Incomplete Credit Markets and Commodity

advertisement

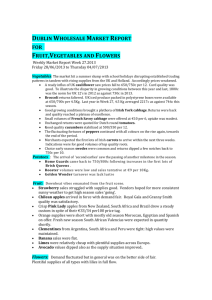

Incomplete Credit Markets and Commodity Marketing Behavior Emma Stephens (Pitzer College) and Chris Barrett (Cornell University) May 1, 2009 seminar Lafayette College Motivation The “Sell Low, Buy High” Puzzle • In developing countries, sharp seasonal grain price fluctuations are common. • Few farmers take advantage of the resulting arbitrage opportunity. • Indeed, many agricultural households do the opposite: “sell low and buy high”. … Why? Hypothesis Hypothesis: Puzzling commodity marketing patterns arise due to a ‘displaced distortion’ from missing credit markets (Barrett 2007). Liquidity-constrained farmers use commodity markets as if they were a source of seasonal credit. The resulting terms of trade losses are akin to an interest rate on a seasonal loan. Hypothesis Competing explanations: Need to rule out alternative explanations: – Impatience /inferior returns to grain storage • Unlikely. Bank deposit rate 5%, seasonal maize price increase 44%. – High cost of storage and social taxation • Unlikely. Inexpensive storage technologies widely used commonly limit losses to 1-2% … improving storage would yield far higher returns than “sell low, buy high”. – Price risk • But price risk aversion should generally lead to precautionary storage as hedging behavior. Conceptual model Conceptual behavioral model: Representative agricultural household both produces and consumes basic grain. Chooses consumption, production and storage so as to maximize intertemporal utility, defined over seasons, with (i) time-varying grain prices, (ii) transactions costs to market participation, (iii) possible liquidity constraints (plus the usual time and budget constraints). Conceptual model Seasonal Household Market Participation In the absence of binding liquidity constraints: - Grain supply and demand functions in each season are a function of current and expected future prices. - Transactions costs generate a price band and householdspecific shadow price … some households buy, others sell, others autarkic. - Given exogenous seasonality in prices, demand increases (decreases) in the post-harvest (hungry) period due to low (high) prices. - With constant transactions costs, if household participates in market, it should be canonical arbitrage: buy low (postharvest period) and/or sell high (lean period), smoothing consumption and maximizing intertemporal welfare. Conceptual model Seasonal Household Market Participation With binding liquidity constraints post-harvest: - Post-harvest grain demand falls. - Yet can no longer smooth consumption across seasons … kinked Euler function means household optimally stocks out in post-harvest. Consumption no longer a function of expected future prices, just current. More likely to sell, even with low prices. - Having stocked out post-harvest, have to buy in lean season to survive, in spite of higher prices. - Result: sell low, buy high behavior. When liquidity constraints bind, expected future prices and income no longer condition current choices. Arbitrage disrupted even though households recognize price seasonality. Conceptual model Behavioral predictions: Standard: - Sales (purchases) increase (decrease) with market prices. - Sales are increasing in productive assets (land, education) Novel: - Greater income and credit access reduces (increases) the probability of harvest period grain sales (purchases) and of lean season purchases (sales). Estimation strategy Challenges: - Transactions costs and shadow prices unobserved. - Market participation behaviors correlated within and across seasons for a given household. Need systems estimator allowing for different parameters for season and market participation regime. - Transaction volume decisions not independent of (discrete) household market participation choice. Potential for sample selection bias. - Transaction volume censored. Estimation strategy Approach: Use Yen’s (2005 AJAE) multivariate sample selection model (MSSM), a switching estimator for censored demand systems: - system of 4 (binary) market participation and 4 (censored) marketed quantity equations: one each for harvest/lean season purchase/sale Marketed quantity Discrete market participation Log(qs,ni) = xsn,i’βsn+υsn,i if zsn,i’αsn+μsn,i > 0 =0 if zsn,i’αsn+μsn,i ≤ 0 where n = season, n = sale or purchase, μ, υ ~ MVN(0, ∑) with ∑ the 8x8 covariance matrix Estimation strategy Key independent variables: Operationalize liquidity constraints using: - Credit access … instrumented due to endogeneity using a probit identified using distance measures - Off-farm cash income Identification: We identify the discrete participation (selection) equations using fixed transactions costs Data Survey data 2005 survey by Tegemeo Institute N=1682 households in western Kenya Choice-based sample (corrections made) Monthly purchase and sale volumes and prices, July 2004-June 2005. We discretize this into two seasons: harvest (July-January) and lean (February-June). Credit use and standard household data. Data Maize is staple crop. Rudimentary, rainfed cultivation of, on average, only 2.3 acres. Simple at-home storage, average value KSh859 (~US$12). Yet 87% report no maize storage losses and mean loss for rest is <8%. 80% of households had no stored maize at the time of survey. Data Buy low/sell high is most common pattern (49.7%) for those with seasonal net sales … average loss: 29.3%. Canonical intertemporal grain arbitrage rare (2% ) Marketing Regime (Harvest-Lean) Net Buyer-Net Buyer Autarkic-Net Buyer Net Seller-Net Buyer Autarkic-Autarkic Net Seller-Autarkic Autarkic-Net Seller Net Seller-Net Seller Net Buyer-Net Seller Net Buyer-Autarkic Frequency 550 327 300 165 114 79 73 38 36 % of sample (non-weighted) 33 19 18 10 7 5 4 2 2 N=1682 100 Data Liquidity Binary indicator of credit obtained, whether for nonagricultural (typically consumption) purposes or for agricultural inputs. Access highly limited, only 28.5% get it. Credit use is a highly imperfect proxy, but the only one available in these data. Supplement with off-farm cash earnings (salary and self-employment). Instrument for credit access using distance measures to local markets and services. Simple first-stage probit to predict credit access. Standard results: credit increases with income, education, longevity in village, etc., decreases with distance. Results With respect to the liquidity variables of interest, effects generally consistent with our core hypothesis. - Credit use associated with reduced likelihood of harvest season sales and lean season purchases and with increased likelihood of hungry season purchases. - Credit use and off-farm income associated with increased purchase volumes (conditional on purchasing) in both seasons. -Magnitude of credit/off-farm effects generally similar. - Only odd result: off-farm income associated with reduced likelihood of harvest season purchases. Results Corrected standard errors in parentheses. Results With respect to conventional explanatory variables, effects are as one would predict: - Purchase volumes decreasing in price, sales volumes increasing in price. - Probability of maize sales (purchases) increasing (decreasing) in land owned and sales volumes increasing in land holdings. - Value of storage facilities has no statistically significant effects on marketing patterns. Results Cross-equation correlations also intuitive: - Correlation of entry and purchase decisions for same season and marketing position – analogous to an inverse Mills ratio – are strongly positive. Households in the market transact more than a randomly selected household. - Maize purchase volumes strongly negatively correlated with likelihood of sales in either season. - Strongly positive interseasonal correlation in both sales and purchases volumes. No significant correlations between purchase and sales volumes. Conclusions - Yen’s MSSM works well in tackling this complex market participation behavior estimation problem. - Liquidity constraints and seasonal “quasiborrowing” seem the bestexplanation of the “sell low, buy high” puzzle. Inferior returns, high storage costs and price risk seem implausible causes. - Financial market failures spill over into commodity markets by inducing stock-outs and breaking of standard intertemporal arbitrage conditions. Damages small farmers’ ability to accumulate agricultural profits and invest. Thank you for your time, interest and support! 21 Harvest Season Market Participation 35 Purchases region (p*>mp+t.c.) 30 qt ( p*t , E t p*t 1 ) latent supply Market Price (Ksh/kg) 25 20 mp+t.c. region Autarkic shadow prices, p* market price (mp) mp-t.c. 15 10 c ( pt ,Yt ( )) =liquidity constrained demand c( p*t , E t p*t 1 ,Yt , E tYt 1 ) latent demand 5 Sales region (p*<mp-t.c.) 0 5 10 15 20 Quantity (kg) 25 30 35 Lean Season Market Participation 35 q (p ) L L =liquidity constrained supply Purchases region (p*>mp+t.c.) 30 qt ( p*t , E t p*t 1 ) latent supply Market Price (Ksh/kg) 25 20 mp+t.c. region Autarkic shadow prices, p* market price (mp) mp-t.c. 15 10 Sales region (p*<mp-t.c.) 5 c( p*t , E t p*t 1 ,Yt , E tYt 1 ) latent demand 0 5 10 15 20 Quantity (kg) 25 30 35