Law Review Publication

advertisement

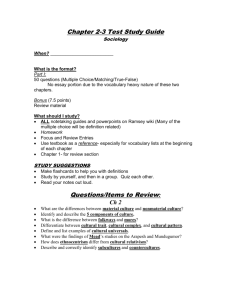

Abandoning the American Rule: Imposing Sanctions on an Empty Head Despite a Pure Heart* Table of Contents A. B. THE ‘AMERICAN RULE’ V. IMPOSING SANCTIONS ................................................ 2 i. History of the ‘American Rule’ ................................................................................. 2 ii. Federal Rules of Civil Procedure - Rules 11 and 37 .................................................. 3 iii. Statutory Sanctions .................................................................................................... 3 iv. Roadway v. Piper ....................................................................................................... 4 v. Congressional Reaction to Roadway ......................................................................... 5 vi. Lower Court Decisions Post-1980 ............................................................................. 5 HAMILTON V. BOISE CASCADE EXPRESS ................................................................ 5 vii. Abandoning the American Rule................................................................................. 6 viii. Courts Requiring ‘Bad Faith’..................................................................................... 8 C. ix. Courts Loosening the ‘Bad Faith’ Requirement ...................................................... 10 x. Which Court Gets It Right? ..................................................................................... 11 A NEW DIRECTION WITH THE ‘AMERICAN RULE’ .............................................. 12 xi. Purpose of § 1927 Sanctions .................................................................................... 12 xii. Interpreting ‘Bad Faith’ ........................................................................................... 13 xiii. Stifling Enthusiasm or Stopping Frivolous Litigation? ........................................... 14 xiv. Considering Ability to Pay Sanctions ...................................................................... 15 D. CONCLUSION ................................................................................................................. 16 Case Comment Number 22 A. THE ‘AMERICAN RULE’ V. IMPOSING SANCTIONS The ‘American Rule’ was adopted in our case history as early as 1796, effectively preventing litigants from recovering legal fees from the losing party of a suit.1 However, various Federal Rules of Civil Procedures and federal statutes have changed the way that courts approach this issue today. In direct opposition to the ‘American Rule,’ the adoption of 28 U.S.C. § 1927 in 1948 has allowed litigants to recover attorney’s fees at the expense of opposing counsel. 2 However, this statute has been met with its fair share of discrepancies regarding interpretation and appropriate application. This comment aims to provide a detailed analysis of statutory interpretation of § 1927, as well as to explore various court approaches to the ‘bad faith’ standard that is often imposed on this statute. Furthermore, this comment discusses the implications that recent decisions and amendments have had on the overall impact of this statute, and provides commentary on other considerations that may play an imperative role in a court’s decision to impose or withhold statutory sanctions pursuant to § 1927. i. History of the ‘American Rule’ This country has abided by the ‘American Rule’ requiring parties pay for their own legal services since the 18th Century until the present day.3 The Seventh Circuit has attributed this rule to the fear that, without it, those who simply and literally cannot afford to lose a lawsuit would refrain from even attempting to one.4 Courts further justify this rule based on the notion that individuals should not be penalized for exercising their right to bring suit “even if they should lose.”5 This tendency, or ‘American Rule,’ is quite distinct from English tradition dating to the 13th Century, allowing costs to be taxed against the loser of a case.6 Today, courts are still quick to point to the ‘American Rule’ as reason why they should hold tight to the reigns of the court’s 2 Case Comment Number 22 sanctioning power.7 However, a slew of federal rules8 and statutory sanctions9 were carved out beginning in the 20th century, which began to challenge this so called ‘American Rule.’ ii. Federal Rules of Civil Procedure - Rules 11 and 37 With the adoption of the Federal Rules of Civil Procedure in 1938 came two rules allowing a prevailing party to recover costs at the expense of the opposing party.10 Federal Rule of Civil Procedure 11 affords sanctions to either the court or a particular party when the opposing attorney files a meritless proceeding,11 while Rule 37 affords sanctions against an attorney for failure to abide by discovery or disclosure rules of the court.12 Both of these rules allow parties to recover partial costs from their opponent when that opponent has engaged in some sort of misconduct. iii. Statutory Sanctions The Civil Rights Attorney's Fees Awards Act of 1976, as codified in 42 U.S.C. § 1988, allows a prevailing party to recover reasonable attorney's fees when the cause of action is created by certain enumerated statutes.13 Although the whole of this act has its roots in the 19th Century, it wasn't until the late 20th Century that it was amended to allow a prevailing party to recover such fees.14 This statute provides a unique remedy in comparison to Federal Rule 11, in that sanctions pursuant to § 1988 allow a party to recover attorney’s fees rather than mere filing fees as Rule 11 is often limited to.15 In 1948, Congress codified a long standing exception to the ‘American Rule’ in 28 U.S.C. § 1927, allowing courts to impose sanctions when a party vexatiously extends litigation that forces excessive and unnecessary costs on the opposing party.16 Similar to § 1988, § 1927 has its roots in the early 19th Century, when the Senate Committee addressed the need to prevent a 3 Case Comment Number 22 "multiplicity of suits."17 The statute was sparsely used throughout the 50's and 60's, 18 and did not gain much attention until the Supreme Court addressed the issues raised in Roadway Express Inc. v. Piper in June of 1980.19 iv. Roadway v. Piper By the time Roadway made its way into the courts, § 1927 had been in effect for 32 years, and the Supreme Court had yet to comment on the statute’s interpretation.20 Roadway was decided prior to the 1980 amendments of §1927, thus the controlling language of the statute read as follows: Any attorney or other person admitted to conduct cases in any court of the United States or any Territory thereof who so multiplies the proceedings in any case as to increase costs unreasonably and vaxatiously may be required by the court to satisfy personally such excess costs.21 The Courts decision restricted recoverable costs to those listed in 28 U.S.C. 1920, noting that the two statutes should be read together since they were derived from the same initial Act, and since there was no Congressional history to denote otherwise.22 This, in effect, prevented recovery of attorney's fees. However, the Roadway opinion rested squarely on the Court’s analysis of the inherent power of a court to impose sanctions.23 Quoting from Alyeska, the Court noted that attorney's fees may be assessed when there is "willful disobedience of a court order" or when a party has acted in bad faith.24 Notice should be given to the fact that the Supreme Court's analysis of bad faith as a requirement for sanctions appears only in reference to the Court's analysis of its own inherent power to impose sanctions.25 In fact, the Court acknowledged that, while some New York Courts imposed sanctions for "mere negligence," the Roadway opinion is confined to ‘bad faith’ and does not address excessive costs imposed by negligence.26 4 Case Comment Number 22 v. Congressional Reaction to Roadway Congress apparently didn't like the Supreme Court’s approach to § 1927 sanctions, and had in fact been contemplating changes to the statute prior to this decision.27 Congress found that sanctions under § 1927 were being over restricted, and thus an amendment was needed to broaden the scope of recoverable sanctions.28 In response to the Court's finding that only those enumerated cost listed in § 1920 could be imposed through § 1927, Congress passed legislation in 1980 that amended 28 U.S.C. § 1927 to include "excess costs, expenses, and attorneys' fees reasonably incurred because of such conduct."29 The only requirements for imposing sanctions pursuant to § 1927 as discussed in the House Conference Report of August 1980 were 1) that the attorney violated some dilatory standard of practice, and 2) that such conduct caused the other party to incur expenses that they otherwise would not have incurred.30 With the decision of Roadway and the subsequent Congressional amendment in 1980, 28 U.S.C. § 1927 began attracting attention in the lower courts. vi. Lower Court Decisions Post-1980 The lower courts have split as to the implications that Roadway and the 1980 Amendment have had upon the correct interpretation of §1927. While the majority of courts find that some sort of ‘bad faith’ is required before sanctions are warranted, the 10th Circuit has interpreted this statute much more broadly.31 The recent decision of Hamilton v. Boise Cascade Express exemplifies the 10th Circuits’ approach to imposing sanctions under § 1927.32 B. HAMILTON V. BOISE CASCADE EXPRESS This decision stems from a race and gender discrimination suit filed by five plaintiffs against their employer, Boise.33 During the settlement of her claim, Mrs. Wright signed a 5 Case Comment Number 22 settlement agreement with Boise.34 The agreement stipulated, among other things, that Mrs. Wright must sign a stipulation of dismissal before any payments would be given to her.35 It further stipulated that Mrs. Wright was to return all Boise documents within her possession obtained during her employment.36 For approximately a month after Mrs. Wright signed the settlement agreement, the parties’ attorneys communicated by phone and e-mail regarding what appeared to be a misunderstanding on Mr. Hammonds’ behalf, the attorney for the plaintiff.37 Mr. Hammonds repeatedly sent communications to Boise’s counsel, demanding that Boise pay the money and drop the condition that Mrs. Wright returns the documents in her possession.38 Boise responded each time that payment was conditioned upon signing and filing the stipulation of dismissal, not upon the return of the documents.39 Furthermore, Boise refused to drop the document return stipulation, as Mrs. Wright had already signed and agreed to the settlement negotiations, which originally included this provision.40 Despite opposing attorney’s attempts to correct his flawed logic, Mr. Hammonds filed a Motion to Enforce the Settlement Agreement, in which he represented to the court that Boise refused to pay the settlement funds until Mrs. Wright had returned all company documents.41 vii. Abandoning the American Rule The District Court of Oklahoma imposed sanctions pursuant to 28 U.S.C. § 1927 against the plaintiff’s attorney for bringing this Motion, which needlessly extended the process of litigation.42 The District Court made no finding that the attorney had attempted to mislead the court, and made no finding of intentional bad faith.43 However, the court found that the plaintiff’s attorney should have known that his statement to the court was in error.44 The District 6 Case Comment Number 22 Court further found that no reasonable person could have interpreted the e-mails or letters as making payment conditional upon the return of documents.45 In effect, the District Court imposed sanctions for the attorney’s reckless disregard of the facts.46 In so doing, the court held that § 1927 sanctions are “not to be reserved for the worst offenders,” but instead should be used whenever an attorney acts recklessly and thus needlessly multiplies the litigation.47 Furthermore, the District Court found that § 1927 sanctions can be imposed regardless of a court’s finding ‘bad faith’ or not.48 The Tenth Circuit affirmed the District Court’s ruling, thus departing from the majority of jurisdictions that require bad faith’ before imposing sanctions under this statute.49 The Tenth Circuit’s rationale for imposing § 1927 sanctions despite not having found bad-faith is to prevent the “empty head, good heart” defense.50 “To excuse objectively unreasonable conduct by an attorney would be to state that one who acts with an empty head and a pure heart is not responsible for the consequences.”51 Imposing a strict requirement of bad faith, interpreted as intentional or willful misconduct, prevents the court from taxing ignorant attorneys who, with reasonable diligence, would discover that certain conduct vexatiously and unreasonably multiplies the proceedings.52 The old adage that “ignorance is not an excuse” applies three-fold to legal profession, whom society expects to be knowledgeable of the law and well-versed in its teachings.53 The Tenth Circuit also addressed Mr. Hammonds’ contention that the District Court had erroneously applied a “negligence standard,” finding his actions worthy of sanctions based simply on the fact that the judge would have done things differently.54 The Tenth Circuit was quick to dismiss this argument, finding instead that the District Court had used the proper standard by determining whether Mr. Hammonds had extended the litigation unreasonably.55 7 Case Comment Number 22 Furthermore, the Tenth Circuit found that, given the extensive communication between the parties revolving around this issue, any reasonable attorney would have been able to make the distinction between the truth of the matter and the way in which Mr. Hammond presented the matter to the court.56 The language quoted by Mr. Hammonds in his brief to the Tenth Circuit in support of his “negligence standard” argument was deemed by the Tenth Circuit to be mere suggestions from the judge, advising Mr. Hammonds on how to avoid this type of problem in future litigation.57 viii. Courts Requiring ‘Bad Faith’ The majority of jurisdictions require some sort of finding of bad faith or misconduct.58 The courts vary in their interpretation of this requirement, but all of them require that the conduct be intentional.59 Despite, or perhaps in response to, the majority’s reference in Roadway to the New York courts’ imposition of sanctions for mere negligence,60 the Southern district of New York has since required a showing of bad faith before imposing sanctions pursuant to § 1927.61 In 1982, the Southern District of New York found that an attorney’s ignorance combined with an “inartful pleading” was not enough to amount to “intentional abuse” of the judicial system, and thus did not warrant § 1927 sanctions.62 This same court later described ‘bad faith’ as a “key element” to imposing sanctions under § 1927,63 and held that the imposition of sanctions requires “a clear showing of bad faith.”64 The New York courts are not alone in this approach, as it has been adopted by a wide array of district and circuit courts.65 The First Circuit refused to impose § 1927 sanctions in Obert as recently as 2005, holding that no improper motive was proved even though the attorney made foolish misrepresentations to the court.66 The Second Circuit has held similarly as recently as 2006 that an attorney must display an improper purpose, thus requiring a specific intent to act 8 Case Comment Number 22 improperly.67 The Second Circuit has also outright stated that bad faith is a requirement for imposing sanctions under § 1927.68 The Third Circuit found in Williams that “before a court can order the imposition of attorneys’ fees under § 1927, it must find willful bad faith on the part of the offending party.” 69 The Fourth Circuit has held that a court may award such costs and fees to a party under 28 U.S.C. § 1927 only upon a finding of bad faith on the part of counsel for the opposing party.70 This court held as recently as 2007 that § 1927 sanctions are “triggered by bad faith.”71 Even though the Sixth Circuit had a history within its own circuit indicating that an objective view of attorney conduct can reveal unreasonable or vexatious conduct,72 the court nonetheless found in In re Ruben that mere negligence is not enough to impose sanctions under § 1927.73 In the same opinion, the court provides an admittedly vague and arguable useless standard to be applied in cases involving § 1927 sanctions, finding that judges should be able to recognize ‘bad faith’ conduct when they see it.74 The Seventh Circuit has argued that the decision regarding ‘bad faith’ in Roadway applies to both Rule 11 sanctions and § 1927 sanctions, and thus this court interprets § 1927 sanctions as predicated by bad faith.75 However, the Seventh Circuit has also acknowledged that the “bad faith standard has an objective component, and extremely negligent conduct, like reckless and indifferent conduct, satisfies this standard.”76 It thus appears that the Seventh Circuit recognizes a class of wrongs that don’t quite meet the strict ‘bad faith’ requirement, yet are still sufficient for the imposition of sanctions.77 The Ninth Circuit refused to impose sanctions in MGIC Indemnity Corporation, finding that the conduct considered was “as consistent with negligence as with bad faith.”78 The court further found that the determination of bad faith should be a subjective one.79 This interpretation 9 Case Comment Number 22 has been used by this court as recently as 2005 in Ingle, where the court found that sanctions were not proper absent a finding that the attorney’s conduct was “motivated by bad faith.”80 Despite the large number of courts interpreting § 1927 as requiring some showing of intentional ‘bad faith,’ a minority hold that such sanctions merely require reckless or excessively negligent conduct, regardless of intent.81 ix. Courts Loosening the ‘Bad Faith’ Requirement In light of and subsequent to the Supreme Court’s decision of Roadway in 1980, the Tenth Circuit has adhered to the same interpretation of § 1927 sanctions as it has recently in the decision of Hamilton.82 In 1985, the Tenth Circuit allowed sanctions under § 1927 against an attorney who repeatedly misquoted the record, finding that the attorney’s lack of good faith was “manifest,” and that he was “either cavalier in regards to his approach to [the] case or bent upon misleading the court.” 83 The Tenth Circuit has further authorized sanctions for raising issues that have already been addressed numerous times by fellow courts, filing “hopeless” appeals as well as “rambling” briefs.84 Only three other circuits adopt this interpretation of § 1927, allowing sanctions when conduct may not quite amount to intentional bad faith, but instead amounts only to recklessness or extreme negligence as viewed objectively by the court.85 The Fifth Circuit has a somewhat vague history regarding its approach to and interpretation of § 1927. In 1991, the Fifth Circuit found that “all that is required to support § 1927 is a determination, supported by the record, that an attorney multiplied proceedings in a case in an unreasonable manner.”86 As recently as 2002, the Fifth Circuit has held that § 1927 requires “evidence of bad faith, improper motive, or reckless disregard of the duty owed to the court.”87 The court did not, however, engage in a detailed account of those things that will 10 Case Comment Number 22 constitute “reckless disregard.”88 This court remains open to sanctions against attorneys for less than intentional bad faith.89 The Eighth Circuit employs an objective test to determine whether an attorney’s conduct “manifests either intentional or reckless disregard of the attorney’s duties to the court.”90 The Eleventh Circuit follows the same approach, finding that conduct is “unreasonable and vexatious” for the purposes of § 1927 when it is “tantamount to bad faith” against “an objective standard.”91 Recklessly pursuing a claim will satisfy this interpretation of § 1927.92 The Ninth Circuit has recently taken a more restrictive approach to § 1927 sanctions, as noted in the previous discussion of MGIC and Ingel.93 However, directly after the Roadway decision, the Ninth Circuit found that § 1927 required counsel to act either “recklessly or in bad faith,” 94 and further recognized a distinction between that requirement for § 1927 sanctions and the requirement of bad faith for imposing sanctions based on a court’s inherent powers.95 Nonetheless, as discussed above, the Ninth Circuit has recently swung the pendulum in the opposite direction, requiring the conduct in question to be motivated by bad faith.96 Similarly, the Second Circuit seems to have swayed from its initial reaction to Roadway, finding in 1985 that ‘bad faith’ could be established with a “careless, casual, and offhand manner.”97 This is not the impression that is being given by the Second Circuit’s recent decisions in cases such as Ball and Schlaifer.98 x. Which Court Gets It Right? To understand the split among the Circuit Courts regarding application of the ‘bad faith’ standard for § 1927 sanctions, one must first understand the purpose of the rule and the nuances inherently involved in statutory interpretation. Further, it is necessary to take the consequences 11 Case Comment Number 22 of these various methods of application into consideration when deciding which one better implements the goals of §1927. C. A NEW DIRECTION WITH THE ‘AMERICAN RULE’ As quoted by the Supreme Court’s decision in Roadway, “Congress enacted the first version of § 1927 in 1813 … to inquire what Legislative provision is necessary to prevent multiplicity of suits or processes, where a single suit or process might suffice.”99 Furthermore, the Supreme Court quotes a letter suggesting “that the provision was prompted by the practices of certain United States attorneys … [whom] were paid on a piece-work basis [and] had filed unnecessary lawsuits to inflate their compensation.”100 Thus it appears that § 1927 sanctions were first imposed to prevent attorneys from overcharging their clients.101 Today, however, courts are faced with a somewhat inverted problem when preventing attorneys from running up a bill on the opposing party through needless litigation. xi. Purpose of § 1927 Sanctions The District Court of Oklahoma found in Hamilton that § 1927 was not a means of punishment, but instead was a means of compensating the “victims of dilatory practices.”102 This is directly in line with the language from the Supreme Court’s opinion in Roadway.103 The holding in Roadway, with regards to the requirement of bad faith, is restricted to the Supreme Court’s analysis of a court’s inherent power to impose sanctions.104 Those actions for which the court may use its inherent powers are, by default, actions that are not already covered by any authorizing statute. Therefore, it is reasonable and expected to require a finding of bad faith before imposing this type of sanction on such conduct.105 This analysis of § 1927 helps explain the Tenth Circuit’s imposition of § 1927 sanctions despite having found no intentional bad faith. 12 Case Comment Number 22 The language of § 1927 merely calls for the conduct of an attorney to “unreasonably and vexatiously” extend the proceedings, making mo mention of a ‘bad faith’ motive.106 Of all social groups, legal professionals should be aware of the potential sanctions codified under § 1927. Again, lawyers are among the groups of individuals that society most expects to have knowledge of and to be aware of certain laws and regulations.107 The Supreme Court made no mention of a ‘bad faith’ requirement for the imposition of § 1927 sanctions, yet within the same opinion specified a ‘bad faith’ requirement with respect to sanctions imposed under a court’s inherent powers.108 The tool of interpretation most well phrased as “expression unius est exclusion alterius” is quite applicable in these respects.109 Had the Supreme Court found it necessary to require bad faith before imposing § 1927 sanctions,110 the Court knew how to do so, yet refrained.111 xii. Interpreting ‘Bad Faith’ Many lower courts have become entangled with the language of the Supreme Court’s decision in Roadway, and thus the ‘bad faith’ requirement is often misapplied and misquoted.112 The courts mistakenly apply a requirement of bad faith to the imposition of § 1927 sanctions, instead of restricting the bad faith requirement only to the inherent powers of a court to impose sanctions upon the abuse of justice.113 Furthermore, the interpretation and use of ‘bad faith’ in and of itself should be examined with close attention to detail. Courts often use this term in a misleading fashion, imposing a subjective point of view into the equation or requiring a finding of intentional maliciousness.114 The Tenth Circuit may only be adding to this confusion by finding that no bad faith is required for imposing § 1927 sanctions, yet still requiring intentional or reckless disregard of the attorney’s duties to the court.115 Many courts use ‘bad faith’ to encompass a wide variety of 13 Case Comment Number 22 conduct, such as extreme negligence and recklessness.116 By definition, conduct amounting to extreme negligence or recklessness does not require a finding of intentional malice but merely some sort of objectively unreasonable disregard of an act’s consequences.117 Thus the wide array of interpretations given to ‘bad faith’ and all that phrase is considered to encompass may have an impact on the rift between the Circuit Courts. xiii. Stifling Enthusiasm or Stopping Frivolous Litigation? Courts have expressed concerns about stifling enthusiasm and chilling creativity within the legal profession by exposing attorneys to sanctions for less than intentional misconduct.118 However, one should ask whether such a change would in effect stifle creativity or rather act to prevent the rising onslaught of frivolous lawsuits within this Country.119 The standard upheld by the Tenth Circuit does not impose sanctions on all conduct that a judge may just so happen to find unappealing.120 Instead, the court imposes sanctions under § 1927 “where, a ‘pure heart’ not-withstanding, an attorney’s momentarily ‘empty head’ results in an objectively vexatious and unreasonable multiplication of proceedings at expense to his opponent.”121 Therefore, broadening the scope of § 1927 sanctions to include reckless and grossly negligent conduct will only help in aiding the purpose of this statute by deterring needless litigation in exchange for an expedited hearing or determination of the case. Pointing again to the rise in frivolous litigation and the expense of lawsuits, courts across the board should be more willing to impose sanctions granted by statutory authority.122 The Tenth Circuit’s tendency to impose § 1927 sanctions despite lack of intentional bad faith has carried over into the court’s imposition of other sanctions, as well, such as sanctions under Rule 37 and 28 U.S.C. § 1912.123 Although courts may be worried about stifling creativity, it is an 14 Case Comment Number 22 attorney’s duty to refrain from abusing the judicial system, and sanctions should be imposed in any such circumstance regardless of the attorney’s intention.124 xiv. Considering Ability to Pay Sanctions Despite adopting a strict standard of imposing sanctions, the overall impact of a court’s decision to do so may be reduced by the importance a court places on a party’s ability to pay such sanctions.125 In the realm of § 1927 sanctions, the court will inherently be addressing the ability of the attorney personally to pay such sanctions, since the ability of the client is of no matter.126 The Tenth Circuit is willing to take this type of information into account when determining the amount of the attorney’s fees to be awarded under 42 U.S.C. §1988.127 This trend is repeated throughout the 5th,6th, and 9th circuits.128 However, the Tenth Circuit was unwilling to consider the attorney’s ability to pay sanctions in Hamilton.129 The Tenth Circuit gave no reason for this determination, instead dismissing the attorney’s contentions since they were based on the court’s previous determination of sanctions under Rule 11 instead of § 1927. Nothing in the congressional record pertaining to § 1927 sanctions prevents a court from taking such information into account when determining the amount of sanctions to award under §1927, and there is nothing in subsequent case history to indicate that courts are opposed to doing so.130 However, there is good policy rationale behind refusing to consider an individual’s income when calculating the damages sustained by the victimized party.131 In essence, America is slowly abandoning her long held rule that parties must pay for their own litigation expenses.132 On the other hand, one could also say that American is simply enforcing the same rule as she has in the past, but has now expanded the boundaries for what count’s as a “personal legal fee” to include those fees unreasonably imposed on the opposing party due to attorney misconduct. 15 Case Comment Number 22 Either way, economy and society equally push the legal profession in the direction of sanctioning attorneys for the entire extent of the costs imposed on the other party, not just those costs that the attorney can afford. When amending the statute in 1980, Congress made no mention of a reduction in fees based on ability to pay, but instead found that “the attorney should be required to satisfy personally this full range of excess costs attributable to such conduct.” 133 Congress did not limit these recoverable fees in any way, but instead decided that the “full range” could be recovered.134 Therefore, there is no Congressional support for the contention that attorney’s fees as awarded under § 1927 should be reduced in proportion to an attorney’s ability to pay. D. CONCLUSION The standards applied 28 U.S.C. § 1927 are as varied as the courts’ own interpretations of the need for such a statute and its potential effects within the legal community. An attorney’s mens rea and ability to pay may be compounded into a court’s equation regarding the imposition of § 1927 sanctions. The statutory language of § 1927 appears clear and unequivocal, yet the majority of courts insist on a ‘bad faith’ requirement before allowing such sanctions. Perhaps, after 28 years since the last landmark decision in Roadway, it is time for the Supreme Court to reconsider this statute and provide a clear cut application and interpretation. Until then, the courts are certain to continue applying standards that tend to butt heads with one another, causing a rift within the circuit courts. In the absence of a future Supreme Court decision or, alternatively, a legislative amendment in this area, courts imposing a strict intentional ‘bad faith’ requirement ought to reconsider the purpose and statutory language of § 1927 in an effort to reconcile these differences.** 16 Case Comment Number 22 * See generally McCandless v. Great Atl. and Pac. Tea Co., 697 F.2d 198, 200 (7th Cir. 1983) (explaining the ‘empty head, pure heart’ doctrine). See also Roadway Express, Inc. v. Piper, 447 U.S. 752, 759 (1980) (describing the ‘American Rule’). 1 Arcambel v. Wiseman, 3 U.S. 306 (1796) 2 28 U.S.C. § 1927 (1994) 3 Arcambel, 3 U.S. at 306 (adopting the ‘American Rule’). 4 McCandless, 697 F.2d at 200. 5 1 ROBERT L. ROSSI, ATTORNEY’S FEES § 6:1 (3d ed. 2007). 6 Roadway, 447 U.S. at 759. 7 Fed. Trade Comm’n v. Kuykendall, 446 F.3d 1149, 1152 (10th Cir. 2006) (adopting the ‘American Rule’). 8 Fed. R. Civ. P. 11(c) (allowing sanctions for misrepresentations to the court); Fed. R. Civ. P. 27 (allowing sanctions for failure to abide by discovery rules). 17 Case Comment Number 22 9 42 U.S.C. § 1988 (1994) (allowing recovery of attorneys’ fees under certain enumerated statutes); 28 U.S.C. § 1927 (1994) (allowing sanctions for vexatious multiplication of proceedings). 10 Fed. R. Civ. P. 11(c); Fed. R. Civ. P. 37. 11 Fed. R. Civ. P. 11(c). 12 Fed. R. Civ. P. 37. 13 § 1988. 14 Id. 15 Fed. R. Civ. P. 11(c); But see Fed. R. Civ. P. 11 advisory committee’s notes (finding that attorney’s fees can be assessed under this rule under limited circumstances). 16 28 U.S.C. § 1927 (1994). 17 Roadway Express, Inc. v. Piper, 447 U.S. 752, 759 (1980) (citing 26 Annals of Cong. 29 (1813)). 18 Case Comment Number 22 18 Cf. Weiss v. United States, 227 F.2d 72 (2d Cir. 1956); Bardin v. Mondon, 298 F.2d 235 (2d Cir. 1961); Gamble v. Pope & Talbot, Inc., 207 F.2d 729 (3d Cir. 1962) (addressing 28 U.S.C. § 1927 during the period noted in the text). 19 Roadway, 447 U.S. at 759. 20 See generally 28 U.S.C.A. § 1927 (West 2008) (citing no Supreme Court case history before 1980). 21 Roadway, 447 U.S. at 756 (emphasis added). 22 Id. at 760. 23 Id. at 766. 24 Id. (quoting from Alyeska Pipeline Serv. Co. v. Wilderness Soc’y, 421 U.S. 240, 258 (1975)). 25 Id. 26 Id. at 767 n.13. 27 Id. at 760 n.8. 28 H.R. REP. NO. 96-1234, at 8 (1980). 19 Case Comment Number 22 29 Id. 30 Id. 31 See Hamilton v. Boise Cascade Express, 519 F.3d 1197 (10th Cir. 2008) (holding that no bad faith is required). 32 Id. 33 Id. at 1199. 34 Id. at 1199-2000. 35 Id. at 1199. 36 Id. 37 Id. 38 Id. at 1200. 39 Id. 40 Id. 41 Id. 42 Id. at 1199. 20 Case Comment Number 22 43 Id. at 1202. 44 Id. at 1201. 45 Id. 46 Id. 47 Id. at 1203. 48 Id. at 1202. 49 Id. 50 Id. 51 Id. 52 Id. at 1201. 53 See generally Douglas L. Pfeifer, Note, Civil Procedure---Court Inflexibility Puts Appellant in a Bad Position Regarding Attorney Mistake--In re Welfare of J.R., JR., 30 WM. MITCHELL L. REV. 647, 647-48 (2003). 54 Hamilton v. Boise Cascade Express, 519 F.3d 1197, 1202-03 (10th Cir. 2008). 55 Id. 21 Case Comment Number 22 56 Id. at 1203. 57 Id. at 1202. 58 See, e.g., Obert v. Republic W. Ins. Co., 398 F.3d 138 (1st Cir. 2005); Ball v. A.O. Smith Corp., 451 F.3d 66 (2d Cir. 2006); Williams v. Giant Eagle Mkts. Inc., 883 F.2d 1184 (3d Cir. 1989); Chaudhry v. Gallerizzo, 174 F.3d 394 (4th Cir. 1999); In re Reuben, 825 F.2d 977 (6th Cir. 1987); McCandless v. Great Atl. and Pac. Tea Co., 697 F.2d 198 (7th Cir. 1983); Ingle v. Circuit City, 408 F.3d 592 (9th Cir. 2005); Gianna Enter. v. Miss World (Jersey) Ltd., 551 F.Supp. 1348 (S.D.N.Y. 1982). 59 Id. 60 Roadway Express, Inc. v. Piper, 447 U.S. 752, 767 n. 13 (1980). 61 Gianna, 551 F.Supp. at 1359. 62 Id. at 1360. 63 Mopaz Diamonds Inc., v. Inst. of London Underwriters, 822 F.Supp. 1053, 1057 (S.D.N.Y. 1993). 22 Case Comment Number 22 64 Novelty Textile Mills, Inc. v. Stern, 136 F.R.D. 63, 73 (S.D.N.Y. 1991). 65 See, e.g., Southmark Inv. Group 86 Inc. v. Turner Dev. Corp., 140 F.R.D. 1 (M.D. Fla. 1991). 66 Obert v. Republic W. Ins. Co., 398 F.3d 138, 147 (1st Cir. 2005). 67 Ball v. A.O. Smith Corp., 451 F.3d 66, 68 (2d Cir. 2006). 68 Schlaifer Nance & Co., v. Estate of Warhol, 194 F.3d 323, 338 (2d Cir. 1999). 69 Williams v. Giant Eagle Mkts. Inc., 883 F.2d 1184 (3d Cir. 1989). 70 Chaudhry v. Gallerizzo, 174 F.3d 394, 411 n. 14 (4th Cir.1999) (quoting Brubaker v. City of Richmond, 943 F.2d 1363, 1382 n. 25 (4th Cir.1991)). 71 Thomas v. Ford Motor Co., 244 Fed.Appx. 532, 539 (4th Cir. 2007). 72 In re Reuben, 825 F.2d 977, 984 (6th Cir. 1987). 73 Id. 74 Id. 75 McCandless v. Great Atl. and Pac. Tea Co., 697 F.2d 198, 201 (7th Cir. 1983). 76 Kotsilieris v. Chalmers, 966 F.2d 1181, 1184 (7th Cir. 1992). 23 Case Comment Number 22 77 Id. 78 MGIC Indem. Corp. v. Moore, 952 F.2d 1120, 1122 (9th Cir. 1991). 79 Id. 80 Ingle v. Circuit City, 408 F.3d 592, 596 (9th Cir. 2005). 81 See generally 28 U.S.C.A. § 1927 (West 2008). 82 Hamilton v. Boise Cascade Express, 519 F.3d 1197, 1208 (10th Cir. 2008). 83 Herzfeld & Stern v. Blair, 769 F.2d 645, 647 (10th Cir. 1985). See also Dominion Video Satellite, Inc. v. Echostar Satellite L.L.C., 430 F.3d 1269 (10th Cir. 2005) (finding sanctions appropriate against attorney who misstated case law, filed prolix briefs, and raising previously rejected arguments). 84 Lewis v. Circuit City Stores, Inc., 500 F.3d 1140, 1153 (citation omitted). 85 See, e.g., Browning v. Kramer, 931 F.2d 340 (5th Cir.1991); Perkins v. Spivey, 911 F.2d 22 (8th Cir.1990); Hudson v. Int'l Computer Negotiations, Inc., 499 F.3d 1252 (11th Cir. 2007). 86 Browning, 931 F.2d at 344. 24 Case Comment Number 22 87 Procter & Gamble Co. v. Amway Corp., 280 F.3d 519, 525 (5th Cir.2002). 88 Id. 89 Id. 90 Perkins, 911 F.2d at 36. See also Tenkku v. Normandy Bank, 348 F.3d 737 (8th Cir. 2003). 91 Hudson, 499 F.3d at 1262 (citations omitted). 92 Id. 93 MGIC Indem. Corp. v. Moore, 952 F.2d 1120, 1122 (9th Cir. 1991); Ingle v. Circuit City, 408 F.3d 592, 596 (9th Cir. 2005). 94 Barnd v. City of Tacoma, 664 F.2d 1339, 1343 (9th Cir.1982) (emphasis added). 95 U.S. v. Blodget, 709 F.2d 608, 610 (9th Cir. 1983). 96 Ingle, 408 F.3d at 596. 97 Mone v. Comm’r, 774 F.2d 570, 574 (2d Cir. 1985). 98 Ball v. A.O. Smith Corp., 451 F.3d 66 (2d Cir. 2006); Schlaifer Nance & Co., v. Estate of Warhol, 194 F.3d 323 (2d Cir. 1999). 25 Case Comment Number 22 99 Roadway Express, Inc. v. Piper, 447 U.S. 752, 759 (1980). 100 Id. at 759 n.6. 101 Id. at 759. 102 Hamilton v. Boise Cascade Express, 519 F.3d 1197, 1202 (10th Cir. 2008). 103 Roadway, 447 U.S. at 759 n.6. 104 Roadway, 447 U.S. at 766. 105 See generally 28 U.S.C. § 1927 (1994) (imposing a notice requirement). 106 Id. 107 See generally Pfeifer, supra note 53, at 647. 108 Roadway, 447 U.S. at 759-66. 109 “The expression of one thing implies exclusion of the other.” (as interpreted in Davidson v. Davidson, No. 05-6414, slip op. at 4 (Ohio Ct. App. Dec, 5, 2005)). 110 Roadway, 447 U.S. at 766. 111 Id. at 759-62. 112 Schlaifer Nance & Co., v. Estate of Warhol, 194 F.3d 323, 338 (2d Cir. 1999). 26 Case Comment Number 22 113 Roadway, 447 U.S. at 766. 114 Thomas v. Ford Motor Co., 244 Fed.Appx. 532, 539 (4th Cir. 2007). 115 Hamilton v. Boise Cascade Express, 519 F.3d 1197, 1202 (10th Cir. 2008). 116 Kotsilieris v. Chalmers, 966 F.2d 1181, 1184 (7th Cir. 1992). 117 See generally Sybil Louise Dunlop, Are an Empty Head and a Pure Heart Enough? Mens Rea Standards for Judge-Imposed Rule 11 Sanctions and Their Effects on Attorney Action, 61 VAND. L. REV. 615 (discussing ‘bad faith’ and ‘negligence’ standards). 118 Eastway Const. Corp. v. City of New York, 762 F.2d 243, 254 (2d Cir. 1985). See also Mone v. Comm’r, 774 F.2d 570, 575 (2d Cir. 1985). 119 See generally Maura I. Strassberg, Privilege Can Be Abused: Exploring the Ethical Obligation to Avoid Frivolous Claims of Attorney-Client Privilege, 37 SETON HALL L. REV. 413, 419 (2007) (commenting on attorney’s duties and avoiding frivolous appeals). 120 Hamilton, 519 F.3d at 1203. 27 Case Comment Number 22 121 Id. 122 See generally Strassberg, supra note 119, at 419. 123 See generally U.S. v. Rayco, Inc., 616 F.2d 462 (10th Cir. 1980). 124 Strassberg, supra note 110, at 426. 125 Roth v. Green, 466 F.3d 1179 (10th Cir. 2006). 126 28 U.S.C. § 1927 (1994). 127 Roth, 466 F.3d at 1194 (applying standard pursuant to 42 U.S.C. § 1988). 128 See, e.g., Alizadeh v. Safeway Stores, Inc., 910 F.2d 234, 238-39 (5th Cir. 1990); Wolfe v. Perry, 412 F.3d 707, 723-24 (6th Cir. 2005); Miller v. Los Angeles County Bd. of Educ., 827 F.2d 617, 621 (9th Cir.1987). 129 Hamilton v. Boise Cascade Express, 519 F.3d 1197, 1206 (10th Cir. 2008). 130 See generally Debra T. Landis, J.D., What Conduct Constitutes Multiplying Proceedings Unreasonably and Vexatiously so as to Warrant Imposition of Liability on Counsel under 28 U.S.C.A. § 1927 for Excess Costs, Expenses, and Attorney Fees, 81 A.L.R. FED. 36 (1987). 28 Case Comment Number 22 131 Hamilton, 519 F.3d at 1206. 132 McCandless v. Great Atl. and Pac. Tea Co., 697 F.2d 198, 200 (7th Cir. 1983). 133 H.R. REP. NO. 96-1234, at 8 (1980). 134 Id. ** As promised to the boss, I would like to thank Loraine D. Farabow for the time off to complete this comment. Here is your designated footnote. 29