Session 3

advertisement

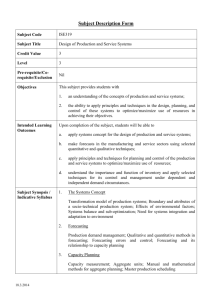

Part VII Short Term Financial Planning and Management Prepared by: Thomas J. Cottrell Modified by: Carlos Vecino HEC-Montreal Chapter 18 Short-Term Finance and Planning Chapter 19 Cash and Liquidity Management Chapter 20 Credit and Inventory Management FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 1 Managers Who Deal with Short-Term Financial Problems (Table 18.1) Title of manager Duties related to short-term financial management Assets/liabilities influenced Cash manager Collection, concentration, disbursement; short-term investments; short-term borrowing; banking relations Cash, marketable securities, short-term loans Credit manager Monitoring and control of accounts receivable; credit policy decisions Accounts receivable Marketing manager Credit policy decisions Accounts receivable Purchasing manager Decisions on purchases, suppliers; may negotiate payment terms Inventory, accounts payable Production manager Setting of production schedules and materials requirements Inventory, accounts payable Payables manager Decisions on payment policies and on whether to take discounts Accounts payable Controller Accounting information on cash flows; reconciliation of accounts payable; application of payments to accounts receivable Accounts receivable, accounts payable Source: Ned C. Hill and William L. Sartoris, Short-Term Financial Management, 2nd ed. (New York: Macmillan, 1992), p. 15. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 2 Survey: The Importance of Short-Term Finance and Planning Long-term investment decisions (capital budgeting) and long-term financing decisions are characterized by the facts that they (a) generally involve large amounts of money, and (b) are relatively infrequent occurrences. Decisions that come under the heading “short-term finance” are equally important, because, while typical decisions often don’t involve as much money, decisions are much more frequent. This is suggested in the results of a recent survey of CFOs. Activity Financial Planning Working Capital Mgmt. Capital Budgeting Long-Term Financing Total Ranked Greatest Importance 59% 27% Average Time Allocated 35% 32% 9% 5% 19% 14% 100% 100% FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 3 Cash Flow Time Line (Figure 18.1) Operating and Cash cycles FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 4 Hermetic, Inc., Operating Cycle The operating cycle a) Finding the inventory period COGS $480 Inventory turnover = = Avg. inventory = 1.362 times $352.5 365 Inventory period = = 268 days 1.362 times FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 5 Hermetic, Inc., Operating Cycle (concluded) b) Finding the accounts receivable period Credit sales Receivables turnover = $710 = Avg. receivables = 2.491 times $285 365 Receivables period = = 147 days 2.491 times Operating cycle = Inventory period + Receivables period = 268 + 147 = 415 days FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 6 Hermetic, Inc., Cash Cycle The cash cycle a) Finding the payables turnover COGS Payables turnover = Avg. payables $480 = = 2.043 times $235 365 Payables period = = 179 days 2.043 times Cash cycle = Operating cycle - Payables period = 415 - 179 = 236 days FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 7 The Size of the Firm’s Investment in Current Assets The size of the firm’s investment in current assets is determined by its short-term financial policies. Flexible policy actions include: Keeping large cash and securities balances Keeping large amounts of inventory Granting liberal credit terms Restrictive policy actions include: Keeping low cash and securities balances Keeping small amounts of inventory Allowing few or no credit sales Is it better Flexible or Restrictive ? FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 8 Cost of holding current assets Carrying cost (costs that rise with the amount held in assets) Financial cost, storage cost and other costs of holding current assets. Shortage cost (cost that decrease with the amount held in assets) Cost of not having current assets available on-hand, or having to get them rapidly. The optimal choice of holding current assets is a trade-off of: Carrying costs versus Shortage costs: FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 9 Total Cost of holding current assets (Cash, receivables and inventory) Cost ($) Total holding cost Carrying cost Shortage cost Amount of assets FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 10 Carrying Costs and Shortage Costs (Figure 18.2) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 11 Carrying Costs and Shortage Costs (Figure 18.2) When is a “Flexible policy” appropriate? FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 12 Carrying Costs and Shortage Costs (Figure 18.2) When is a “Restrictive policy” appropriate? FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 13 Financing Policy for an “Ideal” Economy (Figure 18.3) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 14 Alternative Asset Financing Policies (Figure 18.5) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 15 A Compromise Financing Policy (Figure 18.6) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 16 A Closer look to Cash, Credit and Inventory Cash policy What is the tradeoff between carrying a large versus a small cash balance? What is the proper management of the cash balance? Credit policy What is the tradeoff between a flexible versus a restrictive credit policy? Analysis of a credit policy change Credit information and evaluation of customer credit capacity Inventory policy What are the components of an inventory management system? Use of EOQ inventory model Inventory management systems FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 17 A Closer look to Cash, Credit and Inventory Cash Policy Credit Policy Inventory Policy FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 18 Reasons for Holding Cash Speculative Motive - the need to hold cash to take advantage of additional investment opportunities, such as bargain purchases. Precautionary Motive - the need to hold cash as a safety margin to act as a financial reserve. Transaction Motive - the need to hold cash to satisfy normal disbursement and collection activities associated with a firm’s ongoing operations. Compensating Balance Requirements - cash balances kept at commercial banks to compensate for banking services the firm receives. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 19 Determining the Target Cash Balance Optimal choice of cash balance is a trade-off of Carrying costs: Opportunity costs of holding cash instead of some other income-producing asset. versus Shortage costs: Cost of not having cash available on-hand,or having to rapidly get the cash. Other factors influencing the target cash balance Ability to borrow rather than marketable securities Scale economies in cash management - large firm advantage. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 20 Determining the Target Cash Balance (Figure 19.1) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 21 Cash Balance Cash Balances - The Baumol-Allais-Tobin BAT Model Starting (C) Average (C/2) Ending=0 Minimum cash allowed Time in days, weeks, etc. 2 4 FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 22 Cost minimization model We seek to find the minimum cost of meeting the short-term cash needs F = Fixed cost of selling securities to replenish cash T = Total amount of new cash needed for transactions purposes over the relevant planning period (e.g. over a year) R = Opportunity cost of holding cash (e.g. the interest rate on marketable securities) Total Cost = Total Opportunity cost + Total Trading cost Total Opportunity cost = (Average balance) (R) = (C/2)(R) Total Trading cost = (T/C) (F) Total Cost = (C/2)(R) + (T/C) (F) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 23 Optimal Solution Differentiate the Total Cost with respect to the cash balance to find the... Optimal Cash Balance, when dTC/dC = R/2 + (-1)TF/C2 = 0 2TF C = R * FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 24 Example 19A.1 (pp 663-664) Vulcan corp. has outflows of $100 per day, seven days a week R= 5%, F=$10 per transaction C* = ? Total Cost = ? T = Total Cash needed per year = 365 * $100 = $36,500 Optimal Balance (C*) C = SQRT(2TF/R) = SQRT(2 * $36,500 * $10 / 0.05) = $3,821 Optimal Balance (C*) =$3,821 Average Cash Balance = $ 1,911 Total cost Opportunity Costs = C/2*R= $1,911 (0.05) = $96 The re-supply time is $3,821/$100 per day = 38.21 days Number of re-supplies per year = 365 / 38.21 = 9.6 times Total Trading Costs = 9.6 ($10) = $96 Total Cost = Opportunity cost + Trading cost = $96 + $96 Total Cost = $192 FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 25 The Cash Budget Objective: Identification of short term financial needs, cash surpluses or deficits. Main source of cash : Sales and Cash Collections Other sources of cash: Asset sales, investment income, loans, increase in equity, etc. Main Cash Outflows : Payments of accounts payable Wages, Utilities and other expenses Taxes Capital expenditures – Fixed assets acquisitions Debt services and principal payments FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 26 Example: Cash Budget for Ajax Company All sales on credit Dec. sales were $95,000 ; Expected Jan 55,000 Feb & March 65,000 December 31 receivables were $135,000 Accounts receivable period is 45 days (50% - 30 days, 50% - 60 days) Wages, taxes, and other expenses are 30% of sales Raw materials are ordered two months in advance of sales Raw materials are 50% of sales All purchases on trade credit An annual dividend of $100,000 is expected to be paid in March No capital expenditures are planned for the first quarter The beginning cash balance is $41,000 The minimum cash balance is $25,000 FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 27 Example: Cash Budget for Ajax Company (continued) Cash collections for Ajax (all figures rounded to the nearest dollar) JAN FEB MAR $135,000 $102,500 $ 92,500 Sales 55,000 65,000 65,000 Cash collections 87,500 75,000 60,000 $102,500 $ 92,500 $ 97,500 Beginning receivables Ending receivables FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 28 Example: Cash Budget for Ajax Company (continued) Cash disbursements for Ajax JAN FEB MAR $ 32,500 $32,500 $30,000 16,500 19,500 19,500 Capital expenditures 0 0 0 Long-term financing expenses 0 0 100,000 $ 49,000 $52,000 $149,500 Payment of accounts (50% of next month’s sales) Wages, taxes, and other Total FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 29 Example: Cash Budget for Ajax Company (continued) Net cash inflow for Ajax Total cash collections Total cash disbursements Net cash inflow JAN FEB MAR $ 87,500 $ 75,000 $ 60,000 49,000 52,000 149,500 $ 38,500 $23,000 -$ 89,500 FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 30 Example: Cash Budget for Ajax Company (concluded) Cash balance for Ajax JAN FEB MAR $ 41,000 $79,500 $102,500 38,500 23,000 -89,500 Ending cash balance $ 79,500 $102,500 $ 13,000 Minimum cash balance - 25,000 - 25,000 - 25,000 Cumulative surplus (deficit) $ 54,500 $ 77,500 -$ 12,000 Beginning cash balance Net cash inflow FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 31 A Closer look to Cash, Credit and Inventory Credit Policy Credit Policy Inventory Policy FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 32 Components of Credit Policy Terms of sale The conditions under which a firm sells its goods and services for cash or credit. Credit analysis The process of determining the probability that customers will not pay. Collection policy Procedures followed by a firm in collecting accounts receivable. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 33 The Cash Flows from Granting Credit Credit sale is made Customer mails check Firm deposits check in bank Bank credits firm’s account Time Cash collection Accounts receivable FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 34 Determinants of the Length of the Credit Period Several factors influence the length of the credit cycle. Among these factors are: Perishability and collateral value Consumer demand for the product Cost, profitability and standardization Credit risk of the buyer The size of the account Competition in the product market Customer type FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 35 Credit Policy Effects Revenue effects Payment is received later, but price and quantity sold may increase Cost effects Running a credit department and collecting receivables has costs The cost of debt The firm must finance receivables and, therefore, incur financing costs The probability of nonpayment The firm always gets paid if it sells for cash, but risks losses due to customer default if it sells on credit The cash discount Discounts induce buyers to pay early; the size of the discount affects payment patterns and amounts FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 36 Evaluating a Proposed Credit Policy P v Q Q’ R = = = = = price per unit variable cost per unit current quantity sold per period new quantity expected to be sold periodic required return The benefit of switching is the change in cash flow: New cash flow - old cash flow [(P - v) Q’] - [(P - v) Q] rearranging, (P - v) (Q’ - Q) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 37 Evaluating a Proposed Credit Policy (concluded) The present value of switching is: PV = [(P - v) (Q’ - Q)]/R The cost of switching is the amount uncollected for the period + the additional variable costs of production: Cost = PQ + v(Q’ - Q) And the NPV of the switch is: NPV = -[PQ + v(Q’ - Q)] + [(P - v)(Q’ - Q)]/R FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 38 The Costs of Granting Credit (Figure 20.1) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 39 The Five C’s of Credit Character The borrower’s willingness to pay Capacity The borrower’s ability to pay Capital Financial reserves/borrowing capacity Collateral Pledged assets Conditions Relevant economic conditions FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 40 A Closer look to Cash, Credit and Inventory Credit Policy Credit Policy Inventory Policy FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 41 Inventory Management Inventory Types Raw Materials Work-in-Progress Finished Goods Inventory Costs Storage and tracking costs Insurance and taxes Losses due to obsolescence, deterioration, or theft Opportunity cost of capital on the invested amount FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 42 Costs of Holding Inventory (Figure 20.5) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 43 Inventory Management Techniques ABC Approach Compare number of items with the value of the items An illustration of the “80-20” rule EOQ Model Economic Order Quantity is most widely known approach. Inventory depletion rate Carrying costs Shortage costs and Restocking costs Total costs Extensions to EOQ Safety stocks Reorder points MRP - Material Requirements Planning Just-in-Time Inventory FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 44 ABC Inventory Analysis (Figure 20.4) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 45 Inventory Holdings for the Transcan Corporation (Figure 20.6 ) The Transcan Corporation starts with inventory of 3,600 units. The quantity drops to zero by the end of the fourth week. The average inventory is Q/2 = 3,600/2 = 1,800 over the period. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 46 Cost minimization –The Economic Order Quantity EOQ model We seek to find the minimum cost of holding inventory by defining what size order the firm should place when restocking. Q = Quantity of restocking (size order) F = Fixed cost per order T = Total unit sales per year CC = Carrying Cost of holding inventory (e.g. financial, storage, insurance, obsolescence, deterioration and theft costs) Total Cost = Total Carrying cost + Total Restocking cost Total Carrying cost = (Average stock) (CC) = (Q/2)(CC) Total Restocking cost = (T/Q) (F) Total Cost = (Q/2)(CC) + (T/Q) (F) FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 47 Optimal Solution Differentiate the Total Cost with respect to the size order “Q” to find the... Optimal size order “Q*”, when dTC/dQ = CC/2 + (-1)TF/Q2 = 0 2TF Q = CC * FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 48 Solution to Problem 20.11 Bell Mfg. uses 1,600 switch assemblies per week and then reorders another 1,600. If the relevant carrying cost per assembly is $40, and the fixed order cost is $800, is Bell’s inventory policy optimal? Why or why not? Carrying costs = (_____/2)($40) = $_____ Order costs = (52)($_____) = $_____ EOQ = [2(52)(1,600)($800)/$40]1/2 = _____ units The firm’s policy (is/is not) optimal, since the costs are not equal. Bell should _______ the order size and _______ the number of orders per year. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 49 Solution to Problem 20.11 Bell Mfg. uses 1,600 switch assemblies per week and then reorders another 1,600. If the relevant carrying cost per assembly is $40, and the fixed order cost is $800, is Bell’s inventory policy optimal? Why or why not? Carrying costs = (1,600/2)($40) = $32,000 Order costs = (52)($800) = $41,600 EOQ = [2(52)(1,600)($800)/$40]1/2 = 1,825 units The firm’s policy is not optimal, since the costs are not equal. Bell should increase the order size and decrease the number of orders per year. FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 50 Material Requirements Planning (MRP) - Safety Stocks and Reorder Points (Figure 20.7) Inventory A. Safety Stocks Minimum inventory level Safety Stocks Time FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 51 Material Requirements Planning (MRP) - Safety Stocks and Reorder Points (Figure 20.7) Inventory B. Reorder points Minimum inventory level Delivery time Delivery time Time FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 52 Material Requirements Planning (MRP) - Safety Stocks and Reorder Points (Figure 20.7) Inventory Delivery time Delivery time B. Reorder points Minimum inventory level Safety Stocks Time FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 53 Just – in – Time Inventory Basic Idea: Parts, Raw Material and in general “Work In Process components” are delivered exactly as needed for production Objective: Minimize Inventory Production Objective? Is Just-in-time consistent with EOQ? Financial Objective ? How does JIT fits into Du-Pont? FINANCIAL ANALYSIS AND FORECASTING (HEC-MONTREAL) Fundamentals of Corporate Finance 2002 McGraw-Hill Ryerson, Ltd Slide 54