Mukhtar (2)

advertisement

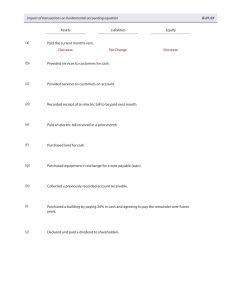

KHATTAK SUBJECT: FINANCIAL ACCOUNTING Definition of Accounting PREPARED BY: MUKHTAR Accounting is the language of business. TERMS • When we study any subject some words are used with their specific meanings, these words are called terms. ACCOUNTING TERMS • When we study accounting subject some words are used with their specific meanings,these words are called Accounting terms. • e.g. Assets, Equity, Liability, Revenue etc (1)BUSINESS • All those economic and legal activities which are operated for earning profit are called business TYPES OF BUSINESS • (1).Trading or Merchandising business: Trading or Merchandizing business are those business in which we buy finished products and resell them to the individual and other business organization. e.g. shoes shop etc. TYPES OF BUSINESS • (2). Manufacturing business: Manufacturing business are those business in which we buy raw-material, transform into finished products by the use of labor and machinery and then sell to the individual and other business organization. e.g. Bata Shoes Company. TYPES OF BUSINESS • (3). Services business: Services business operate to provide in needed services for fees. • e.g. Doctors, Lawyers etc. (2). TRANSACTION • Buying and selling between two persons are called transaction. Kinds of Transaction: (a). Cash Transaction: When Cash is paid or received as a result of an exchange is known as cash transaction. (b). Credit transaction: When the payment or receipt of cash is postponed for a future date is known as credit transaction. (3). BOOK-KEEPING • It is concerned with the recording of business transactions in a systematic and prescribed manner. • The person engaged in this job is called a book-keeper or record-keeper. (4).MERCHANDISE(GOODS) • The things or items bought or sold in an enterprise in order to earn profit are called merchandise or goods. e.g. books, cloth etc. (5).DRAWINGS • Cash or goods taken away by the owner from business for personal use are called drawings. (6).PURCHASES • Goods purchased are called Purchases. TYPES OF PURCHASES • (1). Cash Purchases: Goods purchased on cash is called cash purchases. • (2). Credit Purchases: Goods purchased on credit is called credit purchases. (7). SALE • Goods sold are called sale. TYPES OF SALE • (a). Cash Sales: Goods sold on cash are called Cash sales. • (b). Credit Sales: Goods sold on credit are called credit sales. (8).PURCHASE RETURNS • When the merchandise purchased are found defective and poor in condition (quality ,weight ,size ,color ).They are sent back to the supplier. This is called Purchase Returns. (9).SALES RETURNS • When the merchandise sold to the customers are found defective and poor in condition(quality,weight,size,color), they are sent back to the business. This is called as Sales Returns. (10).PURCHASE ALLOWANCE • When the merchandise purchased are found defective and are not returned to the seller. The seller agrees to allow some reduction from the price charged.This reduction is called purchases allowance. (11).SALES ALLOWANCE • When the merchandise sold are found defective and not returned by the customers, but the business agree to allow some reduction from the price charged. This is called Sales Allowance. (12).DISCOUNT It is allowance from the price of goods sold or purchased. TYPES OF DISCOUNT • There are two types of discount. (1).Cash discount.(2).Trade discount. 1-Cash Discount: A discount which is allowed or received at the time of cash payment on credit sales or purchase is called cash discount. (a). Discount received. (b). Discount allowed. TYPES OF DISCOUNT • 2-Trade Discount: When Concession is given by seller to buyer on listed price of goods at the spot of sale is called trade discount. (13). EXPENSES Expenses are the cost of goods and services used up in the process of obtaining revenue. e.g. Salaries paid to employees, paid rent etc. (14).REVENUE • Income earned from the sale of goods and services are called revenue. e.g. Interest earned, Rental Income, Donation received, Commissioned earned etc. (15).DEBTOR(ACCOUNTS RECEIVABLE) A person who owes money to another is called a debtor. (16).CREDITOR(ACCOUNTS PAYABLE) A person who pays out something or to whom money is owing is called a creditor. (17).VOUCHER A written evidence in support of a transaction is called a voucher. (18).NOTES RECEIVABLES A note-receivable is a written promise in which the customer promises to pay the obligation plus interest charges to the business on or before a specified date. (19).NOTES PAYABLE Notes payable is a written promise to repay the amount owed by a business at particular date and usually calls for the payment of interest as well. (20).ASSETS The things and properties possessed by the business are called assets. e.g. Cash, Accounts receivables ,notes receivables, machinery, building, patents etc. GROUPS OF ASSETS • 1-Current Assets: Current assets are those assets which are either in cash or easily convertible into cash. e.g. Cash, Accounts Receivable, Notes Receivables etc. Groups of Assets 2-Non-Current Assets: These are the assets which are acquired with a view to hold them and earn income other than the business income. Such as Share of other companies, Govt.securities etc. Groups of Assets 3-Fixed Or plant Assets: These assets are acquired to retain and use in business operation. E.g. Land, Building, plant & Machinery, Furniture & Fixture, Motor vehicles etc. Groups of Assets 4-Intangible Assets: These are the assets which are not physically touchable, but still valuable for business operation. e.g. good will, patents,copy rights etc. (21).EQUITIES The claims of the owners or outsiders in the assets of the business are called equities. Categories: (1). Owner equity: The claims of the owner in the assets of the business are called owner equity. (2).Liabilities:The claim of the outsiders in the assets of the business are called liabilities. Types of liabilities • (a). Short Term/Current liabilities: The liabilities which are payable within one year are called as short term or current liabilities. e.g. Accounts payable, Notes payable, expenses payable, Bank overdraft etc • (b). Long Term Liabilities: The liabilities which are not payable within one year are called as long term liabilities. e.g. Long period bank loans, Debentures issued, mortgage loans etc. (22).COMMISSION Remuneration for services performed by one person to another normally on the percentage basis is called commission. (23).ACCOUNT A summarized record of all the business transactions is called an account. Elements of Accounts: (i). Title: The head of any account is called an Title. (ii). DEBIT: The left-hand side of any account is called Debit (Dr). An amount entered in the debit side of any account is called debit entry. (iii). CREDIT: The right-hand side of any account is called Credit (Cr). An amount entered in the credit side of any account is called credit entry. RULES OF DEBIT AND CREDIT Assets increase will be recorded on the Debit side. Assets decrease will be recorded on the Credit side. Expense increase will be recorded on the Debit side. Expense decrease will be recorded on the Credit side. Liabilities increase will be recorded on the Credit side. Liabilities decrease will be recorded on the Debit side. Owner Equity increase will be recorded on the Credit side Owner Equity decrease will be recorded on the Debit side Revenue increase will be recorded on the Credit side. Revenue decrease will be recorded on the Debit side. HOW TO FIND DEBIT AND CREDIT 1-Find out the two accounts. 2-Classification(Assets,O.E(Capital),Liabiliti es, Revenue and Expenses. 3-Increase&Decrease. 4-Apply Debit & Credit rules. Accounting Cycle or Accounting Circle The order of recording the business transactions in the various books of accounts is called Accounting cycle or Accounting circle. MAPS OF ACCOUNTING CYCLE Financial Statements (Income statement and Balance sheet) Trial Balance Transactions (Vouchers) Journals Original records Ledger classification JOURNAL “A book in which all the transactions of a business are recorded first is called Journal.” It is also known as a book of Original Record, a book of Original Entry. Journal Date Description L.F 2009 June Cash 10 10000 15 10000 10000 10000 01 Capital (O.E) Dr. Cr. “Owner started business” 03 Total Recording the Transactions in Journal (A). Assets Purchased for cash 1-Purchased Building for cash Afs.5000 2-Purchased Furniture for cash Afs.3000 3-Purrchased Machinery for cash Afs.2000 4-Purchased Motor Vehicle for cash Afs.2500 5-Purchased Equipments for cash Afs.2000 6-Purchased Patents for cash Afs.3000 7-Purchased Land for cash Afs.4000 Journal Date 2009 June Description 01 L.F Dr. Cr. 5000 Building 5000 Cash “Purchased Building for cash” 02 3000 Furniture Cash 3000 “Purchased furniture for cash” 03 Machinery 2000 Cash 04 2000 “Purchased Machinery for cash” Motor Vehicle Cash “Purchased Motor Vehicle for Cash” 2500 2500 ASSETS PURCHASED ON ACCOUNT 1-Purchased Building on account Afs.1000 2-Purchased Furniture on account Afs.500 3-Purchased Machinery on account Afs.600 4-Purchased Motor Vehicle on account Afs.1000 5-Purchased Equipments on account Afs.3000 6-Purchased Land on account Afs.5000 7-Purchased Furniture from Qureshi Furniture Afs.2000 Journal Date 2009 June Description 01 L.F Dr. Cr. 1000 Building 1000 A/P “Purchased building on account” 02 Furniture 500 A/P 500 “Purchased building on account” 03 Machinery 600 A/P 600 “Purchased Machinery on account” 04 Motor Vehicle 1000 1000 A/P “Purchased Motor Vehicle on account” 05 Equipments 3000 3000 A/P “Purchased equipments on account” 06 Land 5000