Mason Stevens Presentation

advertisement

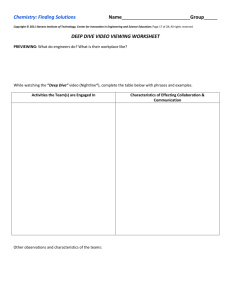

Fishing Net or Fishing Line? 1 Client name: Mortgage Type Interest Rate Amount Income C1 C2 Value INCOME Debt Equity Mortgage Debt Mortgage Type Interest Rate Amount Superannuation Personal Assets Personal Superannuation Mortgage Type Interest Rate Amount Shares / Dividends How much income do you Want annually at Retirement Credit Cards Other _______________________ Family Tax Benefits Pension Passive Investments Liabilities Tax Rent Total Investment Mortgage Type Interest Rate Amount Properties Cash Investment Mortgages Fixed Interest Shares Life Other TPD Trauma Income Business / Key Man Where do you fit in the advice line Accumulator Family 18 - 40 Uni Work Car 41 - 54 Home Rent Marriage Savings Spending Kids Family Assistance Invest property Renovation Sale Portfolio const Pre - Retiree Retirement 55 - 65 66 - + TTR Income Super Panic Pension Pers Conts Panic Estate Planning Holiday Debt reduction What do clients want from you? Death What do clients want from you? 4 What clients want from a service provider | What is your point of difference ? 1. Help me improve my financial situation & the burden debt plays 2. Take Control 3. Protect me and advise me 4. Give me a better experience dealing with your firm 5. Teach me What are your clients asking for? Client Retention Issues Case Study (Slide 1) Point 1: 90% of brokers never contact client once settlement is finalised! Point 2: 93% of clients cannot remember their brokers face 3 months after the mortgage is written. Case – (Slide 1) – The Facts Looking at a Typical Database Clean: 600 Clients Called from clients database Wrong Numbers/Disconnected – 22.55% No Longer Client – 4.5% Remove From Database – 3.0% Total Clients Lost – 30.05% Total Clients Responsive – 69.95% Call to Discuss new Business – 8.0% Details Updated – 69.95% Email Address Gathered – 57.0% Outcome: Solution will allow you to reduce the drop off rate in your client base so this never happens. Client Likelihood of repurchasing a product/service with current provider Fact: In the financial services sector an average of 7% of clients are very likely to change provider. Very Unlikely 9% 33% 5% 34% 11% 4% 11% 10% 6% 46% 48% 53% 14% 4% 4% 41% 32% Not 44% Sure 46% 57% 79% Very 59% 61% Likely 57% 57% 52% 43% 42% 41% 40% 39% 17% PBM Soft Drinks Life Long Distance Laundry Credit Insurance Telephone Detergent Card ** Source: PBMI and McKinsey Quarterly Vol. 2, 2002, Numbers may not total 100% because of rounding Cellular Telephone Home Loans Retail Auto Casual Banking Insurance Apparel Are you really doing things different to your competitor? 8 Ranking of Product Providers % of Gross Income Asteron 1 14.94% AIA 2 12.61% TAL Colonial One Path Colonial 1st State OASIS - Wealthtrac Macquarie Zurich Fee For Service ONEPATH Life Ltd IOOF AMERICAN Intn'l Ass Co Aust Ltd Tower Australia Limited Macquarie Investment Mngt Ltd BT Life Limited NETWEALTH Investment Funds MACQUARIE Wrap Solutions AXA Asteron Wealth Solutions ASGARD Capital Mgnt Ltd 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 7.95% 5.40% 4.24% 4.09% 4.05% 3.80% 2.68% 2.60% 2.52% 2.36% 2.25% 1.72% 1.71% 1.67% 1.58% 1.47% 1.41% 1.41% 1.40% Product Providers ADVISER NUMBER 1 AMERICAN Intn'l Ass Co Aust Ltd $ $ AMP Limited ANZ Securities Ltd AUST Inv Exchange - Ausiex BlackRock Investment Managers BT Funds Mngt Ltd Colonial First State Inv Ltd Dealer Group Fee Fee For Service MACQUARIE Bank Limited Macquarie Investment Mngt Ltd MACQUARIE Wrap Solutions NATIONAL Australia Bank Limited ONEPATH Life Ltd Adviser No 2 Asteron Portfolio Service Limited Fee For Service IOOF Australia Limited MLC Limited MLC Limited - ex Aviva Perpetual Inv Management Ltd Adviser No 3 AMP Limited ASGARD Capital Mgnt Ltd Asteron Life Limited AUSTOCK Life Funds Biz-E-News Dealer Group Fee Fee For Service IOOF Australia Limited MACQUARIE Bank Limited Macquarie Investment Mngt Ltd MACQUARIE Wrap Solutions MASON Stevens Pty Ltd MLC Limited - ex Aviva ONEPATH Funds & Custodians RBS Instreet Group Ltd Tower Australia Limited Zurich Australia Limited $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 17,108.00 4,506.66 1,760.00 60.04 8.91 594.52 2,200.00 910.80 1,387.56 4,040.75 1,320.00 318.76 13,992.88 44.80 2,750.00 7,879.35 193.27 2,667.79 457.67 286,140.37 878.98 144.25 165.00 241,230.50 1,844.97 551.51 8,975.50 335.41 24.91 1,329.10 7.19 800.00 29,317.78 535.27 Presentation to Beacon Financial Conference, FIJI May 2013 Disclaimer This presentation is owned by Mason Stevens Limited (ACN 141 447 207), (AFSL 351578). Any content provided in this presentation is for the purpose of providing general information only. Investment in securities including derivatives involves risk. Securities by nature have rises and falls, given that past performance is not a reliable indicator of future performance. Mason Stevens is only providing general advice in this presentation. You should consider this information, along with all of your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn brokerage, fees or other benefits from transactions arising as a result of information contained in this presentation. Mason Stevens ensures that the information provided in this presentation is as accurate and complete as possible but does not warrant its accuracy or reliability. Opinions and or information may change without notice and Mason Stevens is not obliged to update you if the information changes. Mason Stevens and its associated companies, authorised representatives, agents and employees exclude to the full extent by law, liability of whatever kind, including negligence, contract, fiduciary duties or otherwise, to investors or anyone else in respect of any loss or damage, including indirect or consequential loss or damage, foreseeable or not, arising from or in connection with this presentation. The relevancy of this presentation is designed to illustrate the range of products and services that Mason Stevens offer, it may also provide potential investment outcomes for a particular investment strategy. The presentation uses a broad number of simplifying assumptions to do this. As such the output of the presentation should not be taken as an indication of any actual performance of any particular investment. Any investment return(s) and yield assumptions used in the presentation do not represent a prediction or forecast of actual performance of any product or service offered by Mason Stevens Limited. Mason Stevens ABN 12 Mason Stevens Boutique investment house • Established in 2010; today circa $750m of FUM, has 26 staff Multi-asset, multi-currency offering • Global Equities, Global Fixed Income, Global Derivatives & Cash Investment Choice • Portfolio Accounts, Managed Accounts, Direct Equities, Direct Fixed Interest, and Managed Funds Institutional-style solutions • Transparent, efficient and cost effective with comprehensive online reporting Mason Stevens ABN 13 Access Global Assets Global Equities Global Derivatives & Commodities Margin Lending Foreign Exchange Your Wealth TD Hub Fixed Income Corporate Bonds, Kangaroo Bonds, RMBS, Sovereign Mason Stevens ABN 14 The Executive Team PAT HANDLEY, EXECUTIVE CHAIRMAN • More than 38 years’ banking and finance experience both in Australia and the United States • Number of directorships including Suncorp-Metway, AMP and HHG • Former Executive Director and Chief Financial Officer at Westpac Banking Corporation from 1993 to 2001 • Former Chairman of Nomura Securities Australia and Pacific Brands • Chief Financial Officer of Banc One Corporation (now part of JP Morgan) in the US • Currently the Director of Vantage Private Equity, Chairman of Bridgeport Energy Ltd and is one of the founders of 2020 THOMAS BIGNILL – CHIEF EXECUTIVE OFFICER • Thomas has 18 years experience in financial markets and has worked in major investment banks including Merrill Lynch, Bankers Trust and Bell Potter building substantial private client portfolios specialising in domestic and International equities. • Head of Equity Market Services at Next Financial in 2006 where he built a comprehensive domestic and international equities solution for both private clients and financial advisers. • Founding member of Mason Stevens. VINCENT HUA, CHIEF INVESTMENT OFFICER • Highly experienced trading and portfolio manager with over 19 years’ experience in the Australian and Asian markets • Former Managing Director and Head of Liquid Market Trading for Lehman Brothers (Australia), Global Head of Product and Trading for the CBA, General Manager of Markets for Shinsei Bank in Tokyo and Head of Asset & Liability Management at Westpac • During the past 3 years, Vincent has been involved in the private equity sector • Responsible for all the investment activities of the firm including discretionary money, advised accounts and counterparty relationships 15 Online anytime Mason Stevens ABN 16 Our offering • • • • • • • Individualised portfolios General portfolio advice Opportunistic themes and ideas Access to research Access to IPOs Financing solutions Capital protection solutions • • • • • Self-directed Portfolio Accounts Professionally-managed Managed Accounts Global and domestic equities Derivatives Fixed income / Interest Listed property Cash • • • • • 24/7 online reporting Full tax / year-end reporting Custody of assets Fair tax outcomes Complete transparency • • Client Administer We are not: • Financial Planners • Tax Advisors • Accountants • Risk Assurers Mason Stevens ABN 17 Choice of Investment Vehicles Portfolio Accounts Managed Accounts Managed Funds Comprehensive Administration Platform Consolidated Reporting Mason Stevens ABN 18 Portfolio Accounts - directed by the client or the adviser Individualised approach where a portfolio is constructed to meet your clients specific risk and return objectives Portfolio Accounts put you and your clients in the driving seat of their investment portfolio Choose from our range of equity, derivative, fixed income, managed fund and cash products Assets are held on your clients behalf in custody and there is no minimum investment requirement View your clients investment information at anytime on our online portal Mason Stevens ABN 19 Unique solution Personalised, transparent outcomes Access to global markets Exclusive opportunities • Portfolio Accounts • IPOs • Managed Accounts • Placements • 24/7 online access for Advisers and clients • Idea generation • Institutional access • Audited tax reporting • Direct Fixed Income • Corporate Action management ASIC supervised and regulated. AFSL holder with strict controls and processes to protect underlying client assets. Mason Stevens ABN 20 Managed Accounts – SMA Solution An investment portfolio where deicisions are made by the Portfolio Manager under a mandate Managed Accounts provide direct equity exposure but with the benefit of professional management Choose from our range of portfolios managed by Mason Stevens and other specialist managers As beneficial owner of the securities within your portfolio you achieve fairer tax outcomes and rights to all dividends and distributions View your investment information at anytime on our online portal Mason Stevens ABN 21 What are Managed Accounts? Defining features of managed accounts: • Non-unitised investment account • Held beneficially for the client • Investments managed on a discretionary or non-discretionary basis • Mason Stevens Terminology: • Portfolio Account – Client/Advisor Directed • Managed Account – Mandate based discretionary management Mason Stevens ABN 22 The History of Managed Accounts • Managed Accounts evolved over the last 20 years, primarily in the US, as an offering for family offices to get transparency on their investments • Tax efficiency Transparency Portfolio customisation and flexibility Liquidity US $ 3 trillion is presently invested in Managed Accounts in the US, growing at 15% per annum • Nearly five million US households use Managed Accounts Mason Stevens ABN Source: HFMWeek Annual Managed Account Survey March 2011 23 Managed Account Features Transparent • Beneficial ownership of individual holdings • Full visibility of underlying investments, transaction and fees • Transaction history readily available • 24/7 online reporting for advisers and clients • Allow the advisor and client to be more informed Mason Stevens ABN 24 Managed Accounts Features Scalable • Technology solution enabling you to offer a direct share offering across your broader client base. • Outsourced administration solution utilising the benefits of the custodian • Avoid the inherent issues of traditional HIN based solutions Mason Stevens ABN 25 Managed Accounts features Investment options • Domestic and International Equities • Plus: • Fixed interest & hybrids • Derivative overlays • Listed property trusts • Managed Funds • Margin lending • Managed models of unit trusts Mason Stevens ABN 26 Managed Accounts Features Portable • Direct in-specie transfer in or out • No change of beneficial owner • Easily switch between investments • Only realise those stocks that are not common Mason Stevens ABN 27 Managed Accounts features Tax & investment efficiencies • No inheritance of other investor’s capital gains • In-specie transfers without CGT events enable customisation & flexibility • Realised losses available to investors • Enables accumulation & capital drawdown strategies in direct shares Mason Stevens ABN 28 Managed Accounts features Model Portfolios • Range of investment strategies, managers • Internal & external model managers • As security weightings from model manager change, the SMA provider automatically rebalances each investors portfolio to reflect the changes • Multiple asset classes covered: • Equities • International Equities • Bonds • Managed Funds • ETF • Cash Mason Stevens ABN 29 Managed Account Features Administration • Single HIN – all securities held by a custodian • Trades, corporate actions & income/distributions by aggregated electronic processes • Highly efficient hence cheaper than unit trusts • Highly scalable Mason Stevens ABN 30 The best of both worlds Benefits Broker Managed Accounts Managed Funds Beneficial Ownership Professionally Managed Transparent investment Tax Efficient In specie flexibility Single licensing Consolidated reporting Cost effective No embedded CGT Transactions confirmed daily Mason Stevens ABN 31 Global, multi asset managed accounts Large cap Australian Equities Small/mid cap Australian Equities International Equities Fixed Income Blue Chip Income Equities Model Portfolio Bennelong Ex-20 Magellan Global Equity Model Portfolio Mason Stevens Credit Fund Blue Chip Growth Equities Model Portfolio Blue Chip Small Caps Model Portfolio Mason Stevens ABN 32 Asset Allocation, Growth Conservative and Balanced Beacon Financial Asset Allocation Committee Australian Equities International Equities Fixed Interest Cash G 50% 40% 10% 0% C 30% 25% 45% 5% B 35% 30% 35% 5% Mason Stevens ABN 33 Sample Australian Equities Portfolio offering Australian Equities Blue Chip Asset Management Large Cap equities Growth return Bennelong Ex 20 Portfolio Exposure outside the ASX 20 Blue Chip Asset Management Yield focus large caps Income style returns Mason Stevens ABN 34 SMSF Offering Equities Fixed Interest/Cash Property Yield Mason Stevens ABN Yield 35 Questions Mason Stevens ABN 36