View/Open

advertisement

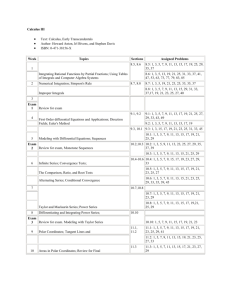

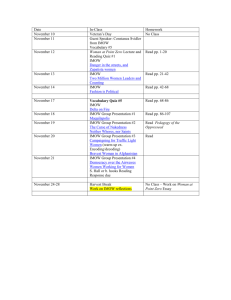

Economics 360 International Economic Problems Prof. Christopher Clague Adams Humanities 4181 Phone 594-5503 Home phone (858) 412-3251 (not after 9PM, please!) Office Hours: TTh 10:15-10:45 and 3:30-4:00 and by appointment Email: christopher.clague@gmail.com Required texts 1. James Gerber, International Economics, 5th Ed. (3-hole version $160,e-book $87) 2. A Course Reader containing exercises, tables, and a paper, “A Three-Good Model of International Trade,” by Prof. Clague. The exercises are an important part of the course, as they form one basis for the homework and the tests. (about $5) 3. MyEconLab is available to you through Blackboard. There will be weekly homework assignments on MyEconLab. Course Description and Scope: In this course, you will learn theories, policies, and institutions of international trade and finance. The purpose of this course is to construct an analytical framework for exploring international economic problems, to gain a fuller appreciation of the economic interrelationships that link nations and people, and to use this opportunity to become genuinely better informed about the world surrounding us. The course is divided into three parts. Part I, on international finance, deals with the foreign exchange market, exchange rate systems (fixed and flexible exchange rates), open economy macro, and international financial crises. Part II, on international trade, explains the theory of comparative advantage, the factor-endowments theory of trade, economies of scale and learning by doing as bases for trade, and the economics and politics of trade restrictions. These two parts provide the conceptual framework for discussing four regional topics in Part III: the European Union, the North American Free Trade Association, Latin American economic development, and the miraculous growth of East Asian countries. Grading Homework and quizzes In-class Exam 1 In-class Exam 2 In-class Exam 3 (Remedial Exam 25%) 25% 25% 25% 25% There are three in-class exams. Each in-class exam is worth 25% of your grade. There will be no make-ups. You have a chance to drop one of your in-class exams and take the remedial comprehensive exam in order to replace the one that you drop. I will only substitute your old grade for the new one if you have improved your score. The remedial exam is comprehensive and worth 25% as well. If you miss an exam for any reason, that will count as the exam that you drop and therefore, you must take the remedial comprehensive exam. You must take your exam at the scheduled time and place. Note that the exam dates below are not tentative – exams will be given in class on the days listed. Homework. MyEconLab homework assignments will typically be due on Wednesdays at 11:59PM. In-class quizzes will normally be on Thursdays. Class Date 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Jan17 Jan22 Jan24 Topic Introduction National Income Accounts BP Accounts; Foreign exchange market Jan29 Exchange Rates and ER systems Jan31 Exchange Rates and ER systems Feb 5 Open Economy Macro Feb 7 Money and the BP Choice of ER System Feb12 International Financial Crises Feb14 International Financial Crises Feb19 Review Feb21 Test 1 February 21 Feb26 Comparative Advantage Feb28 Comparative Advantage Mar 5 Trade and Factor Prices Three-Good Model Mar 7 Beyond Comparative Advantage Mar12 Beyond Comparative Advantage Mar14 Tariffs and Quotas Three-Good Model Mar19 Tariffs and Quotas Mar21 Tariff Politics Mar26 Tariff Politics Mar28 Test 2 March 28 Spring Recess Apr 9 European Union Apr11 European Union Apr16 NAFTA Apr18 NAFTA Apr23 Latin America Apr25 Latin America Apr30 East Asia May 2 East Asia May 7 Test 3 May14 Final Exam 10:30-12:30 Tuesday, May 14 Chap 1 9 9 10 10 11 10, 11 Quizzes MyEc Reader Tests Lab Exd 1 H0 2 Quiz 1 H1 4, 5 Quiz 2 H2 H3 12 6 7 8, 9, 9a 10 H4 Test 1 3 11 H5 4 5 3, 12 Quiz 3 H6 13 6 H7 14 7 H8 15 Test 2 14 16 H9 13 17 H10 15 18 Quiz 4 H11 16 19 H12 Test 3 Final Exam Learning Objectives Part I: International Finance. You will learn how the international economy in represented in the national accounts and the balance-of-payments accounts. I present the items in the balance of payments as elements of the supply of and demand for foreign exchange. In our newly globalized world, the behavior of the macro economy is strongly affected by international trade and capital movements, and we shall see how monetary and fiscal policies work in this environment. We shall consider the choice of exchange-rate systems (flexible rates, temporarily pegged rates, truly fixed rates, common currency) for the United States and other economies. Finally, we look at recent international financial crises: how they originated, how they might be prevented, and how to cope with them when they occur. Part II. International Trade. You will deepen your understanding of the concept of comparative advantage (which you already learned in your principles course). We’ll explore the basics of the factor-endowments theory, a well-developed body of theory that attempts to explain both the causes and consequences of trade and factor movements on the level of income and its distribution. The important message of this theory is that, while trade generally increases real national income, it has strong effects on factor prices and hence income distribution. However, there are other reasons why countries engage in international trade and foreign direct investment, such as economies of scale and learning by doing, and trade based on these phenomena does not have strong effect on factor prices. We shall also examine the effects of trade restrictions on national income and its distribution, and the politics of trade restrictions. While economists regard trade as generally beneficial, they recognize that in the presence of market failures trade restrictions can increase national and sometimes even global welfare. Part III. Regional Issues. The concepts and theoretical tools developed in Parts I and II will inform our analysis of the issues of economic integration and economic development. The Europeans have accomplished an extraordinary amount of economic integration with large economic benefits and some tensions and conflicts among the countries and between economic interests within the countries. They are now struggling to maintain a common currency in the face of severe financial strains. The North American Free Trade Association aims at much less integration than the European Union but still has generated both economic benefits and political tensions between and within countries. An important issue for both these regional groupings is, how much coordination of economic policies (say, with regard to labor market regulation and social welfare expenditures) is required for economic integration to be successful? Economic development is very powerfully affected by the opportunities and challenges offered by international trade and investment. The Latin American countries, with abundant natural resources, pursued industrialization through import substitution, while the East Asian countries, densely populated and with meager endowments of natural resources, have become industrial exporters on a massive scale. Why have some of the East Asian countries catapulted themselves from poverty to developed-country status, while the Latin American countries have generally not narrowed the gap between themselves and the economic leaders? We shall discuss how economic policies related to international trade and investment contribute to the explanation of these different outcomes.