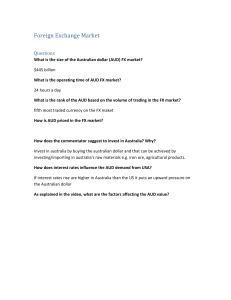

Topic 2: Exchange Rates Top Economics Facts Fixed to Floating • 1983 Australia switches to a floating exchange rate. Value of AUD now determined by market forces rather than by the government. This opens the Aus economy up to global financial flows. • Value of currencies under a floating exchange rate are determined by market forces, i.e supply and demand. What does it all mean? • On a basic level exchanges impact the price of goods and services between countries. • If the AUD appreciates: Our exports become more expensive and our imports become cheaper. You can now buy those shoes from the US online for less Australian dollars. They cost the same amount of US dollars, lets say $50USD but your Australian dollars are worth more so its “cheaper” for you here in Aus. • If the AUD depreciates: Our exports become cheaper and our imports become more expensive. Now it’s going to cost you more to buy those shoes from the US. Again, they’re still $50USD but your Australian dollars aren’t worth as much, so you need more of them to pay for the shoes and therefore “more expensive” for you here in Aus. Changes in Demand for AUD • Size of financial flows - Level of our interest rates. Investors will seek higher interest for their money. As they invest in that country they will need that country’s currency and therefore are ‘demanding’ it. • Speculation – Speculators cause the speculation that they speculate • Demand for our exports - Changes in commodity prices and therefore our terms of trade - Our international competitiveness/keeping inflation low. Both of these keep our prices low and allow trade partners to demand our exports and therefore demand our currency as they pay us in AUD. - Global economic conditions: Our trade partners need to be growing and performing well to continue demanding our particular exports. If China and South East Asia are not experiencing strong economic growth then neither will our exports be in as high a demand. - Taste and preferences of our products: This can include tourism, if people want to travel to Australia then they have to convert their currency to AUD i.e they demand our AUD. Changes in Supply of AUD • Investment flows out of Australia: - Global interest rates compared to Australia. If there are higher interest rates overseas then Australians will send their money overseas and supply our AUD causing the dollar to depreciate • Speculation • Domestic demand for imports - When we buy products from overseas we are essentially supplying our AUD to them. When AUD are used overseas they are exchanged into that country’s currency. This leads to a depreciation of our currency HSC short answers Appreciations | Depreciations The floating exchange rate as an automatic stabiliser Causes/Reasons (this is a big slide, these are good extended response, paragraph points to use) The TRADE WEIGHTED INDEX (TWI) • Comparing the AUD to a single other currency such as the USD can be misleading. The USD is the most commonly traded currency globally so it makes sense to compare to this but what if we appreciate against the USD but depreciate against several other countries? Is it really fair to say the AUD has appreciated if its only against the USD? • The TWI is a more accurate measure of the performance of the AUD. • Weights for the TWI – 2022 | RBA • The RBA changes the weighting of currencies within the TWI based on the volume of trade we do with that country in the previous year. The currencies in our TWI must make up at least 90% of all our trade • TREND: In recent decades one trend has been the Japanese YEN and the USD have fallen in weighting and the Chinese RENMINBI has risen in weighting (due to increased trade with China and decreased trade with Japan and the US). HSC short answers Effects