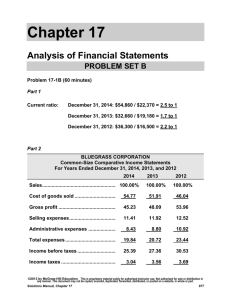

Free Sample - Find the cheapest test bank for your text

advertisement