Cost Accounting Chapter 14 - University of North Florida

advertisement

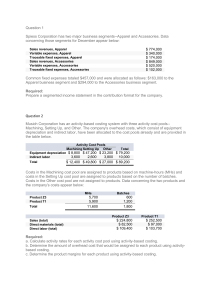

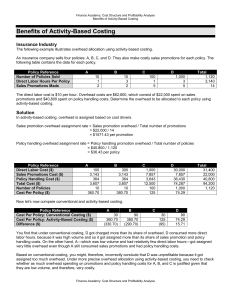

1 Chapter 14 Cost Allocation Decisions Prepared by Diane Tanner University of North Florida Why Do We Allocate Costs? 1. GAAP requires full cost information 2. To make decisions of pricing, expansion, product dropping, cost-plus contracts, etc. 3. Make managers conserve resources 4. Create incentives for evaluating efficiency of ‘fee’ based company services 2 3 Approaches to Assigning Overhead Costs Traditional allocation A single “plant-wide” overhead rate used for entire factory Simple to use Traditional allocation bases Direct labor cost Direct labor hours Machine hours Units produced Activity-based costing Multiple overhead rates—one for each activity Expensive to implement More accurate product costing Criteria That Guide Allocation Decisions Cause-and-effect Links the cost incurred to the reason for the cost Most used of all criterion in activity-based costing Benefits received Allocates the cost to the cost object that received the benefit of the cost Equitable/fairness Problematic – Try making everyone happy with the allocation basis chosen. Ability to bear costs Cost objects that can afford costs are allocated costs 4 What is a Cost Object? A product, job, service provided, batch, or department that will receive a portion of a cost allocation Something for which we want to know its cost 5 6 What is a Cost Pool? A grouping of individual costs whose total is allocated using one allocation base Often based on departments or the output of a particular process in a company Usually consists of both variable and fixed costs Sometimes called a cost bucket 7 What is a Cost Driver? An activity that causes the cost pool to increase Often called an activity base because more of the activity ‘drives’ a cost up # of Customers Products Cost Objects Activity Bases # of DL Hours # of Employees # Sq. Feet # of Inspections # of packages Amt. of DL$ # of Crates 8 Two Stages of Cost Allocation 1. Allocate to Cost Pools 2. Allocate to Cost Objects Support Costs Cost Pool 1 Product 1 Cost Pool 2 Product 2 Product 3 The End 9