Malaysia

advertisement

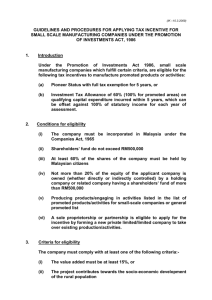

DOING BUSINESS IN MALAYSIA www.mida.gov.my 1 MALAYSIA Global Ranking www.mida.gov.my 2 Top 3 growth centres in emerging markets Deutsche Bank Research 2005 Top 10 countries as a choice for business location TNS Global Reputation Survey 2005 Top 3 countries for Offshore Location Centres A.T.Kearney – Annual Global Services Location Index, 2005 Top 5 countries for energy, finance and logistics in global shared services and outsourcing (SSO) Frost & Sullivan - SSO Hub Potential Analysis 2005 23rd most competitive economy in the world IMD World Competitiveness Yearbook, 2006 Kuala Lumpur is the cheapest city in the world to live in UBS Bank of Switzerland, 2006 3 MALAYSIA Images of Malaysia www.mida.gov.my 4 The Location In the Heart of South East Asia www.mida.gov.my 5 The City www.mida.gov.my 6 www.mida.gov.my 7 The City www.mida.gov.my 8 www.mida.gov.my 9 The People Malaysia truly Asia www.mida.gov.my 10 MALAYSIA Malaysian Economy GDP Growth 5.8% (2007 est.6%) Per Capita Income Euro 3,652 Population 26.1 million Work Force 10.1 million Unemployment 4% Inflation 3.7% Trade Surplus Euro 19.9 billion Int.Reserve Euro 56.8 billion www.mida.gov.my 11 MALAYSIA Strength of the Manufacturing Sector www.mida.gov.my 12 Multinational corporations from more than 50 countries have invested in over 5,000 projects in Malaysia's manufacturing sector. 13 Foreign Direct Investment In Approved Manufacturing Projects (Euro Billion) (Euro Bil.) 6 5 4 3.9 3.8 3.3 2.5 3 4.3 2.8 2 1 0 2001 2002 2003 2004 2005 2006 14 Sources of FDI (Top 10 Countries), 2001-2006 COUNTRY INVESTMENTS (EURO MILLION) USA 3,499.6 JAPAN 2,802.3 GERMANY 2,772.2 SINGAPORE 2,039.5 UNITED KINGDOM 955.5 NETHERLANDS 930.8 UNITED ARAB EMIRATES 849.3 KOREA 808.4 TAIWAN 671.2 AUSTRALIA 665.0 15 MALAYSIA Investment Opportunities www.mida.gov.my 16 Targeted Sectors (Manufacturing) High technology, capital intensive and knowledge driven industries: • Biotechnology • Advanced electronics • Optics and photonics • Wireless technology • Display technology (TFT, LCD, Plasma & parts) • Petrochemical • Pharmaceutical • Medical devices • ICT 17 Industries manufacturing intermediate goods • Machinery and equipment • Components and parts • Moulds and dies Resourced-based industries • Food ( Halal Hub ) • Value-added products from oil palm biomass (particle board, MDF board, animal feed) 18 Targeted Sectors (Services) • • • • • • • • Operational Headquarters (OHQ) International Procurement Centre (IPC) Regional Distribution Centre (RDC) Regional Office (RO) Representative Office (RE) Integrated Logistic Services (ILS) Integrated Market Support Services (IMSS) Integrated Central Utility Facilities (CUF) 19 MALAYSIA Investment Incentives www.mida.gov.my 20 Services Sector Foreign companies could consider the establishment of the following: • • • • • Representative Office Regional Office Operational Headquarters (OHQ) Regional Distribution Centre (RDC) International Procurement Centre (IPC) 21 Incentives Granted for OHQ, IPC & RDC Full income tax exemption for 10 years 22 Manufacturing Sector Foreign companies could consider the establishment of manufacturing operations in the promoted areas of: • High Technology projects • Strategic Projects 23 Incentives Granted • Pioneer Status (PS) with income tax exemption up to 100% for 5 to 10 years; or • Investment Tax Allowance (ITA) up to 100% for 5 years. Allowance can be offset against 100% of statutory income. • Customised Incentives - granted on request of the company and the merits of each case • Reinvestment Allowance of 60% for a period of 15 years (For reinvestment). • Duty exemption on raw materials and machinery and equipment 24 MALAYSIA Liberal Investment Policies www.mida.gov.my 25 Equity Ownership • Foreigners are allowed to hold 100% equity ownership. 26 Employment of Expatriates • Foreign companies are allowed to bring in expatriate personnel to hold - key posts (posts that are permanently filled by foreigners) - term posts (posts that are filled by foreigners for a period of 1-5 years) 27 Approval Process • Fast Track approval • Pre-Packaged Committee • Cabinet Committee on High Impact Projects (Chaired by the Hon. Deputy Prime Minister) 28 Implementation of Projects • Project Implementation Coordination Unit (PICU) in MIDA will monitor and render assistance to expedite the implementation of approved manufacturing and services projects. • Special project officers are appointed to ‘hand-hold’ and assist investors in obtaining all necessary approvals until projects are operational. 29 MALAYSIA Why Malaysia? www.mida.gov.my 30 • • • • • • • • • • • • Political and Economic Stability Strong Government support including liberal investment policies and attractive incentives (Tax and Non Tax) Liberal Investment Policies Transparent Policies Security of Intellectual Property Well Developed Infrastructure Multi Racial (Malays, Chinese and Indians) Trainable, Educated and English Speaking Workforce Harmonious Industrial Relations Quality of Life Good Track Record Member of ASEAN 31 When you want to do business in Asia Do it in Malaysia Your Profit Centre in Asia www.mida.gov.my 32 Appendix MALAYSIA What Foreign Investors Says www.mida.gov.my 33 FLEXTRONICS * PHILIPS * SHELL * UNILEVER * BASF * IKEA * NESTLE * AGILENT TECHNOLOGIES * BP AMOCO HITACHI * ELEKTRISOLA * MOTOROLA * SAMSUNG KOMAG * ERICSSON * SONY * MATSUHITA * INFENION BMW * DAIMLERCHRYSLER * MIECO * PHILLIPS ROBERT BOSCH * IDEMITSU * SHARP * TORAY …….. 34 SCHENKER Reiner Allgeier, Managing Director, Schenker Logistics (Malaysia) Sdn Bhd. “We believe that a strong global network is a very important competitive advantage in the logistics industry and Malaysia is a key market in the Asian Region, Malaysia's continuous growth and the transition of the Malaysian economy into an export-driven economy, spurred on by high technology, knowledge-based and capitalintensive industries proved our decision to be right." 35 BMW Wolfgang Schlimme Managing Director BMW Group Malaysia “Since entering Malaysia, BMW has developed a strong platform, complemented by the professional support and commitment shown by our partners here in Malaysia. With a strong and stable political climate, some of the best infrastructure in the region and a large talent pool, Malaysia serves as a firm base for the BMW Group's growth plans in Asia. The establishment of the Regional Parts Distribution Centre in Port of Tanjung Pelepas, Johor Darul Takzim in August 2004 represents the introduction of a key regional role for BMW Group Malaysia. The Regional Parts Distribution Centre supports the BMW Group by the speedy distribution of parts and accessories throughout the Asia-Pacific markets, providing premium customer service. “ 36 SONY Koichi Nakamura The Malaysian Representative of the Sony Group of Companies in Malaysia. “ Malaysia is an excellent place for do business. The Malaysia government has shown exemplary support through excellent infrastructure development and a good education system that allows us to employ a high quality workforce. There is in existence a large pool of component suppliers in Malaysia, thus we have transferred from Singapore and established an International Procurement Office here for sourcing parts to other Sony companies worldwide. Malaysia's political and economical stability has been and will continue to provide and ideal investment climate for us to prosper. The establishment of business-friendly laws and policies has helped us to remain at the competitive edge of the local and global market.” 37 DAIMLERCHRYSLER “DaimlerChrysler Malaysia’s 250 employees with their unique skills and creativity provide the high-quality workmanship expected by our customers. With a welldeveloped infrastructure and an educated and productive workforce in place, the company is set to take the Mercedes-Benz brand and heritage to newer heights. Frank Steinler President & CEO DaimlerChrysler Malaysia Sdn. Bhd. Malaysia offers numerous advantages to investors. The Malaysian government is committed to improving the investment environment in the country especially its continuous support and efforts in developing the country as one of the automotive hubs in the ASEAN region. We have made the right decision to invest in Malaysia and we look forward to further expanding our investments to complement the growth of Malaysia’s automotive industry.” 38 ERICSSON Mats H. Olsson President & Country Manager Ericsson Companies in Malaysia “The governmental policies that are put in place encourage growth and promote investments in a stable political climate. Malaysia has a welldeveloped infrastructure and strong industrial linkages with supporting industries, thus providing an excellent business environment. In addition, the workforce is educated and productive. All these make Malaysia an ideal choice for investments.” 39