npv_timevalue

advertisement

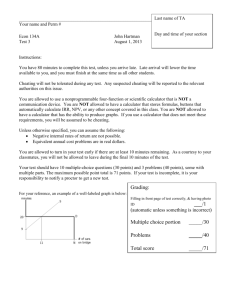

1 P.V. VISWANATH FOR A FIRST COURSE IN FINANCE 2 NPV and IRR How do we decide to invest in a project or not? Using the Annuity Formula Valuing Mortgages and Similar payment plans Valuing Simple Financial Securities 3 The NPV decision rule says: Accept a project if NPV>0. There is another decision rule based on the Internal Rate of Return (IRR). The IRR is the rate of return that makes the NPV = 0. To understand what the IRR is, we can use the concept of the NPV profile. The NPV profile is the function that shows the NPV of the project for different discount rates. Then, the IRR is simply the discount rate where the NPV profile intersects the X-axis. That is, the discount rate for which the NPV is zero. 4 Suppose we are looking at a new project and you have estimated the following cash flows: Year 0: Year 1: Year 2: Year 3: -165,000 (required initial investment) 63,120 70,800 91,080 Suppose the required rate of return is 12%. Then we can compute the NPV as the sum of the discounted present values of these cashflows. NPV = -165000 + 63120/(1.12) + 70,800/(1.12)2 + 91080/(1.12)3 = 12,627.42 If we use different discount rates, we will get different NPVs, as shown in the next graph. 5 70,000 60,000 50,000 NPV 40,000 30,000 20,000 10,000 0 -10,000 0 0.02 0.04 0.06 0.08 0.1 0.12 0.14 0.16 0.18 0.2 0.22 -20,000 Discount Rate Clearly, the IRR decision rule corresponding to the NPV rule is: Accept a project if the IRR > Required Rate of Return. 6 Present Value – earlier money on a time line Future Value – later money on a time line 100 100 100 100 100 0 1 2 3 4 5 100 6 If a project yields $100 a year for 6 years, we may want to know the value of those flows as of year 1; then the year 1 value would be a present value. If we want to know the value of those flows as of year 6, that year 6 value would be a future value. If we wanted to know the value of the year 4 payment of $100 as of year 2, then we are thinking of the year 4 money as future value, and the year 2 dollars as present value. 7 Interest rate – “exchange rate” between earlier money and later money (normally the later money is certain). Discount Rate – rate used to convert future value to present value. Compounding rate – rate used to convert present value to future value. Required rate of return – the rate of return that investors demand for providing the firm with funds for investment. This is from the investors’ point of view. The higher the rate of return available, the more investors are willing to supply. Cost of capital – the rate at which the firm obtains funds for investment; this is from the firm’s point of view. The lower the rate that firms have to pay, the more funds they will demand since more investment projects will meet the hurdle rate of return, i.e. the cost of firms’ funds. The total amount of funds that will be lent will be equal to the amount at which the investors’ required rate of return will equal the amount that the firms is willing to pay. Hence in equilibrium, the cost of capital will be equal to the investors’ required rate of return. Opportunity cost of capital – the rate that the firm has to pay investors in order to obtain an additional $ of funds, i.e. this is the marginal cost of capital. This is the rate that investors demand from this firm because if the firm doesn’t pay this this much, they can get that return from other demanders of capital. 8 If capital markets are in equilibrium, the rate that the firm has to pay to obtain additional funds will be equal to the rate that investors will demand for providing those funds. This will be “the” market rate. Hence this is the single rate that should be used to convert future values to present values and vice-versa. Hence this should be the discount rate used to convert future project (or security) cashflows into present values. 9 Suppose you invest $1000 for one year at 5% per year. What is the future value in one year? The compounding rate is given as 5%. Hence the value of current dollars in terms of future dollars is 1.05 future dollars per current dollar. Hence the future value is 1000(1.05) = $1050. Suppose you leave the money in for another year. How much will you have two years from now? Now think of money next year as present value and the money in two years as future value. Hence the price of one-year-from-now money in terms of two-years-from-now money is 1.05. Hence 1050 of one-year-from-now dollars in terms of two yearsfrom-now dollars is 1050(1.05) = 1000 (1.05)(1.05) = 1000(1.05)2 = 1102.50 10 FV = PV(1 + r)t FV = future value PV = present value r = period interest rate, expressed as a decimal T = number of periods Future value interest factor = (1 + r)t 11 Simple interest Compound interest The notion of compound interest is relevant when money is invested for more than one period. After one period, the original amount increases by the amount of the interest paid for the use of the money over that period. After two periods, the borrower has the use of both the original amount invested and the interest accrued for the first period. Hence interest is paid on both quantities. This is why if the interest rate is r% per period, then a $1 today grows to $(1+r) tomorrow and $(1+r)2 in two periods. (1+r)2 = 1+2r+r2 . The 2r is the “simple” interest for each of the two periods and the r2 = r x r is the interest for the second period on the $r of interest earned in the first period. This computation is done automatically when we use the formula FV(C in t periods) = C(1+r)t 12 From Brealey, Myers and Allen, “Principles of Corporate Finance” 13 From Brealey, Myers and Allen, “Principles of Corporate Finance” 14 Suppose you invest the $1000 from the previous example for 5 years. How much would you have? FV = 1000(1.05)5 = 1276.28 The effect of compounding is small for a small number of periods, but increases as the number of periods increases. (Simple interest would have a future value of $1250, for a difference of $26.28.) 15 Suppose you had a relative deposit $10 at 5.5% interest 200 years ago. How much would the investment be worth today? FV = 10(1.055)200 = 447,189.84 What is the effect of compounding? Without compounding the future value would have been the original $10 plus the accrued interest of 10(0.055)(200), or 10 + 110 = $120. Compounding caused the future value to be higher by an amount of $447,069.84! 16 Suppose your company expects to increase unit sales of books by 15% per year for the next 5 years. If you currently sell 3 million books in one year, how many books do you expect to sell in 5 years? FV = 3,000,000(1.15)5 = 6,034,072 17 How much do I have to invest today to have some amount in the future? FV = PV(1 + r)t Rearrange to solve for PV = FV / (1 + r)t When we talk about discounting, we mean finding the present value of some future amount. When we talk about the “value” of something, we are talking about the present value unless we specifically indicate that we want the future value. 18 Suppose you need $10,000 in one year for the down payment on a new car. If you can earn 7% annually, how much do you need to invest today? PV = 10,000 / (1.07)1 = 9345.79 19 You want to begin saving for your daughter’s college education and you estimate that she will need $150,000 in 17 years. If you feel confident that you can earn 8% per year, how much do you need to invest today? PV = 150,000 / (1.08)17 = 40,540.34 20 Your parents set up a trust fund for you 10 years ago that is now worth $19,671.51. If the fund earned 7% per year, how much did your parents invest? PV = 19,671.51 / (1.07)10 = 10,000 21 For a given interest rate – the longer the time period, the lower the present value What is the present value of $500 to be received in 5 years? 10 years? The discount rate is 10% 5 years: PV = 500 / (1.1)5 = 310.46 10 years: PV = 500 / (1.1)10 = 192.77 22 For a given time period – the higher the interest rate, the smaller the present value What is the present value of $500 received in 5 years if the interest rate is 10%? 15%? Rate = 10%: PV = 500 / (1.1)5 = 310.46 Rate = 15%; PV = 500 / (1.15)5 = 248.58 23 PV = FV / (1 + r)t There are four parts to this equation PV, FV, r and t If we know any three, we can solve for the fourth FV = PV(1+r) t r = (FV/PV)1/t – 1 t = ln(FV/PV) ln(1+r) 24 You are looking at an investment that will pay $1200 in 5 years if you invest $1000 today. What is the implied rate of interest? r = (1200 / 1000)1/5 – 1 = .03714 = 3.714% 25 Suppose you are offered an investment that will allow you to double your money in 6 years. You have $10,000 to invest. What is the implied rate of interest? r = (20,000 / 10,000)1/6 – 1 = .122462 = 12.25% 26 Suppose you have a 1-year old son and you want to provide $75,000 in 17 years towards his college education. You currently have $5000 to invest. What interest rate must you earn to have the $75,000 when you need it? r = (75,000 / 5,000)1/17 – 1 = .172688 = 17.27% 27 Start with basic equation and solve for t (remember your logs) FV = PV(1 + r)t t = ln(FV / PV) / ln(1 + r) 28 You want to purchase a new car and you are willing to pay $20,000. If you can invest at 10% per year and you currently have $15,000, how long will it be before you have enough money to pay cash for the car? t = ln(20,000/15,000) / ln(1.1) = 3.02 years 29 Suppose you want to buy a new house. You currently have $15,000 and you figure you need to have a 10% down payment plus an additional 5% in closing costs. If the type of house you want costs about $150,000 and you can earn 7.5% per year, how long will it be before you have enough money for the down payment and closing costs? 30 How much do you need to have in the future? Down payment = .1(150,000) = 15,000 Closing costs = .05(150,000 – 15,000) = 6,750 Total needed = 15,000 + 6,750 = 21,750 Using the formula t = ln(21,750/15,000) / ln(1.075) = 5.14 years 31 The present value of an annuity can be calculated by taking each cash flow and discounting it back to the present, and adding up the present values. Alternatively, there is a short cut that can be used in the calculation [A = Annuity; r = Discount Rate; n = Number of years] A 1 PV of an Annuity PV ( A, r , n) 1 n r (1 r ) 32 The present value of an annuity of $1,000 at the end of each year for the next five years, assuming a discount rate of 10% is PV of $1000 each year for next 5 years 1 1 (1.10)5 = $1000 $3,791 .10 33 The reverse of this problem, is when the present value is known and the annuity is to be estimated - A(PV,r,n). Annuity given Present Value r = A(PV, r,n) = PV 1 1 (1 + r)n 34 Suppose you borrow $200,000 to buy a house on a 30-year mortgage with monthly payments. The annual percentage rate on the loan is 8%. The monthly payments on this loan, with the payments occurring at the end of each month, can be calculated using this equation: Monthly interest rate on loan = APR/12 = 0.08/12 = 0.0067 Monthly Payment on Mortgage 0.0067 = $200,000 $1473.11 1 1 (1.0067)360 35 The future value of an end-of-the-period annuity can also be calculated as follows(1 + r)n - 1 FV of an Annuity = FV(A,r,n) = A r 36 Thus, the future value of $1,000 at the end of each year for the next five years, at the end of the fifth year is (assuming a 10% discount rate) FV of $1, 000 each year for next 5 years (1.10)5 - 1 = $1000 = $6,105 .10 37 If you are given the future value and you are looking for an annuity, you can use the following formula: Annuity given Future Value r = A(FV, r,n) = FV (1+ r)n - 1 Note, however, that the two formulas, Annuity, given Future Value and Present Value, given annuity can be derived from each other, quite easily. You may want to simply work with a single formula. 38 Assume that you want to send your newborn child to a private college (when he gets to be 18 years old). The tuition costs are $16000/year now and that these costs are expected to rise 5% a year for the next 18 years. Assume that you can invest, after taxes, at 8%. Expected tuition cost/year 18 years from now = 16000*(1.05)18 = $38,506 PV of four years of tuition costs at $38,506/year = $38,506 * PV(A ,8%,4 years) = $127,537 If you need to set aside a lump sum now, the amount you would need to set aside would be Amount one needs to set apart now = $127,357/(1.08)18 = $31,916 If set aside as an annuity each year, starting one year from now If set apart as an annuity = $127,537 * A(FV,8%,18 years) = $3,405 39 You are trying to value a straight bond with a fifteen year maturity and a 10.75% coupon rate. The current interest rate on bonds of this risk level is 8.5%. PV of cash flows on bond = 107.50* PV(A,8.5%,15 years) + 1000/1.08515 = $ 1186.85 If interest rates rise to 10%, PV of cash flows on bond = 107.50* PV(A,10%,15 years)+ 1000/1.1015 = $1,057.05 Percentage change in price = -10.94% If interest rate fall to 7%, PV of cash flows on bond = 107.50* PV(A,7%,15 years)+ 1000/1.0715 = $1,341.55 Percentage change in price = +13.03% 40 A consol bond is a bond that has no maturity and pays a fixed coupon. Assume that you have a 6% coupon console bond. The value of this bond, if the interest rate is 9%, is as follows Value of Consol Bond = $60 / .09 = $667 41 A growing perpetuity is a cash flow that is expected to grow at a constant rate forever. The present value of a growing perpetuity is PV of Growing Perpetuity CF1 = (r - g) where CF1 is the expected cash flow next year, g is the constant growth rate and r is the discount rate.