Module 23 - Learning Space

advertisement

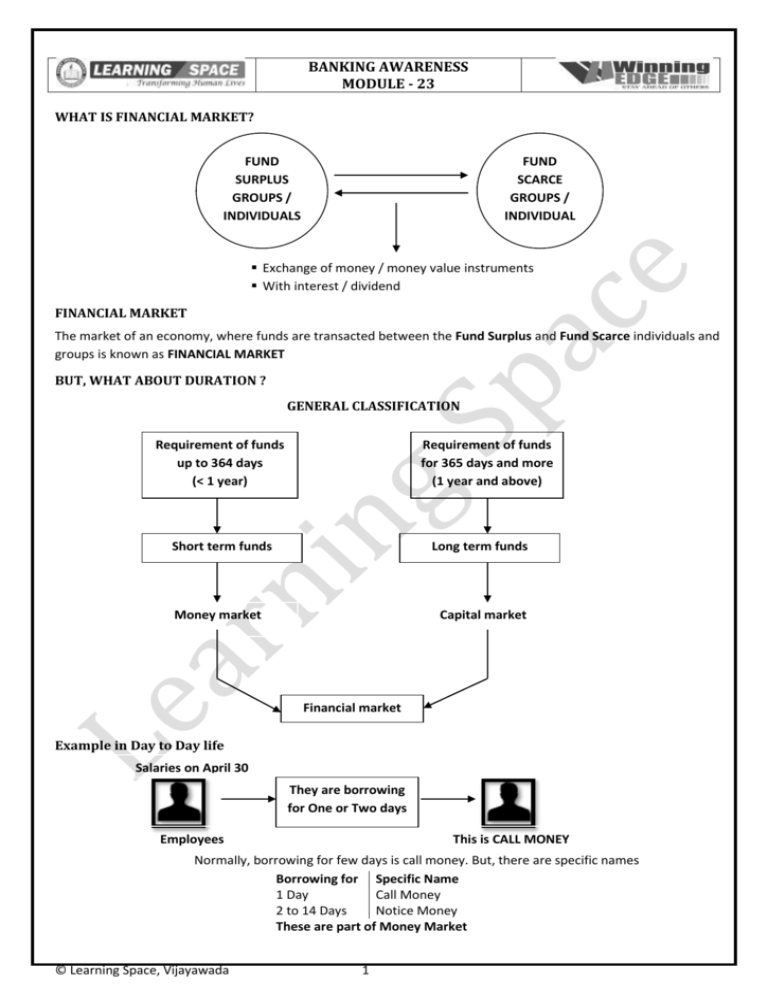

BANKING AWARENESS MODULE - 23 WHAT IS FINANCIAL MARKET? FUND SURPLUS GROUPS / INDIVIDUALS FUND SCARCE GROUPS / INDIVIDUAL S Exchange of money / money value instruments With interest / dividend FINANCIAL MARKET The market of an economy, where funds are transacted between the Fund Surplus and Fund Scarce individuals and groups is known as FINANCIAL MARKET BUT, WHAT ABOUT DURATION ? GENERAL CLASSIFICATION Requirement of funds up to 364 days (< 1 year) Requirement of funds for 365 days and more (1 year and above) Short term funds Long term funds Money market Capital market Financial market Example in Day to Day life Salaries on April 30 They are borrowing for One or Two days Employees This is CALL MONEY Normally, borrowing for few days is call money. But, there are specific names Borrowing for Specific Name 1 Day Call Money 2 to 14 Days Notice Money These are part of Money Market © Learning Space, Vijayawada 1 Example in Day to Day life He is Borrowing for Few Months Fertilizer Shop This is Money Market Normally, borrowing for up to 1 year is Money Market. But, there are specific names Borrowing for 1 Day 2 to 14 Days 15 Days to 1 Year Specific Name Call Money Notice Money Term Money Example in Day to Day life Borrow Fertilizer Shop They Borrow with Repayment of 5 to 10 years Repay This is Capital Market MONEY MARKET AND CAPITAL MARKET I. MONEY MARKET Treasury Bills Commercial Papers Cash Management Bills Commercial Bills Repo and Reverse Repos Call Money Market Certificate of Deposits II. CAPITAL MARKET 1 Govt. Dated Securities Market Though, Technically it is part of Capital Market, but this Market along withTreasury Bills & Cash Management Bills is called“ Govt. Securities Market” and regulated By RBI. © Learning Space, Vijayawada 2 Industrial Securities 3 Development Finance Institutions (DFIs) IPO (for new stocks) Stock Exchanges (for old stocks) All India Financial Institutions i.e. IFCI, IIBI, etc.. Sectoral Finance/Refinance Institutions like SIDBI, NHB, IIFCL, REC, PFC, IRFC, TFCI etc… State Finance Corporations 2 4 Financial Intermediaries Investment Banks Merchant Banks Mutual Funds Leasing Companies Venture Capital INDIAN MONEY MARKET SALIENT POINTS Here money is traded between individuals or groups (Financial Institutions, Banks or Govt. Companies). Between cash surplus and cash scarce. For short term lending up to 364 days. Instruments which are traded can facilitate quick conversion to money. The interest rate depends on demand and supply of cash. Money market takes care of the financial mismatch of day to day operations of organizations,where as capital market is used for creation of assets. Vibrant money market is essential for any economy and co-exists with capital market. Organised money market in India is just more than 2 decades old. In 1985, Chakravarthi Committee underlined the need for organised money market. MONEY MARKET PARTICIPANTS BANKS ICICI Bank HDFC Bank State Bank of India Axis Bank Union Bank Canara Bank INDIAN MONEY MARKET EXAMPLES MONEY MARKET PARTICIPANTS FINANCIAL INSTITUTIONS IIFL LIC IDFC IIFCL 1. 2. 3. 4. 5. 6. 7. Treasury Bills (TBs) Cash Management Bills (CMBs) Repo and Reverse Repos Certificates of Deposits (CDs) Commercial Paper (CP) Commercial Bill Call Money Market Let us discuss in brief… TREASURY BILLS They are available in various forms since independence. Got organized from 1986. Issued by RBI on behalf of Central Government. Used by the Central Government to fulfill short-term liquidity requirements up to 364 days. 91-day, 182-day, 364-day TBs are issued by the Govt. In addition to Governments, they also function as short term investment avenues for Banks and Financial Institutions. Trading is done on discounted rate, hence they are also called discounted instruments. Eligible as security for SLR. CASH MANAGEMENT BILLS They are also discounted instruments like Treasury Bills, issued by RBI on behalf of Central Govt. They are for maturities less than 91 days. They were introduced in 2010 by RBI for short term liquidity Most of the features are similar to Treasury Bills. © Learning Space, Vijayawada 3 REPO AND REVERSE REPOS These were introduced by RBI in December 1992 and November 1996 respectively. We have already discussed about them in previous lectures CALL MONEY MARKET It is short term financial market. Transaction takes place on overnight basis. Funds are transacted for a period between 1 to 14 days normally. All the Scheduled Commercial Banks, Co-operative Banks and Primary Dealers (PDs) participate in the auction. (Regional Rural Banks and Land Development Banks are not eligible to participate.) Interest rates are market driven. Call/Notice Money Market Call Money … Borrowing and lending of funds for one day Notice Money … Borrowing and lending of funds for 2 to 14 days Who can Participate? Scheduled Commercial Banks KarurVysya Bank ICICI Bank Axis Bank Union Bank (RRBs are not allowed) Co-operative Banks Primary Dealers The Gujarat State co-op Bank Ltd The Andhra Pradesh State Co-operative Bank Ltd MSC Bank Odisha State Cooperative Bank SBI DFHI Ltd PNB GILTS LTD Deutsche Bank COMMERCIAL PAPER Introduced in India in 1990. It is a privately placed Instrument. It is unsecured money market instrument issued in the form of a promissory note. Companies, Primary Dealers, Financial Institutions are permitted to issue Commercial Paper. Net worth of the company should not be less than Rs.4 crore. Duration is from 7 days to 1 year. CERTIFICATE OF DEPOSIT Introduced in 1989. Can be issued by Scheduled Commercial Banks or FIs (as authorized by RBI). Minimum amount Rs.1 Lakh (further in multiples of Rs. 1 Lakh). It is also a discounted instrument. Time period... 7 days to 1 year (If issued by Commercial Banks) 1 year to 3 years (If issued by FIs) COMMERCIAL BILLS DISCOUNTING These are the instruments that help companies to get advance payment for the invoices they raise after making sales to their customers. They help companies to get money in advance for the sales they make. © Learning Space, Vijayawada 4 BILL DISCOUNTING FIRE CRACKERS FIRM IN DELHI SOLD TO DELHI FIRM FIRE CRACKERS FIRM IN SIVAKASI ADVANCE MONEY BILL DISCOUNTING WHAT IS DFHI Ltd SBI DFHI Ltd It is Discount and Finance House of India Ltd. It is one of the Primary Dealers (PDs) with majority shareholding by SBI. It is established in 2004 with the merger of RBI promoted DFHI and SBI gilts Ltd. It is one of the Primary Dealers dealing with Govt. Dated Securities, T-Bills, Call Money etc. WHAT IS CCIL Ltd? The Clearing Corporation of India Ltd (An ISO/IEC 27001:2005 CERTIFIED Company) Commercial operations started from April, 2001. SCBs, FIs and PDs have established CCIL jointly. Primarily for providing exclusive clearing and settlements in money market instruments, dated government securities and foreign exchange. Headquarters is in Mumbai. A SNAPSHOT ON MONEY MARKET INSTRUMENTS IN INDIA TREASURY BILLS (T-BILLS) Issued by RBI. Discounted instruments. 91 day, 182 day, 364 day are available. For short term liquidity requirements. CASH MANAGEMENT BILLS Issued by RBI for the first time in 2010. Discounted instruments. Issued up to the duration of 90 days only. Features almost similar to treasury bills. CERTIFICATE OF DEPOSITS REPO AND REVERSE REPO Introduced in Dec 92 and Nov 96 respectively. RBI announces the rates through its monetary policy. Banks can resort to overnight lending subject to the limits. The repo rate will have an impact on other interest rates. © Learning Space, Vijayawada 5 Introduced in 1989. Commercial banks/FIs can issue CD Minimum amount Rs.1 Lakh. 7 days to 1 year (if issued by banks), 1 year to 3 years (if issued by FIs). Also discounted instruments. COMMERCIAL PAPER Private unsecured money market instrument. Introduced in 1990. Designed primarily for high rated corporate borrowers. Companies with minimum net worth of Rs. 4 crores, PDs, FIs are also allowed. 7 days to 1 year. Also a discounted instrument. CALL / NOTICE MONEY Overnight borrowing. 1 to 14 days. Interest is market driven. Commercial banks, co-operative banks, PDs are only allowed (RRBs and LDBs are not allowed).