Creating a Compelling and Persuasive Investor Presentation

advertisement

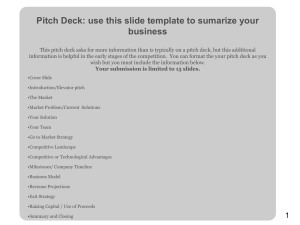

BYOBB Elements of a Pitch Deck February 5, 2015 BYOBB Pitch 2 What it is: A six-to-eight minute presentation with an investor focus Grabs attention early and keeps it by hitting highlights Leaves the investor eager to know more What it isn’t: A technology presentation A sales presentation An opportunity to “get in the weeds” What Investors/Reviewers Want to Know 3 What is the opportunity? How big is it? How do you make money? Do you have proof that customers will buy? Is it essential or a niceto-have? Can you defend it in the market? What’s the secret sauce? Can you execute? Can you prove it with the management team’s track record? What will you do with our money? Big Hint… There is a big difference between a pitch deck when you narrate and when you are sending as a stand-alone. Ideally you have two separate decks BYOBB : Create a narration deck, and include your notes in the note section, if the slides don’t tell the story on their own Title Slide 7 Include on the slide Company name, logo and date of presentation Ensure a highly professional image – get help if you need it Talk about… What your company does (high level) Open with a “wow statement” that commands attention The Opportunity Who is the customer? What is their problem? Why do you know about this problem? A very effective technique here is to tell a story: I was making a lot of money running my own technology consulting company, and yet, I wasn’t saving any money, and was surprised when I couldn’t make ends meet. I decided to… I was watching my brother juggle two kids and a shopping list, and I figured there had to be a better way! I worked in a winery for three years, and was appalled by the amount of fruit we were throwing away. Customer and Problem: Example Product/Service Description 10 Briefly explain your product or service Why and how does it solve the defined problem? Provide diagrams, photos, videos Don’t get in the weeds: this is not a sales presentation! Product/Service Description: Example Product/Service Description Market/Opportunity 13 Goal: Show how big the market/opportunity is, discuss your target market, and which segments you are going after first Explain How is the market solving the problem currently? Why is your solution superior? What is your value proposition Must be compelling and believable What is the target market and size? What segments are you addressing? What are the size of each? Prioritize segments; provide justification Market/Opportunity Example – Part I Competitive Landscape 15 What other firms and products are providing solutions to the problem? What differentiates your product or service? Superior performance, lower cost alternative, lower side effects, etc. How entrenched is the competition? What are their weaknesses? Perceptual maps can help Comparison charts are useful What are the “barriers to entry” for others/how will you discourage new competition Competitive Landscape: Example Competitive Landscape – Example 2 Competitor 1 Criteria 1 X Criteria 2 X Criteria 3 Criteria 4 Criteria 5 Competitor 2 Competitor 3 X X Us X X X X X X Hint: It’s okay to have the competition do some stuff you can’t do. This is how you show which niche you are going for. Hint: Make Criteria 5 the game-changer. Go to Market Strategy (Part of Execution Plan in the Business Plan template) 19 How will you reach target customers and drive revenues? How will you make money (revenue model)? Sell product or service direct to customer License technology Develop product then sell to competitor Merger-acquisition What are the key messages for your target market segments? Describe marketing and sales plan What partnerships or alliances are necessary? The Revenue Model can be its own page, and should tie to the pro forma Go to Market Strategy: Example Management Team 21 Management Team List two or three key players: CEO is the focus List successful exits, impressive affiliations, inventions, discoveries, degrees, etc. Acknowledge additional key players needed Advisory Board List three or four highly impressive members Round out deficiencies or weaknesses of management team Notable industry experts, key executives or former key executives in your field/industry Demonstrate you have the right team to execute! Management Team: Example Financials 23 ($ 000’s) 2014 2015 2016 2017 # Hospitals 1 3 7 15 Revenues $ 277 $7,016 $17,299 $31,765 Expenses $1,1418 $4,075 $6,087 $7,085 EBITDA ($1,155) $2,941 $10,252 $24,680 Show key drivers of revenue Three years’ financial projections plus history These numbers must match the numbers in your proforma income statement BizClarity Rules for Financial Projection Slides Use a table, not a graph. Make the font legible font (sans-serif; not less than 18 pt for anything; 24 is better). Round to nearest 1000, and add the legend “($000)” Example: $1,236,354 displays as 1,236. Show actual calendar years, not quarters and not “Year 1, Year 2″ Use a horizontal table with years across the top row. Go out three years in the future. Put nothing else on the slide except the table. No extra bullets or images. No long title of summary statement—save it for your narrative. All you need for the slide title is “Financial Projections.” http://bizclarity.com/handout-basics/ Road Map - Milestones What milestones are you aiming for in the near future? How much funding will it take to reach them? What milestones have you already reached? You can show this as a timeline, gantt chart, etc Milestones: Example Roadmap - Funding and Uses (If applicable) 27 Goal: Show past investment, current need, primary use of funds How much have you raised to date and from whom? Show founders investment and/or “skin in the game” from management team List current and future asks How will the funds be used? For therapeutics and medical devices, show clinical trials milestone with needed funding Funding and Uses: Example Road Map - Exit Strategy (if applicable) 29 Goal: Reassure the investor that they will make money on your opportunity Questions to answer: When will investors receive back their money? What multiples are likely? Are there comparable exits? Provide examples where possible What will be the scenario? Acquisition by competitor or market leader IPO (proceed w/ caution!) Summary Slide (Optional) Goal Summarize the reasons that an investor should invest in your company. What’s in it for them Notes You can end with the Funding Page if you’d like The last slide stays up throughout Q&A so make sure it’s a good one Summary: Example Ellen’s Rules Forget the rules (including mine) and do what’s right for you and your company Forget the 10-slide rule, but do…. Tell a story. Make it compelling Keep it simple and short. (Put extra material in your appendix.) Cover all the necessary info Show us what the product looks like Pitch decks and standalone decks should be separate. In certain cases, use the pitch deck and use the Notes Feature Never: End with: Any questions? Last slide should be a summary and contact info Say: This estimate is conservative Say: We have no competition Include decimals in your financials We’re investing in you 33 Be passionate Be entrepreneurial Be honest Be coachable Do your homework Listen and accept negative feedback