Cost Reporting for the Georgia Medicaid School Based Services

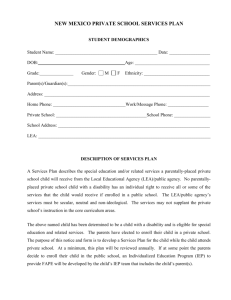

advertisement