Marketing and Business Development Plan 2008

advertisement

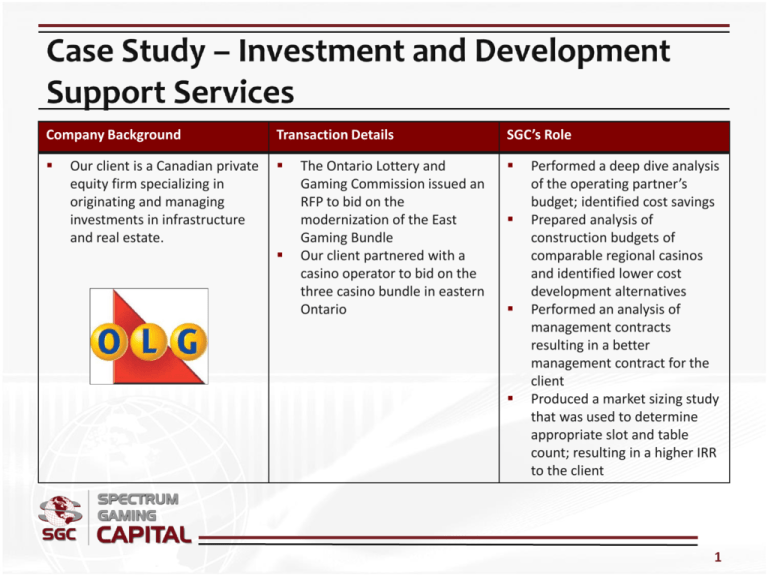

Company Background Transaction Details SGC’s Role Our client is a Canadian private equity firm specializing in originating and managing investments in infrastructure and real estate. The Ontario Lottery and Gaming Commission issued an RFP to bid on the modernization of the East Gaming Bundle Our client partnered with a casino operator to bid on the three casino bundle in eastern Ontario Performed a deep dive analysis of the operating partner’s budget; identified cost savings Prepared analysis of construction budgets of comparable regional casinos and identified lower cost development alternatives Performed an analysis of management contracts resulting in a better management contract for the client Produced a market sizing study that was used to determine appropriate slot and table count; resulting in a higher IRR to the client 1 Company Background Transaction Details SGC’s Role The City of Atlantic City is the second oldest gaming market in the U.S. with annual gross gaming revenue over $2.6 billion In 2013, Borgata Hotel Casino and Spa filed an appeal of its real estate taxes for the 2009 and 2010 fiscal years The tax court ruled in favor of Borgata, valuing the property at $875M, compared with the $2.3 assessed value, and awarded the company a $48M refund The property filed a subsequent appeal for the 2011-2013 fiscal years Prepared a 130-page expert report on the Atlantic City gaming market, Borgata relative to the competition and valuation of casinos Performed an in-depth valuation analysis of Borgata using multiple valuation methodologies Drafted a critical review of the analyses prepared by experts for Borgata Borgata settled the tax dispute at a valuation of $900M, up from the 2009-10 valuation despite continued declines in operating performance 2 Company Background Transaction Details SGC’s Role GMB Racing is a New Orleansbased horse training and racing stable Churchill Downs had engaged an investment bank to sell the company’s Fair Grounds Race Course & Slots in New Orleans, LA GMB Racing was an interested party in acquiring Fair Grounds SGC acted as M& A advisor to GMB Racing SGC prepared a financial analysis of Fair Grounds and performed in-market due diligence on the property and competition SGC structured a joint venture with an undisclosed gaming company to operate the casino GMB would operate the racetrack SGC advised the client on a fair value for the asset and prepared a term sheet to acquire the asset 3 Company Background Transaction Details SGC’s Role Station Casinos owns and operates locals-oriented Las Vegas casinos Station Casinos filed Chapter 11 in July 2009 SGC Advised a group of 13 banks, hedge funds and institutional investors on valuation relative to their collective $200M position in Station Casinos Senior Debt in restructuring Field work based review of Station’s properties, JV’s and land holdings to assess valuation Created independent projections for each property without assistance from property management Valued all other assets based on market comps or independently created projections Developed valuation arguments for counsel regarding IP value and propco/opco considerations. Increased settlement for investor group by 20% 4 Company Background Transaction Details SGC’s Role Harbinger Capital Partners is a private investment firm specializing in event/distressed strategies. Harbinger seeks investments that typically fall into the following four categories: 1) event; 2) distressed/bankruptcy; 3) value; or 4) corporate shorts Tropicana Entertainment filed Chapter 11 in May 2008 SGC principals’ advised Harbinger Capital on its large investment position in Tropicana Entertainment subordinated debt Performed in-market due diligence review of entire asset portfolio Competitive position Capex needs Operational efficiency Market outlook Created projections for each asset to build company model Assisted in restructuring strategy and negotiations 5 Company Background Transaction Details SGC’s Role Our client was a US hedge fund with large positions in high yield securities of Peninsula Gaming and French Lick Springs Resort Our client was seeking detailed valuation analysis of the individual casino properties secured by the securities Performed in-market due diligence review of each asset Competitive position Capex needs Operational efficiency Market outlook Created projections for each asset to build company models Reviewed and summarized bond indentures to assess valuation impact Established asset and company valuations relative to debt Concluded on valuation of bond investments that led to successful investment decisions 6