At end of year

advertisement

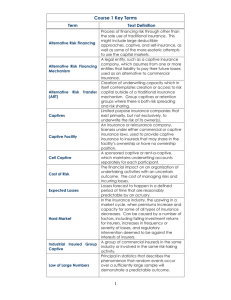

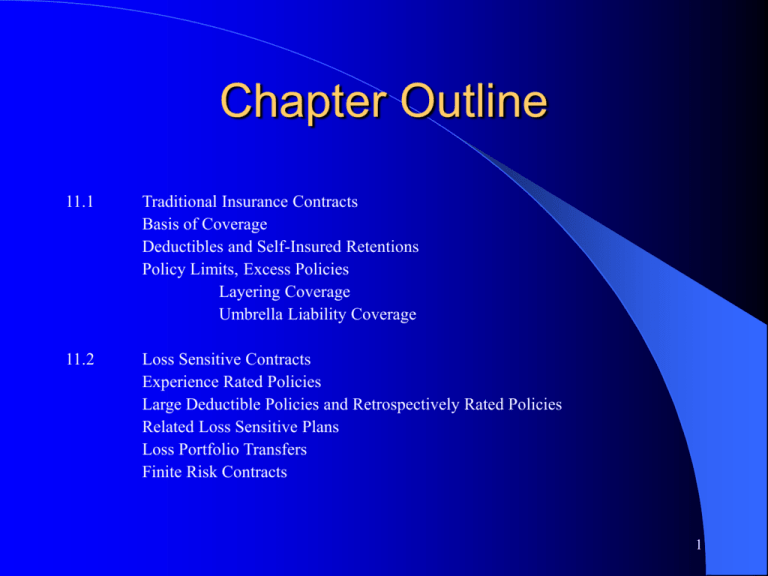

Chapter Outline 11.1 Traditional Insurance Contracts Basis of Coverage Deductibles and Self-Insured Retentions Policy Limits, Excess Policies Layering Coverage Umbrella Liability Coverage 11.2 Loss Sensitive Contracts Experience Rated Policies Large Deductible Policies and Retrospectively Rated Policies Related Loss Sensitive Plans Loss Portfolio Transfers Finite Risk Contracts 1 Chapter Outline 11.3 Captive Insurers Motivations for Forming Captive Insurers Tax and Regulatory Factors Risk Reduction Tax Treatment of Captive Transactions General Legal Principles Captives that Only “Insure” a Single Parent Captives with Unrelated Business Captives that Only Insure a Single Parent and Sister Corporations Risk Retention Groups 2 Chapter Outline 11.4 Methods of Paying Retained Losses Internal Funds Cash Flows Dedicated Assets Lines of Credit Issue New Securities 11.5 Trends and Innovations in Loss Financing 11.6 Summary 3 Traditional Commercial Insurance Policies Basis of Coverage – Occurrence coverage insurer pays losses if they occurred during the policy period – Claims-made coverage insurer pays losses if the claim is made during the policy period and the loss occurred after the retro-active date 4 Claims-Made versus Occurrence Policies Compare risk bearing effects of a series of occurrence policies with a series of claimsmade policies over 1995-1998 period 1995 1998 5 Exposure Diagram with no Insurance 6 5 Loss Paid by Firm 4 3 2 1 0 0 1 2 3 4 5 6 Loss Am ount 6 Exposure Diagram with a Deductible Exposure Diagram with $1 million deductible (w and w/o premium) 7 Types of Deductibles Types of deductibles – per _________ can use stop loss policy to limit aggregate loss – aggregate – franchise Deductibles versus self-insured retentions (SIR) – Deductible: insurer pays losses and then is reimbursed – Letters of ______ 8 Exposure Diagram with a Policy Limit – Usually called excess policy: $3m excess of $1m 9 Layering Coverage Purchase $3m excess of $1m SIR Purchase $5m excess of $4m 10 Coverage for the World Trade Center Retention $100,000 per claim 1st Layer $10 million from Am Home Assurance and Home Indemnity 2nd Layer $290 million from 11 companies 3rd Layer $100 million from 5 companies 4th Layer $100 million from 68 syndicates at Lloyd’s of London 5th Layer $100 million from 65 syndicates at Lloyd’s of London (Source: Business Insurance, March 8, 1993) 11 Umbrella Liability Coverage – Coverage above _______ on other policies covering multiple exposures – Example: Commercial general liability policy limit = $20m Auto liability limit = $1m per occurrence Umbrella limit = $30m 12 Loss Sensitive Contracts Main feature: – Policyholders’ payment depends on______during the policy period usually requires a letter of credit Examples: – _________ rating – Large deductible policies 13 Retrospectively Rated Policies – Characteristics minimum & maximum premium payment based on – ________ losses – paid losses – Exposure diagram 14 Why Use Loss Sensitive? – Want to retain risk but obtain ____________ of insurance Purchase claims processing services Satisfy __________ insurance laws 15 Other Loss Sensitive Plans Can eliminate letter of credit by pre-funding losses – Examples: _________ credit plans Premium financing plans – ______ arbitrage Loss Portfolio Transfers – transfer ______ ________ to insurer – insurer takes on some __________ risk, but mostly ________ risk 16 Finite Risk Plans – Characteristics of finite risk plans (financial insurance) Multi-period loss sensitive plans Example: Cash Flows (in $thousands) from a Three-year Finite Risk Contract (Premium = $4 million, interest = 6% of beginning balance, $20 million aggregate limit) At beginning of year: Balance from previous year Premium Insurer’s fee Beginning balance At end of year: Claim payments Plus interest on beginning balance Ending balance Year 1 Year 2 Year 3 $0 4,000 -400 $ 4,000 -400 $ 4,000 -400 -2,000 _____ -4,000 _____ -5,000 _____ 17 Finite Risk Plans – Another example: Cash Flows (in $thousands) from a Three-year Finite Risk Contract (Premium = $4 million, interest = 6% of beginning balance, $20 million aggregate limit) At beginning of year: Balance from previous year Premium Insurer’s fee Beginning balance At end of year: Claim payments Plus interest on beginning balance Ending balance Year 1 Year 2 Year 3 $0 4,000 -400 $ 4,000 -400 $ 4,000 -400 -1,000 _____ -12,000 ______ -1,000 _____ 18 Smoothing Effect of Finite Risk Plans $12 $6 years 1 2 3 4 5 6 19 Captive Insurers A captive insurer is a ________ of a firm that insures its parent. Types of captives (use diagram) – Pure captive ______ - _______ transactions may purchase reinsurance – Captive with unrelated business insurance reinsurance – Group captives 20 Relationships with Captive Parent Insurers Corporation Insurer A Sister Subsidiary 1 Captive Insurer Insurer B Sister Subsidiary 2 Unrelated NonInsurance Entity 1 Unrelated NonInsurance Entity 2 21 Location of Captive Insurers Locations of Captive Insurers in 1996 Location Bermuda Cayman Islands Guernsey Barbados Dublin Isle of Man Luxembourg Vermont Number of Captives 1,050 373 324 167 134 134 235 293 Source: Business Insurance, April 14, 1997. 22 Motivations for Captives – Tax treat retention as ________ lower tax rates offshore – Regulatory want to ________ risk, but use a fronting insurer to – _______ compulsory insurance laws – comply with restrictions on use of admitted insurers 23 Motivations for Captives – _____ ______ requirements want to retain risk, but use a fronting insurer to meet third party requirements for certificate of insurance – Reduce risk ______ exposures with – unrelated business (primary or reinsurance) – other parents 24 Tax Treatment of Captives Tax Treatment – General legal principles risk ________ matters _________ boundaries matter 25 Tax Treatment of Captives – General cases _______ parent captive that only insures parent _______ parent captive with unrelated business – Sears: 99% unrelated business – Harper: 30% unrelated business Single parent captive with _____-______ transactions – Humana – Kidde 26 Risk Retention Groups Just like ______ _______ Pool liability exposures – 1981 - 1986: only products liability – after 1986: other liability exposures 27 Methods of Paying Retained Losses _______ Funds – Cash Flows – Dedicated assets Lines of credit & contingent equity Issue new ________ following a loss 28 Trends and Innovations in Loss Financing More _______ & ______ use of alternative market (captives, RRG, finite risk plans) Why? Theory Liability insurance crisis in mid-1980s Insurers’ response New policies with _______ retentions, _______ approach to risk management (basket or integrated policies) 29