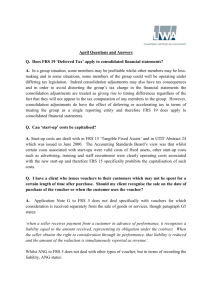

Doc - Small Company Reporting

advertisement