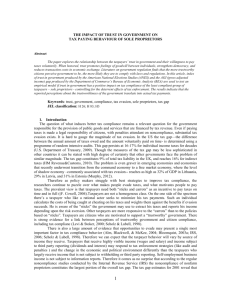

Presentation - International Conference on Taxpayer Rights

advertisement

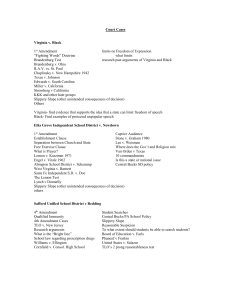

Slippery Slope Framework: The Impact of Power and Trust on Taxpayer Compliance Behavior The National Taxpayer Advocate of the U.S. Internal Revenue Service is convening the Inaugural International Conference on Taxpayer Rights in Washington, D.C Erich Kirchler University of Vienna, Austria 2015 1 Thanks Team (actual) • Barbara Hartl • Christoph Kogler • Eva Hofmann • Janina Enachescu • Jennifer Stark • Linda Dezsö • Jerome Olsen • Matthias Kasper • Sebastian Beer Team (past members) • Barbara Kastlunger • Stephan Muehlbacher • Boris Maciejovsky • Erik Hoelzl • Herbert Schwarzenberger • Katharina Gangl • Ingrid Wahl • Master and PhD students Guests • Anca Nichita • Larissa Batrancea • József Pántya International cooperation • Henk Elffers (baptized: Slippery Slope Framework) • James Alm • Jane Frecknall-Hughes • Veronika Grimm • Claus Lamm • Lucia Mannetti • Luigi Mittone • Aloys Prinz • Michael Wenzel • Paul Webley • Brian Erard • Valerie Braithwaite (Sabbatical) • Cooperation with colleagues in 44 countries • … 2 Overview Social representations & attitudes towards taxes Determinants of compliance and research paradigms Decisions under risk Understanding, services, norms and fairness Interaction climate Slippery Slope Framework Behavioral Insight 3 Taxes Fundamental activities of the state are, … collecting revenues to fund public activities, and … using taxes, charges and levies to influence and regulate markets as well as the behavior of citizens and organizations. … (Progressive) taxes are also an instrument to re-distribute excessive differences in wealth. Imposts can be used as an instrument to indirectly shape human behavior. Providing incentives and disincentives by decreasing or increasing costs enables the state to exert control over undesirable but legal behavior such as smoking, drinking alcohol, and eating unhealthy foods, or to discourage objectionable business activities (Freiberg, 2010, p. 122). 4 Oishi, S., Schimmack, U. & Diener, E.(2011). Progressive taxation and the subjective well-being of nations. Psychological Science, 23, 86-92. Fig. 1. Scatter plot (with best-fitting regression line) showing mean global-life-evaluation rating as a function of progressive taxation (calculated as the difference between the highest and lowest tax rate; N = 54 nations). Copyright © by Association for Psychological 5 Science Giving and Receiving Most citizens appreciate public goods and agree with policy regulations, but many perceive their own contributions too high relative to what they get back. 6 Average perceived public expenditures and desired expenditures for various public goods, and perceived subjective utility and desired utility of public goods (Kirchler, 1997; 1 = very low, 5 = very high) Public goods Perceived amount of Desired amount of public expenditures public expenditures M SD M SD Perceived individual Desired individual utility of utility of public goods public expenditures M SD M SD Education 2.99 1.10 4.16 0.77 2.62 1.31 3.54 1.36 Science and research 2.38 1.03 3.87 1.00 2.08 1.16 3.27 1.18 Pubic health 3.74 1.25 4.08 0.89 3.17 1.24 3.99 0.92 Economic development 3.21 1.07 2.89 0.99 2.11 1.13 2.75 1.20 Art and culture 3.37 1.12 2.67 0.94 2.47 1.25 3.10 1.18 Agriculture 2.85 1.04 3.23 0.99 2.12 1.12 2.61 1.32 Military defense 3.26 1.43 2.42 1.15 1.74 1.00 2.23 1.25 Social security 3.90 1.10 3.67 0.93 2.31 1.14 3.29 1.10 Public security 3.06 0.90 3.65 0.89 2.81 1.07 3.53 1.03 Construction of streets 3.46 1.27 3.13 0.96 3.17 1.14 3.33 1.04 Public transport 3.14 1.04 3.38 0.90 2.72 1.14 3.35 1.09 Housing construction 3.20 1.10 3.68 1.10 2.05 1.27 3.26 1.32 Total 3.21 0.38 3.43 0.41 2.45 0.65 3.19 0.63 7 Overview Social representations & attitudes towards taxes Determinants of compliance and research paradigms Decisions under risk Understanding, services, norms and fairness Interaction climate Slippery Slope Framework Behavioral Insight 8 Representations of taxes Fynantzer = Landbetrieger, derscrews die Leute Tax inspector = Impostor who umbs bescheisset peopleGeld for their money Basilius Faber, 1680 Thesaurus editionis scholasticae 9 Study in progress (Kirchler, E. et al., 2015): N = 64 white colar workers, self-employed, students Representations of taxes Evaluation Honest taxpayers Typical taxpayers Tax avoiders Tax evaders -1.5 Hard-working (vs. lazy) -1.5 Honest taxpayers -1 -0.5 -0.5 0 0.5 0.5 1 1.5 1.5 -1 -0.5 -0.5 0 0.5 0.5 1 1.5 -1 -0.5 -0.5 0 0.5 0.5 1 1.5 1.5 Typical taxpayers Tax avoiders Tax evaders Intelligent (vs. stupid) -1.5 -1.5 1.5 Honest taxpayers Typical taxpayers Tax avoiders Tax evaders -1.5 -1.5 10 Germans have a tense relationship with taxes; however, they feel it is important to adhere to tax law Tax mentality has deteriorated 4 factors • 85% feel high tax pressure • 2/3 claim, the temporal and financial burden to file taxes is too high • The tax system is unjust • 95% claim, the government spends tax money thriftlessly 11 Tax morale and shadow economy Bruno Frey & Benno Torgler Tax morale = intrinsic motivation to comply (Schmölders, 1950s: tax mentality as attitude towards taxation and taxes = tax morale = attitudes = social representations etc.) Tax morale and size of shadow economy (Alm & Torgler, 2005) (Tax morale can be defined as a moral obligation to pay taxes, a belief in contributing to society by paying taxes.” (Torgler & Schneider, 2007; retrieved 2015-11-05 from http://ftp.iza.org/dp2541.pdf) 30 Size of Shadow Economy (in % of the GDP) Social representations and attitudes drive behavior □ Italy 20 □ Belgium Norway □ Spain □ Portugal □ □ Sweden Finland□ Germany Netherlands □ □ Ireland □ □ Denmark France□ □Great Britain Austria □□ □USA Switzerland 10 0 0.0 0.5 1.0 1.5 2.0 2.5 3.0 Degree of Tax Morale 13 Overview Social representations & attitudes towards taxes Determinants of compliance and research paradigms Decisions under risk Understanding, services, norms and fairness Interaction climate Slippery Slope Framework Behavioral Insight 14 How to increase tax compliance ? Decision under risk Sure option Risky option Allingham & Sandmo (1972); Srinivasan (1973) 15 Becker, G. S. (1968). Crime and punishment: An economic approach. Journal of Political Economy, 76, 169-217. Enforcing tax compliance: Command and control Deterrence matters, but … Metaanalyses Andreoni, J., Erard, B., & Feinstein, J. S. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818-860. Kirchler, E., Muehlbacher, S., Kastlunger, B. & Wahl, I. (2010). Why pay taxes? A review of tax compliance decisions. In J. Alm, J. Martinez-Vazques & B. Torgler (eds.). Developing Alternative Frameworks for Explaining Tax Compliance (pp. 15-31). London: Routledge. The effect of deterrence measures is weak and sometimes oppostite to the intended effect… 16 Command and control … is a simple answer to a complex phenomenon For every complex problem there is an answer that is clear, simple, and wrong. Henry Louis Mencken (12 September 1880-29 January 1956), was a twentieth-century journalist, satirist, social critic, cynic, and freethinker, known as the "Sage of Baltimore" and the "American Nietzsche”. 17 Enforcing tax compliance Audits and fines are necessary, but there is more… What effect have fines ? What effect have repeated audits ? (fine = price; bomb-crater effect; echo effect etc.) 18 Overview Social representations & attitudes towards taxes Determinants of compliance and research paradigms Decisions under risk Understanding, services, norms and fairness Interaction climate Slippery Slope Framework Behavioral Insight 19 Growth in number of words in the IRS Code from 1955 to 2000; adopted from www. taxfoundation/org/compliancetestimony.html; quoted in Owens and Hamilton (2004) Thousands of words 1800 1600 1400 1200 1000 Income taxes only Entire tax code 800 600 400 200 0 1955 1965 1975 1985 21 1995 2000 Tax law is not always clear… Moser (1994) undertook a linguistic analysis of tax laws and claims several bad habits which make it difficult for ordinary taxpayers to understand the law. Lewis (1982) reports that the necessary education to understand the law is between 12 and 17 years in USA, UK, and Australia, respectively. Readability is the ease with which text can be read and understood. Various factors to measure readability have been used, such as "speed of perception," "perceptibility at a distance," "perceptibility in peripheral vision," "visibility," "the reflex blink technique," "rate of work" (e.g., speed of reading), “eye movements” and fatigue in reading.“ The Flesch formulas: FleschKincaid readability test 22 Nina E. Olson Taxpayers hire preparers because the tax code is hideously complex, return preparation is anything but straightforward, and a lot of money is on the line. More Than a ‘Mere’ Preparer: Loving and Return Preparation By Nina E. Olson Retrieved 2015-11-14 from http://www.taxpayeradvocate.irs.gov/userfiles/file/nta_taxnotes_lovingcase.pdf 23 Tax laws are not always clear… Efforts to simplify the law are undertaken in almost all countries. “I hold in my hand 1,379 pages of tax simplification.” U.S. congressman Delbert L. Latta 4. Mediation analyses:Private taxpayers Trust 0.13** 0.74*** Service Tax compliance (0.22***) 0.12** Sobel test: z = 2.57, p < .01 Sobel test for mediation analyses with control variables (socio-demographic, economic and psychological): z = 2.20, p < .05 27 4. Mediation analyses:Entrepreneurs Trust 0.14** 0.73*** Service Tax compliance (0.22***) 0.11** Sobel test: z = 3.72, p < .001 Sobel test for mediation analyses with control variables (socio-demographic, economic and psychological): z = 1.80, p < .05 28 Fairness and social norms Bo Rothstein (2000): Two conditions need to be fulfilled: taxpayers need to trust that other taxpayers are paying their share, and rather than filling the pockets of tax bureaucrats tax authorities have to ensure that the money is invested in public welfare. 29 Fairness • Distributive justice refers to the exchange of resources, both benefits and costs • Horizontal justice (distribution of taxes and resources between taxpayers of comparable income groups) Vertical justice (distribution of taxes and resources across income groups) Exchange justice (fairness of tax payments and governmental provision of public goods and taxpayers’ participation) • • • Procedural justice refers to processes • (Leventhal, 1980: consistent, accurate and free of errors, representative and ethical, and correctable in case of errors; see Tom Tylor) • Retributive and restorative justice refer to perceived appropriateness of sanctions in case of norm breaking https://www.youtube.com/watch?v=lKhAd0Tyny0 Fairness – capuchin monkeys Diffusion of income tax evasion Elffers (2000) writes, “[…] the gloomy picture of massive tax evasion is a phantom”. 31 Estimations of shadow economy (% of GDP) (by Friedrich Schneider - January 2015; proxy for tax evasion) USA Canada Australia Europe (average 31 countries) Switzerland Austria UK Germany Italy Greece Romania Bulgaria 5.9 10.3 10.3 18.0 6.5 8.2 9.4 12.2 20.6 22.4 28.0 30.6 Retrieved 2015-11-07 from http://www.econ.jku.at/members/Schneider/files/publications/2015/ShadEcEurope31.pdf The Problem is: Tax Avoidance Tax law is not always clear… Complexity and unclear law opened space for interpretations, negotiations etc. The concern of legality grew with growing business globalisation, increasing complexity of business structures, the nature of financing and transactions, and tax flight by establishing businesses off shore, tax heavens, and money laundering (Owens & Hamilton, 2004). Modern organised noncompliant business acts within the law, exploiting the law’s shortcomings and loopholes. 33 Amancio Ortega Gaona Inditext (e.g., Zara, Massimo Dutti, Bershka) Wealth: 70,7 Billion US$ (2015) - Forbes 34 News agency Bloomberg shows effects of profit shifting in 2014: Inditext (e.g., Zara, Massimo Dutti, Bershka) owns a small company located in the Netherlands, employing 173 people who made a profit in 2013 which is larger than the profit of the firms in Italy, France, Germany, GB in the past 5 years. Each employee made a profit of 3.1 Mio Euro. This small company is 7 times as profitable as Apple. (Source: Die Presse, 18 March 2015) 35 Tim Cook 36 Apple under Investigation Business Insider UK, September 29, 2014 In an exclusive interview with the Financial Times ahead of the report’s publication, Mr Maestri called the investigation 'very unfortunate.' 'We know that we didn’t do anything that was against the law… '… We simply followed the laws in the country over the 35 years that we have been in Ireland.' … it is legal ! 37 Problem Enforcement matters,… thus, audits and fines are at least in part effective, … but they are not reaching out to legal tax avoidance. Audits and fines are ineffective in fighting tax planning against the spirit of the law, as long as tax planning ranges within the brackets of the letter of the law. 38 Tax avoidance To effectively combat aggressive tax avoidance and to increase tax justice, Hey, Schreiber, Pönnighaus and Bierbrauer (2013) underline the need for an international consensus how to jointly regulate taxpaying behavior of people and businesses. It is necessary to respond to multinational corporations’ activities by developing rules and instruments to effectively control and influence their behavior to enforce compliance. It is necessary to establish a sense of wrong-doing in the society, a reflected judgment of unfairness of tax avoidance and evasion, and to effectively regulate taxpaying behavior. How shall a sense of wrong-doing be established in the society? It is necessary to invest in a climate of cooperation basing on power of authorities and trust in authorities. 43 Harsh Criticism Starbucks paid „voluntarily“ money to HMRC (Volontarily? What? Taxes? Donation ? Charity ?) Retrieved 2015-11-14 from http://www.bbc.com/news/uk-politics-23019514 44 Change of Perspective View of humankind: Rational (egoistic) utility maximizers All pursue the same goals Education strategies: audits and fines Change of Perspective View of humankind: Social beings interacting in a social system Strategies: positive interaction climate (trust, power) Co-operative Relationships OECD: Co-operative Compliance Revenue bodies and their relationships with taxpayers and tax intermediaries need to be built on the principle of reciprocity. All parties shall be open to enhanced level of dialogue and co-operation. Co-operative Relationships Horizontal Monitoring (2005, The Netherlands, Austriapilot, etc.) Standard method of customs checking is characterized by “vertical supervision” and distrust. Horizontal supervision operates on the basis of (reason based) trust.Compliance agreement bases on the key values mutual trust, understanding and transparency. Overview Social representations & attitudes towards taxes Determinants of compliance and research paradigms Decisions under risk Understanding, services, norms and fairness Interaction climate Slippery Slope Framework Behavioral Insight 50 The Slippery Slope Framework Perception of authorities Power of authorities: perceived potential of tax authorities to detect and to punish evasion Trust in authorities: taxpayers‘ perception of tax authorities as benevolent and working for the common good Behaviour of taxpayers Compliance: degree of cooperation by taxpayers Enforced compliance vs voluntary cooperation Slippery Slope Framework Kirchler, Hoelzl and Wahl (2008) Enforced Tax Compliance Voluntary Tax Cooperation Maximum Maximum Subjective complexity of tax law Compliance Tax morale and attitudes Personal, social and societal norms Fairness Minimum considerations Maximum Motivational postures Compliance Antagonistic climate: Command and control Audits Fines Minimum Authority’s capacity to detect and punish tax evaders Synergistic climate Maximum Power of Authorities Trust in Authorities Minimum Minimum Authority’ benevolence and investment in common good 52 Cross-cultural testing of the SSF 44 countries study Experimental testing of the main assumptions of the slippery slope framework in 44 countries on 5 continents 53 Africa Asia Europe North America Australia South America Egypt Ghana Morocco South Africa Bhutan China Hong Kong India Indonesia Iran Israel Japan Pakistan Russia South Korea Thailand Turkey UAE Austria Finland France Germany Greece Hungary Iceland Italy Lithuania Malta Norway Poland Romania Slovenia Spain Sweden Switzerland Canada Mexico USA Australia Brazil Colombia 54 Research: 44 Countries Tax compliance 9 Intended Tax Compliance 8 Voluntary Tax Compliance 7 Enforced Tax Compliance 6 5 4 3 2 1 0 Power / Powerlow Low/ trust low Trust Low Power Power high/ High/ trust low Trust Low Power / Powerlow Low/ trust Trusthigh High Power Power high/ High/ trust Trusthigh High 56 57 58 Country India Iran Pakistan Indonesia Egypt Mexico OECD Ghana France Romania Turkey UAE Norway Bhutan Israel Lithuania Morocco South Africa Portugal Slovenia Malta Thailand USA t-value -1.55 -1.53 -1.28 -0.82 -0.55 -0.52 -0.35 -0.34 -0.31 -0.24 -0.20 -0.18 -0.16 -0.10 -0.07 -0.01 -0.00 0.06 0.11 0.13 0.18 0.20 p 0.000 0.000 0.000 0.008 0.055 0.057 0.349 0.353 0.323 0.488 0.611 0.484 0.611 0.742 0.814 0.972 0.990 0.849 0.763 0.682 0.568 0.617 Ireland Colombia Russia Finland China Sweden Australia Spain Brazil Hungary Greece UK Italy Austria Canada Hong Kong Switzerland Poland Iceland Germany Japan South Korea 0.23 0.30 0.37 0.48 0.50 0.50 0.52 0.53 0.54 0.63 0.63 0.68 0.70 0.80 0.82 0.88 0.94 1.11 1.12 1.27 1.88 1.90 0.510 0.415 0.248 0.049 0.109 0.069 0.093 0.086 0.066 0.074 0.047 0.081 0.015 0.019 0.028 0.021 0.001 0.000 0.000 0.000 0.000 0.00059 Coercive power - harsh power Legitimate power – soft power (French & Raven, 1959; Raven, 1965, 1992, 1993; Raven, Schwarzwald & Koslowsky, 1998) Coercive power: Bases of power are force and pressure, either through punishment and withdrawal of rewards Legitimate power: Bases of power are legitimization and expertise 60 Low legitimate power Low reasonbased trust High legitimate power High reasonbased trust + Low coercive power High coercive power not targeted Anger Evasion High coercive power targeted Fear Rational decision: hiding/ enforced compliance Attention/ prudence Enforced compliance not targeted Low coercive power targeted Protection/ security Voluntary compliance Voluntary compliance 61 Corruption Transparency International (2014) 62 Corruption Corruption Perception Index Corruption Perception Index β Variable B SE B Constant 56.80 1.46 Trust 9.56 2.44 .50*** Power 7.87 2.44 .41** R2 .75 F 62.21*** Note. N = 44 **p < .01. ***p < .001. Shadow Economy Schneider, Buehn and Montenegro (2010) 64 Shadow economy Shadow Economy Index Shadow Economy Index β Variable B SE B Constant 22.98 1.12 Trust -2.51 1.86 -.27 Power -3.55 1.86 -.38 R2 .39 F 12.95*** Note. N = 44 ***p < .001. Happiness Veenhoven (2009) 66 National Happiness Veenhoven Happiness Veenhoven Happiness β Variable B SE B Constant 6.69 .11 Trust .165 .18 .18 Power .468 .18 .50* R2 .42 F 14.75*** Note. N = 43 *p < .05. ***p < .001. Overview Social representations & attitudes towards taxes Determinants of compliance and research paradigms Decisions under risk Understanding, services, norms and fairness Interaction climate Slippery Slope Framework Behavioral Insight 68 From enforced to voluntary compliance Deterrence (audits and fines) Power (legitimization, professionalism and coercive power) & Trust building Power matters! Power must be legitimized: power of authorities is effective if citizens trust the authorities. Trust is the necessary bases of power. Coercive power is effective if it is well targeted to prevent exploitation of cooperative citizens (leading to feelings of protection rather than fear and anger) measures 69 Wrap up https://www.youtube.com/watch?v=qEa_KnOhY-Y Change your perspective 70 http://www.irs.com/ 71 https://www.gov.uk/government/orga nisations/hm-revenue-customs 72 https://www.efd.admin.ch/efd/de/ho me.html 73 http://www.bundesfinanzministerium. de/Web/DE/Home/home.html 74 http://government.ru/en/department/ 69/events/ 75 http://uk.fm.dk/ 76 Home page of the Finnish Ministry of Finance http://www.vero.fi/en-US (retrieved 15-11-2013) 77 http://www.mnec.gr/?q=el 78 Home page of the Austrian Ministry of Finance https://www.bmf.gv.at (retrieved 15-11-2013) 79 https://www.bmf.gv.at/ 80