Illustrative for UK

advertisement

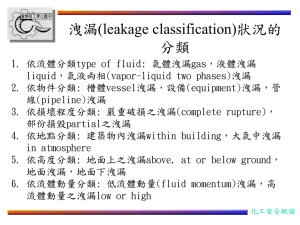

IFO-PIK Workshop: Transition towards global carbon pricing and fossil energy markets Leakage Implications for climate policy Karsten Neuhoff Leiter Abteilung Klimapolitik DIW Berlin 1 Technology „Leakage“ – example RE investment $ Billion Investment in 2012 1.8 9.7 China 4.5 7.6 solar US Germany wind 18.8 67,7 80,6 Uk smart tech Australia biomass 142.5 78.3 biofuels South Africa 2 4,3 geothermal 5,3 5,5 small hydro 2 Source: Bloomberg, New Energy Finance, Jan 2013 Karsten Neuhoff, 22.3.2012 Japan 44,2 6,2 8,3 16,3 22,8 Brazil France Mexico Other countries 2 3 Policy leakage - example feed-in tariff Source: http://www.pv-tech.org/tariff_watch/list Karsten Neuhoff, 22.3.2012 3 Modernisation leakage – example slavery • accurate, publicly available information about the impact of slavery on lives - also against attempts by slavery's defenders • the role of discounting the value of slave lives • gradually more ambitious action against slavery, penalties £100/head in 1807 to the death penalty for traders in 1827 • compensation for slave owners (£20 million in 1838) • not with a global treaty, but country by country 4 Karsten Neuhoff, 22.3.2012 4 Production/Investment leakage – sectors potentially at risk Lime Casting of iron 40% Impact from direct emissions Preparation of yarn Copper Impact from indirect emissions (electricity) Other textile weaving Other inorganic basic chemicals 30% Household paper Non-wovens Industrial gases Coke oven Fertilisers & Nitrogen 4% 2% 0% 0.0% Malt Starches& starch products Flat glass Veneer sheets Retreading/ rebuilding tyres Rubber tyres & tubes manufact. Hollow glass Finishing of textiles Refined petroleum 0.2% Aluminium 10% Basic iron & steel 20% Cement Cost increase relative to value added Commodities with significant carbon cost Pulp & Paper 0.4% 0.6% Share of GDP of UK 0.8% 1.0% 5 Ist all about the detail in analysis, model and policy Cost increase relative to value added (20 €/t CO2) Illustrative for UK 50% Semi finished Iron and steel Hot rolled 40% 30% Total cost increase from CO2 pricing 20% Cost increase from passed on CO2 pricing of first production stage only 10% Total cost increase from higher electricity prices 0% 0 500 1000 1500 2000 2500 3000 Cumulative gross value added (mio €) 6 Climate Policy after Copenhagen – The role of Carbon Pricing, Cambridge University Press Karsten Neuhoff, 22.3.2012 Conditions for green paradoxon (I/II) Increase production Investment 5 years Lower revenue for resource extraction due to carbon price Strong carbon price Time frame too short? Demand Response too big? Uncertainty too high? Difficult to see how this should work Conditions for green paradoxon (II/II) Coal Requirement I Scarce resource /increasing cost curve No? Gas No? Requirement II Optimization horizon T&T No Algeria No Requirement III Ability to control US No 8 Oil Yes? Oil - Iran - Saudi - Russia - Stans US No Difficult to find actor meeting requirements Karsten Neuhoff, 22.3.2012 6 Summary on leakage channels Fossil fuel channel • Oil (+) • Coal (0) (?) • Gas (?) • Invest uncertainty(-) Climate policy Country A (with cap) Direct Emission reductions Modernisation leakage (-) Country B (+?) Product./investment leakage Policy leakage (-) (-) Potential leakage Technology leakage Dominant effect: Unilateral climate policy triggers additional international emission reductions 9 Vielen Dank für Ihre Aufmerksamkeit. DIW Berlin — Deutsches Institut für Wirtschaftsforschung e.V. Mohrenstraße 58, 10117 Berlin www.diw.de Redaktion Karsten Neuhoff kneuhoff@diw.de

![Section 01669/Leakage Test of Hydraulic Structures [spec]](http://s3.studylib.net/store/data/007419897_1-1b5e9897de2aef63720e2aa5ff669e8a-300x300.png)