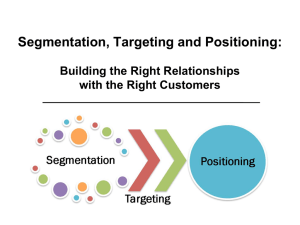

Chapter 7 – Global Segmentation and Positioning

advertisement

Chapter 7 – Global Segmentation and Positioning Variation in customer needs is the primary motive for market segmentation. Most companies will identify and target the most attractive market segments that they can effectively serve. In global marketing, market segmentation becomes especially critical because of wide divergence in cross-border consumer needs and lifestyles. Once the company has chosen its target segments; management needs to determine a competitive positioning strategy for its products. 1. Reasons for International Market Segmentation Segments ideally should possess the following set of properties: i. Identifiable: the segments should be easy to define and to measure. This criterion is easily met for “objective” country traits such as socioeconomic variables (e.g., per capita income). However, the size of segments based on values or lifestyle indicators is typically much harder to gauge. ii. Sizable: the segment should be large enough to be worth going after. Note that flexible manufacturing technologies enable companies to relax this criterion. In fact, many segments that might be considered too small in a single-country context become attractive once they are lumped together across borders. iii. Accessible: the segments should also be easy to reach through promotional and distributional efforts. Differences in the distribution quality and media infrastructure imply that a given segment could be hard to reach income countries and easy to target in others. iv. Stable: if target markets change their composition or behavior over time, marketing efforts devised for these targets are less likely to succeed. v. Responsive: for market segmentation to be meaningful, it is important that the segments respond differently from each other to differentiated marketing mixes. vi. Actionable: segments are actionable if the marketing mix is necessary to address their needs of consistent with the goals and the core competencies of the company. Major reasons why international marketers implement international market segmentation: a. Country Screening: companies usually do a preliminary screening of countries before indentifying attractive market opportunities for their product or service. b. Global Market Research: companies make an effort to design products or services that meet the needs of the customers in different countries. c. Entry Decisions: when a product or service does well in one country, firms often hope to replicate their success story in other countries. d. Positioning Strategy: once the firm has selected the target segments, management needs to develop a positioning strategy to embrace them. e. Resource Allocation: market segmentation is also useful in deciding how to allocate the company’s scarce marketing resources across different country. (Exhibit 7-1) f. Marketing Mix Policy: is how to strike the balance between standardization and customization. 2. International Market Segmentation Approaches Common international segmentation procedures: Country-as-segments or aggregate segmentation: a very common international segmentation procedure classifies prospect countries geographically or a single dimension or multiple socio-economic, political, and cultural criteria available from secondary data sources. o (See Exhibits 7-3 and 7-4.) o For numerous country traits, use data reduction such as factor analysis. Disaggregate international consumer segmentation: focus on individual consumer. Two-stage international segmentation: to address the short comes of the previous two approaches- can offer solace. 3. Segmentation Scenarios I. Universal or global segments: that transcend national boundaries. They are universal in the sense that customers belonging to such segments have common needs. II. Regional segments: here the similarity in customer needs and preferences exists at the regional level rather than globally. III. Unique (diverse) segments: are the norms when gaps in cross-country customer needs and preferences are so substantial that it becomes very hard to derive meaningful cross –border segments. 4. Bases for Country Segmentation A. Demographics: are among the most popular criteria and easy to access (Exhibit 76). B. Socioeconomic Variables: caveats in using per capita income as an economic development indicator. i. Monetization of transactions within a country: to compare measures such as per capita GNP across countries. (local currency should be translated into common currency. ii. Gray and Black Market sections of the economy: national income figures only record transactions that occur in legitimate sector of country’s economy. iii. Income disparities: figures such as per capita GNP tell only part of the story. o Purchasing Power Parity (PPP) criteria: reflects how much a household in each country has to spend to buy a standard basket of goods. o Human development index (HDI) classification: released every year by United Nations. HDI widens the notion of economic development by looking at a country’s achievement in three areas: life expectancy at birth, knowledge, and decent standard of living. o Socioeconomic Strata (SES) Analysis: alternative for analyzing buying power in a se of countries (Exhibit 7-6). C. Behavior-based segmentation: based on behavioral response variables. (Exhibit 7-7) i. Brand loyalty ii. Usage rate iii. Product penetration iv. Benefits D. Lifestyles: Roper Consulting’s Valuescope Model. 30,000 interviews around the world. (This is based on 5th edition the 4th has different variables so this updated in the new book) i. Achievers ii. Traditionals iii. Survivors iv. Nurturers v. Hedonists vi. Social-Rationals vii. Self-Directeds 5. International Positioning Strategies The formulation of a positioning strategy (local or global) includes the following steps: a. Identify the relevant set of competing products or brands. b. Determine current perceptions held by consumers about the product/brand and the competition. c. Develop possible positioning themes. d. Screen the positioning alternatives and select the most appealing one. e. Develop a marketing mix strategy that will implement the chosen positioning strategy. f. Over time, monitor the effectiveness of your positioning strategy and if needed, conduct an audit. Uniform versus Localized Positioning Strategies: management needs to decide whether to use to use the same positioning worldwide or position strategies that are tailored to individual markets. (Exhibit 7-11) Universal Positioning Appeals: are positioning themes that appeal to consumers anywhere in the world, regardless of an individual’s cultural background. Positioning themes: I. Specific product features/attributes II. Product benefit (rational or emotional), solutions for problems III. User category IV. User application V. Heritage VI. Lifestyle 6. Global, Foreign, and Local Consumer Culture Positioning A. Global consumer culture positioning (GCCP): brand managers can position their brand as a symbolic of a global consumer culture, a “foreign” culture, or a local culture. B. Local consumer culture positioning (LCCP): the brand may be global; it is portrayed as an intrinsic part of the local culture. (Some brands have achieved a multilocal culture. C. Foreign consumer culture positioning (FCCP): here the goal is to build up a brand mystique built around a specific foreign culture, usually one that has highly positive connotations for the product. (e.g. Swiss for watches, Germany for household appliances…etc) Appendix: Segmentation Tools Segmentation techniques and tools: i. Cluster Analysis: Collection of statistical procedures for dividing objects into groups (clusters). The grouping is done in such a manner that members belonging to the same group are very similar to one another but quite distinct from members of other groups. ii. Regression Analysis: In regression, one assumes that there exists a relationship between a response variable, Y, and one or more so-called predictor variables, X1, X2 and so on. For each of the parameter estimates, the regression analysis will also produce standard error. The higher the R2 value, the better the ability of the regression model to predict the data. (See Exhibits 7-12 through 7-14.)