Estate Planning - Utah State University

advertisement

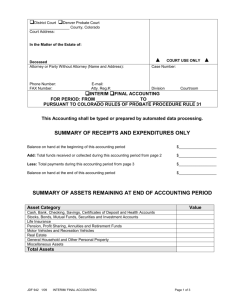

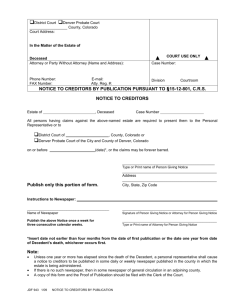

Financial Planning for Women November 2013 Presented by Dr. Jean M. Lown Estate Planning Disclaimer: Education, NOT legal advice! Taking care of business • Sign up for drawing for financial consultation – Drawing will be held at the evening session • Personal Finance Action Plan HO – Commit to taking action! • Estate Planning HO 2 Estate Planning • “ the process of accumulation, management, conservation, and transfer of wealth considering legal, tax, and personal objectives.” • Goal of estate planning is effective and efficient transfers. 3 Overview: How Your Estate is Distributed 4 Wills Property distribution & Guardianship Wills • Document in which a person tells how assets should be given away after death • Transfer the portion of your estate not covered by contract • To ensure property goes to desired heirs 6 Why Write a Will? • Absolutely necessary if you have children • Utah Legislature wrote a will for you • Without a will… Assets will go to spouse, parents, siblings… • Not to your roommate or favorite charity • Without a will, your property may not go to your desired heirs 7 Personal Representative • AKA Executor – Named in will – Carries out provisions of will – Manages assets until they are passed to heirs 8 Will Names Guardian(s) • Person responsible for caring for child(ren) – Name one person, not a couple • May name different person to handle child’s finances – Can change! – Not set in stone – Do it today! – Avoid family fight 9 Without a Will… • Estate transfers to various relatives according to state law – Property may not go to desired heirs • Judge decides on guardianship – May not be the person you would choose to raise your child(ren) 10 Do you need an attorney? • Not with a simple, uncomplicated estate 11 You may not need an attorney • Simple situation? – Attorney’s assistant will fill-in computer form – Buy computer program & fill in yourself • Nolo Press website: www.nolo.com • Complicated family situation? – Remarriage w/ kids from previous union? – Multiple ex-spouses? • Lots of assets? – Educate yourself & then contact attorney 12 Before it’s too late… Wesley Bedrosian 13 Personal Representative? • Who me? Yes, you! • The Executor’s Guide (Nolo Press) 14 Probate Process • Probate – court-supervised process – Ensures transfer of a decedent’s assets to beneficiaries • According to will or state law – Allows creditors to present claims against an estate • Non-Probate Assets – avoid probate process – P.R transfers assets directly to heirs 15 Why Avoid Probate? -time consuming - costly in some states up to 5% of estate 16 Transfer Your Estate (continued) • Will (goes through probate process) • Non-Probate Property – – does not go through probate – includes assets transferred to survivors by contract & beneficiary designation • Life insurance proceeds • Financial accounts (retirement accounts, POD acc’ts) • Joint ownership assets • Assets in Trusts 17 Transfer Your Estate by Naming Beneficiaries • Beneficiary: person or organization designated to receive a benefit • Beneficiary designation – legal form signed by asset owner – Specifies who gets property when owner dies • Primary Beneficiary – Secondary (Contingent) – in case the first-named beneficiary has died 18 Avoid Probate: Transfer Your Estate by Ownership • Joint Ownership (JTWROS) – Married couples – Joint owner automatically inherits the property – Most couples own house JTWROS • Community property – NOT Utah 19 Avoid Probate Summary • POD bank accounts – Fill out bank's form • Transfer on death – Vehicles; securities • Retirement accounts – name beneficiary • Joint ownership • Community Property • TOD real estate deed – Not UT; yes ID – Not UT, ID or WY • Small estates may avoid probate – w/ affidavit – Simplified probate 20 Questions ? 21 Use of Trusts to Transfer Assets Trust • Legal arrangement between – grantor (creator) of trust & trustee, person designated to control & manage trust assets 23 Why Establish A Trust? • • • • • • • Avoid probate (w/ living trust) Control distribution of assets Protect assets from creditors Provide privacy for heirs Avoid battle over will Provide for special needs person If you own property in > one state – Avoids having to probate in > 1 state • Reduce/avoid estate taxes 24 Trust Vocabulary • Grantor: person who establishes a trust – Also called: settler, donor, or trustor • Beneficiary: person for whose benefit a trust is created • Trustee: the person or corporation to whom the property is entrusted to manage for the use & benefit of beneficiaries • Corpus: assets in trust - Also called: trust estate or fund 26 A trust is an empty cookie jar • Grantor MUST legally transfer assets into the trust! – Trust is an empty legal document… until funded 27 Two Categories of Trusts • Living (inter vivos) Trust – takes effect while the grantor is still alive • Revocable (to avoid probate) • Irrevocable (transfer property to reduce taxes) • Testamentary Trust (in conjunction w/ will) – Takes effect upon grantor’s death – Do NOT avoid probate – Often to create a trust for minors • Property must be managed by adult 28 Irrevocable Living Trusts • Assets bypass probate • Grantor gives up 3 rights – to control property – to change beneficiaries – to change trustees 29 Revocable Living Trust • • • • Avoid probate Protect & manage assets Deal with incapacity/incompetence Grantor can change trust’s terms or cancel it while alive • Sets up a testamentary trust at death • Like a will; but more difficult to contest 30 Testamentary Trusts • Take effect at death of grantor • To manage $ after death – Income for spouse & children • Underage children ($ guardian) • Disabled adult children – Maintain eligibility for government benefits • Pass $$$ to adult children at older ages – To give assets to grandchildren while the income supports spouse & children 31 Living Trust vs. Will http://www.nolo.com/legal-encyclopedia/living-trust-v-will.html • • • • • Name beneficiaries Leave property to kids Avoid probate Privacy Requires property transfer • Protection from court challenges • Requires Notary • Name beneficiaries • Name guardians • Name manager for children’s property • Name executor (PR) • Instruct how to pay taxes & debts • Simple to make • Requires witnesses 32 Consult a Lawyer if… • Close relative—someone who would inherit might challenge your decisions • Children from previous marriage don't get along with your current spouse • You are in a relationship your closest relatives don't approve of. • You have a history of mental illness • You don't plan to leave much to your closest relatives, & they fear you are being unduly influenced by someone 33 Questions? 34 Letter of Last Instructions 35 Non-legal instrument with suggestions & recommendations for survivors Letter of Last Instructions Not a legal document Not a will or substitute for will Information that is needed immediately to help family decide & reduce stress to ensure wishes are carried out 36 Letter of Last Instructions Individuals to be notified of your death Contact info: name, address, phone, email Funeral, burial; cremation, memorial service wishes Location of will, trust Financial advisor & attorney contact info Insurance policies Safe deposit box location & #, key, contents list Location of personal papers (not in safe deposit box) Personal property distribution Father’s full name; mother’s maiden name for death certificate Obituary information 37 Letter of Last Instructions Where to keep it? Who to tell? Survivors must be able to locate quickly Tape to bedroom mirror? Copies to parents, siblings, etc. Start today http://extension.usu.edu/files/publications /factsheet/FL_FF-19.pdf 38 Organ Donation Wishes Each day 77 people get a life saving organ transplant 19 others die waiting for donated organ http://organdonor.gov/ Driver license designation NOT enough Utah Donor Registry http://www.yesutah.org/ http://www.yesutah.org/register Tell family & your doctor of your wishes US: opt-in; European countries: opt out 39 Pre-plan Your Farewell “Always go to other people’s funerals; otherwise they won’t come to yours.” Yogi Berra Preplanning a funeral/wake/memorial service/going away party/sky burial http://extension.usu.edu/files/publications/facts heet/FL_FF-09.pdf 40 41 Advance Directive Documents in case of incapacitation Advance Directive – Document names who will make financial, medical, other decisions… If mentally incompetent and/or unable to communicate your wishes Only 1 in 5 Americans has Advance Directive documents Ask your parents and grandparents 42 Advance Directive Documents Living Will Wishes for end of life care Keep alive at all costs vs. do not want to live in permanent vegetative state… & points in between Medical Power of Attorney Authorize person to make health care decisions on your behalf… if you are unable to make decisions 43 Prepare Advance Directive Documents (continued) Durable Power of Attorney Limited Power of Attorney – appoints a person to handle financial affairs if you cannot narrow in scope could be restricted to a certain time period or certain tasks Robert Kirby’s parents going on a church mission Springing Power of Attorney – takes effect if a specified event occurs, usually mental incapacitation 44 Advance Directive (Living Will) Purposes: to make your wishes known To relieve your loved ones of making difficult, painful decisions when they may not agree Utah Advance Health Care Directive New law & forms effective January 1, 2008 Repealed old law and forms! 45 UT Advance Directive for Health Care 1. Name person to make health care decisions for you when you cannot 2. Specify your health care wishes 3. Tells how to revoke or change directive 4. Makes your directive legal 5. Discuss with family & your doctor 46 Utah Advance Directive/Living Will http://aging.utah.edu/utah_coa/directives/index.html Simple form Can be edited & personalized Must be witnessed by one person who is not related heir or beneficiary financially responsible for declarant health care provider health care agent 47 48 Update Documents as needed: 5 Ds 1. Decade birthday 2. Diagnosis 3. Deterioration 4. Divorce 5. Death of someone close to you 49 50 Who will inherit your digital assets? • • • • Email, Facebook, & blog? Password protected financial accounts? Family photos in the cloud? License agreement for digital assets not transferable – Put digital assets in trust – List in will who can inherit (but no passwords) – Details in letter of last instruction 51 Summary • • • • • • • Talk with loved ones Make decisions for yourself & children Put your choices in writing Just do it! Single best resource: http://www.nolo.com Commit to a specific date (Thanksgiving?) Start: Letter of Last Instructions & Advance Health Care Directive 52 • Questions? Questions? FPW Blog: http://fpwusu.blogspot.com/ 53 2014 Upcoming FPW • No December program • Dr. Craig Israelsen: 7Twelve asset allocation • Teresa Hunsaker: Which house investments make sense? • Financial Planner Lon Jeffries • ACA- Health insurance in Utah 54