File

advertisement

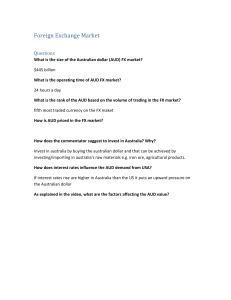

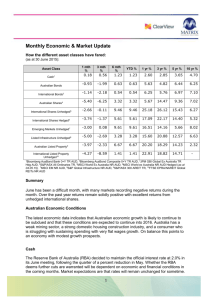

Economic Goal 4: External Stability Exchange Rate The Exchange Rate Individual Exchange Rate: the value of one nation’s currency in relation to another is determined by the market forces of supply and demand for the currency. The Exchange Rate Trade Weighted Index: the average value of the Australian dollar against a basket of foreign currencies of Australia’s trading partners, weighted according to their relative trading importance with Australia. The statistic we use to measure the general trend in the exchange rate is the Trade Weighted Index (TWI) Trade Weighted Index The Trade Weighted Index represents a measure of the value of the Australian $ against a basket of currencies comprising the currencies of our major trading partners. An improvement (increase) in this index means the value of the Australian dollar is increasing compared to the value of these currencies. The improvement in the TWI will see the price of our exports to become relatively more expensive to and the price of imports become relatively cheaper to purchase. Appreciation in the AUD Appreciation in the exchange rate: an increase in the value of Australia’s currency in relation to another country’s currency. An appreciation in the AUD can be caused by either: ◦ An increase in demand for AUD ◦ A decrease in supply of AUD Increased Commodity Prices Strong growth in China Improved terms of Trade Terms of Trade Terms of Trade is a ratio of export prices to import prices. It is a measure that reflects changes in the average prices received for a basket of exports against those average prices paid for a basket of import. The index shows changes in the actual quantity of imports that may be purchased with a given quantity of exports. Appreciation of AUD Increase in demand for AUD can be due to: rises in commodity prices strong overseas economic growth Favourable movement in the Terms of Trade Rise in domestic Interest rate (difference in relative interest rates) Speculation Depreciation of AUD Decrease in supply of the AUD can be due to: A fall in economic activity overseas, Falling commodity prices Recession in Australia – reduced imports Falling interest rates Consequences of a Higher Exchange Rate Impact on the Balance on Good and Services (Net Goods and Services) on Current Account The increase in the value of the Australian dollar makes our exports relatively more expensive for foreigners to purchase. This makes it harder for Australia’s tradeable exporters (manufacturing, tourism and education) to compete. This may lead to a decrease demand for Australia’s exports and result in lower export values. 1. Consequences of a Higher Exchange Rate In addition, imports become relatively cheaper for Australians to purchase which may increase the demand for imports. Overall, export values should decrease leading a decrease in goods and services credits and import values should increase leading to an increase in goods and services debits. This may contribute to a worsening in the Balance of Goods and Services and a worsening of the Current Account Deficit in the Balance of Payments Consequences of a Higher Exchange Rate 1. Impact on Net Income component on Current Account An increase in the value of the Australian dollar means our currency buys more of another nation’s currency. If our foreign debt is valued in $US or another currency then our interest repayments on the debt are lower as we need to use less Australian dollars to pay back the interest in $US. This would reduce the value of debits in the Net income component of the Current Account This would result in a reduction in the size of the net income deficit of the current account.