Time Value of Money - The Ohio State University

advertisement

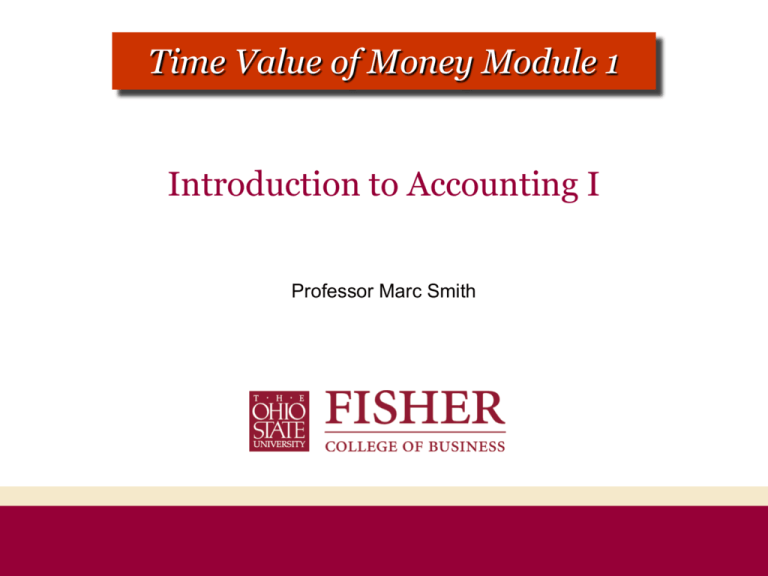

CHAPTER 1 MODULE 1 Time Value of Money Module 1 Introduction to Accounting I Professor Marc Smith Time Value of Money – Module 1 Measurement and recording of liabilities are based on the concept of the time value of money. Time Value of Money = Compound Interest Time Value of Money – Module 1 Compound Interest v. Simple Interest Simple Interest: P x R x T Earns interest on the principal invested. Compound Interest: Earns interest on both principal invested as well as all previously earned interest. Time Value of Money – Module 1 Four Time Value of Money Cases 1. Future Value of a Lump Sum 2. Present Value of a Lump Sum 3. Future Value of an Annuity 4. Present Value of an Annuity Time Value of Money – Module 1 In each of the four time value of money cases, you will need to make use of table factors. These table factors can be found on the course website. Please print the table factors from the website and have them available as you work through the modules for this chapter. If you look at the table factors, you will see that you need to know two variables in order to determine the correct factor to use. You need to know the number of periods (n) and the interest rate (i). The n is located in the left column of each table and the i can be found in the row at the top of each table. The intersection of the i and n is the table factor you will use to solve your problem. Time Value of Money – Module 1 In the future value of a lump sum case, we know the value of some amount today and we want to know the value at some point in the future. •How much will today’s dollar be worth in the future? Future Value = Present Value x Future Value Factor i,n ? TODAY FUTURE Time Value of Money – Module 1 Periods 5% 4 1.2155 5 1.2783 8 1.4775 10 1.6289 6% 1.2625 1.3382 1.5939 1.7909 8% 1.3605 1.4693 1.8510 2.1589 10% 1.4641 1.6105 2.1436 2.5938 Future Value = Present Value x FV Factor 10% | 5 Future Value = $10,000 x 1.6105 Future Value = $16,105 How much interest will Sandy earn over the five years? $6,105 ($16,105 - $10,000) Time Value of Money – Module 1 Question: What happened in part (a) that made our calculations easier? Answer: The interest was compounded annually. Compounding — the frequency with which interest is added to the principal. When interest is compounded in any way other than annually, you must make adjustments to the interest rate (i) and the time period (n). Time Value of Money – Module 1 Necessary adjustments to i & n i ÷ n x NOTE: # of compounds per year # of compounds per year These adjustments must be made in all time value of money cases. Time Value of Money – Module 1 Periods 5% 4 1.2155 5 1.2783 8 1.4775 10 1.6289 6% 1.2625 1.3382 1.5939 1.7909 8% 1.3605 1.4693 1.8510 2.1589 10% 1.4641 1.6105 2.1436 2.5938 Future Value = Present Value x FV Factor 5% | 10 Future Value = $10,000 x 1.6289 Future Value = $16,289 How much interest will Sandy earn over the five year? $6,289 ($16,289 - $10,000) Time Value of Money – Module 1 Periods 5% 4 1.2155 5 1.2783 8 1.4775 10 1.6289 6% 1.2625 1.3382 1.5939 1.7909 8% 1.3605 1.4693 1.8510 2.1589 10% 1.4641 1.6105 2.1436 2.5938 Future value factors can be calculated as follows: (1 + i) n Thus, the future value factor at 5% and 10 periods: (1 + .05) 10 = (1.05) 10 = 1.628895 In answering quiz and exam question, always use the table factors provided. Time Value of Money – Module 1 Question: As the compounding frequency increases, what happened to the future value? Answer: It increases. FV Annual Compounding FV Semi-Annual Compounding $16,105 $16,289 Question: Why does this happen? Answer: The more frequent the compounding, the more interest is earned on interest thus giving a higher future value.