and Monetary Reward* Scorecard Only Control Group * $5000 upside kicker 19 Retention Scorecard Retention Scorecard Employee Name: ___________________________________ Peformance Year: __________________________________ Development Yes No Complete all aspects of the Leadership Development process for all direct reports: Standards & Expectations set and reviewed throughout the year Development Plans established and reviewed throughout the year Career Dialogue conducted (career direction and work-life balance) Annual Development Summary completed All direct reports understand how skill sets and career goals are aligned with job responsibilities, e.g., Position Profiles Maintain overall quality score of 4.0 or higher on career and personal development discussions, as assessed by your direct reports Ensure a diverse slate of candidates for each position filled during the year Management Capability Yes Direct reports understand the department/district/region objectives and how they align with business unit objectives, as assessed by employees Direct Reports have a clear understanding of their role, role objectives and fit with the department/district/region's objectives, as assessed by employees No Weighting 100% completion required for participation in Scorecard 30% Percent of Reward 30% Conduct regular communication and coaching sessions with direct reports: Team meetings/teleconferences, at least monthly One-on-One feedback and coaching, in addition to LD process Retention** Yes No Lose no more than one of your highest performing employee, as identified in January*** Percent of Reward 40% Turn or manage out 100% of identified low performing employees 100%* * 100% of talent management reward = $5,000 20 Retention Scorecard Results No difference between monetary and “scorecard only” group Both groups were significantly better at development, management capability and retention than control group What you measure matters 21 Example 3: Americas Region Scorecard 22 Americas Region Scorecard AMERICAS SCORECARD (SAMPLE DATA) August 2003 Lead with a Compelling Vision by Build Sustainable Long-Term Growth While Living our Mission and Pledge Achieving our 2003 Financial Objectives YTD YTD Perf vs Goal Actual YTD Goal Mission Goal 75% Perf 80% Sales $ 35,000 $ 26,000 23,000 88.5% Pledge 65% 60% BUC $ 16,000 $ 9,754 10,212 104.7% Pride 80% 85% Annual Goal All dollar values reported in millions Drive Key Brand Growth Annual YTD YTD Perf vs Goal Goal Actual YTD Goal Reported Sales Pravachol Exit Share YTD YTD Goal Actual % Attn U.S. Market Share 110.1% Pravachol 56.2 44.6 44.5 99.8% Plavix Glucovance $ 1,546 $ 1,203 $ 1,324 2,545 454 2,124 367 2,012 365 94.7% 99.5% Plavix Glucovance 67.1 12.1 70.1 15.7 71.2 16.2 101.6% 103.2% Glucophage XR 656 578 600 103.8% Glucophage XR 4.6 4.6 4.3 93.5% Tequin 242 168 157 93.5% Tequin 3.7 3.9 2.5 64.1% Avapro/ Avalide 454 375 375 100.0% Avapro/ Avalide 21.6 19.5 14.8 75.9% HIV Paraplatin 879 578 745 457 799 465 107.2% 101.8% HIV Paraplatin 35.4 3.7 37.8 2.3 25.9 4.3 68.5% 187.0% Cardiolite 574 487 467 95.9% Cardiolite 45.9 54.6 58.5 107.1% Excedrin 241 178 164 92.1% Excedrin 64.2 37.9 31.3 82.6% Deliver Pipeline Value Create a OneBMS Culture Annual YTD YTD Perf vs Goal Goal Actual YTD Goal Product Net Sales Abilify Goal 65% Perf 68% 356 $ 256 $ 260 101.6% One BMS Culture Index - Management 85% 73% Metaglip 256 195 172 88.2% Belief in Pipeline 60% 62% Pravigard 87 64 70 109.4% Belief in Future 90% 85% Atazanavir 87 62 36 58.1% Energize 95% 92% Definity 21 11 9 80.6% Focus 45% 45% 18 12 13 111.8% Strengthen Our Team & Develop Our People Lost YTD Ann.YTD 496 5.0% 300 6.5% Development 32 7.1% Employee Development Index 12 11.2% Development Plan Rate (D6+) 38 6.5% 60 2.3% 54 10.0% Goal 80% 95% Perf 86% 92% Excedrin Quick Tabs $ One BMS Culture Index - Enterprise Voluntary Turnover TOTAL Primary Care BMSOV Consumer Medical Imaging LA - C Tech Ops Goal 11% 13% 9% 8% 7% 4% 12% Key Talent Turnover TOTAL Primary Care 5% 6.3% 33 23 3.5% 5.1% BMSOV Consumer 4% 3% 4 3 6.9% 2.3% Medical Imaging 5% 1 1.2% LA - C Tech Ops 4% 6% 2 0 3.2% 0.0% Exit Data Top 3 reasons 1. Direct Manager Quality (43% ) 2. Developmental Opportunity (21% ) 3. Company Culture (19% ) 23 Example 4: Executive Committee (EC) Scorecard 24 Purpose of the EC Scorecard Track progress against company priorities Assess employee perceptions of Bristol-Myers Squibb Guide action planning Provide CEO and Board of Directors with year end results 25 Background Survey 50 questions assessing EC priorities & BMS as a best place to work 1 open-ended item: “What is working well at BMS?” Survey administered April 7 to April 21, 2003 Stratified random sample of 5400 worldwide employees (D6+ internationally, excluding hourly employees in manufacturing) 64.4% response rate (n = 3464) Salary Grade Distribution Key Executive: 128 Key Manager: 1437 Professional: 1516 Non-Exempt: 383 Gender 47.1% Male 51.2% Female 48 countries represented 21 functions represented 26 The Survey Items Assess: EC Leadership Priorities BMS as a Best Place to Work Criteria of Interest (i.e.Intent to Leave) 27 Leaders Make the Difference Nine out of the top ten factors which are correlated with an employees intention to stay with the company are strongly influenced by an employee’s manager 28 Leaders Make the Difference • I am confident I can achieve my career goals at BMS 58% • I am treated in a fair and just manner 73% • I am proud to tell others outside of BMS that I work here 73% • My contributions to the company are recognized 56% • We have a culture that encourages high performance with the highest integrity 62% • It is clear what is expected of me at work 83% • I work in an environment where people support each other 74% • The leaders in my organization listen openly to all points of view 57% • The better my performance, the more I will be rewarded 47% • I am compensated fairly 56% All Employees % Favorable 29 Process and Next Steps Results presented to Chairman and CEO Workshop for EC and Top 35 Executives of the Company Action Planning and Employee Communication Underway Change in Scores Tied to Variable Pay Next administration in September/October 2003 30 What’s Next? Expanded Online Exit Survey HR Measurement Laboratory Follow-on Executive Committee Scorecard in September/October Metrics/Survey Center of Excellence for B-MS 31