Government Contracts – Schwartz – Fall 2011

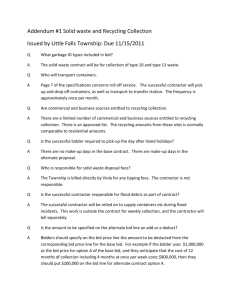

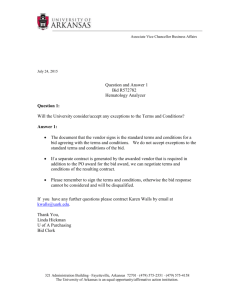

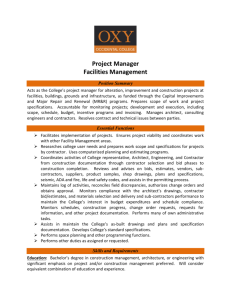

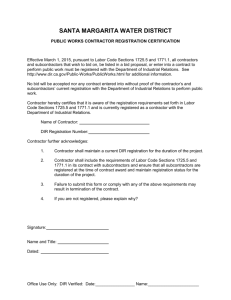

advertisement