Chapter 4 - Angelfire

advertisement

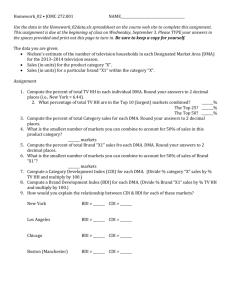

Ch. 5: Gathering Information and Measuring Market Demand Marketing Management Warin Chotekorakul Ch.5 Gathering information and measuring marketing demand Outline: Marketing Information System Marketing Research Marketing Decision Support System Forecasting and Demand Measurement Marketing Information System (MIS) Usefulness of MIS: Examples The Coca-Cola Company knows that we put 3.2 ice cubes in a glass, see 69 of its commercials every year, and prefer cans to pop out of vending machines at a temperature of 35 degrees. Hoover learned that we spend about 35 mins each week vacuuming, sucking up about 8 pounds of dust each year and using 6 bags to do so. Marketing Information System (MIS) --2 Consists of people, equipment, and procedures to gather, sort, analyze, evaluate and distribute needed, timely and accurate information to marketing decision makers. MIS is developed from internal company records, marketing intelligence activities, marketing research, and marketing decision support system. Internal Records System Supplying results data, internal records system includes reports on orders, sales, prices, costs, inventory levels, receivables, payables. Marketing Intelligence System Supplying happenings data to the marketers, marketing intelligence system is a set of procedures and sources used by manager to obtain everyday information about developments in the marketing environment. Marketing Intelligence System (2) How to collect marketing intelligence: Reading books, newspapers, and trade publications Talking to customers, suppliers, and distributors Meeting with other company managers Marketing Research system is the systematic design, collection, analysis and reporting of data and findings relevant to a specific marketing situation facing the company. Suppliers of Marketing Research Set up research department Engage students or professor to carry out project Using the Internet Checking out rivals: visiting competitors Buying information from: 1. Syndicated-service research firm 2. Custom marketing research firms 3. Specialty-line marketing research firms The Marketing Research Process Step 1: Step 2: Step 3: Step 4: Step 5: Step 6: Define the problem Develop the research plan Collect the information Analyze the information Present the findings Make the decision Step 1 : Define the problem Exploratory: to gather preliminary data to shed light on the real nature of the problem and possibly suggest some hypotheses or new ideas. Descriptive: to describe certain magnitudes Causal: to test a cause-effect relationship Step 2: Develop the research plan Data sources Research approaches Research instruments Sampling plan Contact methods Data sources Primary data Secondary data 1. Internal sources 2. Government publications 3. Periodical and books 4. Commercial data Research approaches Observation research Focus-group research: b4 designing large-scale survey Survey research Behavioral data Experimental research Research Instruments Questionnaires 1. Closed-end questions --- dichotomous, multiple choice, Likert scale, semantic differential, importance, rating scale, intention-tobuy scale 2. Open-end questions --- completely unstructured, word association, sentence completion, story completion, picture, thematic apperception test (TAT) Mechanical instruments:Lie-detecting tools, eye camera, audiometer,etc. Research Instruments (2) Psychological tools: to probe a buyer’s deeper beliefs and feelings using psychological tool e.g., laddering techniques, depth interviews. Qualitative measures: e.g., sending handheld videocameras into consumers’ homes Sampling plan Sampling unit: Who is to be surveyed? Individual, or Industrial Org, or Household ??? Sample size: How many people? Sampling procedure: How should the respondents be chosen? 1. Probability sampling --- Simple random, Stratified random, and Cluster samples 2. Non-probability sampling ---Convenience, Judgment, and Quota samples Contact method Mail questionnaire Telephone interview Personal interview: arranged interviews, and intercept interviews On-line interviewing Step 3: Collect the information This stage is most expensive and most prone to error. Beware of 4 problems: 1. Not-at-home 2. Refusal to co-operate 3. Biased or dishonest answers of interviewee. 4. Biased or dishonest interviewer. Step 4: Analyze the information Extract findings from collected data. Tabulate the data and develop frequency distribution. Step 5: Present the findings Data presented to relevant parties. Findings must be presented in a way which is relevant to the major marketing decision Step 6: Make the decision Marketing Decision Support System (MDSS) A coordinated collection of data, systems, tools, and techniques with supporting software and hardware by which an organization gathers and interprets relevant information from business and environment and turns it into a basis for marketing action. An Overview of Forecasting and Demand Measurement 90 different types of demand estimates 1. Product level (all sales, industry sales, company sales, product line sales, product form sales, product item sales) 2. Space level (customer, territory, region, country, world) 3. Time level (short run, medium run, long run) Why study those three levels? They help you make your sales (demand) estimates. For example, NOKIA may want to forecast the sales level of NOKIA 7650 (Product level) worldwide (Space level) in 2 years ahead (Time level). Definitions (Which market to measure?) Market is the set of all actual and potential buyers of a market offer. Potential market is the set of consumers who profess a sufficient level of interest in a market offer( and may have enough income). Available market is the set of consumers who have interest, income and access to a particular offer. (continued) Definitions 2 (Which market to measure?) Qualified available market is the set of consumers who have interest, income, access and qualifications for the particular market offer. Target market (served market) is the part of the qualified available market the company decides to pursue. Penetrated market is the set of consumers who have already bought the company’s product. (continued) Definitions (Vocabs for DD measurement) Market demand is the total volume that would be bought by a defined customer group in a defined geographical area in a defined time period in a defined marketing environment under a defined marketing program. Market DD is not a fixed number but rather a function of the stated conditions. (continued) Market Demand Functions Mkt DD Mkt DD Mkt Poten (Pros) Mkt Poten Prosperity Mkt Poten Mkt Fore Planned Mkt Min (Rec) Recession Expenditures Industry Mkting Expenditures Industry Mkting Expenditures Questions Why does market potential curve become straight? What does it mean by the market minimum? Market Demand Functions (2) Market potential is the limit approached by market demand as industry marketing expenditures approach infinity, for a given environment. Base sales is the market minimum. Market sensitivity of DD is the distance between the market minimum and the market potential. Vocabs 2 Expansible market: affected much by the level of mkting expenditures Non-expansible market: not affected much by the level of mkting expenditures Primary demand --- demand for product class Selective demand --- demand for particular brand Company demand --- company’s estimated share of market demand at alternative levels of company marketing effort in a given time period. Vocabs 3 Company demand --- company’s estimated share of market demand at alternative levels of company marketing effort in a given time period. QA = sAQ QA = company A’s demand sA = company A’s market share Q = total market demand Vocabs 4 Company sales forecast --- expected level of company sales based on a chosen marketing plan and an assumed marketing environment. Sales quota --- is the sales goal set for a product line, company division, or sales representative. Sales budget --- conservative estimate of the expected volume of sales. Vocabs 5 Company sales potential --- sales limit approached by company demand. Total market potential --- maximum amount of sales available to all firms in an industry. Q = nqp Question When does the market potential equal to a company potential? Current Demand Estimation Methods Chain-ratio method Market-buildup method Multiple-factor index method Brand development index (BDI) 1. Chain Ratio Method Starting from the entire population (macro point of view) in a study area and multiply by ratios that discard non-using segment. Example of Chain Ratio Method Suppose we are estimating the demand for organically grown vegetables in Bangkok, assuming the price of organic vegetables is 30% higher than ordinary vegetables. Thus, the target group must have income a little higher than the average. Demand for organically Grown vegetables in Bangkok = Number of Population in Bangkok x Percentage population in Bangkok with income more than B15,000 per month x Personal discretionary income per capita x Avg percentage of discretionary income spent on food x Avg Percentage of food budget spent on vegetables x Avg Percentage of the amount spent on organic vegetables 2. Market Build-Up Method Identifying all the potential buyers in each market and estimating their potential purchases. Starting from the particular area to the entire market. Example of Market Build-Up Method Suppose you are selling metal-sheet punching and cutting machine, there are 2 markets which you can sell to: 1. Electrical switchboard manufacturing sector 2. Metal furniture Sector Each electrical switchboard manufacturing factory which has sales volume of less than 50 million baht per year would need one machine but that which has sales volume more than 50 million baht per year would need 2 machines. For metal furniture sector. The metal-furniture factory which has sales volume of less than 50 million baht per year would need 3 machines and those with more than 50 million of sales per year would need 5 machine. Find the total market potential. Sector Annual sales in million No. of Firms Potential Number of Machine Sold per 1 Customer Market Potential Switchboard < 50 >50 <50 >50 3 6 6 12 1 2 3 5 3 12 18 60 93 Furniture Total 3. Multiple-Factor Index Buying power Index is the function of: W1 * market’s percent of segment’s effective buying income + W2 * market’s percent of segment’s retail sales + W3 *percent of Thai population in the segment Method of finding buying power index by using multiple factors An area is selected to find the buying power. 3 factors are involved: Number of population Disposable personal income Amount of retail sales Each factors will be assigned a weight. Multiply the weight of each factor with the percentage of the factors in the whole country. Example of Multiple-Index Method Province %of Population (0.20) %of Retail Spending (0.35) %of Disposable Income (0.45) A B 0.08 0.02 0.04 0.05 0.02 0.03 What is the buying power index of provinces A and B ? BPI of A = (0.2x0.08)+(0.35x0.04)+(0.45x0.02) BPI of B = (0.2x0.02)+(0.35x0.05)+(0.45x0.03) =0.039 or 3.9% =0.035 or 3.5% If the expected market potential in Thailand is 250 million baht, based on the BPI, what Will be the potential sales in provinces A and B ? Potential sales in Province A is = 0.039x250million = 9.75 million baht Potential sales in Province B is = 0.035x 250million = 8.75 million baht 4. BDI Category development index (primary demand gap) = percentage of a product category sales(shampoo) in a market to the percentage of the population in the same market.. Brand development index (selective demand gap) = percentage of a particular branded product (Sunsilk) sales in a market to the percentage of the population in the same market. Formulae for CDI and BDI CDI CDI = Category development index (used to measure the potential of product category) = %of product category total Thailand’s sales in that market x 100 % of total Thailand’s population in that market BDI BDI = Brand development index (used to measure the potential of a particular brand) = %of Brand Total Thailand’s sales in that market x 100 % of total Thailand’s population in that market Example of BDI and CDI Look at the BDI in Chiangmai. The number of Thailand’s population is 60 million and the population of Chiangmai is assumed to be 6 million. Suppose there are 3 brands of shampoo in Thailand's market: 1. Sunsilk 2. Pantene 3. Clairol The sales of Sunsilk in Thailand is 600 million baht, out of which 30 million baht comes from sales in Chiangmai. The sales of Pantene in Thailand is 400 million baht out of whch 20 million baht comes from sales in Chiangmai. The sales of Clairol in Thailand is 200 million baht out of which 50 million baht comes from sales in Chiangmai. What is CDI in Chiangmai? CDI = %of product category total Thailand’s sales in that market % of total Thailand’s population in that market = (30+20+50) / (600+400+200) (6/ 60) = 0.833 or 83.33% What is BDI of Sunsilk in Chiangmai ? BDI = %of brand total Thailand’s sales in that market %of total Thailand’s population in that market = (30/ 600) (6/ 60) = 0. 5 or 50% Other Points Regarding BDI Taking the percent of segment’s particular branded sales divided by the total percent of segment’s category sales *100 If the result (BDI) is less than 100,the brand is underdeveloped in the particular area. If the result (BDI) is more than 100, the brand is more developed than the category. Estimating future demand Survey of buyer’s intentions Composite of sales force opinions Expert opinion Past-sales analysis Market-test method