PowerPoint - Social Enterprise Associates

advertisement

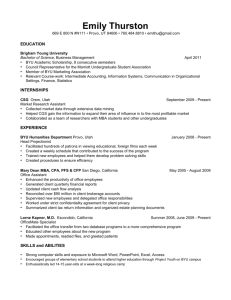

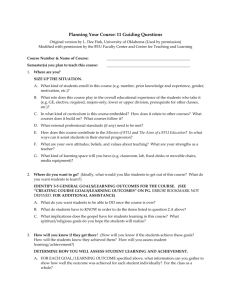

Microfinance & the Double Bottom Line: (Measuring Social Value for Microfinance & Microcredit with Education Programs) Drew Tulchin Social Enterprise Associates BYU Provo, Utah March, 2004 BYU - 3/04 Review of Paper • • • • • • • • The Problem Research Conducted Definitions Frameworks & Logic Models Measure for Microcredit with Education Application for Practitioners Next Steps Q&A Too much information, too little time BYU - 3/04 Acknowledgements This Research Owes Gratitude to: • Ford Foundation • BYU, Grameen Foundation USA, MicroCapital Institute, Mix Market & Prisma Microfinance • The many individuals who have provided feedback & support: Dr. Monique Cohen, Erica Mills, David Myhre, Wendy Prosser, Andrew Ralph, David J. Satterthwaite, Anton Simanowitz, Didier Thys, Dr. Joseph Tulchin, Dr. Koenraad Verhagen, Dr. Gary Woller & Many Others BYU - 3/04 Introduction Who are you? How familiar are you with microfinance, ‘SRI’ & the Double Bottom Line? Who am I? Drew Tulchin, Social Enterprise Associates A network of professionals making communities better by applying business skills & sustainable practices. BYU - 3/04 The Problem • 3 billion people in poverty (live < $2 / day) • Demand exceeds supply (< 10% demand met) – Microcredit Summit 67 mil. clients – Potential aggregate portfolio value $5-7 bil. • Few MFIs financially self-sufficient (1-10%) • Not enough donor funds ($.5 to 1 bil. / year) How can MFIs serve self-reliant entrepreneurs to achieve ‘massification’ as sustainable making an impact on poverty alleviation? BYU - 3/04 Research Conducted • Outgrowth of other work, ‘subsidized research’ • Interviews: more than 30 investors, 30 practitioners & 20 DBL / SR specialists – still ongoing • MFI literature Review & Catalogue • Investigation of SR, DBL & related literature outside of MFI industry • Applied action research. Share findings w/ others, get new ideas, revise, disseminate… BYU - 3/04 First Findings 1. NOT necessarily socially scientific validity E.g. NCAA College Basketball rankings 2. Client motivated activities & program 3. Manager-centric tools & solutions • • • • • BYU - 3/04 Reduce cost Increase accessibility Apply information in decision-making Enable local, self-reliant organizations Encourage BYU Interns Continuum of Return Expectations Donations BYU - 3/04 Morino Institute, Blended Value Proposition Investment Value of Social Return Broadly • • • • What is its function? Enhance impact measurements Marketing / PR Tie to Socially Responsible Investment (SRI) Mobilize new investment/sources of cash into microfinance Specifically • • • • Who is social return for? Use by managers in decision-making Segment interested investors. Craft tailored messages to SRI, use social return for some Consider social benefits from financial inputs (investment) BYU - 3/04 Impact Framework United Way’s Logic Model Org.’s Mission Activities Outputs Outcomes Effect, impact & measurement related back to MISSION BYU - 3/04 Source: United Way & Kellogg Foundation Community Goal Double Bottom Line Framework Track Social & Economic Value Creation Input (Investment) Activities Outputs Outcomes Effect, impact & measurement related back to INPUT as a return ratio BYU - 3/04 Source: Soc. Ent. Assoc Microfinance and the Double Bottom Line, Ford Foundation Impact Double Bottom Line Measurement Goals • • • • Develop an industry metric & apply it uniformly Establish comparables (apples to apples) Aggregate Data (industry totals, vs. other sectors) INTERNAL audience: – • Easy to use, add value to operations EXTERNAL audience: – Easy to understand, add meaning to investment decision &/or evaluation SROI operating on two fronts: 1) 2) BYU - 3/04 R&D to develop better & social science valid standards Use existing available data for best use Double Bottom Line Measurement Goals • • • • Develop an industry metric & apply it uniformly Establish comparables (apples to apples) Aggregate Data (industry totals, vs. other sectors) INTERNAL audience: – • Easy to use, add value to operations EXTERNAL audience: – Easy to understand, add meaning to investment decision &/or evaluation SROI operating on two fronts: 1) 2) BYU - 3/04 R&D to develop better & social science valid standards Use existing available data for best use Measurement - Discount Model Alternative Investment: Financial Return BYU - 3/04 5% Financial Return 10% Bank Total Return: 5% Social Return 10% MFI 10% Measurement - Value Added Model Social Return Education 3% Social Return Microcredit Financial Return Total Return: BYU - 3/04 3% 3% 5% 5% 5% Bank MFI 5% 8% MFI-Microcredit with Education 11% Application for Practitioners • Learn from others: don’t reinvent the wheel – Impact Assessment, Other industries • • • • Avoid decision paralysis, take a first step Use information MFI already captures Examine collected data Consider all client ‘touch’ opportunities – Talk to your client, Listen to what they say & Respond • Emphasize institution’s competitive advantage • Remember DBL is a tool (and only one tool) BYU - 3/04 Next Steps Responsibility of the entire industry / movement: • • • • Increase MFI DBL Dialogue Bring in other allies (i.e. BYU & community) Motivate more activity (like Call for Papers) Measure what you can, build a tool – Version 1.0 ok, don’t wait for perfection – Disseminate widely; transparently • Measure Donors’ & Investors’ activities, too – Continue this process ‘upstream’ • Facilitate increased investment – Use DBL for marketing & PR BYU - 3/04 Q&A Thank you! Drew Tulchin Social Enterprise Associates www.SocialEnterprise.NET drew@SocialEnterprise.NET BYU - 3/04