Mortgage Holder's Interest Insurance

advertisement

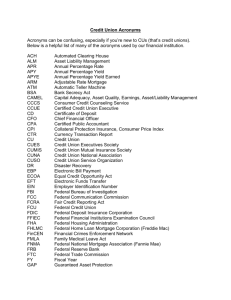

Financial Institutions Overview Trends, Updates, Exposures and Solutions Presented by: Andrew Knight DFI Marketing Manager / FPC Practice Leader Agenda • Section I: • Section II: Sector Overview Key Focus Areas • Asset Management (NI 31-103 Registration) – AMP (Asset Management Protector) – Financial Institution Bonds • Private Equity – VCAP Gateway • Mortgage Lending – Mortgage Protection Insurance • Section III: Why Chubb? • Section I: Sector Overview What is a Financial Institution? • An institution that is in the business of dealing or transacting thirdparty money. • Third-party money can be defined as cash, stock, bonds, promissory notes, loans or many other types of negotiable or non-negotiable securities. • Depository Institutions: banks and credit unions which pay interest on customer deposits and generate capital which can then be loaned or invested to earn a rate of return from other third parties. • Non-Depository Institutions: those firms which sell financial products or earn a rate of return without taking deposits. Examples are insurance companies, brokerage firms or mutual fund companies. • Many financial institutions provide both depository and nondepository services. What is a Financial Institution? 1. Depository Institutions » Banks, Finance Companies, Credit Unions, Trust Companies, Mortgage Companies, Leasing Companies 2. Financial Management Firms » Investment Advisors, Stockbrokers, REITs, Mutual Funds, Wealth Managers, Venture Capital Firms, Investment Bankers 3. Insurance Providers » Insurance Companies, Reinsurance Companies 4. Service Organizations » Exchanges, Financial Intermediaries, Funds Transfer Organizations, SRO’s The Regulators • Investment Industry Regulatory Organization of Canada (IIROC) • Mutual Fund Dealers Association of Canada (MFDA) • Office of the Superintendent of Financial Institutions (OSFI) • Canadian Securities Administrators (CSA) • Financial Services Commissions of Ontario (FSCO) • Securities and Exchange Commission (SEC) • Provincial Regulators Products •Directors & Officers Liability •AMP (Asset Management Protector) •Fiduciary Liability •Mortgage Protection •CANCAP (E&O) •General Liability •Employment Practices Liability •Umbrella •Financial Institutions Bonds (A, B, C) •Property •Electronic Computer Crime •Group Personal Excess •CyberSecurity •Bankers’ Professional Liability •Kidnap & Ransom •BrokerEdge •Mail & Transit •Automobile Liability •VCAP Gateway •Multinational Capabilities • Section II: Key Focus Areas Asset Management • Directors & Officers are vulnerable – Rapidly evolving regulatory environment- increased scrutiny • Bill 198, Bill C-45 • National Instrument 81-107- Independent Review Committee • National Instrument 31-103- New Registration Regime • • • • • • Volatility of Returns Merger & Acquisition Activity Cases of Fraud, Ponzi Schemes, etc Conflicts of Interest Breach of Investment Guidelines Failure to perform due diligence in selection and oversight of sub-advisors or outside funds • Prospectus liability claims against mutual fund directors, advisors, service providers Asset Management Protector (AMP) • Launched in 2009 • Designed for the asset management industry • Customizable to asset managers who want to structure their insurance coverage • Able to address numerous combinations of asset management structures and their foreign equivalents – – – – – – Directors & Officers Liability (Public or Private) Professional Liability Investment Company Private Fund Employment Practices Liability Fiduciary Liability Asset Management Protector (AMP) • Who Is It For? – – – – – – – Investment advisers and consultants Wealth management firms Mutual funds, exchange traded funds, and closed-end funds Hedge Funds Funds of Funds Real Estate Investment Trusts (REITs) Private Real Estate Funds Asset Management Protector (AMP) • Important Considerations: – – – – – – Understanding the Organizational Chart and who is an Insured What is the definition of Claim? Definition of Investment Adviser Services Investment Company vs Private Fund Coverage Independent Directors- additional protection Independent Review Committee (IRC) • Solutions – – – – Broad base policy wording terms and conditions AMPlifier Endorsements Real Estate AMPlifier Endorsements Cost of Corrections Asset Management Loss Scenarios Example 1: Failure to follow investment guidelines Example 2: Inadequate disclosure of risks Example 3: Formal regulatory investigation of possible trading violations Example 4: Failure to adhere to contract provisions Bill C-45 (Amendment to the Criminal Code) Bill C-45 (Section 217.1 in the Criminal Code): • Created rules for establishing criminal liability to organizations for the acts of their representatives. • Establishes a legal duty for all persons "directing the work of others" to take reasonable steps to ensure the safety of workers and the public. • Sets out the factors that courts must consider when sentencing an organization. • Provides optional conditions of probation that a court may impose on an organization. Financial Institutions Bonds 101 • SAA Forms vs Chubb Forms – Bond 14 vs Bond B • National Instrument 31-103 (NI 31-103) – Bond 24 vs Bond A – Bond 25 vs Bond C National Instrument 31-103 • What does this mean? • Definition of ‘Custody’ • Sections applicable to Insurance: – – – – – Section 4.21 Dealer (page 14) Section 4.22 Adviser (page 14) Section 4.23 Investment Fund Manager – IFM (page 15) Section 4.24 Global Financial Institution Bonds (page 15) Section 4.25 Notice of Change, Claim, or Cancellation (page 15) – Appendix A Bonding and Insurance Clauses (page 54) National Instrument 31-103 • Section 4.21 Dealers: • Applies to Investment Dealers, Mutual Fund Dealers, Scholarship Plan Dealers, Exempt Market Dealers, & Restricted Dealers • Must maintain a Bond with a single-loss limit in the highest of the following: – $50K per employee, agent, or dealing representative or $200K, whichever is less – 1% of the total client assets that the Dealer handles, holds, or has access to or $25M, whichever is less – 1% of the Dealer’s total assets or $25M, whichever is less – An amount as determined by the Dealer’s BOD National Instrument 31-103 • Section 4.21 Advisers: • Applies to Portfolio Managers (the old IC/PM category) • Must maintain a Bond with a single-loss limit in the highest of the following: – 1% of AUM that the Adviser handles, holds, or has access to or $25M, whichever is less – 1% of the Adviser’s total assets or $25M, whichever is less – $200K – An amount as determined by the Adviser’s BOD National Instrument 31-103 • Section 4.21 Investment Fund Managers: • This is meant to refer to the Fund Manufacturer/Sponsor & not the IC/PM firm/Adviser • Must maintain a Bond with a single-loss limit in the highest of the following: – – – – 1% of AUM or $25M, whichever is less 1% of the IFM’s total assets or $25M, whichever is less $200,000 An amount as determined by the IFM’s BOD National Instrument 31-103 The key take-away is how you define “handle, hold, or have access to”, as that is the trigger point for the higher insurance requirements. In the absence of this trigger, the required limit can be as low as $50K (unchanged). National Instrument 31-103 • NI 31-103 Companion Policy (CP) has the following to say about “Custody”: – – – – – – – – Hold client securities or cash for any period of time Accept funds from clients, for example, a cheque made payable to the Registrant Have the ability to gain access to client assets Have, in any capacity, legal ownership of, or access to, client funds or securities Have the authority, such as under a POA, to withdraw funds or securities from client accounts Have authority to debit client accounts to pay bills, other than investment management fees Act as Trustee for clients Act as Fund Manager or GP for investment funds Venture Capital & Private Equity • What is Private Equity? – Private pooled investment fund, managed by a firm, to invest in equity of private companies (portfolio companies), to generate increased value out of these portfolio companies, and exit them for a profit – Fund is typically created as a limited partnership, and the private equity firm serves as a general partners. Most of the capital is contributed by outside institutional investors who become the limited partners of the fund – Value creation is generated in the portfolio companies typically though either expansion, new produce development or restructuring of the company’s operations, management or ownership – Typical exit strategies for portfolio companies are: IPO; strategic sale or merger; failure- bankruptcy or closure of portfolio company Types of Private Equity • Venture Capital – Acquire minority interest in seed/early stage companies, little or no revenues – Equity investments only, rarely use leverage – Typically take one board seat – Make small investments in many companies – Exit typically 3-5 years • Buyout and Leveraged Buyout – Acquire and take a majority interest in mature, middle-market companies with operating cash flows – Buyout vs LBO – Typically take multiple seats on the board of the portfolio company – Make large investments in few companies – Exit typically 2-3 years Venture Capital & Private Equity • Claims Trends – Mostly arise from portfolio company related transactions • Bankruptcies/Insolvencies • M&A Activities • IPOs – Claimants are typically interested third parties of portfolio companies • • • • Shareholders Employees/Management Creditors Business partners – Typical Allegations • • • • Breach of fiduciary duties Fraud Breach of Contract Misrepresentation VCAP Gateway Chubb’s new Venture Capital Asset Protection (VCAP) Gateway Policy is designed to respond to the evolving needs of venture capital and private equity firms • State-of-the-art policy that: – Incorporates broadest coverages available – Streamlines coverage for the entire private equity model • Provides coverage for: – Everything that a Private Equity firm is; – Everything that a Private Equity firm does; and – Everyone that does those things VCAP Gateway Insuring Clause 1- Management Liability Coverage Insuring Clause 2- Management Indemnification Coverage Insuring Clause 3- Professional Liability Coverage Insuring Clause 4- Outside Directorship Liability Coverage Insuring Clause 5- Organization Liability Coverage VCAP Gateway The Firm’s People • Insured Person includes: – – – – – – Advisory Board members; More industry specific terms ie venture partner, EIR; In-house counsel; Shareholder Representative; The foreign equivalent; and Automatic coverage for any nature person (including independent contractors) who has a written indemnification agreement with an insured organization VCAP Gateway The Firm’s Activities • Private Equity Venture Investing includes: – The creation, management and dissolution of a Private Fund or Investment Holding Company by an Insured; – Any act by an Insured for Portfolio Company related to a loan; – Advisor/other activities by an Insured for an Organization or Portfolio Company; – An Insured’s sale or purchase of securities issued by a Portfolio Company; – Investment/portfolio management or asset allocation services for a Private Fund; – Selection/oversight by an Insured of outside service providers; – Activities by an Insured or others (for whom the Organization is legally liable) as a Shareholder Representative; – Acts by an Insured as Controlling Shareholder Mortgage Protection Insurance Who Buys It? Banks, Lenders, MICs, Why Buy It? • Primary purpose of coverage is to protect the mortgagee in the event that the collateral is damaged and there is no insurance to repair or replace the building • In event of a significant uninsured loss, the borrower may be unlikely to continue making mortgage payments • If the mortgage goes into default, the owner of the mortgage has the right to recover their outstanding mortgage balance • If there is damage to the property, the value of the collateral may not be adequate to pay off the mortgage balance Mortgage Protection Insurance Mortgage Holder’s Interest Insurance • Mortgage Impairment –borrower’s responsibility to place insurance • Mortgage Errors & Omissions –lender’s responsibility to place • Mortgage Holders’ Liability Insurance ie. Seller/Servicer Liability ie. Real Estate Tax Liability Foreclosed Property Insurance • Forced Placed Property Insurance Mortgage Protection Insurance Mortgage Impairment or E&O Lender believes hazard insurance is in force and that it protects their interest. But, it’s not or it doesn’t! Valuation is “Mortgage Holders’ Interest”. Forced Placed Lender knows that hazard insurance is not in force or it does not cover their interest. Valuation should be replacement cost. Foreclosure Lender has taken action and exercised their right to take title or take deed in lieu possession. Valuation should be replacement cost. Mortgage Protection Insurance Mortgage Protection Insurance Mortgage Impairment Valuation • The most we will pay for loss or damage in any one occurrence is the lesser of the following: – The amount of loss or damage (minus other insurance proceeds); – The amount of your mortgage holder’s interest; or – The applicable Limit of Insurance shown in the Declarations – NOTE: This goes for Mortgage Holder’s Interest Insurance and Mortgagee Errors and Omissions Insurance Mortgage Protection Insurance Forced Placed/Foreclosed Valuation • Subject to the Limit of Insurance for Foreclosed Property shown in the Declarations, Foreclosed Property is valued at the lesser of: a. the full cost to repair the Foreclosed Property at the time of the loss or damage, at the same location and for the same use or occupancy, without deduction for physical deterioration or depreciation; or b. your Foreclosed Property Financial Interest (as defined- which also takes into account an adjustment to appraised market value). • Subject to the Limit of Insurance for Forced Placed Property shown in the Declarations, Foreclosed Property is valued at the lesser of: a. replacement cost; or b. the unpaid principal balance on the mortgage or loan Mortgage Protection Insurance • Fire damage to vacant residence • Homeowner Vandalism- mortgagor is in process of defaulting/vacating residence and decides to damage the property first ie arson, taps are left running or damage to walls, cabinets, bathrooms, etc • Resultant mould subsequent to water damage that was not attended to • Lack of Winterization – water damage and subsequent freezing due to expansion and bursting of frozen pipes due to absence of heating in winter months • Trespassers- Vandalism- attractive nuisance • Vagrants living in and vandalizing vacant homes • Grow Operations *Note the above are examples of typical loss scenarios and coverage may not necessarily apply in some cases Section III: Why Chubb? Why Chubb? • • • • Dedicated Financial Institutions Underwriters Financial Strength- A++ AM Best Rating Best-in-class Product Offerings Local and Global Claims expertise and reputation • Market Knowledge • 7th Consecutive year as #1 Crime/Fidelity Underwriter (SAA) and one of the largest writers of Financial Institutions locally and Globally Contacting Chubb aknight@chubb.com 416-359-3222 ext. 4507 Product Information and Applications: www.chubbinsurance.com Legal Disclaimer • Chubb refers to the insurers of the Chubb Group of insurance Companies. This literature is for informational purposes only. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss and the actual coverage of the policies as issued. • Claims examples are based on actual cases, composites of actual cases, or hypothetical situations. • The information provided herein should not be relied upon as legal advice or a definitive statement of the law in any jurisdiction. For such advice, an applicant, insured, listener or reader should consult their own independent legal counsel. No liability is assumed by reason of the information contained herein.