Postdoctoral Scholar Benefit Program - Garnett

advertisement

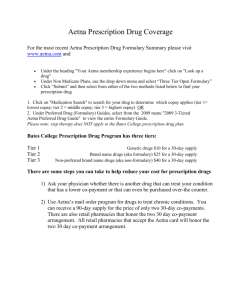

Postdoctoral Scholar Benefit Program Plan Year 2016 | Beginning January 1, 2016 Initial Enrollment November 9th through November 20th Presented by GARNETT-POWERS & ASSOCIATES, INC. New York State License: LB-1161455 Agenda Who is Garnett-Powers & Associates? Eligibility for the Program Review of all Benefits, Rates and Plan Designs Explanation of the Initial Enrollment Process Q&A 2 The Postdoctoral Scholar Benefit Program The University of Rochester has partnered with Garnett-Powers & Associates (GPA) to provide marketing, administrative services and customer service for this program. The Initial Enrollment Period for the program will be November 9th through November 20th with your coverage beginning January 1, 2016. The program offers a package of benefits designed to closely match the benefits offered to the University of Rochester faculty & staff. Medical, dental and voluntary vision insurance will be provided by Aetna. The program replaces current UR employee plan for postdocs associates (093) and fellows (095) and replaces UHS student health plan for postdoc visiting fellows (094). 3 Who is Garnett-Powers & Associates, Inc? GPA is both the broker and third-party administrator. We design, implement, administer and provide customer service to postdoc benefit programs nationwide, offering our services to 19 campuses and labs. At GPA, our Account Managers understand the unique requirements of Postdocs relating to benefits: • • • • • Assistance when there are language challenges for foreign nationals Support through the complicated world of the United States healthcare system Assistance with choosing a benefit plan to meet the needs of your family Education with learning how to access an appropriate provider to avoid unnecessary costs Empower you as a consumer to understand your medical, dental and vision coverage so you may make informed decisions about your, and your family’s, health care. It is our goal to allow your transition to this new program and your access to these new benefits, to be as simple and uncomplicated as possible. 4 Meet Your Postdoctoral Insurance Program Representative! Ms. Candace Nicholson is a graduate from California State University of Long Beach, holding a Bachelor’s Degree in Business Management. As a Garnett-Powers & Associates university services account representative, she is eager to assist you with any enrollment, benefits or billing questions you may have in regards to the Postdoctoral Scholar Benefit Program. 5 Benefits Offered Through The Postdoctoral Scholar Benefit Program Plan Type Insurance Type Point of Service (POS) Medical DPPO Dental PPO Voluntary Vision Company 6 Eligibility for the Program Postdocs appointed in the following title codes are eligible for the University of Rochester Postdoctoral Scholar Benefit Program: 093 – Postdoctoral Associate 094 – Visiting Postdoctoral Fellow 095 – Postdoctoral Fellow If you are unsure as to your actual appointment title and eligibility, please check with your departmental administrator for this information. 7 Medical Insurance Provided by What is a POS Plan? The Point of Service (POS) plan offers much more flexibility and choice than the HMO plan because there is an ‘In-Network’ and ‘Out-of-Network’ choice at the time you seek service from a provider. The Aetna POS plan offers you the choice of choosing a Primary Care Physician if you so desire. You are not obligated to choose one. The In-Network benefits (copays, coinsurance, etc.) will be greater than the Out-of-Network benefits. You will pay less when you seek your care In-Network. For example, your POS plan offers a Copay of $30 for a specialist office visit In-Network; that same office visit Out-of-Network is 30% after satisfying the deductible. At the time of service, the member has the ability to seek care from a Specialist, without having to obtain a referral from a Primary Care Physician. The contractual agreement between the POS Plan and the Provider is on a “discounted fee for service” basis. This means that the provider who participates in the network has agreed to provide their service on an agreed upon discounted fee. The Provider who is not in the network will not agree to that discounted fee and will typically charge a “Reasonable and Customary” fee. 8 Postdoctoral Scholar Benefit Program Aetna POS Medical Plan Core Benefits Deductible (Individual / Family) In-Network Postdoc Pays Out-of-Network Postdoc Pays $250 / $500 $750 / $1,500 OOP – Single/Family $2,500 / $5,000 $5,000 / $10,000 Office Visit (Primary / Specialist) $20 / $30 Copay 30%* $0 Copay 30%* Inpatient Hospital 10%* 40%* Outpatient Surgery 10%* 40%* E-Visit to PCP $20 Copay 30%* Urgent Care $75 Copay 30%* Routine Adult Physical Exam Emergency Room RX (Generic / Preferred Brand/ Non-Preferred Brand) * Deductible applies to these services $100 Copay (waived if admitted) $10 / $20 / $35 $10 / $20 / $35 (plus 20%) For more detailed plan design information go to: www.garnett-powers.com/rochester 9 Glossary of Medical Insurance Terms Copayments are fixed dollar amounts (for example, $20) you pay for covered health care, usually when you receive the service. Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example: If the plan's allowed amount for an overnight hospital stay is $1,000, your coinsurance payment of 10% would be $100. This may change if you haven't met your deductible. The deductible is an amount of money that must be paid, or ‘satisfied’ before the coinsurance amount can be paid. The Maximum Out-of-Pocket , also known as Payment Limit, becomes the limit of how much you will pay for your and your family’s medical care for a calendar year, after which point, you will not pay any more. The medical POS plan has a dollar limit of $2,500 for individual and $5,000 for family. 10 Summaries of Benefits and Coverage The Patient Protection and Affordable Care Act (PPACA) requires that you be notified that the Summaries of Benefits and Coverage for your medical plans are currently available on our website. The Summaries of Benefits and Coverage follow the recommended guidelines of PPACA in a standardized format to make them easier to read and comprehend to better serve you in making your plan selections. You may request a paper copy at no charge by calling the toll-free number on your new ID card. You may also print a copy directly off of the GPA website. 11 Prescriptions – Mail Order Pharmacy You can order maintenance medications through Aetna’s Rx Home Delivery for chronic conditions as asthma, arthritis, diabetes, high cholesterol and heart conditions. Under the POS plan, this service provides you up to a 90 day supply of these medications after a copay of $20 for generic, $40 for preferred brand-name, and $70 for non-preferred brand name drugs. Please click on Aetna RX Home Delivery/Order Form on the website after January 1, 2016 for more information, as well as directions on how to order your prescriptions. 12 University of Rochester Wellness Programs • URMC Employee Pharmacy: Your Aetna insurance plan allows you to fill your prescriptions at the campus pharmacy, located on the first floor of the Medical Center. • Lifestyle Management Programs: Take advantage of programs available to help you reduce stress, lower blood pressure, lower cholesterol and keep physically active. A team of counselors and physicians will work with you to assist you in managing a healthy lifestyle strategy. • Condition Management: Manage chronic conditions, as asthma, diabetes, low back pain and COPD with a personalized program to meet your needs and schedule. • Employee Assistance Program (EAP): Free counseling service that provides help to postdocs and their household members by offering counseling and up to 5 visits per household member with Strong EAP. • See physicians within Accountable Health Partners: Aetna is contracted with this ACO. • For more information, visit: http://www.rochester.edu/working/hr/wellness/ 13 Wellness Programs through Aetna • Women’s Preventive Services: Your Aetna insurance plan covers many women’s preventive services with no copays, coinsurance or deductible when provided in network, as generic contraceptives, purchase of a breast pump in certain circumstances, and well-woman care. • Fitness Discount Program: You'll receive lower rates on gym membership in the large GlobalFit™ network, plus receive discounts on health coaching and fitness equipment. • Discount Program: Save on gym memberships, eye exams and eyeglasses, weight-loss programs, massage therapy and more. • Informed Health Line: By calling a toll-free number, you can get answers from a registered nurse 24/7, 365 days a year regarding health conditions, medical tests or procedures, as well as listen to the Audio Health Library. 14 Wellness Programs through Aetna (continued) • Beginning Right® Maternity Program: This program provides educational materials on prenatal care, signs of preterm labor, newborn care and more. It is dedicated to helping keep the Mother healthy during the pregnancy and provide the necessary tools and information to assure a healthy delivery and baby. • Weight Management Discount Program: You can access savings on weight-loss programs like Jenny Craig, eDiets and Nutrisystem, while receiving the support you need to be successful in reaching your weight-loss goals. • Mobile App: Now you can use your cell phone with web access to view your Aetna health plan information — whenever you want, wherever you are. The above programs are just a few of the many that are offered through Aetna. To learn more about what is offered, and to register for Aetna Navigator, please visit www.aetna.com. 15 Urgent Care The hospital emergency room is to be used only if the situation is limb or life threatening. The Urgent Care Center should be used as often as possible to avoid additional charges. The Urgent Care Center is open 24 hours and is available to treat most non-life threatening emergencies, as broken bones (not multiple fractures), wounds not bleeding profusely, fevers and flu symptoms. The Urgent Care copay is less: POS Plan - $100 copay for emergency room versus $75 copay for urgent care. There are 7 Urgent Care Centers within 5 mile radius of the University of Rochester. 16 Dental Insurance Provided by Postdoctoral Scholar Benefit Program Aetna Dental PPO Plan Core Benefits In-Network Postdoc Pays Annual Deductible Out-of-Network Postdoc Pays $50* per individual / $150* per family Annual Benefit Maximum $1,500 Preventive/Diagnostic Care Routine Exams Teeth Cleanings (Prophylaxis) X-rays 0% 0% 0% 20% of Usual, Customary and Reasonable Charges 20% of Usual, Customary and Reasonable Charges 20% of Usual, Customary and Reasonable Charges Basic Procedures Fillings Endodontics Periodontics Oral Surgery 20% 20% 20% 20% 30% of Usual, Customary and Reasonable Charges 30% of Usual, Customary and Reasonable Charges 30% of Usual, Customary and Reasonable Charges 30% of Usual, Customary and Reasonable Charges Major Procedures Crowns Bridgework Dentures 50% 50% 50% 50% of Usual, Customary and Reasonable Charges 50% of Usual, Customary and Reasonable Charges 50% of Usual, Customary and Reasonable Charges Orthodontia * Deductible applies to these services Not Covered For more detailed plan design information go to: www.garnett-powers.com/rochester 17 Accessing the Out-of-Network Tier An example of how seeking out-of-network services can impact your out-of-pocket costs: Porcelain Crown on a molar - We will estimate that the usual, customary and reasonable charge is considered $800. total of $500 for the crown, which includes the extra $100 that the dentist charged above what is considered usual, customary and reasonable. Per the out-of-network benefit structure, you will pay 50% (your coinsurance) toward that crown, which would be $400. Using the out-of-network tier costs you more because the dentists do not discount their services per a provider contract, whereas those contracts do reduce your out-of-pocket costs in the in-network PPO tier. In addition, if the out-of-network dentist performing your crown services charges more than what is considered usual, customary and reasonable, you will pay the $400 PLUS any additional amount that the dentist wishes to charge. So, if the dentist charged $900 for the crown in total, you would pay a When you access care out-of-network, you and the insurance carrier incur more costs, consequently affecting the overall pricing of the plan. Aetna has a robust PPO network. 18 Voluntary Vision Insurance Provided by Postdoctoral Scholar Benefit Program Aetna Voluntary PPO Vision Plan In-Network Postdoc Pays Out-of-Network Postdoc Pays $10 Copay Up to $25 Reimbursement Frames (every 24 months) $130 allowance (20% off remaining balance) Up to $65 Reimbursement Lenses (every 12 months) Single Bifocal Trifocal Lenticular Standard Progressive $10 Copay $10 Copay $10 Copay $10 Copay $75 Copay Up to $20 Reimbursement Up to $40 Reimbursement Up to $65 Reimbursement Up to $65 Reimbursement Up to $40 Reimbursement $115 Allowance (additional 15% off balance over allowance) Up to $80 Reimbursement $115 Allowance Up to $80 Reimbursement $0 Copay $200 Reimbursement Core Benefits Eye Exam (every 12 months) Conventional Contact Lenses* (materials only) Disposable Contact Lenses * (materials only) Medically Necessary Contact Lenses* *Contact lenses in lieu of traditional lenses For more detailed plan design information go to: www.garnett-powers.com/rochester 19 The Open Enrollment Process All eligible Postdoctoral Scholars may visit the enrollment form to make their benefit selections from: November 9th – November 20th, 2015. First, you will click on Enrollment in the Plans. Next, you will click on Create a Login Account. Next, you will click on Create Your Account and Start the Enrollment Process. Your enrollment form has already been pre-populated with your personal information in Section 1. We would only require that you change your email address if the one shown is not accurate, or if you do not use that email account on a regular basis. 20 The Open Enrollment Process Continued… You will make your benefit selections in Section 4 by choosing medical, and/or dental, and/or voluntary vision for you and your family members. You may choose a Primary Care Physician at this point for the medical POS plan if you wish to do so. Click on Calculate My Contributions to learn what your monthly contribution will be. Postdoctoral Associates (093) and Postdoctoral Fellows (095) will have contributions for medical and dental deducted through the UR payroll and will pay for voluntary vision to GPA via credit or debit card. Visiting Postdoctoral Fellows (094) will be paying a monthly contribution for medical, dental and voluntary vision to GPA via credit or debit card. 21 The Open Enrollment Process Continued… Next, click on Submit and Create Printable Enrollment Form. An electronic version of the enrollment form will be submitted to GPA’s secure database for data entry, at the same time taking you to the payment form for you to make your initial contribution payment by credit or debit card. GPA accepts foreign issued Visa and MasterCards as well as U.S. issued cards. For future visits to access your account, you will simply use your email address and your unique password. Future billing for your monthly contributions will happen electronically. You will receive an email from GPA, allowing you to click on a link to take you to the payment page to make your payment. Please review the instructions on the website to make your payment. 22 The Open Enrollment Process Continued… An email will be sent to you no later than December 11th, confirming your enrollment in the plans you have selected, as well as providing you with detailed information on how to access benefit information and provider services with the insurance carriers. ID cards (if applicable) will be mailed to your home. 23 Family Member Eligibility Family member eligibility requirements are the same as the family member eligibility requirements for the University of Rochester faculty/staff plans. The Major Family Member Categories Are: Spouse Domestic partner (opposite sex or same sex). Requires Certification of Domestic Partner Status • Form available on the GPA website Natural or adopted children up through the end of the month in which they turn 26, then the option to transition to an extension of benefits through age 30. Your domestic partner’s children Your children who are handicapped prior to age 26 and are dependent on you for support • Eligible children includes: biological, legally adopted, stepchildren, and children who are placed with you by an authorized placement agency or by judgment, decree or other order of any court of competent jurisdiction 24 Information Sources For general inquiries and customer service regarding enrollment, benefit questions and ID cards, please contact Garnett-Powers & Associates, Inc. Tell: 1 (844) 243-0027 | Fax (949) 583-2929 | Email: URPD@garnett-powers.com www.garnett-powers.com/rochester 25 Thank you for joining us today! Any Questions?