Insurance Coverages – Property and Casualty

advertisement

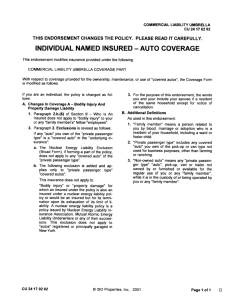

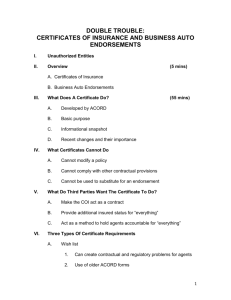

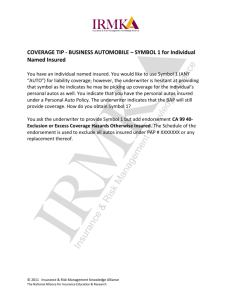

Insurance Fundamentals for Policymakers Insurance Fundamentals for Policymakers Four assignments: • Insurance Principles • Insurance Coverages: Property and Casualty • Insurance Coverages: Life and Health • Insurance Regulation and Legislation Insurance Coverages: Property and Casualty Topics • • • • • The Homeowners Policy The Personal Auto Policy The Surplus Lines Market Reinsurance Workers Compensation: Statutes and Methods of Demonstrating Financial Security The Homeowners Policy Property and casualty insurance covers real and personal property and the insured’s liability for others’ injuries or property damage. The Homeowners Policy Section I—Property Coverages Dwelling Other Structures Personal Property Loss of Use Section II—Liability Coverages Personal Liability Medical Payments to Others Section I—Property Coverages, Dwellings and Other Structures Protects: • House and structures attached to house • Detached structures on premises Perils insured against depend on policy Section I—Property Coverages, Personal Property and Loss of Use • Personal Property—property other than dwelling and other structures • Loss of Use—financial losses when an insured residence is uninhabitable – Reimbursement for living or meal expenses – Fair rental value Section II—Liability Coverages, Personal Liability • Bodily injury or property damage for which the insured is legally liable • Insurer is obligated to defend the insured Section II—Liability Coverages, Medical Payments to Others • For persons injured at insured’s premises • Applies whether or not insured is liable • Claim must be made within three years Policy Choices—Insureds • Owner-occupants • Tenants • Condominium owners Policy Choices—Perils • Perils are causes of loss • Named perils—Perils listed in the policy • Open perils—All perils not excluded by the policy Owner-Occupant Policies Other Policies The Personal Auto Policy An individual or family can use a personal auto policy (PAP) to insure against the consequences of losses involving ownership or use of an auto. Coverage Options • • Liability Medical payments Uninsured/underinsured motorists Physical damage Personal injury Liability Coverage • Covers bodily injury and damage to others’ property caused by an insured in an auto accident. • Insured must be found legally responsible. • Applies to – Covered vehicles and other vehicles driven by an insured – Occasional drivers of covered vehicles Medical Payments Coverage • Covers reasonable and necessary medical expenses for injuries from auto accident to – – – Insured in any auto Insured pedestrian injured by auto Occupants of insured auto • Paid regardless of fault • Carries per-person limit Uninsured Motorists Coverage Covers bodily injury caused by At-fault uninsured motorist Hit-and-run driver Driver who is insolvent Underinsured Motorists Coverage • • • • Added as endorsement to PAP Covers insured’s injury caused by underinsured at-fault driver In some states, also covers property damage Pays difference between underinsured motorists coverage limit and at-fault vehicle’s liability limits Physical Damage Coverage • Applies to insured’s covered autos • Applies to certain other autos – Nonowned auto not for insured’s regular use – Auto or trailer used as temporary substitute (loaner) • Has a deductible Physical Damage Coverage—Collision Applies when covered auto – Strikes an object – Collides with another vehicle – Overturns Physical Damage Coverage—Other Than Collision • Applies to damage not resulting from collision • Examples: damage from fire, theft, vandalism, hail, animal contact, flood, and glass breakage Personal Injury Protection • Pays benefits regardless of fault • Covers medical expenses, income loss, and other losses of injured occupants of covered auto • May restrict victims’ right to sue (“true” no-fault laws) • Added by endorsement The Surplus Lines Market The surplus market includes unique or unusual exposures, as well as those exposures that the standard market is unwilling or unable to insure. Excess and Surplus Lines (E&S) Classes of E&S business Unusual or unique loss exposures Nonstandard business Insureds needing higher coverage limits Insureds needing unusually broad coverage Loss exposures that require new forms of coverage Unusual or Unique Exposures • Standard insurance depends on a large number of similar exposures. • Without that, coverage is difficult to price. • E&S coverage may be available. Nonstandard Business • Standard insurers may not cover high-loss or uncontrollable-loss exposures. • Premiums may be too high. • E&S coverage may be available. High Limits, Broad Coverage, New Exposures In comparison to what the standard market provides, the E&S market provides: – Higher-limit coverages – Broader coverage – Coverage for new exposures E&S Lines Regulation • Some states maintain lists of approved E&S insurers. • Other states maintain lists of unapproved E&S insurers. • Most states require all E&S business to be placed through an E&S broker. Reinsurance Reinsurance enables insurers to meet the needs of the public and handle their own risk portfolios efficiently. Reinsurance helped the United States insurance industry withstand such disasters as the September 11, 2001, terrorist attacks and Hurricane Sandy in 2012. Basic Reinsurance Concepts • • • • Insurer transfers liability for certain losses to reinsurer. In exchange, insurer pays reinsurer a ceding commission. Insurer retains some of the loss, and coverage is subject to limits. Reinsurers also use reinsurance (retrocession). Indemnification of Policyholders • Policyholders cannot collect directly from reinsurers. • Two exceptions: – – Cut-through endorsement Purchase of reinsurance for captive insurer or pool Workers Compensation Workers compensation (WC) laws provide an exclusive remedy for work-related injuries: employers are required to cover such injuries without regard to fault, and employees’ right to sue in such cases is limited. State WC Laws • Obligate employers to compensate employees for job-related injuries • Limit employees’ rights to sue employers for such injuries • Guarantee prompt payment • Reduce court burdens and litigation costs Scope of Coverage • Medical expenses and wage loss • Work-related injuries and occupational diseases Benefits Payable • • • • Medical benefits Disability income benefits Rehabilitation benefits Death benefits Persons Covered or Exempt • Covered—Industrial workers and most workers of private employers • Exempt (varies by state) – – – – – Small businesses with few employees Farm labor Domestic employees Casual employees Independent contractors Employers’ Financial Security • State laws require employers to demonstrate ability to pay WC claims. • Employers can meet this requirement through insurance or selfinsurance. WC Insurance • Voluntary market—private insurers • Assigned risk plan • State fund Self-Insurance for WC • Self-insurance plans • Self-insured groups Summary • • • • • Homeowners policies—property damage, loss of use, liability Personal Auto Policy—losses from ownership/use of autos Surplus lines—unusual or unique exposures Reinsurance—insurance for insurers WC—medical expenses and wage loss