SampleAns90630

advertisement

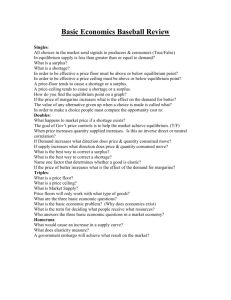

Achievement Standard (Sample) Economics 90630 Understand the market and allocative efficiency AME Task A1 One (a) A3 (b) Achievement Evidence Supply curve is drawn to give an equilibrium price of $30. Supply curve drawn as required and labelled, with the equilibrium price and quantity also labelled/ indicated. Consumer surplus shaded/identified as area below demand but above equilibrium price. Consumer Surplus correctly identified. P Merit Consumer Surplus P* D Q A1 (c) Demand is shifted to the right and a new equilibrium price and quantity are identified. All this correct. A1 (d) eg If price was to remain at $30, there would be an excess demand for boxer shorts. Consumers who have missed out on buying boxer shorts will be prepared to pay a higher price, which will attract extra production from suppliers. This process continues until the market is at the new equilibrium. Excess demand is identified at $30 and the concept of price being bid up until at new equilibrium is described. A3, M1 (e) Idea of: Identifies the concept that the market is still allocatively efficient as it is at equilibrium. A3 (f) A2 Two (a) A2 The market is still allocatively efficient as it is in equilibrium and consumer and producer surplus are being maximised. (b) (c) Idea of: Producer surplus is increased. Responsiveness of quantity demanded to a change in price. Ed = –0.17, (negative is not required for coefficient). Price inelastic (circled). Correctly stated. General idea is stated. Both correct. A full explanation of allocative efficiency is provided. Excellence A2 (d) (e) A2, M2, E Thre e (a) Cross elasticity = +1.68 Substitutes (circled). Both correct Eg elastic because: Identifies one reason without explanation. Explains two reasons (it is not good enough to simply state ‘luxury’ or ‘many substitutes’, further explanation must be given. Identifies that price should not be raised without reason. A clear explanation is provided. 1. Restaurant meals are considered a luxury item so, if the price rises, people do not need to buy them. 2. There are many substitutes for restaurant meals, such as takeaway food or cooking at home, so people can easily switch away. Eg A2, M2, E (b) A1 Four (a) A3 (b) (i) Sw line is moved up by $100 to $400 and Curve shifted correctly and labelled. A3 (b)(ii) SNZ line is moved down by $100 at each Curve shifted correctly and labelled new equilibrium P and Q identified. M1, E (c)(i) The tariff reduces imports by 4 000 whereas the subsidy reduces imports by only 2 000. (ii) Less allocative efficiency with both policies as both the tax and the subsidy will create a deadweight loss in the market. The owner should not increase the price of meals. If demand is price elastic, then if the price of meals is increased they will earn less revenue in sales from meals as people will switch away. The equilibrium price identified as $500, equilibrium quantity as 6 000, and the level of imports as 8 000 (same for both graphs). labelled appropriately. and every point. New equilibrium price ($450 approx.) and quantity (7 000 approx) are identified. (iii) With a tariff, NZ consumers will be worse off (as their consumer surplus is reduced, they pay a higher price and consume less) but with a subsidy the consumer surplus remains the same (as the price of imports is unchanged and consumers still consume the same quantity of cameras). NZ producers are better off under both methods as their producer surplus is increased as they sell more. In the case of a tariff they sell at a higher price, and in the case of the subsidy they sell more at A fully developed explanation is provided for each reason. A comprehensive explanation is provided. All correctly identified. Some of the points mentioned in the evidence are explained. A comprehensive analysis is completed covering most of the points in the evidence (reference to deadweight loss, producer and consumer surplus is required) and a policy option is chosen and justified. the same price but also receive the subsidy. Both policies may lead to more employment in the camera industry in New Zealand. NZ government will collect tariff revenue from the tariff but will have to pay money out for the subsidy. Policy choice, eg tariff – both methods increase producer surplus and create a loss of efficiency. However, a tariff does not cost the government money and reduces imports by more. This outweighs the loss in consumer surplus associated with a tariff. Sufficiency Indicator Judgement Statement Achievement (A) Describe and illustrate market equilibrium. Any two A1s or better. Use concepts of demand, supply and elasticity. Any three A2s or better. Use supply and demand analysis to illustrate the efficiency of markets. Any three A3s or better. Merit (M) Explain the effects of a change in the market. Achieved plus any three M1 or M2s or better. Explain and apply the concepts of demand, supply and elasticity. Excellence (E) Comprehensively analyse the effects of a change in the market. Merit plus one E from each of Questions Three and Four (total of 2 E1).