GST Meeting with Customs Officials on 20150209

advertisement

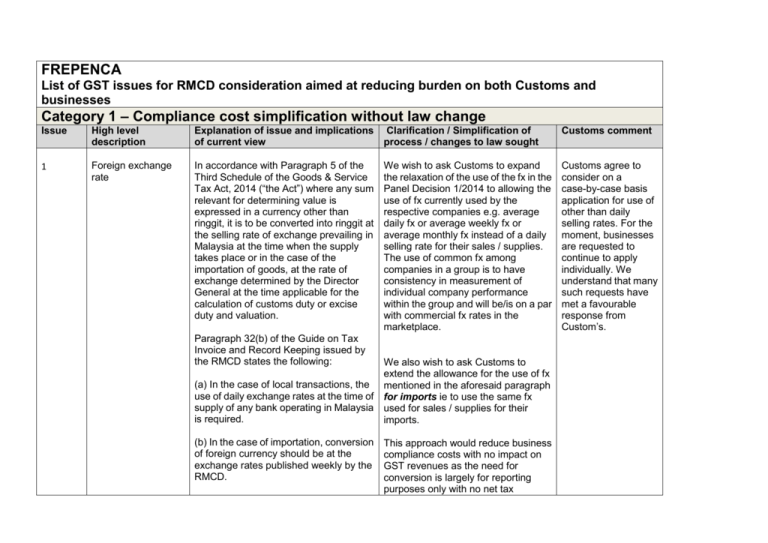

FREPENCA

List of GST issues for RMCD consideration aimed at reducing burden on both Customs and

businesses

Category 1 – Compliance cost simplification without law change

Issue

High level

description

Explanation of issue and implications Clarification / Simplification of

of current view

process / changes to law sought

Customs comment

1

Foreign exchange

rate

In accordance with Paragraph 5 of the

Third Schedule of the Goods & Service

Tax Act, 2014 (“the Act”) where any sum

relevant for determining value is

expressed in a currency other than

ringgit, it is to be converted into ringgit at

the selling rate of exchange prevailing in

Malaysia at the time when the supply

takes place or in the case of the

importation of goods, at the rate of

exchange determined by the Director

General at the time applicable for the

calculation of customs duty or excise

duty and valuation.

Customs agree to

consider on a

case-by-case basis

application for use of

other than daily

selling rates. For the

moment, businesses

are requested to

continue to apply

individually. We

understand that many

such requests have

met a favourable

response from

Custom’s.

We wish to ask Customs to expand

the relaxation of the use of the fx in the

Panel Decision 1/2014 to allowing the

use of fx currently used by the

respective companies e.g. average

daily fx or average weekly fx or

average monthly fx instead of a daily

selling rate for their sales / supplies.

The use of common fx among

companies in a group is to have

consistency in measurement of

individual company performance

within the group and will be/is on a par

with commercial fx rates in the

marketplace.

Paragraph 32(b) of the Guide on Tax

Invoice and Record Keeping issued by

the RMCD states the following:

We also wish to ask Customs to

extend the allowance for the use of fx

(a) In the case of local transactions, the mentioned in the aforesaid paragraph

use of daily exchange rates at the time of for imports ie to use the same fx

supply of any bank operating in Malaysia used for sales / supplies for their

is required.

imports.

(b) In the case of importation, conversion

of foreign currency should be at the

exchange rates published weekly by the

RMCD.

This approach would reduce business

compliance costs with no impact on

GST revenues as the need for

conversion is largely for reporting

purposes only with no net tax

The Panel Decision 1/2014 allowed the

following relaxation to the law:

(i)

The use of exchange rates

published by BNM, any commercial

banks in Malaysia or any banks

registered under BNM, any news

agencies eg Bloomberg, Reuters,

Oanda, foreign central banks eg

European Central Bank and

Federal Reserve Bank of New

York.

(ii) Provided the exchange rates must

be the prevailing rate (selling rate)

corresponding to the time of

supply, consistently used for

internal business reporting and

accounting purpose and used

consistently for at least one year.

collected from business to business

transactions.

Further, the use of the proposed fx

would enable businesses to comply

with the Panel Decision 1/2014 para

6(b)(ii) “..consistently used for internal

business reporting and accounting

purposes” which otherwise, may be a

requirement by Customs which MNCs

may not be able to comply.

Extending the relaxation of the use of

fx in a revised Panel Decision (or a

clarification in an appropriate GSDT

Guide) would reduce the number of

businesses writing to Customs and so

reduce the burden of reviewing and

responding to numerous requests.

Currently many MNCs use a common

global foreign exchange rate (fx) within

the companies in the group which could

be fixed daily / weekly / monthly.

2

Reverse charge on

imported services –

accounting for output

tax and claim of ITC

In accordance with Section 13(1), (2), (3)

and (4) of the Act, imported services are

subject to GST and the company is

required to account for output tax on the

imported services (as though these were

supplied by company to itself) by way of

the “Reverse Charge Mechanism”.

In accordance with Section 13(4) of the

Act, the time of supply for imported

Whilst 1/2014 Panel Decision allows

for output tax to be accounted for at

either time of payment or receipt of

invoice is a welcomed compliance

simplification, if the input tax credit

cannot also be claimed at the same

time, then this is no simplification at

all.

We wish to request Customs to

Customs confirm that

the Panel Decision 1

specifically gives

concession to

accounting for output

tax only. Claiming of

input tax remain as

per Paragraph 38(e)

of the GST

Regulations.

services is when the supplies are paid for approve the accounting for, and claim

by the recipient.

of input tax credit, in the same taxable

period as the GST is payable, based

on the time when the transaction is

Paragraph 38(e) of GST Regulations

processed, be it invoice processing, or

specifies that for imported services

any other date, so long as this is

where reverse charge mechanism

applies, input tax credit is allowed to be before actual payment date.

claimed upon payment of the invoice.

Again, this impacts merely the way

GST is reported and not on the net

Panel Decision 1/2014 paragraph 2(ii)

only allows the accounting for output tax GST payable as in most cases the

based on invoice date and is silent on the GST payable will also be recoverable.

time of claim of input tax credit.

If RMCD has any concerns about

potential revenue leakage then it

could restrict this application to those

approved for ATS and/or ATMS only.

FREPENCA then

made the following

requests which

Customs agreed to

consider and issue a

separate guide in due

course:

(i) Reconsider the

businesses’

request to allow

the claim of input

tax and

accounting for

output tax on the

same date and

allow businesses

to do so either on

invoice date or

invoice

processing.

(ii) If (i) cannot be

allowed by

Customs, to clarify

Panel Decision 1

regarding the

claim of input tax

as many

businesses are

not aware of

Custom’s position

on the subsequent

claiming of input

tax.

3

Availability to pull

information on

imports from

Dagangnet - for

reporting / use of

value of goods

imported in K1/K8 for

GST03 reporting

Value of imported goods (CIF + Duty)

reflected in Custom declaration forms for

imports (K1/K8) are currently not input

into financial systems of most

businesses. However, these value of

imported goods (CIF + Duty) in K1/K8 s

are now required to be reported in Line

6a & 6b of GST03 return, or if a business

has approval under the Approved Trader

Scheme (ATS), be reported in Line 14 &

15 of GST03 return.

Based on the current practice of

businesses, the amounts of the imports

that get captured into the financial

system are cost of goods purchased

based on final invoice from supplier, cost

of insurance, freight / carriage based on

invoices from the respective supplier and

custom duties, if any. These amounts do

not necessarily tie or is reconcilable to

the value of imported goods (CIF + duty)

reflected in the K1/K8 due to the

following reasons:

(i)

the different foreign exchange rate

used in K1/K8 and financial

system, to convert the value of

purchase in foreign currency (refer

also item 1 of this Appendix); and

(ii)

the insurance and freight amounts

declared in the K1/K8 at most times

are estimates;

We wish to request Customs to firstly

acknowledge the inherent differences

of value of imports (CIF + duty) for

K1/K8 and amounts captured into the

financial system and not require

businesses to prepare reconciliations.

We would use the value of goods

imported as reflected in K1/K8 for

GST03 reporting.

We suggest that Customs makes

available information from Dagangnet

{information on value of imports (CIF +

duty)} to companies for GS03 return

reporting purposes.

We understand that the Singapore tax

authorities allow information from

Tradenet to be made available to

companies to download for Singapore

GST reporting purposes.

In Australia taxpayers who have

applied for a special scheme to defer

the payment of GST on their

importations, have the GST amount

payable printed directly on their GST

return by the tax authorities.

Custom’s appreciate

the concerns being

raised by

FREPENCA in

obtaining the

necessary

information. Customs

agreed to look into

how it may be able to

assist businesses to

make arrangements

with Dagangnet.

As such, if businesses are now required

to compile the value of imports (CIF +

duty) for reporting in GST03 return,

businesses need to re-configure the IT

system and accounting process to

capture the amounts for mere purpose of

GST reporting and has no value-add to

the business.

4

Provision of space to In accordance with Paragraph 5(3) of the

canteen operator

First Schedule of the GST Act, goods

held or used for the purposes of the

business that are put into private use or

made available to any person for use, for

any purpose other than a purpose of the

business, whether or not for a

consideration, the usage or making

available of goods is a supply of

services.

5

Gift Rule – not

claiming input tax

It is common practice for large

manufacturers located in the various

special zones, where access to food

outlets for their employees is not

readily available, for employers to

provide canteen facilities for their

workers. This is also good business

practice in that it reduces staff

absences and boost staff morale

increasing productivity and business

profits.

There appeared to be

differing views within

Custom’s on this

issue. On the one

hand the supply of

free space to a

canteen operator

could be seen as

being for business

use as per

FREPENCA

It is not uncommon for employers to offer

submission and so

canteen operators the use of space for

Arguably, the provision of the space to the provision of

free within their facilities from which to

the canteen operator is for the

services for free to a

operate the canteen.

furtherance of the businesses

non-connected party

operations and can be distinguished

is out of scope.

We are seeking Customs confirmation

from the provision of businesses

Alternatively this is a

that such transactions are out of scope of assets to a third party for no

supply of a business

the GST as the use of business assets is consideration and should be treated

asset for free and a

for the purposes of the businesses. We

as out of scope. This should be the

deemed supply at the

also seek Custom’s concurrence that no case irrespective of whether the

standard rate.

Gift rules are triggered and that there is Canteen operator is required to

Customs will discuss

no private / non-business use of assets. provide food at below OMV to that

this issue in their

businesses’ employees.

Committee meeting

and issue guidaince

in due course.

The gift rule does not apply to the giving Another way of reducing the burden

Customs does not

of gifts which are zero rated, exempt or

on businesses of having to track gifts agree. However,

credit on acquisition

where the input tax credit was blocked.

is to allow them to exclude gifts from

the Gift Rule where they choose not to

claim the input tax credit on its

acquisition.

We wish to seek clarification that this

would apply equally to where the

employer chose not to claim the input tax

credit.

We refer you to the situation in

Singapore where this choice is

permitted and provide an extract from

the Singapore GST: General Guide

for Businesses:

Example

A local GST-registered company (H)

purchased 2 hampers from a GST

registered supplier on 1 Oct 2013 at

$190 (exclusive of GST, inclusive of

GST price is $190 x 1.07 = $203.30).

H chose not to claim input tax on its

purchases. H subsequently gave both

hampers to one employee during a

company function for free to reward

him for his good performance. Under

the gift rule, H is required to account

for output tax on the hampers since

the gift inclusive of GST costs more

than $200. However, since H did not

claim input tax on its purchase of the

hampers, H is not required to account

for output tax. If H has claimed the

input tax incurred on its purchase of

the 2 hampers, H would need to

account for GST on these 2 hampers

(i.e. output tax to be accounted for =

$13.30 ($190 x 0.07)).

6

Use of incoterms as

primary indicator for

transfer of title &

Section 17(1) of the GST Act reads as

follows:

Customs had no

objection to

businesses

accounting for output

tax on the total

amount of purchase

per the invoice, at the

same time input tax is

claimed, on

assumption that all

the said purchases

are meant for gifts at

a later time. In other

words it was okay for

businesses to pay

more GST than may

otherwise have been

payable and have to

track gifts given to

employees.

We are of the view that incoterms are The discussion

not to be the only factor in

couldn’t arrive at a

determination of transfer of title and as resolution. In the

determination of

movement of gods

A zero rated supply is:

(a) Any supply of goods or services

determined to be a zero rated supply

by the Minister under subsection (4);

and

a consequence, used in the criteria for

determining whether a supply of

goods qualifies as export and be zero

rated. Reference must be made to the

commercial arrangements between

the parties, the contracts and other

(b) Any supply of goods if the goods are agreements relating to the transaction

in question.

exported.

Reference is also made to the Guide on

Export (draft) issued on 4 November

2013

We understand from the GST Act and

Guide on Export that a person who

exports goods outside Malaysia and is

named as exporter in the Custom’s

export declaration form (K2) would be

entitled to zero-rate the supply

irrespective of the incoterms.

However, we have in recent times,

through various conversations with

Customs officers been informed that

incoterms is to be used as a determinant

of point of title transfer and hence a

deciding factor on whether that supply

qualifies for a zero rate.

Case scenario extracted form Q&A 4 of

the Guide on Export:

Q4: My local customer ordered some

goods from me but he requested me to

send the said goods to his overseas

customer. Do I have to charge GST

when I invoice my local customer?

We ask Customs to revisit the Panel

Decision 1/2014 and issue clear and

consistent guidance on the

determination of export and

qualification criteria for applying a

zero rate to reflect this point.

interest of time, it was

suggested that a

separate meeting be

held for an in-depth

discussion. This is a

critical issue

impacting on the

competitiveness of

Malaysian exports.

A4: If you export the goods yourself in

your own name, you can zero rate that

supply even though you bill your local

customer. However you should maintain

the necessary documents to enable your

supply to be zero-rated.

We also draw your attention to item 5 (ii)

of Panel Decision 1/2014. The scenario

provided is exactly as Q&A 4 of the

Guide on Export. However, the response

provided is entirely different as the

response in the Panel Decision made

references to the “transfer of ownership”

which in this case, is deemed to happen

in Malaysia. Extract of Item 5(ii) of Panel

Decision 1/2014 is as follows:

Item 5(ii) Local company X purchases

goods from local manufacturer M and

request the local manufacturer M to

export the goods to his overseas

customers.

Whether the supply by the local

manufacturer M to the local company X

is subject to GST.

Reply to Item 5(ii)”

i.

The supply made by local

manufacturer M to the local

company X is a standard rated

supply, because the transfer of

ownership of the goods took place in

Malaysia;

ii.

The supply made by the local

company X to his overseas client

can be zero rated if the export

declaration was in the name of the

local company X.

According to Incoterms@2010,

published by The International Chamber

of Commerce

(http://store.iccwbo.org/incoterms-2010),

Incoterms 2010 do not deal at all with

transfer of title to the goods. Incoterms

2010 deals only with transfer of risks,

meaning risks of loss of or damage to the

goods while they are in transit.

We highlight another example on the

confusion which would arise if we are to

use incoterms as a factor in determining

transfer of title and consequently the

meaning of export:

Co A, a Malaysian GST registered

company supplies goods to Co B, a

foreign customer on ex-works incoterms.

Co A is named as exporter in the

Customs export declaration form

(K2/K8).

In this scenario, if we were to use the

meaning of export as in the GST Act and

Guide to Export, the supply by Co A

would qualify for zero rate,

If we were to throw in the incoterms as

determinant of transfer of title happening

in Malaysia, even if Co A is the named

exporter in the Customs Export

Declaration form (K2/K8), it appears that

from the Panel Decision, this supply is

standard rated.

7

Definition of

Third Schedule paragraph 2(1), GST Act Within the context of paragraph 2(1),

Customs clarified that

connected person

8

Movement of goods

from PCA into

Bonded Warehouse

provides for definition of connected

persons as follows:

(a)

they are officers or directors of one

another's business

(b)

…..

(c)

…

Businesses have been receiving

differing view on whether, for GST

purposes, the movement of goods

located in PCA and placed into a bonded

warehouse will be treated as those

goods having been exported.

GST Act, we would like Customs to

clarify the meaning of:

(i)

Officers;

(ii) “…. …one another’s business”

In particular we ask Custom’s to

confirm that officers or directors of a

business are not connected persons

of the same business that they are

officers or directors of.

We wish to clarify whether, for GST

purposes, the movement of goods

from PCA into a Bonded Warehouse

will be treated as an export of those

goods.

This is the treatment that applies in a

Section 17 of the GST Act mentions that number of neighbouring countries.

any supply of goods is zero rated if the

goods are exported. Export in GST Act is

given the same definition as export in the

Customs Act, 1967 (Customs Act) For

purposes of the Customs Act, goods

may be placed in bonded warehouse for

export without the payment of customs

duty. However, for GST, it is silent and

therefore appears that goods placed in a

bonded warehouse are subject to GST

(local sales)

This can have significant implications on

businesses eligibility for special

item (a) is meant to

define that 2

companies are

“connected persons”

when they have

common officers or

directors.

This issue was not

discussed as

Customs indicated

that they, together

with MoF, were in the

midst of discussions

on treatment of

bonded warehouses.

schemes such as ATMS that require at

least 80% of their goods to be exported.

9.

Approved toll

manufacturers

scheme (ATMS)

Regulation 91 of the GST Regulations

2014 provides that a person making

supplies comprising the treatment or

processing of goods for and to a person

who belongs to another country and

exports at least 80% of the finished

goods may apply for ATMS.

We request Customs to issue clear

guides on the definition of a toll

manufacturer and clarify whether

does billing arrangement (where

separate billings for value add portion

and for components and parts used

for processing and treatment) affect

the defining of a toll manufacturer.

In reality, many manufacturers have

arrangements, not only to supply the

service of treatment or processing but

may also purchase many components

and parts as specified by the principal to

be built into the final finished product as

part of the treatment or processing

service. Often times, separate billings for

service portion and components & parts

are raised.

Many discussions with Customs officers

has caused some confusion on the

definition of a toll manufacturer which

then brings about concerns on the

application for the ATMS which requires

the local toll manufacturer, overseas

principal and the local end customer to

make a joint application, submitting the

Toll Manufacturing agreement which

contains many private & confidential

information.

Custom’s were of the

view that a toll

manufacturer was

essentially someone

who processed

goods belonging to

another business and

that that ownership of

those goods

remained with the

business they had

contracted with.

Customs agreed to

look into and issue

further guidance on

criteria to determine

who is a toll

manufacturer for the

purposes of the

various GST

schemes.

Category 2 – Compliance cost simplification which may require law change

10

Reverse charge on

imported services

Section 13(1) of the GST act imposes a

reverse charge obligation on persons in

We are again asking Customs to

consider a more pragmatic approach

Custom’s to consider

this at an appropriate

receipt of imported services for use in

their business.

The requirement that all services

imported for business use be reverse

charge places an unnecessary burden

on business. It is understandable that

Customs would wish to ensure that it

collects GST on services consumed in

Malaysia. However, in nearly all

instances the GST payable is claimable

as an input tax credit by that same

business. The only time there is a net

gain to revenue is if that business is

using the imported services to make an

exempt supply – this covers a small

population of Malaysian businesses.

in achieving the desired outcome.

time.

Rather than require all businesses to

reverse charge an alternative

approach could be to either:

(i)

Only make reverse charge

compulsory for businesses

not making wholly taxable

supplies; or

(ii)

Only make reverse charge

compulsory for businesses

where the imported service is

not used wholly for making a

supply for which full input tax

credit would not be available.

Either of these approaches achieves

the desired outcome without imposing

an unnecessary burden on the

majority of businesses. Again you

may wish to look to the practice in

Australia and New Zealand which has

adopted the second of the

approaches outlined above.

11

Bonded warehouse

(BWH, free

commercial zone

(FCZ), free industrial

zone (FIZ) / licensed

manufacturing

warehouse (LMW)

company be treated

as outside Malaysia.

Overseas companies with no presence

in Malaysia are required to appoint a

GST agent in order to register for GST in

Malaysia if it is making taxable supplies

in Malaysia. Many overseas companies

perceive there are permanent

establishment (PE) risks in registering

their overseas principal. Moreover,

registering for GST in Malaysia will

We are asking that Customs introduce See comment to Item

a special permit for a company who

8 above.

supplies to an overseas company /

overseas principal but drop ship the

goods into a BWH, FCZ, FIZ / LMW

companies in Malaysia to be GST

zero rate or suspended, whether

goods or service.

require costly IT System configuration.

We acknowledge that Customs has

provided the Approved Toll

The perception that registering their

Manufacturer Scheme (ATMS) for

overseas principal may result in

businesses under toll arrangement

unnecessary attention from tax

having overseas principal but would

authorities means that many may simply like to highlight to Customs that in

choose not to register – this has been the many instances, the toll arrangement

experience in many other GST countries. is very complex and may involve

Non-registration will result in Malaysian

several parties along the supply chain

exports being more expensive as the

within Malaysia and therefore involves

GST charged is not recoverable by the

movements of goods from toll

overseas principal contrary to the

manufacturer to toll manufacturer for

intention of the GST Act.

value add services and purchase by

foreign principals of goods from local

Below are 2 very common specific

supplier to be placed with various toll

scenarios happening in Malaysia:

manufacturers for assembly. This

makes the application for ATMS

A. Sale by local manufacturers to

approval complex and tedious, not to

overseas company with goods drop mention that processing the

application may take long time as it

ship to BWH, FCZ.FIZ/LMW

requires Customs to understand each

company

and every application.

Currently, there are many sale

arrangements by local manufacturers

with overseas customers where goods

are delivered into BWH or FCZ or FIZ /

LMW company with subsequent title

transfer happening within the BWH / FCZ

or somewhere along the delivery chain in

Malaysia. The GST law states that these

are local supplies subject to GST. Most

of the goods are eventually exported out

of Malaysia by the foreign customers but

some of the goods may be sold to local

customers. These arrangements create

the following dilemmas for the overseas

companies:

Our request for Customs to grant

special permits for a company who

supplies to a overseas company /

overseas principal but drop ship the

goods into a BWH, FCZ or FIZ / LMW

company in Malaysia to be GST zero

rate or suspended, whether goods or

services, produces the same GST

outcome as if the overseas principal

had registered for GST but reduces

the need for such registration resulting

in both administrative and compliance

cost savings.

(i)

The GST charged by the local

manufacturer to the overseas

supplier will become an additional

cost of doing business in Malaysia

thus making Malaysia

uncompetitive, unless the

overseas entity gets itself GST

registered.

(ii)

Registering for GST will create

other issues as mentioned in the

first paragraph of this section,

again additional costs of doing

business in Malaysia.

B. Toll manufacturers with foreign

principals where goods, after value

add are drop ship to BWH, FCZ, or

another FIZ/LMW company.

Currently, many toll manufacturing

arrangements with foreign principals

require local toll manufacturers to

deposit the goods (after value add) into

either a BWH or FCZ or another FIZ

/LMW company. Some of these goods

are then on-sold by the foreign principal

to local customers. This arrangement

creates the following dilemma:

Drop shipment of the goods (after

value add) into a BWH or FCZ

constitutes a local sale by the foreign

principal, thus causing the local toll

manufacturer not able to meet the

export requirement to qualify for

Approved Toll Manufacturer Scheme

(ATMS), without which, value add

services are subject to GST.

12

Services on goods

eventually exported

to be zero rated

Section 14 of the GST Act provides for

the place where supplier of services

belongs. If the supplier of services

belongs to Malaysia, then the supply of

service is subject to GST unless the

supply is zero rated under the Goods &

Services Tax (Zero-Rated Supply) Order

2014 (“Zero rated Order”).

Extract of paragraph 12 of Second

Schedule of Zero rated Order reads as

follows:

In order to put Malaysia on level

Custom’s to consider

competitive ground with our

this at an appropriate

neighbouring countries who are also

time.

vying for foreign direct investment

from MNCs and which currently

accord GST zero rates to such service

charges, we ask Customs to accord

zero-rating to all services on goods

which are eventually exported.

We do not believe that it was the

intention of the GST law to impose

additional costs on Malaysia’s export

Services supplied under a contract with a competing industries but rather to

person who belongs in a country other

improve its international

than Malaysia and which directly benefit competitiveness.

a person who belongs in a country other

than Malaysia who is outside Malaysia at

the time the services are performed, but

shall not include :

(a) Any services comprising either one

or both of the following:

(i) The supply of a right to

promulgate an advertisement by

means of any medium of

communication; and

(ii) The promulgation of an

advertisement by means of any

medium of communication; or

(b) Services which are supplied directly

in connection with:

(i) A land situated in Malaysia or any

improvement to such land;

(ii) Goods which are in Malaysia at

the time the services are

performed; or

(iii) Capital market products as

defined in the Capital Markets

and Services Act 2007 [Act 671]

traded in Malaysia or insurance

contracts where the coverage

relates to risk in Malaysia and

includes any similar transaction

conducted in accordance with

the principles of Syariah.

Malaysia is heavily dependent of foreign

direct investment and is a manufacturing

base for many large MNCs. Many

support industries to these large MNCs

sprang up in Malaysia, setting up base

close to their major customers. Many of

these manufacturing plants of MNCs and

the supporting industries provide key

services to these foreign companies

such as :

(i) Research & development;

(ii) Toll manufacturing (and do not

qualify for ATMS);

(iii) Re-manufacturing;

(iv) Repair and rework;

(v) Failure analysis and testing; and

(vi) Handling services.

13

Billing for

non-recurring

expenditure (NRE) to

be zero rated

In the electronics industry, there are

various billing arrangements apart from

the billing for the finished goods which is

often based on agreed upfront selling

price by the local company with their

overseas customers where the final

finished goods are eventually exported.

However, at the time these other billings

are raised, the goods are still in

Malaysia. Such arrangements have

been agreed upon for various reasons.

Examples of such billings are:

(i) Billings for the purchase of toolings,

jigs, fixtures and equipment used

specifically for a customer in the

local company’s premises. These

toolings, jigs, fixtures and equipment

usually have a lifespan based on

when the finish product reaches

‘end-of-life’;

Similar to item 11 above, we ask

Customs to accord zero rating to all

such billings where these can be

clearly related to finished goods that

are eventually exported outside

Malaysia.

We understand that Singapore has

adopted zero-rating for item (i).

Custom’s to consider

this at an appropriate

time.

(ii) Billings for components, materials or

parts to be used in the production of

finished goods prior to the

completion and billing of finished

goods (billing in advance);

(iii) Recovery of price fluctuations in the

purchase price of components,

materials and parts for the

production of finished goods, and

adjustments to prices / price

re-evaluation. Such billing usually

occurs before the finished goods are

completed and ready to export;

(iv) Lump sum service cost,

manufacturing overheads, labour

costs, overtime payments not

budgeted into initially agreed selling

price but identifiable to a specific

order of finish goods, billed

separately.