Federal Accountability Act - Financial Management Institute of Canada

advertisement

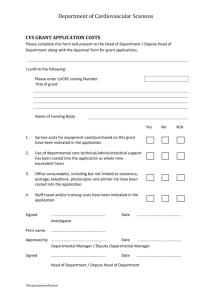

Federal Accountability Act: Implications By Bill Matthews May 2008 What is important to departments? Context 1. 2. 3. 4. 5. 2 Departmental management – Accounting Officer model – Public Servants Disclosure Protection Act Personal obligations – Conflict of Interest Act – Lobbying Act – Fraud offences and penalties Human resources – Public Service Employment Act amendments Program activities / Business lines – Grant & contribution programs – Procurement – Public Opinion Research Reporting and Access to Information – Requests from Parliamentary Budget Officer – Access to Information Act amendments Context 1. 2. 3. 4. 5. 6. 3 Numerous changes occurring in the financial management environment in the Federal Government; Independent Audit Committees; Internal Control Certification; CFO Model Audited departmental financial statements; Accrual appropriations; Quarterly Financial Statements? Departmental management The Accounting Officer Model • Deputy Ministers and heads of government institutions are designated as accounting officers for their respective organizations • Legal obligation to appear before parliamentary committees and answer questions relating to: 1. the measures taken to organize resources to deliver departmental programs in compliance with government policy and procedures 2. the measures taken to maintain effective systems of internal control 3. the signing of the departmental accounts 4. the performance of other specific duties assigned by law or regulation in relation to administration of the department • 4 However, this obligation is set within the context of the Minister’s management and direction of the department and his or her accountability to Parliament Accounting Officer Model: Tools and Strategies Compliance with Policies #1. The measures taken to organize resources to deliver departmental programs in compliance with government policy and procedures Scope – Key Questions and Tools • • 5 How do I know what I am supposed to be compliant with? – Clarify accountabilities through Policy Suite Renewal Initiative – Three Reviews: • Blue Ribbon Panel on Grants and Contributions “Web of rules” • Review on Procurement Practices initiatives • Financial Management Review How do I know if I am compliant? – The Management Accountability Framework (MAF) – Investments in Functional Communities – Investments in Oversight Mechanisms Accounting Officer Model: Tools and Strategies Systems of Internal Control and Signing the Accounts #2. The measures taken to maintain effective systems of internal control Scope – Key Questions and Tools • How to ensure an effective system of internal controls? – MAF: • Stewardship Element – Investments in Functional Communities #3. The signing of the departmental accounts Scope – Key Questions and Tools • 6 Assurance with respect to signing the departmental accounts: – Audited financial statements – New accreditation standards for Chief Financial Officers (CFOs) and Chief Audit Executives Departmental management Overview of Public Servants Disclosure Protection Act (PSDPA) • • • • • 7 PSDPA strives to achieve an appropriate balance between the two principles of freedom of expression and duty of loyalty to the employer PSDPA applies to all persons employed in public sector including agencies, separate employers and parent crown corporations (CF, CSIS, CSE excluded) Commitment in Preamble to a Charter of Values of Public Service PSDPA requires that: – TB adopt a Code of Conduct for the federal public sector – Chief executives establish organizational codes consistent with TB code – Bargaining agents be consulted in developing the TB code PSDPA gives mandate to Minister responsible for Canada Public Service Agency (CPSA) to promote ethical practices and a positive environment for disclosing wrongdoings in the public sector Departmental management Public Servants Disclosure Protection Act [cont] • New regime imposes significant obligations on chief executives, including: – Ensuring employees are aware of legislation, how it works and protection available – Designating senior officer, and establishing mechanisms and procedures for internal disclosures – Protecting employees in disclosure process from reprisals, ensuring confidentially of information and protecting identities as possible – Permitting employees access to Public Sector Integrity Commissioner, responding to PSIC’s recommendations and taking corrective action where necessary – Making information about disclosed wrongdoing accessible to the public – Reporting annually to CPSA on all disclosures of wrongdoing 8 Personal obligations Conflict of Interest Act • Few changes for public office holders, but greater scrutiny for all • COIEC can self-initiate examinations • Public can bring complaints, through a MP, against any public office holder • Minor administrative breaches could be subject to administrative monetary penalties and publication Lobbying Act • 5-year ban on lobbying for designated public office holders – includes former DMs, Associate DMs, ADMs and similar rank, Ministers • Breaches subject to criminal proceedings and fines • Confirmation of meetings with registered lobbyists may be requested by the Commissioner 9 Personal obligations Fraud offences and penalties • New indictable offence of fraud involving public money by public servants managing it • Maximum penalty of: – Five years and a fine of $5,000 for a fraud of $5,000 or less; – Fourteen years and a fine equal to the amount of the fraud for a fraud of more than $5,000 • Inability to contract with the government, or to hold a government office, for those convicted of the offences 10 Human resources Public Service Employment Act amendments • Remove priority appointment process for ministers’ staff, but allow those with 3 years of consecutive service to apply for internal public service competitions for up to one year • Give the GIC authority to appoint special advisors to Ministers 11 Program activities / Business lines Grant and contribution programs • Requirement for review every five years of relevance and effectiveness of all departmental programs • Expansion of AG’s “follow the money” powers – Amended definitions of “funding agreement” and “recipient” expands class of recipients of grants, contributions and loans into which AG can inquire about use of funds and conduct performance audits to assess value for money – Authority to make regulations to include deemed terms in contracts respecting provision of information or records to AG about the use of those funds • Authority to make regulations to include deemed terms in contracts prohibiting payment of contingency fees as part of a contract to any person to whom the Lobbying Act applies 12 Program activities / Business lines Procurement • Legislated commitment to fairness, openness and transparency in the bidding process for contracts • Procurement Ombudsman to be appointed at PWGSC to review procurement practices of departments to assess fairness, openness and transparency • Authority to make regulations to include deemed terms in contracts: – Respecting corruption and collusion in the bidding process – Requiring bidders on contracts to make declarations they haven't committed specific offences – Requiring public disclosure of basic information on contracts in excess of $10,000 Public Opinion Research • Library and Archives of Canada Act requires all departments to send final written POR reports to LAC • Every POR contract must contain term that a written report is to be provided • Authority to make regulations prescribing form, content and public release of contracts and reports 13 Reporting and Access to Information Parliamentary Budget Officer (PBO) • PBO may request any financial or economic data in possession of department Access to Information Act amendments • New requirement to make every reasonable effort to assist requestor, without regard to identity • New discretionary exemption for internal audit drafts/working papers for up to 15 years • Time limit for making complaints clarified to 60 days • New requirement for annual report on Ministers’ offices expenses • Amended discretionary exemptions regarding potential financial injury as a result of release of information, to include harm’s test on the basis of a government institution as well as government as a whole 14 General Implications • • • 15 Federal Accountability Act is not a new rulebook for public sector management – It is largely a codification of existing practices, conventions and policies Most changes impacting public sector are related to increasing transparency about government management: – New reporting requirements around meetings with lobbyists – Conflict of Interest Act requirement for reporting public office holders to publicly disclose recusals from discussions, decisions, debates or votes – Establishment of Parliamentary Budget Officer – Expansion of Access to Information Act coverage – Establishment of Procurement Ombudsman However, new reality for management accountability and government transparency, along with need for balance between rules and flexibility – TBS continues efforts to clarify expectations, decrease transactions and reduce reporting requirements Impacts on Financial Management Function • Accounting Officer = more attention on financial information; • Support for audit committees and departmental financial statements growing; • More questions (PBO , Audit Committees); • An already heavy workload is growing- questions about capacity 16