PowerPoint Presentation - Texas State University

advertisement

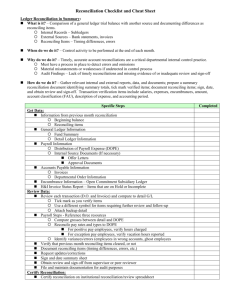

Account Reconciliation Training Course Objectives This course consists of two primary objectives: 1. To inform reconcilers of the resources available to perform a proper reconciliation. 2. To provide guidance on completing the account reconciliation. What is an account reconciliation? • Process of comparing information • Analyzing differences • Making corrections • Consistent data Why reconcile your department account? • Ensure the account is correctly charged for all expense and encumbrances • Ensure that all revenue is recorded (as applicable) • Ensure the accuracy and completeness of transactions • Ensure errors or discrepancies noted during the reconciliation process are corrected Accuracy and Completeness includes a review of the entries to insure that they are: • Appropriately classified to the account, • Authorized in accordance with University policies, State and Federal laws and regulations, and specific sponsor or donor requirements or restrictions, Accuracy and Completeness includes a review of the entries to insure that they are: • Within the guidelines of the stated purpose of the account and • Have matching dollar values for each transaction between SAP and your department’s records. Who should prepare account reconciliations? • UPPS No. 03.04.02. The account manager or designee must regularly reconcile budget and financial transactions in university financial systems with the transactions’ corresponding source documents. • If possible, reconciliations should be prepared by the department’s support staff, but reviewed and approved by the account manager for proper segregation of duties. When should account reconciliations be prepared? Departmental account reconciliations should be prepared monthly. All postings in SAP will be complete by the 10th of the following month, with the exception of Restricted funds. Where should account reconciliations be kept? • Evidence of reconciliation, and its completion, along with supporting documentation, should be maintained in department offices. How long should account reconciliations and support documentation be retained by the department? Per University’s Retention Schedule for Financial Documents: Fiscal Year End + 3 Types of Transactions The department should maintain support documentation for each of these types of transactions for reconciling purposes. 1.Budget changes and carryforwards 2.Encumbrance transactions 3.Expenditure transactions 4.Revenue transactions What is Support Documentation? 1.Budget changes and carryforwards – budget change forms, or documentation of budget at beginning of fiscal year 2.Encumbrances – small purchase orders, departmental purchase requisitions, purchase orders, travel applications, etc. 3.Expenditures – invoices, report of phone charges, packing slips, travel vouchers, receipts, etc. 4.Revenue – deposit receipts, etc. What reports should I use in SAP to reconcile our department’s account(s) The suggested beginning point for any reconciliation should be the Budget to Actual Report in SAP (Transaction Code: ZBUDACT) • • • • • The Budget to Actual Report provides a summary of the account: It summarizes the budget balance, how much has been spent from the account, how much revenue has been taken in, how much has been encumbered and the available balance. Refer to the Budget Office’s training document http://www.fss.txstate.edu/budget/training/how-to-andreference How To Instructions for Budget to Actual Report: Where can I obtain Line Item Detail without drilling down into each Commitment Item on the Budget to Actual Report? Line Item Detail can be obtained from : All Postings Report Transaction Code: ZFMRP_RFFMEP1AX Refer to the Budget Office’s training document http://www.fss.txstate.edu/budget/training/how-to-andreference Let’s Reconcile! Step 1 – Gather Source Documents and Prior Month’s Reconciliation (i.e. transactions you initiated in the past month) Make it a habit to track transactions in an Excel Spreadsheet because it: • Helps eliminate accidental omission of account activity • Provides an up to the minute budget balance • Makes the reconciliation process easier to complete Step 2 – Check Beginning Balances The reconciler must verify that the beginning revenue/expense totals match to the prior month ending amounts. Run the Budget to Actual report in SAP to confirm balances. Step 3 – Current Period Activity In SAP, run All Postings for applicable period. (Transaction Code: ZFMRP_RFFMEP1AX) Subtotal results by Reference Document number to obtain totals by invoice, journal entry, etc. SAP-ALL POSTINGS ZFMRP_RFFMEP1AX Results have been filtered to include Invoices and Profit Transfer Postings only. Results then subtotaled by Period/Year and Reference Document Number, providing totals for each transaction, each month and cumulatively. Step 4 - Compare SAP current period records to department’s records 1. For visual ease, check off items in the SAP report and matching department record. 2. Add the month cleared, document number and dollar amount paid in the columns to the right of your running balance on the Department’s Excel Record. The unchecked items on both set of records represent your reconciling items. Step 5 – Investigate each Reconciling Item Reconciling items may or may not require adjustments in accounting records. Reconciling Items Common Reconciling Items • Timing Differences • $ Amounts are different • Incorrectly Coded Items • Missing Items Timing Differences • Identify prior month timing differences which posted in the current period. These are no longer reconciling. • Identify current period items expected to clear in the following month due to timing differences. These ARE reconciling items. Timing Difference Example eIDT has been entered into SAP, but not posted by month end. The expense would be reflected in your departments records, but not posted in SAP. It is expected to move through the approval process and post in the following month. This IS a reconciling item. $ (Dollar) Amounts are different • Identify invoices/charges with differing dollar amounts. Is the invoice final? Do you expect additional charges to be paid for this transaction? These ARE reconciling items. Difference in $ Amount Example • eIDT posted to your account charging for 3.5 hours of police work @ $40 per hour, but amount posted in SAP is $160.00. Contact the department that processed the eIDT to determine why: Is the amount a result of a calculation error? If yes, then the difference of $20 ($160.00 - $140.00) would be a reconciling item in SAP, requiring an eIDT correction. Is the amount a result of the officer working 4 hours instead of 3.5? If yes, then the difference of $20 would be a correction that needs to be made to your department’s records. Incorrectly Coded Items Possible coding errors: Fund Fund Center Internal Order General Ledger Code Incorrectly Coded Item Example Expense amount of $125.00 matches in SAP and your department’s records for 1000 pink answer sheets. The General Ledger code in SAP is 721000 (Professional Fees and Services), but your records indicate the GL is 730000 (Consumable Supplies). The SAP GL is incorrect. This would be a reconciling item for SAP. Incorrect GL Code Doc# 123 -$125.00 Correction of GL Code Doc# 123 $ 125.00 An eIDT correction must be initiated. Erroneously Posted Items Items posting in SAP that are not your expense (revenue). Contact the department that initiated this transaction and obtain a copy of the source document. Is the item charged to the wrong fund or fund center? If yes, this would be a reconciling item in SAP and a correction in SAP will be required. Erroneously Posted Item Example An invoice is paid to an Outside Vendor, but your department did not initiate the transaction. Contact Accounts Payable (AP) to obtain a copy of the invoice. Review transaction to determine initiator. Contact the initiator’s department so that they can process an eIDT AP invoice correction in SAP to fix the fund / fund center. Missing Items • Missing items can occur in either SAP or your department’s records. • Identify which system of record is missing the item. • Contact the appropriate office. • Evaluate the supporting documents to determine if the item is coded to the correct funding source. • Initiate corrections to the correct system of record. Missing support documentation Example An eIDT was paid to Copy Services, but you do not have a copy of the transaction. Obtain a copy of the transaction from the Copy Services. If the charge is correct, the expense needs to be added to your department’s records. If the charge is incorrect, the expense needs to be adjusted in SAP through an eIDT. This would be a reconciling item in SAP. Proposed Corrections The reconciler will occasionally need to initiate corrections to SAP. The eIDT process can be used to correct Interdepartmental Transfers, Cash Receipts and Accounts Payable transactions. The reconciler should make certain that all proposed corrections from previous months have posted. Once reflected in both systems, they are no longer considered reconciling items. Review for Proper Approval During the course of reconciling, the reconciler must make certain that each transaction has proper approval given by the department’s account manager or delegated authority. Note: The new eIDT system does not require the account manager receiving revenue to approve the transaction. An assumption has been made that additional funds are never refused. Step 6 – Reconciliation Report Upon completion of the reconciliation, a report should be created which provides a snapshot of the reconciled balances between SAP and the department records (aka systems of record). Each system of record will include the prior month’s ending balance, plus/minus reconciling items and an adjusted ending balance. The adjusted balances should equal. The reconciliation report will provide an accurate depiction of your true account balance as of a specific point in time. Step 6 – Reconciliation Report The reconciler should provide the completed reconciliation report to the department’s account manager for review and approval. The account manager should sign and date the report to verify review. The report should then be filed within the department along with supporting documents used in the reconciliation process. Reconciling Items from the Department’s Excel Record are added to the Reconciliation Summary RECONCILIATION TEMPLATE (Can be found on Texas State Website under GAO-FR&A Forms) SAMPLE RECONCILIATION A sample reconciliation packet will be handed out in class as a reference. This sample packet can also be accessed on the GAO FR&A Texas State Website @ http://www.txstate.edu/gao/Forms.html HELPFUL SAP T-CODES TO RECONCILE ACCOUNT • • • • • Budget to Actual Report - ZBUDACT Salary/Fringe Report- ZFISALFRINGE Purchase Orders by Account Assignment – ZME2K Operating Expense Report – ZFI_OPER_EXP_RPT Open Encumbrance Report – ZOPEN_ENCUMBRANCE Typical Document Types • • • • • • ZB – Budget Changes RB – Cash Receipt Transactions J* - Journal Vouchers PA – Payroll Posting RE / NP – Accounts Payable PK – Pcard Transactions • * Represents a wildcard SAP-ALL POSTINGS ZFMRP_RFFMEP1AX Results have been filtered to include Invoices and Profit Transfer Postings only. Results then subtotaled by Period/Year and Reference Document Number, providing totals for each transaction, each month and cumulatively. SAP-ALL POSTINGS ZFMRP_RFFMEP1AX Results have been filtered to include Invoices and Profit Transfer Postings only. Results then subtotaled by Period/Year and Reference Document Number, providing totals for each transaction, each month and cumulatively. SAP-ALL POSTINGS ZFMRP_RFFMEP1AX Results have been filtered to include Invoices and Profit Transfer Postings only. Results then subtotaled by Period/Year and Reference Document Number, providing totals for each transaction, each month and cumulatively. SAP-ALL POSTINGS ZFMRP_RFFMEP1AX Results have been filtered to include Invoices and Profit Transfer Postings only. Results then subtotaled by Period/Year and Reference Document Number, providing totals for each transaction, each month and cumulatively. SAP-ALL POSTINGS ZFMRP_RFFMEP1AX Results have been filtered to include Invoices and Profit Transfer Postings only. Results then subtotaled by Period/Year and Reference Document Number, providing totals for each transaction, each month and cumulatively. Congratulations!! You have successfully completed Account Reconciliation Training through Texas State University.