forecast instructions

advertisement

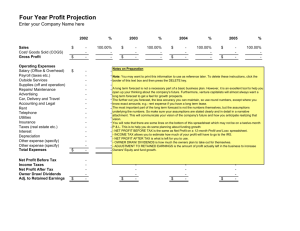

Instructions for completing the Forecast Form A separate forecast form is to be completed for your operating, P.I. fund centres and self-funded/internal centres. Both revenue and expenditure amounts are to be entered as positive numbers. Increases and decreases are to be entered as positive and negative numbers, respectively. Keep in mind there are exceptions. For instance, if your total expenses for a specific category is a number representing a recovery, it would be entered as a negative. Any errors in entering numbers will be identified when the form is balanced to FIS prior to entering forecasting numbers. Operating and Self funded/internal Centres Forecast Forms Use variant named OISEOPANDSF when completing the form for operating and self-funded/internal centres. Adjust date accordingly. The CRC accounts in the 100000 fund centre series should be treated as self-funded, while the research allowance in the 200000 fund centre series should be included in the PI fund centres forecast form. CURRENT BUDGETED AMOUNTS (columns 2 and 10) REVENUE 1. Run Divisional Income Statement Report using variant named OISEOPANDSF. Keep report open as it will be used again. 2. Enter Current Inc Budget in column 2, row A. EXPENDITURES Use the forecast form tool to determine current expenditure budget by category. Reminder: the tool is used only to determine current expense budget by categories on forecast form. 1. Run Budget to Plan Report to determine original budget. Use G/L descriptions to split into the categories on the Forecast form. 2. Run Budget Movement Report to determine all changes to date to original budget eg. transfers, supplements & returns. Allocate by category using the text description. 3. Use Budget Movement Report to identify carryforward – add to supplies and expenses category since it is difficult to allocate among categories, unless you are aware that funds have been designated to one of the other categories. 4. Place the total for each column into the proper cell on the forecast form as per the instructions on the bottom of the tool. COLUMNS 2 and 10 ARE NOW COMPLETED. REVENUE AND EXPENDITURES – ACTUAL YTD (columns 6 and 14) 1. Run Divisional Income Statement Report using variant named OISEOPANDSF. 2. Enter rev actuals in Column 6, Row A. 3. Enter supplies & expenses actuals in Column 14, Row F. Created on 21/09/2009 1 4. Drill down on the amount in the commitments column. Identify non-personnel commitments (personnel commitments are retrieved from the Payroll Distribution Report) and enter in supplies & expenses projected amounts in Column 15, Row F. REMINDER: Commitments/reserves are treated as forecasting numbers. ALL SALARY & BENFIT RELATED CATEGORIES 1. Download Payroll Distribution Report and sort by G/L. Delete G/Ls 801910 and 801920 since the benefit amounts are calculated based on individual. 2. Total fiscal and reserve salary columns and fiscal and reserve benefit columns by G/L. Enter fiscal salary and benefit totals into Column 14 cells based on the appropriate category. Enter reserve salary and benefit totals into Column 15 cells based on the appropriate category. 3. Run Divisional Income Statement Report using the OISEOPANDSF variant. Add the corresponding amounts in the Divisional Income Statement under headings ‘Acad Salaries, Teaching Stipends, Admin Salaries, Benefit (ext), Benefit (int) and Student Assistance’ which represent debit memo transactions involving salary and benefit G/Ls to the Payroll Distribution Report values mentioned above. NO ACCESS TO PAYROLL DISTRIBUTION? Run Funding fc or fund report. Drill down on expenditures and retrieve payroll actuals by G/L. AT THIS POINT ALL CURRENT BUDGET, ACTUALS YTD AND COMMITMENTS IN FIS ARE REFLECTED ON THE FORM. IT IS IMPORTANT TO ENSURE THAT THE FORM IS BALANCED TO FIS. TO DO THIS: 1. Run the Statement of Accounts and compare the current revenue and expense budget, actuals YTD and expense commitments. 2. The Statement of Accounts Report is more difficult to use in balancing to FIS if your form includes several individual fund centres. In this case, run the Divisional Income Statement report using the variant RECONCILIATION listing all individual fund operating/self funded fund centre and compare the current revenue and expense budget, rev and exp act YTD and expense commitments. This variant can only be used for reconciliation purposes since the current budget and expenditures are not allocated by category. 3. If they balance, then proceed to enter forecasting values in Columns 3, 4, 7, 11, 12 and 15. This may mean changes to columns 7 & 15. 4. The values for columns 5, 8, 9, 13, 16, 17 and 18 will automatically calculate. 5. Provide an explanation by category for the variances identified in Column 18 on page 2 of the forecast form. 6. Have the form authorized by your Chair/Unit Head. 7. Submit to the Finance Office by the due date. Created on 21/09/2009 2 P.I. FUND CENTRE FORECAST FORMS REMINDER: The CRC accounts in the 100000 fc series should be treated as self-funded. The research allowance in the 200000 fc series should be included in the PI fc’s form. 1. Run the Divisional Income Statement Report on the top fund centre of your hierarchy using variant OISEPIFUNDCTR. Adjust date accordingly. 2. Enter current revenue budget, current expense budget, revenue actuals ytd, expense actuals ytd and non personnel commitments into forecast form. The current expense budget should be entered in the Supplies & Expenses category unless you are aware the funds have been designated to one of the other categories. 3. Download Payroll Distribution Report and sort by G/L. Delete G/Ls 801910 and 801920 since the benefit amounts are calculated based on individual. 4. Total fiscal and reserve salary columns and fiscal and reserve benefit columns by G/L. Enter fiscal salary and benefit totals into Column 14 cells based on the appropriate category. Enter reserve salary and benefit totals into Column 15 cells based on the appropriate category. 5. Run Divisional Income Statement Report using the OISEPIFUNDCTR variant. Add the corresponding amounts in the Divisional Income Statement under headings ‘Acad Salaries, Teaching Stipends, Admin Salaries, Benefit (ext), Benefit (int) and Student Assistance’ which represent debit memo transactions involving salary and benefit G/Ls to the Payroll Distribution Report values mentioned above. 6. Run Divisional Income Statement Report using the variant RECONPI on the top fund centre of your hierarchy and compare the current revenue and expense budget, actuals YTD and expense commitments. This variant can only be used for reconciliation purposes since the current budget and expenditures are not allocated by category. 7. If they balance, then proceed to enter forecasting values in Columns 3, 4, 7, 11, 12 and 15 8. The values for columns 5, 8, 9, 13, 16, 17 and 18 will automatically calculate. 9. Provide an explanation by category for the variances identified in Column 18 on page 2 of the forecast form. 10. Have the form authorized by your Chair/Unit Head. Submit to the Finance Office by the due date. Created on 21/09/2009 3 APPENDIX A Glossary for EXPENSE categories Continuing academic salaries & benefits – include tenure/tenure stream and lecturer/senior lecturer appointment. For clarity, exclude sessionals. Non continuing academic salaries & benefits (including honoraria)– include contractually limited academic appointments (CLTAs), contract, sessionals, secondments, stipends, as well as honoraria Administrative salaries – include all appointed and non-appointed administrative salaries and benefits Student financial assistance – include teaching assistants, financial student assistance accounts, graduate assistants and TEPAS accounts administered by Dean’s Office and Student Services Supplies & Expenses – all other items not included in the other categories listed above and outstanding purchase orders REMINDERS: Both the old and new hierarchies will need to be included in your forecast. The forecast form and explanation of variance are to be reviewed by the Chair, Department/Unit Head. Please submit a hard copy of the form authorized by the Chair, Department/Unit Head to the Finance Office by the due dates indicated in the memo from the CAO. It is recommended that the Divisional Income Statement Report be run in RPT to avoid any run time problem. Created on 21/09/2009 4 APPENDIX B FORECASTING TIPS FORECASTING Identify trends from previous years Identify known situations and their impact on your accounts Make assumptions about future events eg. relatively the same as last year Forecast future expected revenues and expenditures on the basis of these assumptions. Examples of forecasted expenses Salary costs not yet encumbered eg. bi-weekly payments Mastercard charges Invoices not yet paid for merchandise/services already received Charges pending from other University departments eg. F&S, telephone, photocopier SUPPLIES AND EXPENSES Use the divisional Income statement report using the appropriate variant for the actual from the column called Supplies & Expenses. COMMITMENTS To determine outstanding commitments, run the Divisional Income statement report and drill down on the amount under commitments. Allocate the non-personnel commitments to the appropriate category. REMINDER: Commitment items are to be included in the forecast columns Created on 21/09/2009 5