What is money

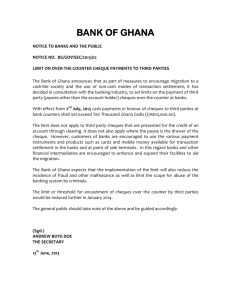

advertisement

Nature and functions of money Terms to know: Meaning of Barter system Inconveniences of Barter system Definition of money Kinds of money Functions of money Meaning of Barter: There was a time when money did not exist, people used to exchange goods for goods. Such a system for exchange of goods without the use of money is called barter. Or The direct exchange of goods for other goods is called barter. Inconveniences of Barter system Lack of common measure of values B Lack of double coincidence of wants Difficulties in tax collection A C Lack of store of values Difficulties In Barter system E D Payments in the future Inconveniences of Barter system: Lack of double coincidence of wants: First difficulty was that… exchange of goods can take place b/w two persons only if each posses the good which the other wants. Lack of common measure of value: If incidentally two persons met together who wants each other goods, they could not find a satisfactory value of their goods, under such circumstances one party has to suffer. Lack of store of value: Goods cannot be stored for a long time, because their value decreases as time passes. Inconveniences of Barter system (continued): Payments in the future: Under the system of barter, it is very inconvenient to lend goods to other people. With the lapse of time, the value of the commodities may fall. Difficulties in tax collection: Under Barter system the tax cannot be collected in the form of goods. If the commodities are collected from the tax payers, they will not only lose value as time passes on but are difficult to store also. What is money “Money is the modern medium of exchange and the standard unit in which prices and debts are expressed.” (Prof. Samuelson) Money is any material, which is commonly accepted and generally used as a medium of exchange for all types of transactions. Thus all kinds of currency notes and coins plus chequing deposits etc. can be regarded as money Legal and Functional definition of money Legal definition: Legally money is anything proclaimed by law as a medium of exchange .Nobody can refuse its acceptance as a medium of exchange . Functional definition of money: Functionally money refers to anything that performs four basic functions : It serves as a medium of exchange It serves as a standard unit of value It serves as a mean for future payments It serves as a store of value Money value of money and commodity Value of Money Money Value of Money : It refers to what is inscribed on a coin or written on a paper note . Thus money value of a paper note is what is written on it: One hundred rupees , five hundred rupees etc .Thus ,with a five hundred rupee note you can buy goods and services worth five hundred rupees in the market. Commodity value of money : It refers to the value of thing the money is made of . Thus ,if coins are made of gold or silver (as was the practice in the old days), commodity value of money refers to the market value of the gold or silver contained in a coin. Kinds of money: Money Deposit money OR Credit money Currency Metallic money (Coins) Full value Near money (fixed deposits) Paper money (Currency notes) Token money Or Fait money Convertible Inconvertible Kinds of money (cont’d): The following is the main classification of money 1. CURRENCY: The money issued by the govt. as official medium of exchange is called currency. It is of two types; I. Metallic money: Metallic money consists of various kinds of coins. in AFGHANISTAN, coins of one, two and five afs. are the example of metallic money. II. Paper money: Paper money includes currency notes issued by the central or state bank of a country. Paper money circulates in the form of notes of 10, 20, 50 etc. Kinds of money (cont’d): Metallic money is of two types; I. Full value money: when the face value of a coin is equal to the value of a metal contained in the coin, it is called full-bodied money. II. Token money (Fait money): when the face value of a coin is greater than the value of metal it contains, is called token or fait money. Kinds of money (cont’d): Paper money can be classified into two: I. Convertible paper money: This type of money easily converted into the metallic money or into the gold, if demanded. II. Inconvertible paper money: Some times after an over issue of paper money in an emergency like war and floods ,the authority feels unable to convert its notes into coins. So government breaks its promise of converting notes into standard money and thereby makes the money inconvertible. Kinds of money (cont’d): 2. DEPOSIT MONEY or CREDIT MONEY: This is the most modern form of money. Demand deposits (current account) in the banks are called deposit money. 3. Near money: The deposits of the banks which are not operated through cheques. For example; fixed deposits, the govt. securities, bonds, and saving certificates. Functions of money: Functions of money Primary function Secondary function Contingent function Functions of money (primary functions): Medium of exchange Unit of account The primary functions of money are; 1 2 Standard of deferred payments Store of values 3 4 Functions of money (primary funct.): A. The primary functions of money are as under: 1. Money as a medium of exchange: Money acts as a medium of exchange and helps in overcoming the difficulty in barter economy. In all market transactions, money is used to pay for goods and services i.e. the sale or purchase of goods is done through money. 2. Money as a unit of account: Money serves as a common measure of value i.e. the value of goods and services can be expressed in terms of unit of money. Functions of money (cont’d): 3. Money as a standard of deferred payments: Money is used to make payments in the future time. Money is the only unit of account which is easy to borrow and easy to lend. 4. Money as a store of value: Money also functions as a store of value. Money is the most liquid of all assets, therefore it is, easier to store value (resources) in the form of money. Functions of money (secondary functions): Aid to production The secondary functions of money are; 1 Money facilitates to FOP 2 Money as a tool of monetary management 3 Money as a instrument of making loan 4 Functions of money (secondary functions): B. The secondary functions of money in brief, are as; 1. Aid to production and trade: The market mechanism, production of commodities and expansion of trade etc. have all been facilitated by the use of money. 2. Money facilitates to FOP: All production takes place for the market and the factors payments (rent, wages, interest and profits) are made in money. Functions of money (secondary function……cont’d): 3. Money as a tool of monetary management: All the monetary progress is done due to money. 4. Money is an instruments of making loans: People save money and deposit it in the banks. The banks advance these savings to businessmen and industrialists. Thus money is the instruments by which savings are transferred into investments. Functions of money (contingent functions): Distribution of National income The contingent functions of money are; 1 Basis of credit 2 Liquidity of property 3 Functions of money (contingent functions): C. The Contingent functions of money are as follows: 1. Distribution of national income: (Money value of all goods and services produced in a country during a period of one year) Money facilitates the distribution of national income among the various productive and nonproductive purpose. 2. Basis of credit system: Banks create credit on the basis of their cash reserves. Functions of money (contingent function): 3. Liquidity of property: Money gives a liquid form to wealth. A property can be converted into liquid form with the use of money. Essential attributes of a good money The essential attributes of a good money material are as follows: 1. General acceptability: The essential quality of a good money material is that it would be acceptable to all without any hesitation in exchange for goods and services. 2. Stability of value: Another very important attribute of good money is that it should be fairly stable in value .If the commodity chosen as money is subject to violent fluctuations, then that Qualities of a good money material cont….. is a useless money. Money is the standard by which we measure the value of all other commodities and if the standard itself is influenced by changes in its demand and supply ,then how does it serves as a perfect money. 3.Transportability: The commodity chosen should be easily transportable without any depreciation. It should have a large value in small bulk. 4. Storability: Another requisite of a good money material is that it should be storable without depreciation .If the commodity chosen as money is perishable ,then that cannot serve as a good money. Qualities of a good money material cont….. 5. Divisibility: The commodity chosen as money should be capable of being re United without losing its value. 6. Homogeneity: The commodity as money should be of uniform quality and capable of standardization. 7. Cognizability . One very essential condition of perfect money is that it should be easily recognized by the eye , ear or touch. Origin and Growth of Commercial Banking Terms to know: 1 3 Evolution of Banking 2 Functions of commercial Bank 3 3 Role of commercial Banks in the economic development 4 Classification of Banks Evolution of Banking There are various views about the origin of the ‘bank’. One view is that it is derived from an Italian word ‘banque’ which means a ‘bench’. The other point of view is that it has originated from the German word, ‘banc’ which means a joint stock firm. G. Crowther in his famous book, “An outline of money” defined that present day banker has three ancestors; The merchants The goldsmiths and The money lenders. 1) 2) 3) Evolution of Banking: According to Crowther, the present day banker has three ancestors; The money lenders The goldsmiths The merchants Evolution of Banking (cont’d): The merchants: The earliest stage in the growth of banking can be traced to the working of merchants. These merchants were traders in commodities and those activities were carried on by them from one place to another. The traders faced many difficulties to carry metallic money with themselves for payment. The traders with high reputation began to issue receipts which were accepted as titles of money. These receipts or letters of transfer also called hundi in indo sub continent were first mode of payment .The merchant banking thus forms the earliest stage in the evolution of banking. Evolution of Banking (cont’d): The goldsmiths: The second stage in the growth of banking is normally traced to earlier goldsmiths. These goldsmiths received gold and silver for safe custody and issue receipts for the metallic money kept with them. In this way these receipts became a medium of exchange and a mean of payment. Evolution of Banking (cont’d): The money lenders: The third stage in the development of banking arose when the goldsmiths became the money lenders. The goldsmiths kept a small proportion of the total deposits for meeting the demands of customers for cash and the rest they could easily lend. The modern commercial banking system actually developed in the nineteenth century. What is a commercial bank A bank is a financial institution which deals with money and credit. It is organized on a joint stock company system primarily for the earning of profit. Commercial bank accepts deposits from individuals , firms and companies at a lower rate of interest and gives at a higher rate to those who need it. The difference between the terms at which it borrows and those at which it lends forms the source of its profit. According to Crowther “a bank is a firm which collects money from those who have it spare .it lends money to those who require it.” According to Mr. . Parking .” a bank is a firm that takes deposits from households and firms and makes loans to other households and firms”. Functions of commercial banks: Functions of commercial Banks The basic functions of commercial bank The secondary Functions of Commercial banks Functions of commercial banks: 1) Basic functions: The basic functions of commercial banks are (A) Accepting of deposits and (B) Advancing of loans A. Accept of deposits: In order to attract the savings from different persons and institutions, the banks maintain the following three types of accounts: (i) Current account (ii) Saving account (iii) Fixed deposit account. Functions of commercial banks i. Current account. On demand deposits, the banks pay no interest.The deposits can be withdrawn at any time in full or in part. Current account holders receive a check book and regular statements containing details of money paid in and paid out. Saving account: The banks pay interest on this types of deposits and advance the facility to withdraw the amount, subject to certain restrictions. Functions of commercial banks iii. B. Fixed deposit account: Fixed deposit (term deposit) are kept with the banks for a specified period of time. The rate of interest on fixed deposits are fairly high. The longer the period of deposit, the higher is the rate of interest. Making loans: the lending of money may be in any of the following forms; (i) Loans (ii) Cash Credit (iii) Overdraft (iv) Discounting of Bills. Functions of commercial banks i. Loans: The commercial banks grant short term loans and long term loans to individuals, firms, and companies mostly against some securities. ii. Cash credit: The banks advance long term loans to the different sectors against the security of goods. The borrower is permitted to draw within the cash credit limit sanctioned by the bank. The interest is charged only on the amount of money withdrawn by the borrower. Functions of commercial banks iii. iv. Overdraft ( O/D): It is a convenient form of short term financing by a bank. The customer is allowed to draw certain amount of money over and above his own deposited money. Interest is charged on daily balance on the overdrawn amount. Discounting of bills: A bill of exchange is a peace of paper representing a promise by the buyers of goods on credit, to pay the seller at a specified time. The discount charged is the earning of the bank. Functions of commercial banks 2) i. ii. Secondary functions: The secondary function of a commercial bank are as follows: Special financial services: commercial banks are now offering international services in the form of currency exchange, issue of letters of credit, ATMs (Automatic Teller Machine), banker’s acceptances and Electronic Fund Transfer (EFT). Purchase or sell of securities: The bank, if authorized by the customer, purchases or sells securities on behalf of the customer. Functions of commercial banks iii. iv. Execution of standing Instructions: The customer may order in writing to his bank to make payments of regular installment to an individual or firm by loaning them to his account. Against such payments the bank charge a small commission. Acting as Trustee: If a client directs his bank to act as a trusty in the administration of a business, the bank performs this responsibility for the benefit of its customer. The bank charge a small fee for providing this services. Role of Commercial Banks in the Economic Development of a Country: 1. 2. The significance of commercial banks in the economic development of a country are as given in brief: Banks promote capital formation: The commercial banks encourage savings. These savings are then available in the businesses which make use of them for productive purposes. Promotion of trade and industry: with the growth of commercial banks in the 19th and 20th centuries, the trade and industrial sector expanded. The use of cheques, bill of exchange, credit card etc. has increased both national and international trade. Role of Commercial Banks in the Economic Development of a Country (cont’d): 3. 4. Development of Agriculture sector: The commercial banks advance credit to the agricultural sector which greatly support in rising agricultural productivity and income of the formers. Investment in new enterprises: Businessmen normally hesitate to invest in new enterprises. The commercial banks generally provide short and medium term loans to the firms to invest in new enterprises. 5. Influencing economic activity: The banks can also influence the economic activity of a country by increasing and decreasing the rate of interest. 6. Implementation of Monetary policy: The central bank of a country controls and regulates the volume of credit through the active cooperation of the commercial banking system in the country. 7. Export promotion cell: In order to increase the export of a country, the commercial banks provide information about trade and conditions both inside and outside the country to its customers. Classification of Banks: 1. 2. The main types of banks are as under: Central Bank: The central bank is the head, the leader, and the supervisor of the banking and monetary system of a country. Almost every country of the world has its own central bank. Commercial Banks: Commercial banks are the financial institutions, which perform general banking functions. They receive deposits, advance loans and create credit. Classification of Banks: 3. 4. Industrial Banks: The industrial banks mainly provide, medium and longterm credit to the industries. These banks are established for industrial development. Agriculture Banks: Agricultural banks are set up to provide financial assistance to the agriculturists. They advances short-term and long-term credit to the formers for purchasing seeds, tractors and introducing modern techniques in forming. Classification of Banks: 5. 6. 7. Mortgage Banks: Such banks mortgage land, houses and other property and advance loans. Some commercial banks perform such activates. Exchange Banks: Exchange banks mainly deal with international trade. These banks take the responsibility of settlement of foreign exchange and arrange the foreign business. Investment Banks: These banks provide funds for long-term projects. They can raise their funds by getting deposits or selling share/stocks, issuing bonds or commercial paper. Instruments of Credit Terms to know: 1. Definition of Credit 2. Instruments of Credit 3. Documentary/Negotiable Credit Instruments Definition of Credit: The word ‘Credit’ is derived from the Latin word ‘Credo’ which means “I trust you”. It is define as, “An exchange which is complete after the expiry of a certain period of time after payment”. i.e. The promise usually based on the confidence and on the belief that the debtor whether a person, a business firm or a government unit will be able and willing to pay on demand or at some future time. The creditor is to exchange present goods for the right to receive payments in the future. Instruments of Credit: 1. 2. The main instruments of Credit are: Pay roll credit: Pay roll credit is also called oral agreement. In development countries as well underdevelop countries some credit is extended to individuals, friends, businesses associations without keeping any record. The agreement to pay back the money is purely oral. Book Credits or Open book accounts: Open book account merely consists of entries on the books of business concerns. Instruments of Credit (cont’d): These entries appear as an account receivable on the books of lender and as an account payable on the books of the borrower. 3. Documentary Credit instruments: Most of the credit is evidenced by a written contract. Such instruments exhibit the existence and terms of debt, the identity of lender, the amount to be lend, the rate of interest, the time of maturity etc. These are also represents Negotiable instruments (written document which entitles a person to receive a sum of money). What is negotiable instrument The term negotiable instrument means a written document which entitles a person to receive a sum of money. A negotiable instrument is transferable by delivery or endorsement and delivery. A person who takes the negotiable instrument in good faith becomes the true owner even if he has not received it from the true owner. The negotiable instrument is thus a document which is legally recognized by custom of trade or law, transferable by delivery or by endorsement. Characteristics of Negotiability An instrument is negotiable by virtue of the following features. 1. Transferable by delivery: It is transferable from one person to another person by delivery or by endorsement and delivery. 2. Entitled to receive money. The legal holder of the instrument is entitled to receive money mentioned in it. 3. Filling a suit: The holder of a negotiable instrument has the right to file a suit in his name for payment from all or any of the concerned parties. Instruments of Credit (cont’d): The main negotiable instruments are: (1) Promissory Note (2) Bill of Exchange (3) Cheque 1) Promissory Note: It is an unconditional written promise by one person to another in which the maker (Payer) promises to pay on demand or at a fixed or determinable date in the future, a stated sum of money to or to the order of a specified person or to the bearer of the instrument . Instruments of Credit (cont’d): Maker: He is the person who draws and signs the promissory note and promises to pay the amount. Payee: He is the person to whom the amount of the promissory note is payable. Specimen of a Promissory Note Afs. 20,000 Stamp Payee Kabul June 1,2008 Sixty days after for value received, I promise to pay, Mr. Qais or order the sum of Afs. Twenty thousand only. Mr. Qais Fahim Ahmad Parwan-e-2, signature Kabul Maker Instruments of Credit (cont’d): Conditions for Promissory note: The following are the essential features of a promissory note: There are two parties to a promissory note. The promise to pay must be in written. The promise to pay must be signed by the Maker or Payer. The promise to pay must be unconditional. The amount to be paid must be definite in terms of money. The promissory note must be payable to a definite person. The promissory note must be payable on demand or at a fixed or determinable future date . Instruments of Credit (cont’d): 2) i. Bill of Exchange: A bill of exchange is a peace of paper representing a promise by the buyers of goods on credit, to pay the seller at a specified time. Parties to the bill: There are three parties involved to a bill of exchange. Drawer: The drawer is the person who draws the bill. He is the person who orders to pay a certain sum of money. Instruments of Credit (cont’d): ii. Drawee: Drawee is the person on whom the bill is drawn. He is the person who is ordered to make the payment of the bill. iii. Payee: Payee is the person to whom the money is directed to be paid. He gets the payment of the bill. Instruments of Credit (cont’d): Bill of Exchange: Specimen of a Bill of Exchange Afs. 30,000 Kabul March 1,2009 Payee Two months after date pay to a Financial Institute. To Drawee Mr. Amir Khan Wahedullah signature Parwan-e-2, Kabul Drawer Classifications of bills Bills of exchange are classified on several bases . The main classifications in brief are as under. 1. Classifications of bills by parties: If one bank orders the other bank to pay , it is called a bank draft or bank bill. If the order to pay in drawn on any other type of drawee (individual or firm) it is named as trade draft or trade bill. A trade bill is drawn either by a seller on a buyer or by a creditor on debtor. When we talk of a bill of exchange, we mean by it a trade bill. 2. Classification on the basis of maturity: A bill of exchange is also classified on the bases of period of time required for payment . A bill ordering payment on demand or at sight is called sight bill. A bill ordering payment after a period of time specified on it is called time bill. continued 3. Classification of bill on the basis of security: If a bill is fully supported by documents for payments, it is called documentary bill. In case no security or document is provided , that bill is called clean bill. 4. Classification on the bases of place: A bill of exchange is either inland or foreign bill of exchange. Inland bills are those which are drawn and payable inside a country. Foreign bills are those which arise out of trade transactions between on a persons or firms in a foreign country. Advantages of bill of exchange Following are the advantages of bill of exchange. 1. Written verification of bill: The accepted bill of exchange shows the amount owned by a person and the exact date of payment. In case of delay or non payment , the payment can be enforced on him in the court of law. 2. Negotiable instrument: The bill of exchange is a negotiable instrument , being transferable , it enables increase in commercial transactions. 3. Discounting facility: The bill of exchange being a negotiable instrument enables the payee or holder to obtain prompt cash by discounting it with bank . The banks consider the discounting of bills of exchange as a very useful investment. continued 4. Easy transfer of money: With the help of bill of exchange , the money can be easily transferred merely by signing and delivery of the bill. The risk involved in the actual transfer of money is thus avoided. continued 5. Self liquidating credit: A businessman can easily purchase goods by promising to pay a specified sum at a determined future time to the seller. Before the maturity of the bill, he can arrange to sell the goods in the market and the proceeds can be used for meeting the obligation . A bill of exchange is thus a self liquidating credit. 6. Facilitates foreign trade: The bill of exchange facilitates settlement of international obligations . It thus helps in promoting trade between nations. Instruments of Credit (cont’d): 3. Cheque: A written order of a depositor upon a bank to pay to or to the order of a designated party or to bearer, a specified sum of money on demand. The person who draws the ceque is called Drawer. The bank on which the cheque is drawn is called Drawer. The person to whom payment is to be made is called Payee. Instruments of Credit (cont’d): Cheque: Drawee Payee Cheque Number CHEQUE ABC Bank (pvt.) Ltd. Paroshgah Branch Kabul Pay Shafiullah Sahak Afs. Ten Thousand Only 34634528 Date 30 May, 2008 Afs. 10,000 A/C No. 000268003 Signature *************************************** Counter work Account Number Amount in Words Code Number Amount in Figures Features or Characteristics of the Cheque: The main characteristics or features of a Cheque are as follow: ◦ It is an order of the customer without condition. ◦ It is drawn upon a certain bank in writing. ◦ The bank has always to pay it on demand. ◦ It is payable to a certain person or to his nominee or to the bearer of the instrument. Types of Cheque: How many types of cheques we have? We have two types of cheques: 1) Open Cheque and 2) Crossed cheque Types of Cheque (cont’d): 1. Open cheque: Open cheques are those cheques which are paid across the counter of the bank. Open cheques has further two types: ◦ Bearer cheque and ◦ Order cheque Types of Cheque (cont’d): Bearer cheque: ◦ If a drawer orders the bank to pay a stated sum of money to the bearer, it is called a bearer cheque. ◦ Any person who lawfully possesses a bearer cheque is entitled to receive payment of that cheque. Order cheque: ◦ If the cheque is to the order of a person in whose favor the cheque is drawn, it is called order cheque. ◦ The order cheque is paid by the bank only when the bank is satisfied about the identity of the payee. Types of Cheque (cont’d): 2. Crossed cheque: If a cheque is crossed by drawing two parallel lines across the face of the cheque, with or without the words & Co or A/c payee only, it is called a Crossed cheque. The crossed cheque cannot be paid on the counter of the drawee bank. It will be deposited in the account of a person in whose order or favor it is drawn. Types of Cheque (cont’d): How many kinds of cross cheque we have? There are two kinds of cross cheque; ◦ General crossing and ◦ Special crossing Types of Cheque (cont’d): General crossing: The drawing up of two parallel lines on the face of the cheque at the top left hand corner with or without the words & Co not negotiable or Account payee only is known as a General Crossing. The effect of general crossing is that the crossed check cannot be paid at the counter of the bank. Its payment can only be deposited into the payee’s account only. Types of Cheque (cont’d): Special crossing: A cheque is deemed to be crossed specially when it bears across its face the name of the banker either with or without the words not negotiable. In case of special crossing the payment can only be made to the bank named therein the cheque. Endorsement The word endorsement is derived from the Latin word ‘indorsum’ which means the back . According to the negotiable instrument act , 1881, the writing of a person’s name either on the back or the face of instrument followed by one’s signature for the purpose of negotiation is called endorsement. There may be endorsement on a separate piece of paper attached to the instruction called ‘allonge’. Kinds of endorsement The main types of endorsement are as under: 1. Blank or general endorsement: If the holder of the instrument signs his name only and delivers it to the endorsee, it is called general or blank endorsement. 2. Full endorsement: it contains not only the signature of the endorser but specifies the endorsee or to his order also. 3. Restrictive endorsement: Here the endorser uses such words in endorsement which restricts further negotiation and transfer of bills. 4. Sans recourse endorsement: In this type of endorsement , the endorser refuses to accept any liability on the instrument to any subsequent party in case of dishonor of instrument. 5. Conditional endorsement: it contains an order to pay only when a condition expressly laid down by the endorser is met with. Kinds of endorsement continued 6. Partial endorsement: it contains an order to pay only a part of the amount mentioned in the instrument . This type of endorsement is not valid in law. Main Modes of inland remittances by commercial banks The main modes of inland remittances by commercial banks are as under: 1. Bank draft: A bank draft is an order by one branch of a bank to another branch of the same bank to pay a certain sum of money on demand to the person named therein. 1. 2. 3. 4. Features of bank draft it is drawn by one branch of a bank to another branch of the same bank. Drawer and drawee bank is the same but branches are different. The amount payable is specified in the draft. The person to whom amount is payable is also specified therein. Features of bank draft continued 5. 6. 7. 8. 9. It is payable on demand. It is unconditional order for payment. It bears no stamp. Draft can be negotiated by endorsement and delivery. The purchaser of the draft may or may not be customer of the bank. 2. Pay order A pay order is an unconditional which is drawn by the bank and is payable on the issuing branch only. We can say that one and the same branch is both the issuing and the paying branch. A pay order is paid only to the person named there-in. It is thus non transferable. 3. Inland traveler cheque inland traveler cheque is also named Rupee traveler cheque. The cheque is drawn by the bank for round amount and is payable at all the branches of the issuing bank in the country. The purchaser signs on the face of the cheque at the time of purchase . He is also required to sign once again on the face of cheque when he presents it for encashment . The bank releases the payment if the two signatures tally. In case the two signatures are not identical , the paying branch will insist on identification of the payee through some independent source. 4. Telegraphic transfer(T.T) Telegraphic transfer is an instrument that is cabled or telexed for the transfer of money to a third party by one branch of a bank to its another branch located in some other town. The remitter branch instructs the paying branch in coded language to pay cash or credit the specified sum of money into the account of the named payee. All local remittances through T.T are payable in local currency. Bank remittances through T.T are cheap and convenient to use. 5. Mail transfer Mail transfer is another method of remitting money by one branch of a commercial bank to another branch of the same bank functioning in some other town. Here the remitting branch instructs the paying branch by mail to pay cash to or credit into the account of the named payee the specified sum of money . ( This method of transferring money is outdated and is replaced by electronic funds transfer system) Electronic funds credit system ( EFTS) As the telecommunication system is advancing , the payments both inland and foreign are increasingly being made by electronic fund credit system. We are now gradually moving towards a payment system in which the use of paper is diminishing with the introduction of telebanking services , The ATM and credit card facilities, a cashless and chequeless society is emerging. Basis Difference between three negotiable Promissory note Bill of exchange cheque instruments Two 1)maker 2) payee Three 1)Maker 2)Drawee 3)payee Three 1) Drawer 2) Drawee 3) Payee 2.Acceptance Not required A legal necessity Not required 3. Period Payable on demand also Payable on demand only only payable on demand order order 1. Parties 4. Promise or order Promise 5. Stamp A legal necessity A legal necessity Not required 6. Crossing Cannot be crossed Cannot be crossed Can be crossed 7. Grace days Allowed Allowed No grace days . 8. Liability The maker is not free from liability The maker and others free from liability The maker is not free from liability 9. Area Generally inland Inland and foreign Only on the bank of the depositor End of CH #3 Chapter # 4 Financial markets and their functions Terms to know: 1 What are Financial Markets? 2 Classification of Financial Markets: 3 What is Money Market? 4 Instruments of money market 5 What is capital market? Financial markets: Financial markets are markets in which funds are transferred from people who have surplus funds to people who have a shortage of funds. Its allow the movement of surplus funds from savers to investors. By facilitating transfer of funds , the financial markets contribute to higher production and efficiency in the overall economy. These markets also improve the well being of consumers by providing them timely funds to purchase goods and improve their standard of living. Financial sectors in developing countries comprises of commercial banks, development financial institution, micro finance companies, investment banks, mutual funds, stock exchange and insurance companies. Classification of Financial Markets: Financial Markets Financial markets basically divided into two: MONEY MARKET CAPITAL MARKET Money Market: 1. Money market: is a financial market for short term loans. It basically meets the short term requirements of the borrowers for money and provides liquidity of cash to the lenders. Technically money markets refers to the collection of institutions engaged in the employment of short term funds. In the money market, commercial banks are the most important lenders. MONEY MARKET Financial institutions Financial intermediaries Instruments of money market: I. The main short term credit instruments traded in the money market are as follows: Call loans: These loans are also called ‘loans at call and short notice'. The call loans are generally granted maximum for seven days. It is granted to bill brokers, discount houses and stock exchange dealers. The commercial banks also lend their surplus funds on call to other banks as they need them. Call loans are usually made without any security. Instruments of money market: Treasury bills: Treasury bills are short term govt. securities. These are sold by the central bank on behalf of the government. The period of maturity generally ranges from 3 to 12 months. Treasury bills are usually issued for meeting the temporary deficit which a government faces due to excess of its expenditure over revenue at some point of time. Thy should not be made a permanent source of funds for the central government. II. Instruments of money market: III. Bankers acceptance: These are bills of exchange accepted by commercial banks on behalf of their customers. A bill of exchange is a peace of paper representing a promise by the buyers of goods on credit, to pay the seller at a specified time. Banker’s acceptances are used mostly in financing the commercial transactions both within and outside the country. Instruments of money market: IV. Collateral loans: The commercial banks usually grant short term loans against collateral securities to stock exchange dealers and brokers. V. Sales / purchase operations (Repo): Under a Repo transaction, the treasury bills and securities are sold by their holder to an investor with an agreement to repurchase them at a predetermined rate and date. Under reverse Repo transactions , securities are purchased at with a simultaneous commitment to resell at a predetermined rate and date . Importance of money market If the money market is well developed and broad based in a country , it greatly helps in the economic development of a country. The importance of money market in brief is given as under. 1. Financing industry: A well developed money market helps the industries to secure short term loans for meeting their working capital requirements . It thus saves a number of industrial units from becoming sick. 2. Financing trade: An outward and a well knit money market system plays an important role in financing the domestic as well as international trade. The traders can get short term finance from banks by discounting bills of exchange. The acceptance houses and discount market help in financing foreign trade. continue 3. 4. 5. Profitable investment: The money market helps the commercial banks to earn profit by investing their surplus funds in the purchase of treasury bills and bills of exchange . These short term credit instruments are not only safe but also highly liquid. The banks can easily convert them into cash at a short notice. Self sufficiency of banks: The money markets is useful for the commercial banks themselves . If the commercial banks are at any time in need of funds , they can meet their requirements by recalling their old short term loans from the money market. Effective implementation of monetary policy: The well developed money market helps the central bank in shaping and controlling the flow of money in the country.The central bank mops up excess short term liquidity through the sale of treasury bills and injects liquidity by purchase of treasury bills. continue 6. Encourage economic growth: if the 7. money market is well organized , it safeguards the liquidity and safety of financial asset. This encourage the twin functions of economic growth , savings and investment. Proper allocation of resources: In the money market , the demand for and supply of loan able funds are brought at equilibrium . The savings of the community are converted into investment which leads to proper allocation of resources in the country. What is capital market? 2. Capital Market: Capital market deals with the grant of medium and long term loans. The capital market refer to the institutional arrangements which facilitate the lending and borrowing of medium and long term loans. Instruments of capital market: Capital Market Issue of Debt instruments Issue of debt instruments such as a bonds or securities having a maturity of more than one year. Issue of shares Rising funds by issuing of Equities (shares) by public Limited companies. Instruments of capital market: BONDS GOVERNMENT SECURITIES Mortgages Debt instruments Instruments of capital market: A. Issue of debt instruments: I. Bonds: Bond is a debt security that promises to make payments periodically for specified period of time. Companies issue long term bonds for raising of funds. II. Mortgages: Mortgages are long term loans to individuals or firms. Instruments of capital market: III. Government securities: The long term debt instruments are issued by the govt. of a country to finance the deficit of the budget. B. Issue of shares: The second method of raising funds is by issuing of shares by the public limited companies. The market where the shares of public companies are traded is called the equity market. Equity market is of two types (a) Primary market (b) Secondary market Primary and secondary markets Primary market: A primary market is a financial market which deals with the issuance of and purchase of new shares of a public company. Secondary market: A secondary market is a market which deals with the purchase and sale of old shares of public companies. Role of capital market Capital market plays an important role in the mobilization of long term funds for the economic development of the country. 1. Mobilization of equity market: The security market both primary and secondary help the companies to raise long term capital. If there were no such organized market it would then be very difficult to exchange their shares for cash. 2. Savers and borrowers: The capital market provides a link between savers of money and borrowers of funds. There are a numbers of organizations like commercial banks , insurance companies and saving organizations which collect the savings from people and then advance these savings to the people and institutions who are in need of money. Continue…. 3. 4. saving incentives : If in a country the capital market is organized , it encourages people to save money. If there had been no banking and non banking financial institutions to collect savings of the people , it would have been diverted to unproductive channels such as purchase of Jewellery , land , gold etc. Balanced economic growth: The capital market provides an opportunity to mobilize savings from the areas where people are economically quite well of . The financial resources are then transferred to backward areas of the county for expansion of trade and industry. The capital market , thus, helps in promoting balanced growth in the county. Continue….. 5. Attraction to foreign investors: An efficient capital market attracts the foreign companies to invest funds in the shares of companies, build up factories etc. The foreign investment thus helps in increasing the productivity and prosperity of the country. What is a mutual fund Mutual fund is a company which pools the savings of individual , organizations for investment in capital market instruments. Mutual fund is an ideal tool or instrument for individuals who want to invest in stocks , debentures and other securities which otherwise is difficult for them to invest. The working of mutual fund is very simple. The money pooled by a number of investors is entrusted to a fund Manger who is hired by the trust . The fund manager invests money directly in primary market or through brokers in secondary market on behalf of the investors . The fund manager is paid a management fee . If there is a profit on investment , it belongs to the investors. In case there is a loss , it is also shared by the investors. Types of mutual fund There are two types of mutual funds 1. Open end mutual fund: are those where subscription and redemptions of shares are allowed on a continuous basis. 2. Closed end mutual funds: are those where the shares are initially offered to the public and then traded in the securities market. Advantages of mutual funds The advantages of mutual funds are that the money pooled for investment is managed by expert professional fund managers . The Funds are invested in different instruments which reduces the risk of losses. In addition to this, they are well regulated . A mutual fund generates profit from three different sources. 1. Dividend 2. Capital gains 3. Appreciation of shares prices Chapter Completed Foreign Exchange There is not a single country in the world which is self sufficient. There is constant inflow and outflow of goods and services from one country to another country . When goods and services are exported , the money is to be received from the foreigners, and when they and imported , the money is to be paid to them. The receiving or making of payments to a person, firm or government in foreign countries involves many problems. Definition of foreign exchange The term foreign exchange is used in narrow as well as in broad sense. In the narrow sense , foreign exchange simply means the money of a foreign country. For example the Japanese's Yen is a foreign exchange to a Afghani and a Afghani AFS is a foreign exchange for Japanese. In the broader sense , the word ‘foreign exchange’ is related to the exchange methods and mechanism through which the payments in connection with international trade are made. It covers the methods by which: 1. The currency of one country is exchanged for that of another. 2. The forms in which exchanges are conducted. 3. The ration at which they are effected. continue In the words of H.E. Evitt , “the means and methods by w3hcih rights to wealth expressed in terms of the currency of one country are converted into rights to wealth in terms of the currency of another country are known as foreign exchange”. Hartley whither defines foreign exchange “ as a mechanism by which international indebtedness is settled between one country and another”. Importance of foreign exchange 1. 2. 3. 4. Strength of economy: The financial reserves indicate the financial strength and the stage of development of the economy. If a nation possesses large reserves of foreign exchange , it indicates the stability, soundness and the development of the economy. Balance of payments: If a country is facing shortage of foreign exchange and is having persistent adverse balance of payments , it indicates that the economy is in a bad shape. Makes international trade easy: The international payments are made in the currency of credito0r’s country on the mutually acceptable rates . This makes the international trade easy. Rate of exchange: The rate of exchange at which the different monetary units are exchanged shows a direct relationship between the prices of the commodities in national and international market. Continue…. Hard currency nations: The foreign exchange balances of a country directly affect the rates of exchange . A country having large foreign exchange i.e., a sound nation for the other country. A hard currency nation has stability in foreign currency rate. 6. Credit worthiness: The rising foreign exchange balances of a nation increases its credit worthiness in the international capital market. 5. What is Foreign exchange market Foreign exchange market is a place in which foreign exchange transactions take place. In the words of Kindleberger, “ Foreign exchange market is a place where foreign moneys are bought and sold.” It is the part of money market in the financial centers. Functions of foreign exchange market There are three main functions of foreign exchange market. 1. Transfer functions: The basic function of foreign exchange market is to transfer foreign moneys between countries. The main credit instruments used for payments in foreign currencies are letter of credit , bill of exchange ,banker’s draft, telegraphic transfer. 2. Credit functions: Another function of the foreign exchange market is to provide credit to the importer who is a debtor . The credit facility is provided through the bill of exchange. 3. Hedging functions: Foreign exchange market provides the facility to the importer to pay for the goods at the foreign exchange rate prevailing in the market called spot rate or at the future date called future rate called hedging. Forward exchange rate protects the importer from all risks of fluctuations in the foreign exchange market. Factors influencing rate of exchange Following are the factors influencing rate of exchange. 1. Trade movements: change in the volume of exports and imports of goods between two countries in foreign exchange market may lead to fluctuations in the rates of exchange. For example , if the imports of a country exceed its exports , it will be obligated to pay more in terms of foreign exchange and therefore, the rate of native currency will fall . Conversely , if the exports of a country exceeds its imports, the demand for foreign exchange decreases and as a result the rate of exchange rises and moves in favor of the native country. 2. Capital flow : Movements of capital from one country to another also influences the rate of exchange. For example, if there is a flow of capital form America to Pakistan for investments in shares , or in the shape of loans , the demand for Pakistani currency will go up in the foreign exchange market. As a result , the rate of exchange of Pakistani rupees in terms of American $ can rise. Continue….. 3. 4. Banking influences: Banking operations also influence the rate of exchange . For example if the central bank of a country increases its bank rate . Its market rate of interest will rise . The higher interest rate will attract the foreign capital in the country. As a result of increase in demand of Pakistani currency , Its rate of exchange in terms of foreign currency will rise . If the bank rate is reduced , the effect will be in favor of foreign currency and against home currency. Speculations: Rate of exchange is also affected by speculation in the foreign exchange market. If the speculators expect that value of foreign currency to rise, they begin to buy foreign currency in order to sell it in future to earn profit. By doing so , they tend to increase the demand for foreign currency . The rate of exchange will be in favor of foreign currency and against home currency. Continue….. Policy of protection: If the government of a country follows the policy of protection of the domestic industries, it discourages imports and encourages exports. As a result of discouraging imports form other countries , the demand for foreign currency will decrease . The rate of exchange will move in favor of home currency and against the foreign currency. 6. Exchange control: the rate of exchange is also affected by the exchange control measures taken by the government of a country. If the government of a country imposes restrictions to curtail imports, It would lead to a fall in the demand for foreign currency . As a result the rate of exchange moves in favor of home currency and against the foreign currency. 5. continue 7. Monetary policy: if the monetary policy perused by the central bank fails to achieve its objectives and creates inflationary conditions in the country, it will lead to the flight of capital form the country. The supply of foreign currency will fall and the rate of exchange will turn in favor of foreign currency and against home currency. 8. Political conditions: political situation has a direct impact over the rate of exchange in a country. If there is stable government and the various institutions function smoothly, it will encourage inflow in the country . As a result the supply of foreign currency increases and their value in terms of home currency falls. continue Peace and security: if there is strict maintenance of law and order and peace in a country , it will encourage the supply of foreign capital in the country . Such a situation leads to favorable rate of exchange for the home currency. 10. Industrial conditions: if there is industrial discipline in the country it will attract foreign capita and in turn the foreign currency fall . 9. Exchange control Under the system of free market in foreign exchange, the citizens of a country are at full liberty to buy and sell foreign currencies to any extent . Under a controlled economy the free movements in foreign exchange are restricted and control is imposed on the purchase and sale of foreign exchange by the state or the central bank of the country .Foreign exchange control thus means interference by the state or control bank in the free play of market forces that determine foreign exchange rate. the government or central bank monopolizes the foreign exchange business and exercises full control over the foreign exchange market in the country. The exchange control usually take the following three forms. 1. The monetary authority or the government of a country manages the foreign exchange rate and buys and sells foreign currency at the rate fixed by it. 2. All foreign exchange earned by the exporters are surrendered to the central bank which pays the money in local currency. 3. The importers of goods are allocated foreign exchange at the official rate or enabling them to make payments for the imported goods. Objectives of exchange control 1. 2. a. b. c. 3. To correct an adverse balance of payments: One of the main objectives of the exchange control to be followed by a county is to correct its adverse balance of payments. This objective is achieved by restricting the volume of imports to essential items and according to availability of its reserves. To conserve foreign exchange: A country may introduce exchange control for conserving its hard earned foreign exchange. These reserves are restricted for Payments of external debt Imports of essential goods Purchase of defense material To protect home industry: Exchange control is also employed with the object of protecting home industry . If certain domestic industries are facing stiff competition from abroad and the government desires to protect them from foreign competition , it will not sanction foreign exchange for the import of these commodities. Objectives of foreign exchange Conti…. 4. To stabilize exchange rate: A government may introduce exchange control for keeping exchange rate stable . The fluctuations in exchange rate cause disequilibrium in the economy . In order to create confidence and stability in the economic life of the country , the government officially fixes the exchange rate at a predetermined level. 5. To prevent the flight of capital abroad: if the capital of a country is moving abroad due to depreciation of currency at home, or in response to higher rate of interest in other countries , then the large scale movement of the capital can be checked by the introduction of exchange control.