Accounting Project Group Project: Madison L. Vestergaard David

advertisement

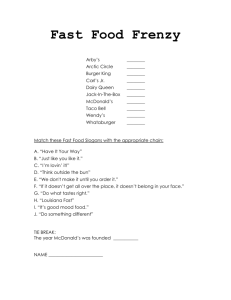

Accounting Project Group Project: Madison L. Vestergaard David Serkosky Emma Borson Ryan Griscom Alfredo Frausto I. 1. Looking through the percentage change in revenues for all of the selected restaurants, Wendy’s had the highest positive percentage change in revenue with 96.40%. The lowest percentage change in revenue was the Cheesecake Factory with -0.03%. Ruby Tuesday’s and Burger King both had a positive percentage change in revenues under 10%. Ruby Tuesday’s had an 8% change in revenue and Burger King had a 3.37% change in revenues. What was surprising was McDonald’s had a negative percentage change in revenues, with -3.30%. 2. The largest decrease in costs of goods sold was The Cheesecake Factory with a -5.37% decline. This could be a result of the economy’s downturn; they are not making as much money, therefore they would not have to buy as many goods. The next lowest was McDonald’s with -5.14%, because their inventory turnover ratio is very high at 145.83. Their business is very efficient and inventory surpluses are rare. However, the most surprising increase of costs of goods sold was Wendy’s. The percentage change was recorded at a 92.7% increase. The high percentage change in revenues is attributed to the company investing in more inventories. 3. The highest percentage change in income was Wendy’s with 102.6%. This is also a positive result of the global economic downturn. Even though they lost money in the previous year of 2008, this increase shows that Wendy’s has high customer retention, even in the toughest of times. Ruby Tuesday’s had the lowest percentage change in income at -32%. Revenue decreased because many loyal customers that they had no longer have the disposable income. 4. Burger King came out on top when we analyzed the percentage change in assets. With a 70% increase Burger King shows expansion through allocation of new properties and equipment. An example of this is present in Milford, CT when the newly renovated Burger King is now in business. The lowest was Ruby Tuesday’s. They decreased assets by -11.60%. 88% of their total assets were property and equipment and there was approximately a $103 million decrease in 2009 total assets because 54 out of their 933 restaurants closed. 5. The Cheesecake Factory has the highest asset turnover ratio at 1.55. This means the company is making $1.55 for every dollar in assets they have. This beats out the other selected restaurants; it is a higher quality restaurant, and holds to be true because comparatively, Ruby Tuesday’s attains the second highest asset turnover ratio, 1.11, and is also the second most expensive restaurant of all our chain restaurants. 6. McDonald’s dominated in the area of net profit margin. This is to say that the performance of McDonald’s is well done, and the expenses are controlled appropriately. They are documented at a 20.01% net profit margin. However, Wendy’s has the lowest recorded net profit margin. Because Wendy’s lost so much profit in 2008 (as a result of the economic downfall), they had a lot of ground to recover. 7. Again, McDonald’s is in lead with 91.57% gross profit percentage. What is surprising is that McDonald’s has the most affordable price structure and still manages to exceed Ruby Tuesday’s (78.47%), Burger King (35%), and The Cheesecake Factory (75.30%). Because of the income deficit of 2008, Wendy’s only had a gross profit percentage of 14.70%. This formula is relevant because even after considering cost of products sold, it informs us of the percentage of profit earned on each dollar of sales and whether they have developed strength or a weakness. Even though Wendy’s had the lowest gross profit percentage, it shows the company’s ability to come back from a low-earning fiscal year. 8. McDonald’s and Burger King have the highest return on equity. McDonald’s shows a 32.40% return on equity followed closely by a 20% return on equity from Burger King. Both companies’ stockholders are able to enjoy greater returns on invested dollars. Wendy’s, showing the lowest return on equity of .40%, shows that investor confidence with this company was shaken due to the loss of income during 2008. 9. The highest current ratio is 1.74 by Wendy’s. The current ratio has increased by 2010, suggesting that the company is adequate and able to pay current liabilities. Following the highest current ratio is McDonald’s with 1.1. Ruby Tuesday’s (.816), Burger King (.77) and The Cheesecake Factory (.16) all fall short of being able to quickly pay their short term obligations. 10. Ruby Tuesday’s receivable turnover was shockingly high. The receivable turnover was 200.47, while all others came in between 20-40. Ruby Tuesday’s does not provide information regarding inventory because the company only sells what is received by third-party suppliers. Therefore, this company has an especially high receivable turnover but a non-applicable inventory turnover. 11. Wendy’s and McDonald’s represent the highest inventory turnover. This shows that these two companies take advantage of their inventory to quickly and efficiently generate income. This is strength within both companies because the higher the ratio the faster the inventory is turned over. Both Wendy’s and McDonald’s had sales that allowed them to purchase new inventory multiple times during the year. 12. Debt-to-asset ratio shows a company’s debt position for that fiscal year. Potential lenders would prefer the debt to total assets ratio to be smaller because it would mean the company has the ability to repay its existing liabilities, or little financial risk. In the instance of The Cheesecake Factory, not many lenders would be in favor of this company in the year of 2009 because the debt-to-asset ratio was a high of 1.16, in comparison to the lower ratio of McDonald’s at .349. 13. Times interest earned tells us whether sufficient resources are generated to cover interest costs; a higher number means greater coverage. In 2009, McDonald’s attained the highest at 10.62 and Burger King had the lowest. This is strength for McDonald’s because it is capable of covering its interest charges up to 10 times before it lacks efficient coverage. This is good for its investors because it illustrates that McDonald’s can repay their investments. In Burger King’s circumstances, it tells us that they would not have enough money to cover their debts. II. Wendy’s: The Inventory turnover ratio was extremely high in comparison to the annual ratio report. This can be justified by the comeback that the company has gone through in the past year as a response to the economic downfall. Also, their return on equity was very low; the annual report was at a 19.39 and Wendy’s was recorded at .4. This means that the stockholders of Wendy’s Inc. will not enjoy great returns. We also noticed that the net profit margin for Wendy’s was very low at a .003 compared to the annual ratio report of 7.26. This can also be a consequence of the economy. Considering the $-365,086 recorded as net income in 2008, Wendy’s had a lot of ground to cover to replace that lost income. McDonald’s: Similar to Wendy’s records, the inventory turnover ratio is extremely high compared to the annual ratio report. This is because they sell so much of their product within the fiscal year at a higher rate than the average restaurant. A reason supporting this is because it is shown that McDonald’s pushes their dollar menu to sell more products at a cheaper price. McDonald’s also recorded a low net profit margin; even though McDonald’s does not meet industry standards, in the past three years they have reported significant net profit margin increases. In 2007, it was .1051, which increased to .1834 in 2008 and increased further in 2009 with an ending .2001 net profit margin. Ruby Tuesday’s: When looking at the numbers recorded for the 2009 fiscal year of Ruby Tuesday’s we found many of their numbers were very similar to the annual report with the exception of the return on equity and receivable turnover. The industry standards suggest a 19.39% return on equity and Ruby Tuesday’s recorded a 4.3%. Compared to the annual ratio report the total asset turnover for Ruby Tuesday’s is extremely high. The industry standards for the receivable turnover are 36.63 and Ruby Tuesday’s has a recorded 200.469 for receivable turnover. This shows that Ruby Tuesday’s receivables are turning over faster and more often during the fiscal year than that of industry standards. Burger King: For all of the other companies the return on equity and net profit margin were extremely low; however, Burger King’s numbers match up, almost exactly, to that of the annual ratio report. The net profit margin was 7.80% and the industry standard was 7.26%. This is a calculation shows that Burger King is controlling their expenses very well. The Cheesecake Factory: The numbers for the current ratio, inventory ratio, receivables turnover, and total asset turnover match up with the numbers on the annual ratio report. However, The Cheesecake Factory’s net profit margin was 2.6 compared to 7.26 on the annual report ratio. This shows The Cheesecake Factory is not controlling their expense as well as industry standards. The return on equity is the amount of income earned for every dollar of stockholder’s equity, for the Cheesecake Factory this is only 8.3% and on the annual ratio report the return on equity is 19.29%. Although this number is low compared to industry standards the return on equity ratio is rather high compared to other companies. III. Wendy’s, McDonald’s and Burger King have larger ratios as a result of their larger franchises. The most surprising number from Wendy’s was the percentage change in income. We have come to the conclusion that the losses in 2008 and the gains in income in 2009 is caused the percentage change in income. For McDonald’s the gross profit percentage was higher than any other company with 91.57%. We believe that this is through global expansion and acquisition of new markets. Receivable turnover for Wendy’s, McDonald’s, Burger King, and The Cheesecake Factory were consistent. The largest deviance was from Ruby Tuesday’s with 200.469. The reason for this large difference is because Ruby Tuesday’s inventory comes from third-party suppliers and is sold immediately. IV. We feel McDonald’s is a conservative investment. Showing consistency in gains for the past two years with the earnings share in 2009, recorded at 4.16 and in 2008, recorded at 3.82. That shows a .34 gain on the investment. Also, the return on equity has remained consistent, which shows stability with the investors’ money. 2009 reports a 32.4% return on equity and in 2008 a 32.2% return on equity. These similar numbers show that McDonald’s manages invested money properly. V. We would lend money to McDonald’s. They have a low debt-to-asset ratio; in 2009 it was a .349, which shows the lack of excessive debt. McDonald’s has substantially raised their net income through taking advantage of long-lived assets. The second reason is that their earnings per share have increased over the past year (McDonald’s is able to generate income). Lastly, their assets have risen in the past year. This is because of increase in global expansion and acquisition of new markets, showing an increase in profitability through operations.