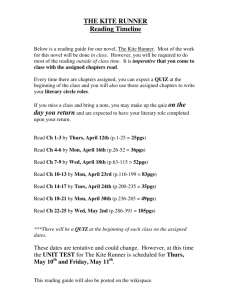

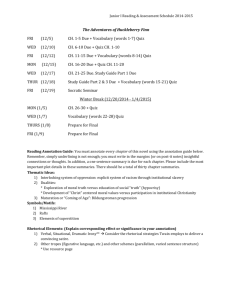

BUSG 1370 - Personal Financial Planning

advertisement

SAIGONTECH Course Syllabus BUSG 1370 - Personal Financial Planning 1. Class : PFP Semester : Summer 2015 2. Instructors Instructor: Office: Tel: Mobile: Email: Lâm Hữu Hoàng Phúc Room 604 – SaigonTech Tower (08) 3715 5033 (ext. 1619) 0943 77 83 86 phuclhh@saigontech.edu.vn 3. Campus and Room Location with Days and Times Venue:Room 204 – SaigonTech Tower Time: Mon and Wed 9:45 – 11:45 4. Course Semester Credit Hours (SCH): 3 5. Total Course Contact Hours: 48 6. Type of Instruction: Lectures 7. Course Description This course introduces students to basic principles of finance applied in family and personal financial planning and mangement. Topics include financial planning, tax planning, asset management, credit, insurance, investment basics, securities markets, retirement and estate plans. 8. Course Prerequisite(s): There is no prerequisites to this course. 9. Course Student Learning Outcomes (SLOs) Program Students’ learning Outcomes 1. Identify essential management skills necessary for career success. 2. Describe the relationships of social responsibility, ethics, and law in business. 3. Construct a business plan. 4. Examine the role of strategic human resource planning in support of organizational mission and objectives. 5. Describe the impact of corporate culture and atmosphere on employee behavior. Course Students’ learning Outcomes 1. Understanding basic concepts and using techniques in the personal financial planning process (Program SLO # 1, Chapter 1 – 4) 2. Understanding various aspects of money management: cash, credit card, and consumer loans (Program SLO # 1, Chapter 5 – 8) 3. Understanding different kinds of insuance and knowing how to use them to protect oneself (Program SLO # 1, Chapter 9 – 10) 4. Understanding and managing the investment process. Asset classes 1 Learning Objectives covered: stocks, bonds, and other alternatives (Program SLO # 1, Chapter 11 – 15) I. Understanding basic concepts and using techniques in the personal financial planning process 1. Describe the five basic steps of personal financial planning 2. List ten principles of personal finance. 3. Calculate level of net worth or wealth using a balance sheet. 4. Analyze income statement. 5. Analyze financial ratios 6. Implement a financial plan or a budget plan 7. Understand and perform calculations of time value of money 8. Identify and understand the major federal income tax features that affect all taxpayers. Chapter 4 1.9 Estimate your income taxes. II. Understanding various aspects of money management: cash, credit card, and consumer loans 1. Manage your cash and liquid assets. 2. Know how credit cards work. 3. Know the determinant of credit worthiness 4. Understand the various consumer loans. III. Understanding different kinds of insuance and knowing how to use them to protect oneself 1. Determine life insurance needs and design a life insurance program. 2. Design a health care insurance program and understand what provisions are important. 3. Describe disability insurance and available choices 4. Understand, buy, and maintain homeowner's insurance in a costeffective way. IV. Understanding and managing the investment process. Asset classes covered: stocks, bonds, and other alternatives 1. Know how to manage risk in investments. 2. Identify and describe the primary and secondary securities markets. 3. Know how to trade securities using a broker. 4. Know how read stock quotes online or in the newspaper. 5. Determine the value of stocks. 6. Describe different investment strategies. 10. Textbook Personal Finance: Turning Money into Wealth, 5th (Global) Edition (2009) By Keown, Arthur J., Pearson. ISBN: 978-0-13-607776-3 11. Course Requirements Make-up policy Make-up test is not allowed. If any class session is canceled, the instructor will discuss with the students to arrange a make-up class. Attendance and Withdrawal Policies Please read information about attendance and withdrawal policies on SaigonTech website: http://www.saigontech.edu.vn/saigontech/english/general_academic.jsp?subid=37#6 12. Instructor’s Requirements Classroom policy 2 Please be seated before lecture begins, and don't leave early without prior permission since it is very distracting to me and your classmates. Arriving late or leaving early will count as half of an absence. Because it is distracting to other students and to me, you should keep mobile phones off/silent, and not carry on private conversations. Being active in class discussions and asking questions are highly encouraged. To make best use of our scarce time, do NOT study for another exam, work for another class, play games, or surf the Internet. If you are caught red-handed, you will be dismissed from the class and your attendance for that class will be ABSENT. It also reduces your participation grade. Do not close your books or rustle your papers to signal the end of class. Pack up only when I say I have done. Academic Honesty Students are responsible for conducting themselves with honor and integrity in fulfilling course requirements. Penalties and/or disciplinary proceedings may be initiated by SaigonTech officials against a student accused of scholastic dishonesty. Please read my PowerPoint on “Cheating and Plagiarism” and the following policies for more details about Academic Dishonesty Policy: Acts of plagiarism include but are not limited to: Submit other people’s works to get points (Nộp bài làm của người khác để lấy điểm cho mình). Copy words or ideas without citing source and author’s name (Sao chép từ hoặc ý tưởng củangười khác mà không nêu nguồn tài liệu và tên tác giả được trích dẫn). Do not use quotation marks for direct citation (Không đặt dấu ngoặc kép trong các trích dẫn nguyên văn). Cite the wrong source (Đưa thông tin sai về nguồn của một trích dẫn). Change the wording but sentence structure without citing author’s name (Thay đổi từ ngữ nhưng vẫn giữ nguyên cấu trúc câu của một nguồn tài liệu mà không nêu tên tác giả). Borrow words/ phrases from a source without using quotation marks or with making negligible change (Vay mượn từ/ cụm từ của một nguồn tài liệu mà không đặt dấu ngoặc kép hoặc chỉ thay đổi chúng một cách qua loa). Copy too many words or ideas that make up the most of personal work, regardless of whether source and author’s name are cited (Sao chép quá nhiều từ ngữ hoặc ý tưởng từ một nguồn tài liệu làm cho các ý tưởng đó chiếm phần lớn bài làm của mình, bất kể có nêu tên nguồn hoặc tác giả hay không) Copy information from Internet such as company information, market information etc. (Sao chépthông tin từ Internet (thông tin công ty, thông tin thị trườngv.v) Use Google Translation to write up papers, regardless of whether you use your own ideas or borrow ideas (Sử dụng Google Translation để viết bài, bất kể là ý tưởng của bản thân hay vay mượn). Use Google Translation to write up papers by translating Vietnamese from existing Vietnamese study materials/ sources into English (Sửdụng Google Translation để dịch thông tin từ nguồn tài liệu tiếngViệt sang tiếng Anhvà đưa vào bài làm của mình). Other Student Information: Refer to SaigonTech’s website at www. saigontech.edu.vn for other students rights and responsibilities at the school. 13. Grading Policies 3 An Incomplete may be given only for extenuating circumstances (i.e. family illness, accident, and an unforeseen event occurring at exam time). The grading policy is summarized below: Course Grading 1) Quiz (quantity: 12, mode: individual) 2) Participation 3) Mid-term exam 4) Final exam 5) Presentation Total 24% 10% 20% 30% 16% 100% Grading Scale A 90 – 100 B 80 – 89 C 70 – 79 D 60 – 69 0 – 59 F The passing grade of this course is D. 1) Quiz (individual, closed book, only calculator accepted) Each student must attend the class to take the quizzes. If he/she is absent, there is no other opportunity to make up. Mark of 0 will be given if not taking the quiz. Specific time and date for the quizzes are specified in the course calendar. The duration of each test is 10 minutes. There are 12 quizzes in total. The quizzes will be provided in order to test students’ knowledge about the materials provided in the previous lectures and to help students be prepared before mid-term and final examinations. The results and feedbacks will be received at the next class. 2) Examination Format (individual, only calculator accepted) Exam Midterm Endterm Type MCT Application No. of questions 60 2 MCT Application 60 2 Points 60 40 60 40 90 Chapters Mode Duratio n Reading time 1, 2, 3, 4, 5, 7, 8, 9, 10 Closed -book 120 mins 5 mins 11, 12, 13, 14, 15 Closed -book 120 mins 5 mins 3) Participation (individual): Participation mark depends on your diligence and activeness. To get full mark (10%), you have to attend all 24 class-sessions and be very active in the class. 4) Presentation (individual): Make your personal financial plan. 14. Course Calendar: Week Date Mon Jun 15 2015 1 Mon Jun 22 2015 Recommended Readings Course introduction – Assignments Chapter 1: The Financial Planning Process. Quiz 1 Wed Jun 17 2015 2 Content Rich Dad Poor Dad Chapter 2: Measuring Your Financial Health and Making a Plan Quiz 2 4 Wed Jun 24 2015 Mon Jun 29 2015 3 Chapter 3: Understanding the Time Value of Money Quiz 3 Chapter 4: Tax Planning and Strategies Quiz 4 Wed Jul 01 2015 Chapter 7: Using Consumer Loans: The Role of Planned Borrowing Quiz 5 Mon Jul 06 2015 4 Chapter 8: The Home and Automobile Decision Mon Jul 06 2015 Quiz 7 Wed Jul 08 2015 Mon Jul 13 2015 Wed Jul 15 2015 Chapter 10: Property and Liability Insurance. 5 Mon Jul 20 2015 7 Chapter 09: Life & Health Insurance Chapter 11: Investment basics Quiz 8 Chapter 12: Securities markets Mon Jul 27 2015 Quiz 9 Wed Jul 29 2015 Mon Aug 03 2015 9 Wed Aug 05 2015 Mon Aug 10 2015 Vietnam's Laws on Social Securities MIDTERM EXAM Wed Jul 22 2015 8 10 Chapter 5: Cash and Liquid Asset Management Quiz 6 Wed Jul 08 2015 6 Vietnam's Laws on Personal Income Tax Bodie – Kane – Marcus Finance Investments (Chapter 2, 3) Aswath Damodaran Relative valuation Chapter 13: Investing in stocks investopedia.com Guide to Stock-Picking Strategies Quiz 10 investopedia.com Bond Basics Chapter 14: Investing in bonds and other alternatives Quiz 11 Chapter 15: Mutual Funds: An Easy Way to investopedia.com Advanced Bond Concepts investopedia.com Choosing quality mutual funds 5 Diversify Quiz 12 Wed Aug 12 2015 11 12 Mon Aug 17 2015 Wed Aug 19 2015 Mon Aug 24 2015 Wed Aug 26 2015 Chapter 18: Fitting the pieces together FINAL EXAM Presentation 6