Trade Policy I

advertisement

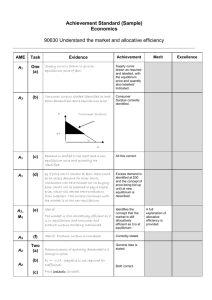

Trade Policy: Instruments and Impacts Appleyard & Field (& Cobbs): Chapters 13–14 Krugman & Obstfeld: Chapter 8 1 Today’s Lecture 1. Instruments of trade policy 1. 2. 3. 2. Tariffs Quotas Other Non-tariff Barriers to Trade Impact of trade policies 1. 2. 3. 4. Partial Equilibrium: Small Country Partial Equilibrium: Large Country General Equilibrium: Small Country General Equilibrium: Large Country 2 Tariffs • Imports tariffs o specific tariff: (a monetary sum that must be paid to import 1 physical unit of a product) Advantage: easy to collect Disadvantage: doesn’t take price changes into account o ad valorem tariff: (a percentage of the monetary value of 1 unit of import) Advantage: takes price changes into account Disadvantage: Need to know the monetary value of the good and seller is tempted to undervalue the price • Other instruments o Import subsidy negative import tariff o Export tariff/subsidy (levied/paid on home-produced goods that are destined for export) 3 Features of Tariff Schedules • Preferential duties o products form certain countries are subject to lower tariffs than the normal tariff rate o Generalized System of Preferences (GSP) for developing countries • Most-favoured-nation (MFN) treatment = normal trade relations (NTR) o “if country A grants country B the status of mostfavoured nation, it means that B’s exports will face tariff that are no higher (nor lower) than those applied to any other country that A calls a MFN” (Economics A-Z in The Economist website) 4 Non-tariff Barriers to Trade (1) • Import Quotas o a government agency allocates the rights to import o limits the number of goods (not the price) for a given time period • “Voluntary” export restraints (VER) o foreign suppliers agree to “voluntary” refrain from sending some exports • Government procurement provisions o restriction on purchasing foreign products by the domestic government agencies • Domestic content provisions o a given percentage of the value of a good must consist of domestic components or labour 5 Non-tariff Barriers to Trade (2) • Administrative classification o different tariffs to different product categories + leeway for customs officials to decide on classification • Restrictions on services trade • Trade-related investment measures • Domestic policies affecting trade o etc. health, environment and safety standards; packaging and labeling requirements; inconsistent treatment of intellectual property rights; subsidies to domestic firms... 6 Impact of Trade Policy: Levels of Study Partial Equilibrium analysis • o analysing one market and ignoring the subsequent or secondary effects General equilibrium analysis • o analysing all markets simultaneously (but still holding technology, endowments etc. constant) • Note that here “market” means a market for one good (which can be sold in many countries). We will use both approaches to study onecountry and two-country cases. The difference is that in general equilibrium analysis we take also into account what happens in the markets of goods not subject to trade policy. 7 Consumer and Producer Surplus Price (P) • • • • In a partial equilibrium approach we can use the concepts of consumer and producer surplus Both reflect the fact that there is only one market price Hence, there are consumers who would have been willing to pay more for the product Similarly, all but the “last” unit is produced with lesser marginal cost than the market price received S= marginal cost of production P consumer surplus producer surplus D Quantity (Q) 8 The Impact of Import Tariff: The Small-Country* Case * Small country = cannot affect world prices Increase of producer surplus and government income Loss of consumer surplus SD P SD P increase of producer surplus Loss of consumer surplus Pint tariff to the government (1+τ)Pint (1+τ)Pint Pint DD imports after tariff Q DD imports after tariff Q 9 imports in free trade imports in free trade The Impact of Import Tariff: The Small-Country Case • Introducing a tariff → Domestic price increases → Domestic quantity supplied increases → Domestic quantity demanded falls → Increase of government revenues • Distributional effect o surplus is transferred from the consumers to the producers and the government • Consumers lose more than producers and government win: deadweight loss 10 The Impact of Import Quota: The Small-Country Case • For every quota there is an equivalent tariff (and for every tariff there is an equivalent quota) SD P • The changes in consumer and produce surplus are equivalent to that of a tariff • However, the increase of government revenue may be lost (depending on how the quotas are allocated) PQ Pint DD quota imports in free trade Q 11 The Impact of Subsidy to ImportCompeting Industry (Small Country Case) SD P P Cost to the government P P SD increase of producer surplus DD DD imports after the subsidy imports in free trade Q imports after the subsidy Q imports in free trade 12 The Impact of Subsidy to ImportCompeting Industry (Small Country Case) • Equivalent subsidy = producers are subsidised to produce the same amount as they would under a tariff → Equal increase in the producer surplus as under tariffs → Large cost to the government → No impact on price no impact on consumer surplus • Cost to the government is larger than the increase of producer surplus, i.e. there is a loss of efficiency • However, this cost is less than the loss of consumer surplus in the tariff/quota case → subsidies are more efficient than tariffs/quotas 13 Large country, partial equilibrium Single Market, Two Countries P Country A Country B P SA SB DB DA Q Q 14 Single Market, Two Countries P Country A Country B P SA SB DB DA Q Q Countries A and B have different supply curves (cost of production) and demand curves 15 the (preferences). In free trade equilibrium the world price is such that country B is willing to export same quantity as country A is willing to import. Single Market, Two Countries, Tariff P Country A Country B P SA SB DB tariff DA Q Q Price in Country A = Price in country B + tariff. If the price in country B would remain constant after a tariff is set, country B would be willing to export more that country A would be willing 16to import → price in country B must decrease (next slide) Effect of a Tariff in a Single Market and Two-Countries Country A P DA Country B P SA DB SB PA PFT e a D b tariff C price decrease in country B PB Q Q Country A: Loss of consumer surplus = e+a+D+b; increase of producer surplus = e; Increase of government revenue = C+D. Gain for Country A = gains–losses = (e+C+D)-(e+a+D+b) = C – a – b. That is, if C > a + b country A has gained from the imposition of the tariff (due to lower prices of imports 17 before tariff). Impact of Elasticises Country A P DA P SA PA PFT Country B SB DB e tariff a D b PB C Q The more elastic in the exporting market and the more inelastic in the importing market supply and demand are, the less chances the importing country has on gaining from tariff price decrease in country B Q 18 The Impact of Import Quota • Graphically identical to the case of tariff • The difference is in, who gets areas D (country A’s government revenue from the tariff) and C (loss of country B’s producer surplus that is transferred to country A in the tariff setting) • Voluntary export restraints (VER) can be seen as a way for the exporting country to capture areas C and D o Then, if this gain is greater than the deadweight loss of the exporter (triangles around C), the exporting country will gain from the quota 19 General Equilibrium Analysis Partial Equilibrium analysis • o analysing one market and ignoring the subsequent or secondary effects General equilibrium analysis • o analysing all markets simultaneously (but still holding technology, endowments etc. constant) • Note that here “market” means a market for one good (which can be sold in many countries). We will use both approaches to study onecountry and two-country cases. The difference is that in general equilibrium analysis we take also into account what happens in the markets of goods not subject to trade policy. 20 General Equilibrium Effects of a Tariff for a Small Country • • • • • Import tariff on good Y changes the price ratio Producers adjust from point PFT to Pt Since the tariff doesn’t change world prices, country’s real income changes to (PX/PY)t Consumers maximize given domestic prices and real income and move to a lower utility level Note that real income is determined by the world prices Good Y CFT Ct Pt PX/(1+τ)PY PFT (PX/PY)FT Ct Pt CFT PFT Good X 21 General Equilibrium Effects of a Subsidy for a Small Country • • • Assume the government subsidizes producer of good Y to impose the same production pattern as with the tariff The real income of the country remains the same Consumers face world prices and are able to consume at a higher utility level Good Y CFT CS PS PX/(1+τ)PY PFT (PX/PY)FT CS PS CFT PFT Good X 22 Terms of Trade Effect of a Tariff • Imposing a tariff shifts offer curve inwards (the (PX/PY)E’ = TOTE’ Imports to country 1 exports from country 2 → The tariff imposing country’s terms of trade improve (the price of exports decrease), which may offset the, at least in part, the decrease of welfare due to efficiency loss Good Y: country is now willing to trade less for all terms of trade) (PX/PY)E = TOTE Country 2’s offer curve Country 1’s offer curve Good X: Exports from country 1 Imports to country 2 23 Terms of Trade Effect of a Quota • Country 1 sets a Imports to country 1 exports from country 2 Good Y: quota for imports of good Y → country 1’s offer curve becomes horizontal at the quota level → Country 1’s terms of trade improve (PX/PY)E’ = TOTE’ (PX/PY)E = TOTE Country 2’s offer curve Country 1’s offer curve Good X: Exports from country 1 Imports to country 2 24 Terms of Trade Effect of a Voluntary Export Restraints • Country 2 uses Imports to country 1 exports from country 2 Good Y: voluntary export restraints (VER) to limit exports of good Y → country 2’s offer curve becomes horizontal → country 2’s terms of trade improve (PX/PY)E Country 2’s offer curve (PX/PY)E’ Country 1’s offer curve Good X: Exports from country 1 Imports to country 2 25 Other Effects of Protection • Restricting imports is likely to result decrease of exports as well o o Reallocation of domestic resources Retaliation by the trading partners • Distributional Effects o o Transfer from the consumers to the import-competing producers HO-model: transfer from the abundant factor to the scarce factor 26