Small Business and Business Ownership

advertisement

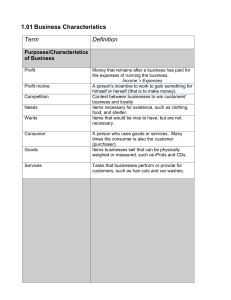

Small Business and Business Ownership Chapter 2 Small business and the US Economy Independently owned and operated w/fewer that 500 employees. Non-employer are self-employed Less than 4% of all income received from business transactions Employer businesses Account for 99% of all businesses 40% of all business income Starting a small business Three approaches Starting from “scratch” Risk of failure is high Must understand market: location, product/service offered, how much will be sold Must understand competitors’ market Buying an existing business Less risky Have current data on which to make decisions Franchise The buyer (franchisee) purchases the right to sell the good or service of the seller (franchisor). 90% success rate. Franchisor/Franchisee Relationship Franchisor: Known and advertised brand name Management skills Training and materials Method of doing business Franchisee: Investment Labor and capital Operations Agrees to follow the franchise contract. Advantages of Franchising The Explosive Growth of Franchising Worldwide (pg 13) Franchisee: Start a new business while buying an existing business Successful business model already developed Control of risks in External and Internal Business Environment Already have brand recognition and a fully developed product/service Access to business experts and management training Can purchase advertising and supplies through co-op with other franchisees Franchisor Ability to expand business without trouble of opening a new location. Able to delegate managerial and operational responsibility to franchisee Disadvantages of Franchising Operational control: Franchisor preserve brand recognition and unique characteristics Protect product quality Tendency to “micromanage” franchisee. Franchisee: Start up costs are high Must pay a percentage of sales (royalty) back to Franchisor Dependent upon other Franchisees upholding reputation Franchisor may compete with franchisee Evaluating Franchise Opportunities Name recognition and reputation Quality products? Franchisor’s experience How long has the company been franchising? Growth Steady growth or growth too fast? How many franchisees, especially in location Your investment Affordability? Can you afford to lose the start up cash? Do you need to borrow? Annual expected (realistically) income Your Knowledge, Skills, and Experience Training? Do you have previous experience in this area? Be wary of franchise brokers Broker represents franchisors, who are paying a commission Written documentation of expected earnings. Hire an accountant and/or lawyer to review documents Study the disclosure document After filing application for franchise, request and receive the franchisor’s disclosure document at least 14 days before any contract is signed. Document will include key sections pertaining to financial and legal history of franchise. Seek input from current and previous franchisees Most reliable way to verify franchisor’s claims Seek professional help Contact franchise associations The importance of a Business Plan Business Plan: formal written plan that clearly explains every aspect of your business. Missions/Goals Strengths/Weaknesses Market Analysis Break Even Analysis Components of a Business Plan Executive Summary Concise overview of the nature and organization of the business, the rationale for opening it, and why the business will be a success. Business Description Business Purpose, goals, and how these will be achieved. Name of business Contact information Analysis of industry Form of business ownership Who are your “ideal” customers? What is your competitive advantage? Ethical issues and social responsibility Management and Operation Plan SWOT analysis Strengths Weaknesses Opportunities Threats Mission Statement Business goals Management team Organization structure Physical layout Operational scenarios Etc. Human Resource Plan Personnel Job descriptions and specifications Compensation and incentives Corporate culture Leadership Training and prof. dev. Marketing plan Who is your ideal customer? Analysis of competition • Financial Plan • • • • • Revenue Expenses Financing the business Balance Sheet/Income Statement Break Even Analysis • Appendix Key to Success? Market Demand Business failure is often due to a lack of understanding of the marketplace. Location Need to know the characteristics of customer and locate where they are! Zoning laws are crucial. Lack of managerial experience Incompetence and managerial mistakes are often listed at top of lists of reasons why a business fails. Insufficient capital to grow the business Including poor control over cash flow and expenses. Cash flow: the net amount of cash and cash-equivalents moving into and out of a business. Financing the Small Business Venture Capital Company: group of investors that pool their capital to invest in companies with rapid growth potential in return for owning part of the company (equity position). must have high profit potential Angel Investor: Wealthy individual who will provide a business with capital in exchange for equity in the company. “Shark Tank”. Angel Investors • You tube: Shark Tank Tree T Pee Governmental Sources Small Business Investment Company (SBIC): investment company that borrows money from the Small Business Administration solely for the purpose of investing or lending to small businesses. Minority Enterprise Small Business Investment Company (MESBIC): finances business owned by minorities. Microloans: makes small loans (under $35,000) to people such as single mother and public housing tenants CDC/504 Loans: long-term, fixed rate financing for expansion or modernization. Private, non-profit that works through the SBA. Assistance for Small Businesses SCORE: Service Corps of Retired Executives: retired executives that work with small businesses. Website with wealth of info for small businesses. ACE: Active Corps of Executives: ran by executives who are still working. SBI: Small Business Institute: college and university students and instructors work with small businesses on specific problems. SBDC: Small Business Development Center: consolidates information from various disciplines for small businesses. Why start your own Business? Want to be small and stay small More satisfying relationships with employees, clients, vendors, etc. Becomes an integral part of the community where it resides Ability to adapt quickly to changing business environment Disadvantage: risk of failure due to lack of capital. Small size usually equals limited financial resources and lack of access to capital market By deciding to stay small, the owner limits the potential of the business. The Role of the Entrepreneur More of a mindset: Love innovation Have a wide vision of where they want to go A strong desire to be successful and make money Love to idea of creating employment opportunities Willing to accept a higher level of risk. Skills Entrepreneurs need: Need to be alert to changes in their everyday environment Have a wild enough imagination to see how the changes can alert them to other possibilities Deep belief in their ideas and believe in the importance of their ideas Research everything they need to know about fulfilling their ideas, their dreams. Self disciplined; task oriented; hard workers. Very demanding out of themselves and others. Not for wimps! Women-owned business—pg 20 Internet Based Small Business Appealing because it’s easy and has a low cost However: Must follow federal privacy laws enacted by the Federal Trade Commission Must know how to properly collect and pay any applicable state sales and use tax which are applicable in the state where the customer resides. Must understand rules and regulations that apply for exporting to foreign countries. Become familiar with the federal laws regulating advertisement and marketing online. Must follow Digital Millennium Copyright Act that protects the copyright of intellectual property owners whose work is transmitted or used over the internet. May need to hire a consultant who specializes in online retailing. Using Social Media Affiliate Marketing: A common marketing strategy for increasing sales and customer loyalty is to reward customers for referrals. Widget: a small piece of software from the retailer’s web page that is placed on the customer’s social media page. When a friend clicks on the widget and buys, the customer is rewarded. Research: engage current and potential customers in a conversation about a product or service. Provides relevant information that assists a cutomer in making a purchase. Types of Business Ownership Sole Proprietorship: One person owns and operates Easy to establish Simple structure Owner maintains a high degree of control Tax implications Income from business goes on owner’s personal tax return. Taxed only once Disadvantage: Lack of access to capital Owner is exposed to risk Personal assets may be seized to pay business debt. May cause personal bankruptcy Business succession if owner dies. General and Limited Partnerships General partnerships Each partner contributes financially, increasing the amount of capital available. Financial losses are shared in proportion to the investment Share in work and managerial duties Tax implications Income is included on personal tax returns of partners. Taxed only once. Liability—unlimited Personal assets can be seized to cover business losses. May cause personal bankruptchy Limited Partnership Partners have some limited liability in case of business failure. Are not allowed to manage the business. “General Partner” manages the business for all other partners. Has unlimited liability—may be personally liable for debts Paid a salary Participates in the profits and losses of the partnership Page 23: Why General Partnerships are a Liability Nightmare Corporation Legal entity that can act and have liability separate from the individuals who set up the corporation. Owners are “stockholders”. Only liable up to the amount of their personal investment. Chartered by the state government. In Indiana—through the Secretary of State’s Office Profit/Non-Profit Public/Private Ownership Advantages Limited liability Ease of raising capital through the sale of stock Continuity of the business. Lives beyond the lifetimes of the owners Disadvantages Legal: Charter, filing fees, additional expenses Tax implications: Taxed twice—first as a corporation and then on each individual stockholder’s income tax for the dividends received. May become inflexible; non-responsive to stockholders. Public corporations must publicly disclose financial information The “S” Corp Provides the protection of a corporation but taxed like a partnership. Under Subchapter S of Chapter 1 of the US Internal Revenue Code Conditions to meet: Have no more than 100 stockholders Shareholders must be individuals (not companies) who are citizens or permanent residents of the United States Offer only one class of stock (either common or preferred stock) Receive no more than 25% of corporate income from passive sources such as rent, royalties, or interest Disadvantages: Subject to IRS Code, which changes frequently May have a state corporation tax to pay Limited Liability Corporation Liability of each owner is limited to the amount that each invests Option of being taxed like a partnership or corporation Not limited on membership Must have an operating agreement Disadvantages LLC must be dissolved after 30 years (some states) Death of a member dissolves the LLC Flexible Cooperatives Same people who buy and use the products and services of the cooperative are the people who own and run it. Combine resources for mutual benefits in order to provide services Elect Board of Directors Surplus revenue is returned to the members in proportion to the member’s use of it, not in proportion to investment. Farmers use them a lot. Non-Profit Organizations Exist to provide services to the public, not to make a profit Any capital left after operating expenses are paid is funneled back into the non-profit. Exempted from income taxes Must apply to state for incorporation; must file with IRS to become a 501( c )3. Must be charitable, educational, scientific, religious, or literary Must meet other criteria as established by the IRS code. Merger/Acquisitions Merger: two or more companies become a single company Vertical: companies at different phases of the production process become one. Ex: Steel Dynamics buying scrap metal recycler Horizontal: companies in the same industry or companies involved in the same phase of a production process. Reduces competition and can reduce production costs by eliminating duplicate facilities and realizing economies of scale. Ex: Comcast and Frontier Conglomerate: highly diversified company made up of two or more corporations in different industries. Ex: Berkshire Hathaway owns MedPro, Dairy Queen and Geico Acquisitions: One company purchases the property and assumes the liabilities of another. The acquired company may keep its own identity. Leveraged Buyout: Merger or acquisition is accomplished by using borrowed money Business Plan Workbook • Well Functioning teams • Characteristics • Shared set of values and mutual respect for the perspectives and skills of each team member. • “group” vs “team” • Methods of communication • Face to face; virtual; email • When • What to cover • • • • Collaborative vs cooperative Team contract? Agenda/minutes/assignments Project schedule