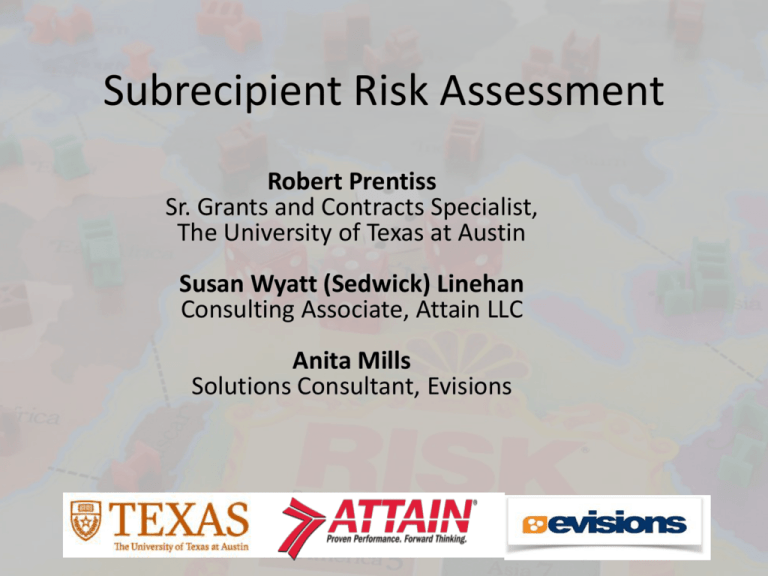

Session 23: Subrecipient Risk Assessment and Monitoring in the

advertisement

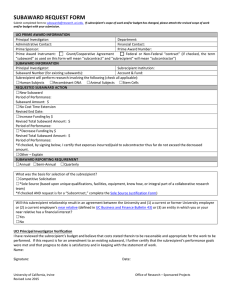

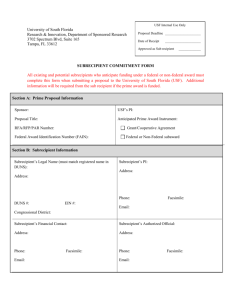

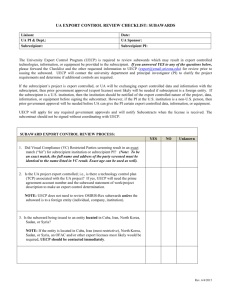

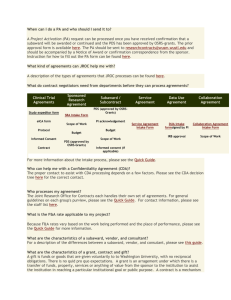

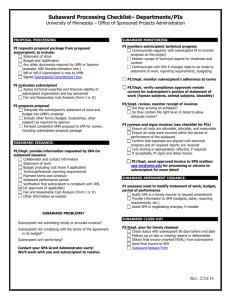

Subrecipient Risk Assessment Robert Prentiss Sr. Grants and Contracts Specialist, The University of Texas at Austin Susan Wyatt (Sedwick) Linehan Consulting Associate, Attain LLC Anita Mills Solutions Consultant, Evisions Accountability Timeline 2009 False Claims Act and Fraud Enforcement and Recovery Act (FERA) 2006 FFATA Signed 2007 2009 ARRA 2010 FFATA Reporting 2014 Digital Accountability and Transparency Act of 2014 Omni Circular Recent Finding Criminal Charges Fraud Happened Institution Allegations 2014 2008-2009 Morgan State NSF Grant – Paid personal expenses and work never completed - Facing 20 year 2013 2006-2009 University of Maryland P-card Fraud and paying Fake Companies 2011 1999-2009 Florida State University Fraudulent Contracts on NSF grant 2006 2001-2002 UMass and Yale Overstate cost on subcontracts UG Sub Risk Assessment Requirements • §200.331 requires an evaluation of each sub’s risk of noncompliance – Prior experience – Results of previous audits including project specific – New personnel or substantially revised systems – Existence of other Federal awards – Other considerations are allowed §200.110 Effective/Applicability • For awards with incremental funding under UG, subaward flow down will need to be addressed. • Agencies have the option of considering incremental funding actions under the UG on previously issued awards to be opportunities to change award terms and conditions with the first increment issued on or after 12/26/14. Subrecipient Risk Assessment The FDP has been developing a questionnaire to assess subrecipient risk. UT-Austin has been using draft versions of the questionnaire for over a year. We’ve got enough data to start drawing some conclusions about how it works in practice. The FDP RAQ The Risk Assessment Questionnaire (RAQ) consists of fifteen unscored (yes/no) questions, and thirteen scored questions. Of the scored questions, six are related to the institution, and seven are project-specific. The FDP RAQ There are some ambiguities in the questions, but the questionnaire is intended to be fairly straightforward and easy to complete. The more difficult questions are: What does the score mean? What should be done with the score? Institutional Questions Maximum Score 1) Location 9 2) Type of organization 6 3) Negotiated IDC rate agreement 3 4) Audit results 6 5) Maturity 6 6) Conflict of interest experience 6 36 Project Questions Maximum Score 1) Prime sponsor type 8 2) Prime award type 6 3) Subaward amount 3 4) Percent of prime award 9 5) Human or animal subjects 9 6) Scope of work and deliverables 6 7) Place of performance 6 47 Subaward A Subrecipient is a large public university in Texas. Prime award is a research grant from a large federal agency. Subaward A Institutional Questions 1) 2) 3) 4) 5) U.S. based institution University Negotiated IDC rate Satisfactory A-133 audit 10+ years subrecipient experience 6) Conflict of interest experience Score 0 0 0 0 0 0 0 Subaward A Project Questions 1) 2) 3) 4) 5) 6) Routine granting agency Grant Outgoing funds > $650,000 25%-49% of prime award No human/animal subjects Responsible for tangible products 7) All work at subrecipient institution Score 0 0 3 3 0 1 0 7 Subaward A Institutional Score 0 Project Score Total Score 7 7 Subaward B Subrecipient is a non-profit research organization. Prime award is a cooperative agreement from a large federal agency. Subaward B Institutional Questions 1) 2) 3) 4) 5) U.S. based institution Non-profit Negotiated IDC rate Satisfactory A-133 audit 10+ years subrecipient experience 6) Conflict of interest experience Score 0 4 0 0 0 0 4 Subaward B Project Questions 1) 2) 3) 4) 5) 6) More stringent federal sponsor Cooperative agreement Outgoing funds > $650,000 0-24% of prime award No human/animal subjects Continuation funding tied to sub performance 7) Some work at prime institution and in the field Score 4 2 3 0 0 6 4 19 Subaward B Institutional Score 4 Project Score Total Score 19 23 Subaward C Subrecipient is a small company. Prime award is a contract from a state agency. Subaward C Institutional Questions 1) 2) 3) 4) 5) Score U.S. based institution Industry No IDC requested No audit 5-9 years subrecipient experience 0 6 0 6 2 6) No conflict of interest experience 6 20 Subaward C Project Questions 1) 2) 3) 4) 5) 6) State sponsor Contract Outgoing funds $150,000 - $649,999 Over 50% of prime award No human/animal subjects Responsible for tangible products 7) All work at subrecipient institution Score 4 6 2 9 0 1 0 22 Subaward C Institutional Score 20 Project Score Total Score 22 42 Quantifying Risk The FDP questionnaire was designed with the assumption that risk of subrecipient noncompliance is always multifaceted. No single factor would cause a subaward to be considered high risk. Quantifying Risk Like most quantifications of complex ideas, the score can be accurate, but not precise. Accuracy vs. Precision An example: walkscore.com 2900 Guadalupe Street 4300 Avenue H The Approach Subawards will be grouped into pools of low, moderate, and high risk. The Approach Moderate and high risk subawards will receive an additional, comprehensive review at the pre-award stage. Non-quantifiable risks can be assessed and considered at this point. High risk subawards will be the focus of our post-award desk review program. Subaward scores at UT-Austin Institutional Score Project Score Total Score Average 4 8 12 Average Deviation 4 5 8 Number of subawards in each scoring range (total score) Institutional Score Correlations The maturity of the subrecipient correlates moderately with the type, indirect cost rate agreement status, and A-133 audit status. Less mature subrecipients tend to: a) be in industry b) not have a negotiated IDC rate agreement c) not have an A-133 audit Project Score Correlations Prime sponsor type correlates moderately with prime award type. Federal sponsors tend to award grants, while industry sponsors are more likely to award contracts. Correlations: a problem? We have much more quantifiable information about the project then we do about the institution. Domestic colleges and universities with clean A-133 audits almost always have an institutional score of zero. Subaward scores at UT-Austin Average Average Deviation Average + Average + 2 x Average Dev. Ave. Dev. Institutional Score 4 4 8 12 Project Score 8 5 13 18 Total Score 12 8 20 28 Subaward scores at UT-Austin Average Average Deviation Average + Average + 2 x Average Dev. Ave. Dev. Institutional Score 4 4 8 12 Project Score 8 5 13 18 Total Score 12 8 20 28 Review of subawards A, B, and C Subaward A Subaward B Subaward C Institutional Score 0 4 20 Project Score 7 19 22 Total Score 7 23 42 Review of subawards A, B, and C Subaward A Subaward B Subaward C Institutional Score 0 4 20 Project Score 7 19 22 Total Score 7 23 42 The Plan Moderate risk threshold will be set by the institutional and project scores. Moderate risk begins when the score equals the average plus the average deviation. High risk threshold will be set by the total score. High risk begins when the score equals the average plus twice the average deviation. Subaward scores at UT-Austin Average Average Deviation Average + Average + 2 x Average Dev. Ave. Dev. Institutional Score 4 4 8 12 Project Score 8 5 13 18 Total Score 12 8 20 28 Risk Pools Risk Pools Institutional Risk How much do scores vary over time? What will the institutional risk profile look like in 5 years? 10 years? How much follow-up work will desk reviews require? When will site visits be necessary? Institutional Risk Institutional Risk In order to mitigate institutional risk, thresholds will be reset every six months, based on the scores of the previous twelve months. Institutional Risk Current thresholds were set on January 1st: If they were reset today, they would be: Moderate Risk High Risk Moderate Risk High Risk Institutional Score 8 Institutional Score 8 Project Score 13 Project Score 12 Total Score 28 Total Score 27 Other Approaches Three institutions had responses to UTAustin’s methodology. We’ll refer to them as institutions X,Y, and Z. Institution X “Have you lost your mind?” Institution X We’ll take a much more straightforward approach. We’ll use a shorter, simplified version of the FDP questionnaire. We’ll set fixed thresholds based on our collective judgment and experience. Institution Y The total score should set the moderate risk threshold. The institutional and project scores should set the high risk threshold. Institution Z There should only be two risk pools: low and high. Total score will be the sole determinant. Additional questions will be added to better assess the risk of subawards issued from state prime awards. Institution Z Statistician: Nothing about the FDP questionnaire or UTAustin’s methodology is scientific. UT-Austin: We agree! It couldn’t possibly be at this point. But that doesn’t mean it’s not valuable. FDP/COGR From the June 2014 White Paper on the Uniform Guidance: A major issue of interest to Universities is the unnecessary and unproductive duplication of audit reviews and a pass-through entity’s inability to rely on auditor and federal agency management decisions for entities already subject to the A-133 process. The Problem No individual institution looks forward to a desk review that reveals significant problems with a subrecipient. But it’s in our collective interest to avoid unnecessary desk reviews of compliant institutions. The Solution Therefore our tools in assessing risk should be sharp, so that they may be used sparingly. The only way to improve them is to collect and analyze data about how our subrecipient risk assessments correspond with the results of our desk reviews. Questions How will your institution be conducting subrecipient risk assessments? What are your thoughts on the FDP questionnaire and UT-Austin’s implementation of it? Contacts Robert Prentiss rprentiss@austin.utexas.edu Susan Wyatt (Sedwick) Linehan ssedwick@attain.com Anita Mills Anita.Mills@Evisions.com