What is Project Finance

advertisement

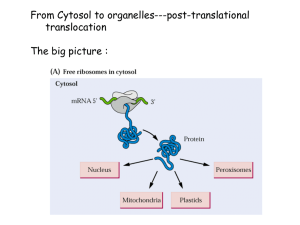

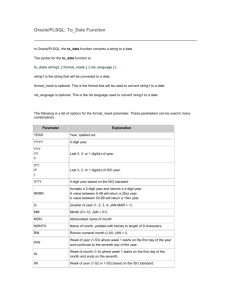

Financing of Infrastructure Projects: The Role of a Project Finance Counsel Presentation by Mohit Saraf Partner Luthra & Luthra Law Offices Overview • • • • • • What is Project Finance? Role of a Project Finance Counsel Public Private Partnership Financing Risk Matrix Project Finance Requirements Requirements L&L/NLS 2 What is Project Finance ? • There is no strict definition but as per the international practice the definition below could be used • Project Finance is financing the development or exploitation of a right, natural resource or other asset where the bulk of the financing is not be provided by any form of share capital and is to be repaid principally out of revenues produced by the project in question L&L/NLS 3 Role of a Project Finance Counsel • Risk allocation and mitigation through Negotiation and Documentation among the project participants • Minimizing residual risk with the SPV • Balancing conflicting interests of various project participants • Achieving successful Financial Closure by ensuring fulfillment of Project Finance requirements L&L/NLS 4 Role of a Project Finance Counsel (Cont’d) • Structuring of Project Vehicle • Tax Structuring • Ensuring regulatory and statutory compliances L&L/NLS 5 Public Private Partnership • Structures – Build Operate Transfer (BOT) – Build Own Operate Transfer (BOOT) – Build Transfer Operate (BTO) – Build Own Operate (BOO) – Design, Construct, Maintain & Finance (DCMF) – Design, Build, Finance & Operate (DBFO) – Disinvestment L&L/NLS 6 Financing • Project Financing vs. Balance Sheet Financing vs. Asset Financing • Project Financing • Source of Finance – – – – Commercial Banks Financial Institutions Export Credit Agencies & Multilateral Agencies Capital Market L&L/NLS 7 Finance Risks Market Risks Promoters Shareholder’s Agreements Supplier Lenders – Credit Agreement – Security Documents Supply Agreement Offtaker Offtake Agreement Insurances Insurers Project company – Concession Agreement – Consents Construction Contract Operating and Maintenance Agreement Government Construction & Operation Risks Contractor L&L/NLS Operator 8 Risk Matrix • • • • • • • • Completion Risk Technological Risk Supply Risk Market Risk Financial Risk Political Risk Environmental Risk Force Majeure Risk L&L/NLS 9 Project Finance Requirements • Hate surprises; will not accept risks which are either incapable of proper assessment or which are potentially open-ended in their effect • No change in law risk • No discriminatory taxation • Minimise “risk-dumping” on project company • No liability for consequential loss • Contracts must survive enforcement of Banks’ security L&L/NLS 10 Project Finance Requirements Consents • Consents must last for duration of project • Regulators should not be able to vary the terms of consents unduly • Consents should inure to project and not just to project company • Government Support Agreements L&L/NLS 11 Project Finance Requirements Promoters • All equity contributions to be provided up-front • Promoters to provide cover for cost overruns • Promoters to provide cover for gaps in undertakings including insurance. L&L/NLS 12 Project Finance Requirements Concession Agreement • • • • • • Terms of concession fixed for life of project No unduly onerous terms on project company Extension of term for force majeure Compensation for termination must repay debt Concession should survive enforcement of security Transferability of concession on security enforcement L&L/NLS 13 Project Finance Requirements Construction Contract • Turnkey fixed price contract • Fixed completion date • Force majeure, price increases and completion must back to back with concession agreement • Adequate liquidated damages for late completion • Performance Guarantees L&L/NLS 14 Project Finance Requirements Operation & Maintenance Contract • Proper incentives to run project properly and profitably including penalties for failure to meet targets • Ability to remove operator for poor performance L&L/NLS 15 Project Finance Requirements Supply Contract • Security of supply and remedy for interruptions • Take or Pay obligation L&L/NLS 16 Project Finance Requirements Off-take Agreement • Full pass-through of capital and variable costs • Foreign exchange protection • Take or Pay obligation • Credit enhancement including Government Guarantees L&L/NLS 17 Security • Why Security? • Security Package – – – – Key contracts Physical assets Revenue Insurance • Direct Agreement – Cure & Step in Rights – Substitution L&L/NLS 18