(A) Accounting Standards

advertisement

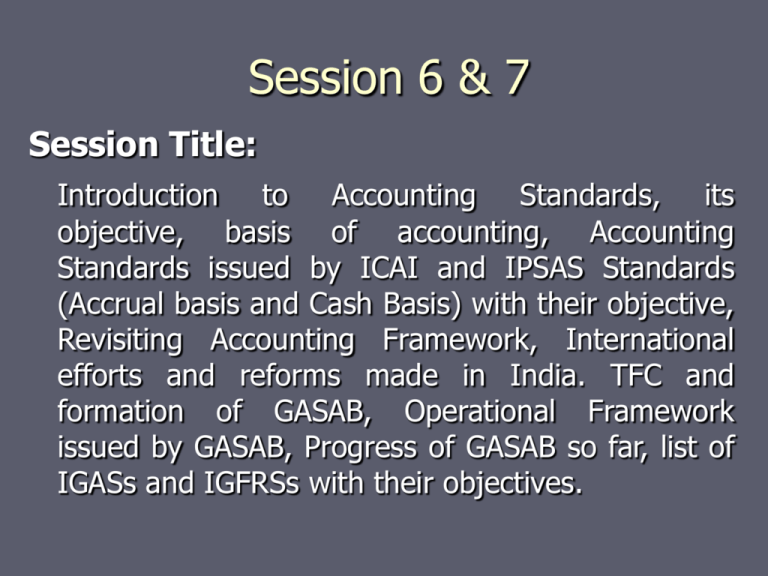

Session 6 & 7 Session Title: Introduction to Accounting Standards, its objective, basis of accounting, Accounting Standards issued by ICAI and IPSAS Standards (Accrual basis and Cash Basis) with their objective, Revisiting Accounting Framework, International efforts and reforms made in India. TFC and formation of GASAB, Operational Framework issued by GASAB, Progress of GASAB so far, list of IGASs and IGFRSs with their objectives. SESSION OVERVIEW: In order to make accounting methods and principles uniform and comparable and financial reporting show true and fair view of all the activities of the government, to the extent possible, standards are necessary to be evolved. The basic objective of Accounting Standards is to remove variations in the treatment of several accounting aspects and to bring about standardization in accounting and its presentation. In this context, it is appropriate to discuss Accounting Standards issued by IPSAS (both accrual and cash basis). The twelfth Finance Commission (TFC) recommended Accrual Accounting for the Union and the State Governments. The GASAB in the office of the C&AG (2002) was set up to recommend an operational framework and detailed roadmap for its implementation. GASAB has so far developed five IGASs namely (i) IGAS 1-Guarantees given by governments: Disclosure requirements (ii) IGAS 2 - Accounting and classification of grants-in-aid (iii) IGAS 3Loans and advances made by governments (iv) IGAS 7- Foreign currency transactions and loss or gain by exchange rate variations (v) IGAS 10- Public debt and other liabilities of governments : Disclosure requirements and four IGFRSs namely (i) IGFRS 2 (i) Property, plant and equipment (ii) IGFRS 3- Revenue from government exchange transactions (iii) IGFRS 4- Inventories (iv) IGFRS 5- Contingent liabilities (other than guarantees) and contingent assets: Disclosure requirements Session Structure: ► 1. Introduction to Accounting Standards. ► 2. ► 3. Objective of Accounting Standards. TFC, 13th Finance Commission, 14th report of 2nd Administrative Reforms Commission recommendations and formation of GASAB ► 4. Road map and Operational Framework of GASAB. ► 5. Accounting treatment and measurement procedures proposed by GASAB. ► 6. ICAI Accounting Standards and IPSAS ► 7. IGASs and IGFRS (Notified/Under Notification/ prepared/ Proposed by GASAB) ► 8.Excercise and Group Discussion Introduction: Financial Statements specially Appropriation and Finance Accounts of governments are prepared to summarize the end-result of all the activities by the government during an accounting period in monetary terms. Combined Finance Accounts compares the financial results of different state governments and union government. The government accounting in India are on cash basis and accounting follows the rule based. Though there is standardized classification structure (List of Major and Minor heads) of government activities are available, but reporting governments may adopt divergent policies in methods and principles in their financial reporting. In order to make accounting methods and principles uniform and comparable and financial reporting show true and fair view of all the activities of the government, to the extent possible, Standards are necessary to be evolved. What is Accounting Standards? i. Accounting Standards are the statements of code of practices of regulatory accounting bodies (C&AG, CGA for government accounting) that are to be observed in preparation and presentation of financial statements. ii. that Accounting Standards are rules according to which accounts have to be drawn up. iii. In layman terms, accounting standards are written documents issued by experts, institutes or other regulatory bodies covering various aspects of measurement, treatment, presentation and disclosure of accounting transactions, whether it is based on single entry cash basis or double entry accrual basis. What are the objectives of Accounting Standards? (i) The basic objective of Accounting Standards is to remove variations in the treatment of several accounting aspects and to bring about standardization in accounting and its presentation. (ii) They intent to harmonize the diverse accounting policies followed in the preparation and presentation of financial statements by different reporting entities. Accounting Standards issued by various authorities: (A) Accounting Standards (Accrual basis) issued by the Institute of Chartered Accountant of India (ICAI) are as follows: Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS 1 Disclosure of Accounting Policies in preparation and presentation of the financial statements AS2 Valuation of Inventories to formulate the method of computation of cost of inventories / stock, determine the value of closing stock / inventory at which the inventory is to be shown in balance sheet till it is not sold and recognized as revenue AS3 Cash Flow Statements This statement exhibits the flow of incoming and outgoing cash. AS4 Contingencies and Events occurring after the Balance Sheet Date The Accounting Standard deals with Contingencies and Events occuring after the balance sheet date Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS5 Net Profit or Loss for the period, Prior Period items and changes in Accounting Policies. to prescribe the criteria for certain items in the profit and loss account so that comparability of the financial statement can be enhanced. Profit and loss account being a period statement covers the items of the income and expenditure of the particular period. This also deals with change in accounting policy, accounting estimates and extraordinary items. AS6 Depreciation Accounting It is a measure of wearing out, consumption or other loss of value of a depreciable asset arising from use, passage of time. Depreciation is nothing but distribution of total cost of asset over its useful life AS7 Construction Contracts As the period of construction contract is long, work of construction starts in one year and is completed in another year or after 4-5 years or so. There may be following two ways to determine profit or loss: On year-to-year basis based on percentage of completion or On completion of the contract. Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS8 Accounting for Research and Development This deals with accounting for research and development AS9 Revenue Recognition The standard explains as to when the revenue should be recognized in profit and loss account and also states the circumstances in which revenue recognition can be postponed. AS10 Accounting for Fixed Assets It is an asset, which is:- Held with intention of being used for the purpose of producing or providing goods and services. AS11 The effects of Changes in Foreign Exchange Rates (Revised 2003) This accounting Standard applicable to accounting for transaction in Foreign currencies in translating in the Financial Statement Of foreign operation Integral as well as non- integral and also accounting for For forward exchange. Effect of Changes in Foreign Exchange Rate, an enterprises should disclose following aspects: •Amount Exchange Difference included in Net profit or Loss; •Amount accumulated in foreign exchange translation reserve; •Reconciliation of opening and closing balance of Foreign Exchange translation reserve; Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS12 Accounting for Government grants Government Grants are assistance by the Govt. in the form of cash or kind to an enterprise in return for past or future compliance with certain conditions. AS13 Accounting for investments It is the assets held for earning income by way of dividend, interest and rentals, for capital appreciation or for other benefits. AS14 Accounting for Amalgamation It deals with accounting to be made in books of Transferee company in case of amalgamation AS15 Employees Benefit (Revised 2005) The scope of the accounting standard has been enlarged, to include accounting for short-term employee benefits and termination benefits AS16 Borrowing costs It prescribe the treatment of borrowing cost (interest + other cost) in accounting, whether the cost of borrowing should be included in the cost of assets or not Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS17 Segment Reporting Disclosure of information regarding multiple products/services and their operations is called segment reporting AS!8 Related Party Disclosures disclosure of related party transaction is essential for proper understanding of financial performance and financial position of enterprise AS19 Leases Lease is an arrangement by which the lesser gives the right to use an asset for given period of time to the lessee on rent. It involves two parties, AS20 Earning Per share The statement is applicable to the enterprise whose equity shares or potential equity shares are listed in stock exchange. AS21 Consolidated Financial Statements the consolidated balance sheet if prepared should be prepared in the manner prescribed by this statement. Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS22 Accounting for taxes on Income This accounting standard prescribes the accounting treatment for taxes on income. AS23 Accounting for Investments in Associates in Consolidated financial statements It set out the principles and procedures for recognizing the investment in associates in the consolidated financial statements of the investor, AS24 Discontinuing operations The objective of this standard is to establish principles for reporting information about discontinuing operations. AS25 Interim Financial Reporting As per clause 41 of listing agreement the companies are required to publish the financial results on a quarterly basis Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS26 Intangible Assets An Intangible Asset is an Identifiable non-monetary Asset without physical substance held for use in the production or supplying of goods or services for rentals to others or for administrative purpose AS27 Financial Reporting of Interests in Joint Ventures 'Joint control' is the contractually agreed sharing of control over economic activity. AS28 Impairment of Assets As per AS-28 asset is said to be impaired when carrying amount of asset is more than its recoverable amount. AS29 Provisions, Objective of this standard is to prescribe the Contingent accounting for Provisions, Contingent Liabilities, Liabilities and Contingent Assets, Provision for restructuring cost Contingent Assets Accounting Standards (ASs) No. Accounting Standards on Objectives of the Standards AS30 Financial Instruments : Recognition and Measurement and Limited Revisions to AS 2, AS 11 (revised 2003), AS 21, As 23, AS 26, AS 27, AS 28, and AS 29 this Standard is to establish principles for recognizing and measuring Financial assets, financial liabilities and some contracts to buy or sell non-financial items AS31 Financial Instruments: Presentation This Standard is to establish principles for presenting financial instruments as liabilities or equity and for offsetting financial assets and financial liabilities. AS32 Financial Instruments: Disclosures, and Limited Revision to Accounting Standards(AS) 19 , leases The objective of this Standard is to require entities to provide disclosures in their financial statements that enable users to evaluate: •the significance of financial instruments for the entity’s financial position and performance; and •the nature and extent of risks arising from financial instruments to which the entity is exposed during the period and at the reporting date, and how the entity manages those risks (B) International Public Sector Accounting Standards (IPSAS) issued by International Federation of Accountings (IFAC)[Effective from 01.01.2004] • The International Federation of Accountants — International Public Sector Accounting Standards Board (the IPSASB) develops accounting standards for public sector entities referred to as International Public Sector Accounting Standards (IPSASs). • The IPSASB recognizes the significant benefits of achieving consistent and comparable financial information across jurisdictions and it believes that the IPSASs will play a key role in enabling these benefits to be realized. • The adoption of IPSASs by governments will improve both the quality and comparability of financial information reported by public sector entities around the world. • IPSASs are being prepared for application by entities adopting the accrual basis of accounting and for application by entities adopting the cash basis of accounting. (a) Accrual Basis Accounting Standards IPSAS No. Accounting Objectives of the Standards Standards on IPSAS 1 Presentation of The objective of this Standard is to prescribe the Financial manner in which general purpose financial Statements statements should be presented in order to ensure comparability both with the entity’s own financial statements of previous periods and with the financial Statements of other entities. IPSAS2 Cash Flow It sets out requirements for the presentation of Statements the cash flow statement and related disclosures. IPSAS3 Net Surplus or Deficit for the period, Fundamental Errors and changes in Accounting Policies The objective of this Standard is to prescribe the classification, disclosure and accounting treatment of certain items in the financial statements so that all entities prepare and present these items on a consistent basis. Accounting Standards IPSAS No. Accounting Objectives of the Standards Standards on IPSAS4 The effect of changes in Foreign Exchange Rates The principal issues in accounting for foreign currency transactions and foreign operations are to decide which exchange rate to use and how to recognize in the financial statements the financial effect of changes in exchange rates. IPSAS 5 Borrowing Costs This Standard generally requires the immediate expensing of borrowing costs. IPSAS 6 Consolidated Financial Statements and Accounting for Controlled entities This Standard establishes requirements for the preparation and presentation of consolidated financial statements, and for accounting for controlled entities in the separate financial statements of the controlling entity. Accounting Standards IPSAS No. Accounting Objectives of the Standards Standards on IPSAS 7 Accounting for Investments in Associates IPSAS 8 Financial This Standard provides the basis for accounting Reporting of for interests in joint ventures Interests in Joint Ventures IPSAS 9 Revenue from The objective of this Standard is to prescribe the Exchange accounting treatment of revenue arising from Transactions exchange transactions and events. IPSAS 10 Financial In a hyperinflationary economy, reporting of Reporting in operating results and financial position in the local Hyperinflationa currency without restatement is not useful. ry Economics This Standard provides the basis for accounting for ownership interests in associates. Accounting Standards IPSAS No. Accounting Objectives of the Standards Standards on IPSAS 11 Construction Contracts The objective of this Standard is to prescribe the accounting treatment of costs and revenue associated with construction contracts. IPSAS 12 Inventories The objective of this Standard is to prescribe the accounting treatment for inventories under the historical cost system. IPSAS 13 Leases The objective of this Standard is to prescribe, for lessees and lessors, the appropriate accounting policies and disclosures to apply in relation to finance and operating leases. IPSAS 14 Events after The objective of this Standard is to prescribe: the Reporting (a) When an entity should adjust its financial Date statements for events after the reporting date; and (b) The disclosures that an entity should give about the date when the financial statements were authorized for issue and about events after the reporting date. Accounting Standards IPSAS No. Accounting Objectives of the Standards Standards on IPSAS 15 Financial Instruments: Disclosure and Presentation he objective of this Standard is to enhance financial statement users’ understanding of the significance of on-balance-sheet and off-balancesheet financial instruments to a government’s or other public sector entity’s financial position, performance and cash flows. In this Standard, references to “balance sheet” in the context of “on-balance- sheet” and “off-balance-sheet” have the same meaning as “statement of financial position.” IPSAS 16 Investment Property The objective of this Standard is to prescribe the accounting treatment for investment property and related disclosure requirements IPSAS 17 Property, Plant The principal issues in accounting for property, and plant and equipment are the timing of recognition Investment of the assets, the determination of their carrying amounts and the depreciation charges to be recognized in relation to them. Accountin g Standards IPSAS No. Accountin g Standard s on Objectives of the Standards IPSAS 18 Segment Reporting The objective of this Standard is to establish principles for reporting financial information by segments. The disclosure of this information will: (a) Help users of the financial statements to better understand the entity’s past performance and to identify the resources allocated to support the major activities of the entity; and (b) Enhance the transparency of financial reporting and enable the entity to better discharge its accountability obligations. IPSAS 19 Provisions, Contingent Liabilities and Contingent Assets The objective of this Standard is to define provisions, contingent liabilities and contingent assets, identify the circumstances in which provisions should be recognized, how they should be measured and the disclosures that should be made about them. IPSAS 20 Related Party Disclosures The objective of this Standard is to require the disclosure of the existence of related party relationships where control exists and the disclosure of information about transactions between the entity and its related parties in certain circumstances. (b) Cash Basis IPSAS Section Accounting Standards on Objectives of the Standards PART 1 REQUIREMENT The purpose of this Standard is to prescribe the manner in which general purpose financial statements should be presented under the cash basis of accounting.. 1.1 Scope of the requirement An entity which prepares and presents financial statements under the cash basis of accounting, as defined in this Standard, should apply the requirements of Part 1 of this Standard in the presentation of its general purpose annual financial statements 1.2 Cash Basis The cash basis of accounting recognizes transactions and events only when cash (including cash equivalents) is received or paid by the entity. Section Accounting Standards on Objectives of the Standards 1.3 Presentation and Disclosure Requirement The specific disclosure requirements of International Public Sector Accounting Standards need not be met if the resulting information is not material. 1.4 General Consideration It consists standards on •Reporting Period •Timeliness •Authorization Date •Information about the entity •Restrictions on cash balances and access to borrowings 1.5 Correction of errors When an error arises in relation to a cash balance reported in the financial statements, the amount of the error that relates to prior periods should be reported by adjusting the cash at the beginning of the period. Section Accounting Standards on Objectives of the Standards 1.6 Consolidated Financial Statements consolidated financial statements which present financial information about the economic entity as a single entity without regard for the legal boundaries of the separate legal entities. 1.7 Foreign Currency Governments and government entities may have transactions in foreign currencies such as borrowing an amount of foreign currency or purchasing goods and services where the purchase price is designated as a foreign currency amount. They may also have foreign operations and transfer cash to and receive cash from those foreign operations. In order to include foreign currency transactions and foreign operations in financial statements the entity must express cash receipts, payments and balances in reporting currency terms 1.8 Effective date of Sections 1.1 to 1.7 of Part 1 and Transitional Sections 1 to 7 of Part 1 of this International Public Sector Accounting Standard become effective for annual financial statements covering periods beginning on or after 1 January 2004. Provisions Section Accounting Objectives of the Standards Standards on 1.9 Presentation of Budget Information in Financial Statements An approved budget as defined by this Standard reflects the anticipated revenues or receipts expected to arise in the annual or multi-year budget period based on current plans and the anticipated economic conditions during that budget period, and expenses or expenditures approved by a legislative body, being the legislature or other relevant authority. 1.10 Recipients of External Assistance The entity should disclose separately on the face of the Statement of Cash Receipts and Payments, total external assistance received in cash during the period. PART 2 ENCOURAGE D ADDITIONAL DISCLOSURE S It sets out encouraged additional disclosures for reporting under the cash basis. It should be read together with Part 1 of this Standard, which sets out the requirements for reporting under the cash basis of accounting. Section Accounting Objectives of the Standards Standards on 2.1.2 Future Assets that are used to generate net cash inflows are Economic often described as embodying “future economic Benefits and benefits”. Service Potential 2.1.3 to Going 2.1.5 Concern When preparing the financial statements of an entity, those responsible for the preparation of the financial statements are encouraged to make an assessment of the entity’s ability to continue as a going concern 2.1.6 to Extraordinar 2.1.7 y items An entity is encouraged to separately disclose the nature and amount of each extraordinary item. The disclosure may be made on the face of the statement of cash receipts and payments, or in other financial statements or in the notes to the financial statements Section Accounting Objectives of the Standards Standards on 2.1.8 Distinct from Whether an event or transaction is clearly distinct ordinary from the ordinary activities of the entity is determined activities by the nature of the event or transaction in relation to the activities ordinarily carried on by the entity rather than by the frequency with which such events are expected to occur. 2.1.9 Not Expected to Recur in the Foreseeable Future The event or transaction will be of a type that would not reasonably be expected to recur in the foreseeable future, taking into account the environment in which the entity operates 2.1.10 Outside the Control or Influence of the Entity A transaction or event is presumed to be outside the control or influence of an entity if the decisions or determinations of the entity do not normally influence the occurrence of that transaction or event. Section Accounting Objectives of the Standards Standards on 2.1.11 to 2.1.14 Identifying Extraordinar y Items 2.1.15 to 2.1.17 Administered An entity is encouraged to disclose in the notes to the Transactions financial statements, the amount and nature of cash flows and cash balances resulting from transactions administered by the entity as an agent on behalf of others where those amounts are outside the control of the entity. 2.1.18 to 2.1.20 Revenue Collection Public sector entities may control cash or administer cash receipts or payments on behalf of the government or other governments or government entities. 2.1.21 “Passthrough” Cash Flows Cash flows arising as a consequence of transactions as administrative arrangements where government entity undertakes as an agent of another party are sometimes termed “pass-through” cash flows. Whether or not an item is extraordinary will be considered in the context of the entity’s operating environment and the level of government within which it operates. Section Accounting Standards on Objectives of the Standards 2.1.22 Transfer Payments amounts appropriated to a government entity (a department, agency or similar) may include amounts to be transferred to third parties in respect of, for example, unemployment benefits, age or invalid pensions, family allowances and other social security and community benefit payments. Where this occurs, the entity will recognize the cash appropriated for transfer during the reporting period as a cash receipt, the amounts transferred during that reporting period as a cash payment and any amounts held at the end of the reporting period for transfer in the future as part of closing balance of cash. 2.1.23 to 2.1.30 Disclosure of An entity is encouraged to disclose, either on the face of the Major Classes statement of cash receipts and payments or other financial of Cash Flows statements or in the notes to those statements: (a) an analysis of total cash payments and payments by third parties using a classification based on either the nature of the payments or their function within the entity, as appropriate; and (b) proceeds from borrowings. In addition, the amount of borrowings may be further classified into type and source 2.1.31 to 2.1.32 Related Party Disclosures An entity is encouraged to disclose in the notes to the financial statements information required by IPSAS 20 Related Party Disclosures Section Accounting Standards on Objectives of the Standards 2.1.33 to Disclosure An entity is encouraged to disclose in the notes to the financial 2.1.35 of Assets, statements: (a) information about the assets and liabilities of the Liabilities entity; and (b) if the entity does not make publicly available its approved budget, a comparison with budgets 2.1.36 2.1.40 Comparison with Budgets Public sector entities are typically subject to budgetary limits in the form of appropriations or other budgetary authority which may be given effect through authorizing legislation 2.1.41 to 2.1.43 Consolidate d Financial Statements An entity is encouraged to disclose in the notes to the financial statements: (a) the proportion of ownership interest in controlled entities and, where that interest is in the form of shares, the proportion of voting power held (only where this is different from the proportionate ownership interest); (b) where applicable: (i) the name of any controlled entity in which the controlling entity holds an ownership interest and/or voting rights of 50% or less, together with an explanation of how control exists; and (ii) the name of any entity in which an ownership interest of more than 50% is held but which is not a controlled entity, together with an explanation of why control does not exist; and (c) in the controlling entity’s separate financial statements, a description of the method used to account for controlled entities. Section Accountin g Standards on Objectives of the Standards 2.1.44 to 2.1.48 Acquisitions and Disposals of Controlled Entities and Other Operating Units An entity is encouraged to disclose and present separately the aggregate cash flows arising from acquisitions and from disposals of controlled entities or other operating units. 2.1.49 to 2.1.50 Joint Ventures An entity is encouraged to make disclosures about joint ventures which are necessary for a fair presentation of the cash receipts and payments of the entity during the period and the balances of cash as at reporting date 2.1.51t Financial o 2.1.52 Reporting in Hyperinfla tionary Economies In a hyperinflationary economy, the presentation of the financial statements in the local currency without restatement is not useful. Section Accounting Standards on Objectives of the Standards 2.1.53 to The 2.1.58 Restatement of Financial Statements An entity that reports in the currency of a hyperinflationary economy is encouraged to: (a) restate its statement of cash receipts and payments and other financial statements in terms of the measuring unit current at the reporting date; (b) restate the comparative information for the previous period, and any information in respect of earlier periods in terms of the measuring unit current at the reporting date; and (c) use a general price index that reflects changes in general purchasing power. It is preferable that all entities that report in the currency of the same economy use the same index 2.1.59 Comparative Information If comparisons with previous periods are to be meaningful, comparative information for the previous reporting period will be restated by applying a general price index so that the comparative financial statements are presented in terms of the measurement unit current at the end of the reporting period. 2.1.60 to 2.1.61 Consolidated Financial Statements If the statement of cash receipts and payments and other financial statements are to be prepared on a consistent basis, the financial statements of any such controlled entity will be restated by applying a general price index of the country in whose currency it reports before they are included in the consolidated financial statements issued by its controlling entity. Section Accounting Standards on 2.1.62 to Selection 2.1.63 and Use of the General Price Index Objectives of the Standards The restatement of financial statements in accordance with the approach encouraged by this Standard requires the use of a general price index that reflects changes in general purchasing power. It is preferable that all entities that report in the currency of the same economy use the same index. 2.1.64 to 2.1.65 Assistance Received From NonGovernment al Organization s (NGOs) Where practicable, an entity is encouraged to apply to assistance received from non-governmental organizations (NGOs), the required disclosures identified in paragraphs 1.10.1 to 1.10.27 of Part 1 of this Standard and the encouraged disclosures identified in paragraphs 2.1.66 to 2.1.93. 2.1.66 to 2.1.93 Recipients of External Assistance An entity is encouraged to disclose by significant class in notes to the financial statements: (a) the purposes for which external assistance was received during the reporting period, showing separately amounts provided by way of loans and grants; and (b) the purposes for which external assistance payments were made during the reporting period Section Accounting Standards on 2.2 Objectives of the Standards Governments and Other Public Sector Entities Intending to Migrate to the Accrual Basis of Accounting 2.2.1 to 2.2.2 Presentatio n of the Statement of Cash Receipts and Payments An entity which intends to migrate to the accrual basis of accounting is encouraged to present a statement of cash receipts and payments in the same format as that required by International Public Sector Accounting Standard IPSAS 2 Cash Flow Statements. 2.2.3 to 2.2.6 Scope of Consolidate d Statements – Exclusions from the Economic Entity When an entity adopts the accrual basis of accounting in accordance with the accrual IPSASs, it will not consolidate entities in which control is intended to be temporary because the controlled entity is acquired and held exclusively with a view to its subsequent disposal in the near future. Temporary control may occur where, for example, a national government intends to transfer its interest in a controlled entity to a local government. REVISITING ACCOUNTING FRAMEWORK: International efforts on Standard setting: (1) In 1980’s INTOSAI emphasized standard setting for governments and in early 1990’s INTOSAI’s Accounting Standards Committee issued “Accounting Standards Framework”. (2) Similarly several national governments set up accounting standard boards/ committees (3) IFAC- Public Sector Committee takes lead in issuing IPSAS (Cash based and Accrual basis) (4) IMF issued Government Financial Standards (GFS) laying down statistical reporting standards for governments (5) In USA, FASAB (Federal Accounting Standard Advisory Board) framed SFFAS (Statement of Federal Financial Accounting Standards), GASAB(Governmental Accounting Standard Board) (State & Local as well as agencies) (6) In Canada, CICA’s (Canadian Institute of Chartered Accountant) & FSAB sets standards for government. (7) In Australia and New Zealand, AASB( Australian Accounting Standard Boards) framed FRS.( Financial Reporting Standards) (8) In India: (i) Report of Admn. Reform commission on Accounts and Audit (1968). (ii)Multi-tier Classification System introduced (A.K.Mukherjee Committee) (iii) Management Accounting at the Union Government ( 1976 Budget speech of the Finance Minister) (iv) Departmentalization scheme of Union Government introduced in 1976. (v) Financial Advisory Unit (FA System) introduced in 1980. (vi) Classification system rationalized (R.C.Ghai Committee) in 1987 (vii) EAS Sarma Committee report on FRBM in 2000 (viii) Ahuwalia Committee, 2004 (RBI) on Medium term fiscal policy ( 3 year rolling target – receipts, payments, borrowing etc) Fiscal Policy Strategy Statement (Taxation, Borrowings, Pricing, Guarantees, Subsidy etc.) Macro economic framework statement (GDF, Fiscal balance, BOP etc) (ix) Lahiri Committee (2004) introduced Multidimensional classification) on functional and economic classification (x) Twelfth Finance Commission (TFC) recommends Accrual Accounting. (xi) New GFR (General Financial Rules) was introduced in 2005. The Twelfth Finance Commission TFC (2004) – Transition to Accrual Based Accounting and formation of GASAB: 1. The Twelfth Finance Commission (TFC) recommended Accrual Accounting for the Union and the State Governments. The Central Government has accepted the recommendation in Principle. At the same time, TFC recognized that transition to accrual based accounting is a time consuming process and suggested changeover only in medium term. 2. In the Interim period, TFC suggested to add some additional information to the present system of accounting to enable more informed decision making. TFC has suggested standardization of accounting classification upto object head level for all States to improve fiscal management. Additional eight statements relating to subsidies, expenditure on salaries, expenditure on pensions, committed liabilities, maintenance expenditure, segregation of salary and nonsalary portions and liabilities and repayment schedule on outstanding debts. The TFC has also suggested that definition of revenue and fiscal deficits be standardized. 3. Accepting the recommendations in Principle, the GASAB in the office of the C&AG (2002) was set up to recommend an operational framework and detailed roadmap for its implementation. Apart from the Central Government, so far 23 State Governments have accepted the idea of accrual accounting in principle. The Twelfth Finance Commission TFC (2004) – Transition to Accrual Based Accounting and formation of GASAB: (cont…) 4. There are two fold mandate of GASAB: (i) To establish and improve standards of governmental accounting and financial reporting and formulate and propose standards that improve the usefulness of financial reports based on the needs of the users. (ii) Since the principles of accrual accounting being followed in commercial entities cannot be transposed in their entirely in Government accounting, GASAB was entrusted with preparation of a Roadmap for transition to Accrual Accounting System and Operational Framework of such a system that will prevail in Government. The Twelfth Finance Commission TFC (2004) – Transition to Accrual Based Accounting and formation of GASAB: (cont…) 5. The Operational Framework developed / to be improved by GASAB would detailed out the broad accounting heads and treatment of transactions relating to: Revenues and Expenditure Accounting Fixed Assets Accounting Long term Liability Accounting. Accounting for current Assets and Liabilities Accounting for period costs – Interest and Depreciation. Non-financial and Contingent Liabilities. 6. The design of framework suggested by GASAB indicates broad deviations from the conventional basis of accrual accounting due specific requirements emerging from the nature of transitions of the Government. The framework for transition spread over across five stages depending upon the recognition on accrual basis given to – expenses, revenue, assets and liabilities at different point of time. A broad framework for transition to the accrual accounting is as under: Stages Expenses Revenues Assets Liabilities Contingent Liabilities Current Stage ExpCurrent and Capital Receipts Financial Assets Stock of Public Debt and Borrowings on Public Account Guarantees Stage I Receipts Financial Assets Stock of Public debt and Borrowing on Public Account + Payables Guarantees Current Expense on accrual basis and Capital Expenditure on cash basis Stages Expenses Revenues Assets Liabilities Continge nt Liabilitie s Stage II Current Expenses on Accrual basis and Capital Expenditur e on Cash Basis ( Excluding Expenditur e on Military Assets) Non Tax Revenues on Accrual Basis + Receivables + Tax Revenue on Cash Basis Financial Assets + Receivable s + Military Assets Stock of Public Debt and Borrowing on Public Account + Payables + All other Liabilities (Except Superannuation benefits. Compensated leaves, provisions and social security) Guarantee s Stage III All expenses on accrual basis + Depreciatio n ---do--- All Assets All liabilities (except super- annuation benefits, compensated leaves, provisions and social security) All explicit continge nt liabilities (Excluding infrastructure, land, heritage, intangible assets) Stages Expenses Revenues Assets Liabilities Continge nt Liabilitie s Stage IV All expenses on accrual basis + Depreciation + Provisions Non Tax Revenues on Accrual Basis + Receivables + Tax Revenue on Cash Basis All Assets including infrastructur e and land (excluding heritage and intangible) All Assets including infrastructure and land (excluding heritage and intangible) All explicit continge nt liabilities Stage V All Expenses All Revenues All Assets on accrual basis All Liabilities All explicit continge nt liabilities 7. Transition through these stages is likely to happen at varying pace in different departments of government entities. GASAB suggests that Stage I depicted in Table above should be the starting point for introduction of accrual basis of accounting in Governments. Accounting reforms should incrementally graduate to Stage V, which represents full accrual accounting. It is, however, noted that there could be certain entities within the Government, e.g. the Railways, which may like to straightaway adopt full accrual due to their preparedness and nature of activities (i) Stage-I introduces accrual based recognition principle for current expenses. Capital expenditures, as well as all revenues, will continue to be accounted for on cash basis as at present. Recognition of current expenses on accrual basis would lead to recognition of payables, which will be shown as a liability. (ii) Stage-II introduces accrual recognition of non-tax revenues. Tax revenues will continue to be recognized on cash basis. Recognition of non-tax revenues on accrual basis would lead to recognition of receivables, which will be included in assets. Military assets will also be recognized on accrual basis at this stage and included in assets shown in the Statement of Financial Position. The remaining capital expenditure will continue to be shown on cash basis. Another change would be inclusion of all other liabilities except those on account of superannuation benefits, compensated leaves, provisions and social security (iii) Stage-III requires recognition of all expenses on accrual basis including recognition of depreciation. No provisions will be recognized at this stage. Assets recognized at this stage on accrual basis would include all financial and physical assets [with the exception of infrastructure, land, heritage, and intangibles] and inventories. Tax Revenue continues to be recognized on cash basis. There is no change in terms of liability over Stage-II. Disclosure of all explicit contingent liability is made. (iv) Stage IV requires inclusion of provisions as expense and extension of physical assets to cover infrastructure and land on accrual basis. Other elements are same as that in the previous stage. (v) Stage V is introduction of full accrual accounting for all the four elements – expense, revenues, assets and liabilities. All expenses, all revenues, all assets and all liabilities are recognized on accrual principles and presented. (8) In the Road Map, the proposed transition was envisaged in three stages namely (i) Value addition within the existing system by additional statements – short term activity; (ii) Value addition in the existing system with minor modifications to enable greater disclosures such as arrears in revenue, committed liabilities, etc. This is a medium term activity; and (iii) Achieving the desired accounting system in the long-term based on accrual system. Note: Other modalities of Road Map have already been discussed in Session III. (9) As the Operational Framework provides the overall architecture of the accounting model, these guidelines also aim at laying down the principles for recognition and measurement for General Purpose Financial Reporting (GPFR). (i) Objectives of General Purpose Financial Reporting: Provide financial information about the reporting entity which would be useful in making decisions about providing resources to the entity and in assessing whether the government has made efficient and effective use of the resources. Make financial reporting more transparent. Improve understandability of financial statement by users. Make financial statements more relevant. Improve performance reporting in keeping with Results Framework Document (RFD) (ii) Components of GPFR: GPFS + MDA = GPFR GPFS : General Purpose Financial Statements (a) The Conceptual Framework of International Accounting Standards (IPSAS) • On General Purpose Financial Statements (GPFS) provides guidance for the structure and minimum requirement for the contents of financial statements prepared under accrual basis of accounting. (i) The complete set of financial statements, keeping in view the requirement as prescribed by the Government of India, may include the following statements: GPFS Statement of Financial Position MDA Statement of Financial Performan ce Statement of changes in Net Assets Cash Flow Stateme nts Appropriation Account s : Management and Discussion Analysis Accoun ting Policies and Notes to the Financi al Statem ents A management report commenting on financial statements highlighting key performance indicators • To be signed by the Chief Accounting Authority as prescribed in GFR 64 (ii) For a complete set of General Purpose Financial Reporting (GPFR), Management Discussion and Analysis report is essential. (iii) Statement of Financial Position: The Statement of Financial Position exhibits the balance of assets and liabilities as on a particular date. The assets and liabilities may be further classified into current and non current categories. Statement of Financial Position must include the following: • Assets – This should include all physical and financial assets, cash and cash equivalents, investment, inventories, receivables from exchange and non exchange transactions, capital work in progress. • Liabilities – This should include all debts and borrowings of the government, payables, and benefits payables to employees. • The progressive total of capital expenditure available in Finance Accounts should reconcile with lump sum figure in the Statement of Financial Position after making adjustment for valuation of historical assets. • (iv) Statement of Financial Performance: The Statement of Financial Performance exhibits the revenue and expenses for an accounting period and the excess/deficit of revenue over expenses. The Statement of Financial Performance must include the following: • Revenue from exchange transactions • Revenue from non exchange transactions • Expenditure by function and nature. • Surplus/Deficit • Appropriation to earmarked funds • Cost of borrowings (v) Statement of Changes in Net Assets: The Statement of Changes in Net Assets represents the changes between two reporting dates reflecting the increase or decrease in its assets during the period. (vi) Cash Flow Statements The Cash Flow Statement should provide cash flows during the period classifying them into operating, investing and financing activities. 1. Cash flows from operating activities are primarily derived from the principal cash-generating activities. This includes cash receipts from taxes, from non-tax revenues, cash payments to suppliers/contractors, grants in aid received or given. 2. Cash flows from investing activities are derived from acquisition and disposal of long term assets and other investments not included in cash equivalents. This includes cash payments to acquire or construct property, cash advances and loans made, etc. 3. Cash flow from financing activities represents the changes in the size and composition of the contributed capital and borrowings. (vii) Appropriation Accounts As part of GPFS, Appropriation Accounts would continue to reflect 1. Comparison of budget with actual 2. Original with final budget 3. Detailed reason for variations of actual with final budget (viii) Accounting Policies and notes to the Financial Statements: 1. Accounting policies, rules and practices applied by an entity in preparing and presenting financial statements be stated 2. Use of reasonable estimates and valuation methods for assets and liabilities be stated 3. Stages and period of transition be stated (b) Various stages of Operational Framework highlight maintenance and recognition of Assets and Liabilities, recognition principles for Current Expenses and Receipts new head 'Payables', Revenue receipts and new head 'Receivables'. (ii) Provision for depreciation: 1. Provision of depreciation should be made by allocating the value of assets category wise. 2. Capital assets may be depreciated over their estimated useful lives unless they are either inexhaustible or infrastructure assets. 3. The provision should be estimated on a realistic basis and only revised where justified in the light of further experience. 4. The provision of depreciation should be made each year and put away in a sinking fund. 5. As is the accepted principle, land is not depreciated. (iii) Liabilities: 1.The first step towards accrual based accounting system is identification and categorization of liabilities into distinct groups eg. short term, long term and contingent liabilities. 2. Guarantees should be disclosed in accordance with Indian Government Accounting Standard (IGAS 1) on 'Guarantees given by Governments: a disclosure requirement' notified by Government of India in December 2010. 3. Accounting and classification of Grants-in-Aid should be disclosed in accordance with Indian Government Accounting Standard (IGAS 2) notified by Government in May 2011 4. Liabilities of the Government including Stock of Public Debt and Borrowings on Public Account and Liabilities on account of superannuation benefits, compensated leave, provisions and social security are to be provided for on accrual basis. 5. Recognition of expenses relating to superannuation benefits, compensated leaves, provisions and social security may be taken after actuarial valuation. 6. Contingent liabilities other than guarantees, Claims made by third parties against the Government should also be disclosed. (iv) Recognition of all expenses and payables: Recognition of all expenses on accrual basis would lead to recognition of payables, which will be shown as a liability. (c) The following table shows the accounting treatment and measurement to be followed in case of common expenses. Item of Expenditure Realization Measure Criteria ment Recommended basis of Accounting (Accrual) Salaries, Wages, Dearness Allowance, Traveling Allowance, office expenses, etc Obligation Agreed established in amount the period of utilization of service Full cost should be charged to the accounts of the relevant period e.g.' within the period in which the employees work. Material amounts earned but unpaid at the end of the period should be accrued and placed under the head payables Interest Obligation established at the time of entering into the loan agreement. Liability to be recognized periodically on the due date for payment. Expense recognition to be in the period for which it is charged under the head payable, regardless of when the payment is made. Multiple of loan value, period, and rate of interest Item of Expenditure Realization Measure Criteria ment Recommended basis of Accounting (Accrual) Contribution to PF and defined contribution to Superanuation Funds Obligation Agreed established amount when an employee enters service To be accounted on accrual basis. Gratuity and Superanuation liabilities Obligation established when an employee enters service To be determined on the basis of actuarial valuation To be accounted to the extent of contribution made to recognized funds – accrual basis Leave encashment benefit Obligation established when an employee enters service To be determined based on service rules To be accounted when it is due- accrual basis (except when leave encashment is permitted within the reporting period) The following table shows the accounting treatment and measurement to be followed in case of common expenses. Item of Expendit ure Realization Criteria Measureme Recommended basis of Accounting nt (Accrual) Rents Right to charge rent established at the time of entering into agreement, realizable on due date for payment of rent. Agreed amount To be accounted for in the accounting period to which it is realizable – Accrual basis. If rent becomes overdue, income should be recognized and a provision should be made. Hire charges of machiner y Right established at the time of entering the contract Agreed amount To be accrued and accounted for in the accounting period to which it relates – accrual basis Interest Realizable on the due dates for the interest payment Function of loan value, period and rate of interest Interest income to be accounted on accrual basis on the due dates. If interest becomes overdue, income should be recognized & provided for. Note: revenue from taxes, Stamps and registration, at this satge , is recommended on cash basis for conservative approach so as not to inflate revenue. (e) The Way Forward: (i) 1st Phase: (2011-12 to 2012-13) • Formation of an apex body at Ministry of Finance level with representation from key stakeholders at Union and State level for coordination, monitoring, decision making and overseeing implementation issues • Formation of task based groups in each entity to initiate the transition process in a time bound manner • Revision of Chart of Accounts to integrate accrual accounting needs • Development of an IT enabled Integrated Financial Management System • Centrally Sponsored Scheme for Treasury Modernization issued by MoF mention developing of an Accounts Module and budget module. The benefits of these modules can be greatly enhanced to include revision in account code classification/ chart of accounts, building into it features of asset management, liabilities and other key features of accrual accounting. • Capacity building in terms of human resources • Identification and consolidation of assets category wise at DDO level • Valuation of all assets except historical assets • Valuation of asset with historical cost after determination of a cut off date to ensure no backlog accumulates • Identification of liability and their valuation (ii) 2nd Phase (2013-14 to 2014-15) Valuation of historical assets Provision of depreciation Recognition of all expenses and payables Recognition of revenues and receivables (iii) 3rd Phase- Preparation of Statements of General Purpose Financial Reporting (GPFS) including the following (2015 onwards) Statement of Financial Position Statement of Financial Performance Statement of Changes in assets/liabilities Cash flow Statements Appropriation Accounts Accounting policies and Notes to the Financial Statements Management and Discussion Analysis (iv) Indian Government Accounting Standards (IGASs) and Indian Government Financial Reporting Standard (IGFRS) so far notified/under consideration of GOI/approved/proposed by GASAB : Standar ds Standard on: Notified/pre pared/draft stage Objective of the standards IGAS 1 “Guarantees given by Governments: Disclosure Requirements” relating to the form of accounts of the Union, States and Union Territory Governments (with legislatures) Notified on 20th December 2010 The objective of this standard is to set out disclosure norms in respect of Guarantees given by the Union, the State Governments and Union Territory Governments (with legislature) in their respective Financial Statements to ensure uniform and complete disclosure of such Guarantees. IGAS 2 Accounting and Prepared & classification of Grants- notified by in -Aid GOI To prescribe the principles for accounting and classification of Grants-in-aid in the Financial Statements of the Government both as a grantor as well as grantee. And their appropriate disclosure. Standar ds Standard on: Notified/prepar ed/draft stage Objective of the standards IGAS 3 Cash Flow Under Statements consideration of Government of India for notification To provide information about the historical changes in cash and cash equivalents of the Government by means of a cash flow statement, which classifies cash flows during the period into operating, investing and financing activities. IGAS 4 General Under Purpose consideration of Financial Government of Statements of India for Governments notification •To lay down the principles to be followed in presentation of general purpose financial reports of Governments and to prescribe the minimum requirements relating to structure and contents of financial statements of government prepared under cash basis of accounting. •General Purpose Financial Statements (GPFS) essentially consists of Finance Accounts and Appropriation Accounts. The Financial Statements referred to in this standard are the General Purpose Financial Reports (GPFR). Standar ds Standard on: Notified/prepar ed/draft stage IGAS 5 Loans and Advances Made by Governments Under consideration Government India notification IGAS 6 Under preparation by GASAB IGAS 7 Foreign Currency transactions and Loss or Gain by Exchange Rate Variation Under consideration Government India notification Objective of the standards To lay down the norms for Recognition, of Measurement, Valuation and Reporting in of respect of Loans and Advances made by for the Union and the State Governments in their respective Financial Statements to ensure complete, accurate, realistic and uniform accounting practices, and to ensure adequate disclosure on Loans and Advances made by the Governments consistent with best international practices. The objective of this standard is to of provide accounting and disclosure of requirements of foreign currency for transactions and financial effects of exchange rate variations in terms of loss or gain in the financial statements. It also deals with the requirements of disclosure of foreign currency external debts and the rate applied for disclosure Standar ds Standard on: Notified/prepar ed/draft stage Objective of the standards IGAS 8 Contingent Proposed Liabilities (other than Guarantees) and Contingent Assets: Disclosure Requirements The objective of the proposed IGAS on the subject is to lay down the principles for disclosure requirements of Contingent Liabilities (other than guarantees) and Continent Assets of both the Union and the State Governments including Union Territories with Legislatures, in their respective Financial Statements in order to ensure uniform and appropriate disclosure of such liabilities and assets. IGAS 9 ‘Government Investment in Equity’ Proposed The objective of the Standard is to lay down the norms for Recognition, Measurement and Reporting in respect of Investments made by the Union Government, the State Governments and Governments of Union Territories with Legislatures in their respective IGAS 10 Public Debt and other Liabilities of Governments: Disclosure Requirements Under consideration of Government of India for notification To lay down the principles for identification, measurement and disclosure of public debt and other obligation of Union and the State Governments including Union Territories with legislatures in their respective financial statements. Indian Government Financial Reporting Standards (IGFRS) Standar ds Standard on: Notified/p repared/d raft stage Objective of the standards IGFRS Inventories Proposed To prescribe the accounting treatment for inventories. This standard aims at using accrual principles of accounting for Inventories – both at the stage of charging as expenditure and depicting the closing stocks in the financial statements at the end of reporting period. IGFRS 2 Property, Plant and Equipment Prepared To prescribe the accounting treatment for property, plant and equipment (PPE) so that users of financial statements can obtain information regarding an entity’s investment in its property, plant and equipment and any changes in such investment. IGFRS Revenue Proposed from Exchange Transaction s This standard lays down the principles to be followed for recognition of revenue by Governments under accrual basis accounting. This standard excludes from its scope revenue recognition principles relating to specific items (eg: Income from sale of Plant, Property and equipment) which are covered in other standards.