Liabilities: Accrued Compensated Absences

advertisement

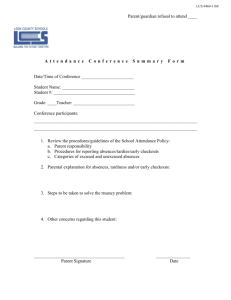

. CHAPTER 4.3.3 GAAP ADJUSTMENTS AND RECLASSIFICATION ENTRIES LIABILITIES: ACCRUED COMPENSATED ABSENCES 1 GAAP POLICIES AND PROCEDURES Compensated absences is a liability that is attributable to services already rendered and that are not contingent on a specific event that is outside the control of the employer and employee should be accrued as employees earn the rights to the benefits. Compensated absences that relate to future services or that are contingent on a specific event that is outside the control of the employer and employee should be accounted for in the period those services are rendered or those events take place. Vacation Leave GASB Statement No. 16, paragraph 7 requires that vacation leave should be accrued as a liability as the benefits are earned by the employees if both of these conditions are met: a. The employees’ rights to receive compensation are attributable to service already rendered. b. It is probable that the employer will compensate the employees for the benefits through paid time off or some other means; such as cash payments at termination or retirement. A liability should be accrued for vacation leave that were earned but not used during the current or prior periods and for which employees can receive compensation in a future period. Benefits that have been earned but are not yet available for use as paid time off or as some other form of compensation because employees have not met certain conditions (for example, a minimum service period for new employees) should be accrued to the extent it is probable that the employees will meet the conditions for compensation in the future. Benefits that have been earned but are expected to lapse and thus not result in compensation to employees should not be accrued as a liability. ACCRUAL RATE: Calculation of the compensated absences liability should be calculated based on the pay or salary rates in effect as of July 1st of the following fiscal year. Other salary related payments GASB Statement No. 16, paragraph 11 states that, an additional amount should be accrued as a liability for salary-related payments associated with the payment of compensated absences, using the same accrual rate as of the SNP date. The salary-related payments subject to this accrual are those items for which an employer is liable to make a payment directly and incrementally associated with payments made for compensated absences on termination. Such salary-related payments include the following: a. The employer’s contribution of social security 4.03.3-1 GAAP Manual | GAAP Adjustments and Reclassification Entries – Liabilities: Accrued Compensated Absences | June 30, 2015 . b. The employer’s contribution of medicare taxes c. The employer’s contribution to the employee’s retirement benefit (defined benefit pension plans) The accrual should be based on the entire liability for each type of compensated absence to which the salary-related payments apply. That is, payments associated with termination payments of vacation leave should be accrued for the entire vacation leave liability, including leave that might be taken as paid time off rather than paid as termination payments. The benefit rate in either the H46 report, from The California Leave Accounting System (CLAS), or the standard reports generated from the Absence Management System (AMS) has included the above employer’s contributions. Sick Leave Paid time off for earned sick leave is contingent on a specific event (illness) that is outside the control of the employer and employee. Based on GASB Statement No. 16, compensated absences that are contingent on a specific event that is outside the control of the employer and employee should be accounted for in the period those events take place. Since sick pay for the CSU is contingent only upon an employee’s future sickness and will be forfeited on employee’s termination, the accumulated sick hours are excluded in the calculation of the compensated absences liability. Besides, sick pay has already been added as part of calculation of the employer’s contribution to employees’ retirement benefit (defined benefit pension plans) because unused sick time will be incremented as time worked in the calculation of retirement (pension plan) benefits. 2 RELEVANT ACCOUNTING LITERATURE GASB Statement No. 34 Basic Financial Statements – and Management’s Discussion and Analysis – for State and Local Government GASB Statement No. 16 Accounting for Compensated Absences 3 OBJECTIVE OF GAAP ADJUSTMENTS To reverse accrual for compensated absences at June 30, 20PY. To record an accrual for compensated absences at June 30, 20CY. 4 GAAP ACCOUNTING T REATMENT AND JOURNAL ENTRIES 4.1 RELATED GAAP ACCOUNT(S) 712104 – Accrued compensated absences, current portion 712201 – Accrued compensated absences, net of current portion 4.03.3-2 GAAP Manual | GAAP Adjustments and Reclassification Entries – Liabilities: Accrued Compensated Absences | June 30, 2015 . GAAP ACCOUNTING TREATMENT 4.2 COMPENSATED ABSENCES The GAAP adjustments made to record compensated absences liability are timing adjustments, since salary expense ultimately is recorded in a campus’ legal basis accounting records as employees use vacation, CTO or holiday credits and will need to be reversed in the subsequent year unless a campus chooses to adjust for only the change in compensated absences amounts between the prior and current years. Campuses are required to disclose in the SNP, the current and non-current portion of the compensated absences liability at the end of the fiscal year. The current portion of the liability is the amount that is expected to be paid out as salary over the next 12 months to employees who use vacation or other leave credits during that period of time. It has been determined that either the dollar value of compensated absences paid out during the current fiscal year or, where a campus determines it to be more accurate, an average of amounts paid out over the past few fiscal years, are reasonable methods to estimate the current portion of the ending liability. Measurement And Required Data The cost of vacation and other compensated absences must be accrued in the period in which the absences were earned on a GAAP basis. Since academic year faculty positions do not accrue vacation, these positions are not subject to this analysis. Staff and management personnel who remain employed at the end of the fiscal year constitute the population for whom the cost of accrued compensated absences must be computed. The data necessary to calculate the compensated absences liability includes: Name of Employee Vacation or Personal (Holiday) Leave Accrued (hours) Compensated Time-Off (CTO) Accrued (hours) Salary Rate for Vacation Benefit Rate CLAS accumulates this information for campuses using that system. A report (H46) has been developed using data from CLAS that will allow campuses to determine the number of hours and dollar value of vacation, CTO, and holiday leave credits earned, used, and remaining at the end of the fiscal year. Campuses may download this information into an Excel spreadsheet and calculate the total amount of the compensated absences accrual, usage and ending liability. There are 22 campuses and Office of the Chancellor currently using AMS in CMS Human Resources module as it maintains similar leave accounting data. The data for calculating the compensated absences liability using AMS can be retrieved through the standard reports developed by the CMS team. Below is the website which provides step by step instructions to run the standard reports in PeopleSoft: 4.03.3-3 GAAP Manual | GAAP Adjustments and Reclassification Entries – Liabilities: Accrued Compensated Absences | June 30, 2015 . https://csyou.calstate.edu/ProjectsInitiatives/CMS/AppDevelopment/Pages/default.aspx The number of hours of accrued compensated absences, multiplied by the salary rate per hour, plus benefits (employer’s share of social security, medicare and retirement contributions) calculated at the current rate (percentage of salary) yields the compensated absences accrual amount. Note: For campuses using the H46 report, the benefits are already built into the “new base salary” amounts, which are used to determine the “hourly rate”, which in turn is multiplied by the “total hours” to derive the accrual amount. These total dollars must be allocated to the appropriate CSU funds and programs. EXAMPLE The campus determines that the liability for compensated absences at the end of the current year is $8,000,000. At the end of the prior year, the campus recorded a corresponding amount of $7,000,000 as a GAAP adjustment, where the noncurrent amount is $5,200,000 and the current amount is $1,800,000. The dollar amount of accrued compensated absences paid out during the current year was determined to be $2,000,000, and is believed to be a reasonable estimate of the portion of this year’s ending liability that will be paid out next year. Reverse Prior Year Balance – Unrestricted Account 712104 712201 722001 722002 Journal Description Account Name Accrued compensated absences, current portion Accrued compensated absences, net of current portion Salaries Program Class (CSU Fund) 881 – Unrestricted 90 485 $1,800,000 881 – Unrestricted 90 485 $5,200,000 881 - Unrestricted Various 485 ($5,000,000) Fund (Net Position) Amount Benefits 881 - Unrestricted Various 485 ($2,000,000) To properly reverse the prior year accrued compensated absences balance recorded in PY for GAAP basis. Current Year Balance Account 722001 722002 712104 712201 Journal Description 4.03.3-4 Account Name Salaries Fund (Net Position) 881 - Unrestricted Program Various Class (CSU Fund) 485 Amount $6,500,000 Benefits 881 - Unrestricted Various 485 $1,500,000 Accrued compensated absences, 881 – Unrestricted 90 485 ($2,000,000) current portion Accrued compensated absences, net 881 – Unrestricted 90 485 ($6,000,000) of current portion To properly record 6/30/CY accrued compensated absences balance on a GAAP basis. GAAP Manual | GAAP Adjustments and Reclassification Entries – Liabilities: Accrued Compensated Absences | June 30, 2015 . REMINDERS FOR CAMPUSES Campuses should record compensated absences liability in the CSU funds where the actual payroll expenses have been recorded. For instance, the general fund (CSU fund 001) usually does not record payroll expenses, therefore, should not have any compensated absences liability balance. This means most compensated absences should be recorded in CSU fund 485 since this is where most payroll expenses are recorded. 5 REFERENCE TOOLS 5.1 TABLES OF OBJECT CODE AND CSU FUND DEFINITIONS http://www.calstate.edu/SFSR/standards_and_rules/2014/Tables-of-Object-Code-andCSU-Fund-Definitions-Updated-10-30-14.xls 4.03.3-5 GAAP Manual | GAAP Adjustments and Reclassification Entries – Liabilities: Accrued Compensated Absences | June 30, 2015 . REVISION CONTROL Document Title: CHAPTER 4.3.3 – GAAP ADJUSTMENTS AND RECLASSIFICATION ENTRIES – LIABILITIES: ACCRUED COMPENSATED ABSENCES REVISION AND APPROVAL HISTORY Section(s) Revised 4.03.3-6 Summary of Revisions Revision Date GAAP Manual | GAAP Adjustments and Reclassification Entries – Liabilities: Accrued Compensated Absences | June 30, 2015