Retail Distribution of Dairy Products

advertisement

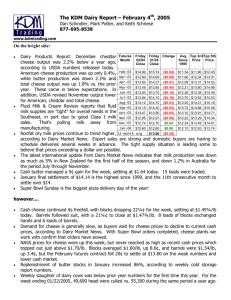

Retail Distribution of Dairy Products Bob Cropp Dairy Marketing and Policy Specialist University of Wisconsin-Madison April 2001 U.S. Milk Production & Commercial Disappearance, 1980 to 2000 170 Milk Production 160 Commercial disappearance 150 140 130 120 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 110 1980 Billion Pounds of Milk 180 BFP or Class III Milk Price versus the Support Price, 1970-2000 $19 Dollars Per Hundredweight $17 $15 $13 $11 $9 $7 $5 $3 Support price BFP/Class III price Utilization of U.S. Milk Production Product: Fluid milk Cheese Butter Frozen products Nonfat dry milk Other* 1990 2000 32% 41% 6% 8% 3% 10% 28% 47% 6% 8% 4% 8% * Milk proteins, lactose, nutritional beverages, etc. Per capita Fluid Milk Sales, 1990 – 2000 Pounds Year Plain Reduced Nonfat Flavored Total Whole lowfat 1990 85.6 98.3 22.9 9.4 219.7 1995 71.3 92.4 31.9 10.0 208.5 1999 68.3 87.1 33.2 11.9 201.9 Per capita consumption of manufactured dairy products, 1980 – 1999 Pounds Year Butter Amer. Other Nonfat Ice Lowfat Cheese Cheese dry cream ice milk cream 9.6 7.9 3.0 17.5 7.1 1980 4.5 1990 4.4 11.1 13.5 2.9 15.8 7.7 1999 4.8 13.0 16.8 3.0 16.8 7.9 U.S. Dairy Cooperatives and Their Share of Farm Milk Marketings Year Market Share 1950 Number of Cooperatives 2,072 1970 971 61% 1990 264 82% 1997 226 88% 1999 220 89% 53% Cooperatives' share of U.S. farm marketings 100 88 89 Percent of U.S. cash receipts 90 80 1982 1997 1999 77 70 60 50 43 40 36 38 36 34 30 29 29 30 27 20 19 18 20 13 11 12 10 0 Milk Cotton Grain Fruit & veg Livestock Total Dairy Cooperatives marketed most of farm milk to others as raw milk. • 61 % sold as raw milk and 39% processed and manufactured in co-op’s milk plant. • Dairy cooperatives are moving towards more value added activities. • Dairy cooperatives are entering into joint ventures with other cooperatives and public corporations. Dairy Cooperative Share of Manufactured Dairy Products, 1997 Dairy Product Butter Dry milk powder Cheddar cheese Other American cheese Mozzarella cheese Other Italian cheese Other cheese Total natural cheese Packaged (beverage) milk Market Share 61% 81% 70% 43% 26% 18% 9% 40% 14% Share of Dairy Products Sold Through Retail Stores • Fluid Milk 74% • Ice Cream 45% • Butter 36% • Cheese 40% Fluid Milk • Factors that have changed fluid milk distribution: 1) Glass bottle late 1800’s 2) Paper carton 1940’s 3) Plastic containers 1980’s • These changes forced small bottlers out of business - 10,000 bottlers in 1940 - Less than 300 today Distribution Method of Fluid Milk Products, 1983 – 1997 Distribution method: Home delivered Wholesale: Supermarkets Dairy/convenience Military Schools Other 1983 2% 98% 50% 10% 1% 7% 30% 1997 1% 99% 58% 10% 1% 6% 24% Distribution of Fluid Milk By Type of Container, 1973 - 1997 Type of container 1973 1985 1997 Glass 4% Paper 71% Less than 0.5% 34% Less than 0.5% 21% Plastic 25% 65% 79% Total 100% 100% 100% Fluid Milk Distribution By Size of Container Size of container 1973 1985 1997 Gallon 37% 60% 66% Half gallon 38% 22% 18% Quart 5% 5% 4% Pint 1% 2% 2% Half-Pint 10% 9% 9% Bulk – Over 5 5% 2% 1% Qts. Total 100% 100% 100% Since 1960’s, the balance of power for fluid milk has shifted from milk processors (dealers) to food retailers, primarily large supermarkets. • This is forcing bottlers to get bigger • Deans Foods and Suiza Foods have been active with acquisitions • Deans Foods (13% of market) and Suiza Foods (17% of market) on April 5 announced intent to merge. • Dairy cooperatives have entered into milk supply arrangements with major fluid companies. - Dairy Farmers of America with Suiza Foods - Land O’ Lakes with Deans Foods Top U.S. Foodservice Distributors, 1999 Company 1999 Sales (Bil. $s) 1999 Market Share Sysco Foods 17.4 13.3 Wal Mart 14.1 10.7 U.S. Food/Ahold 8.0 6.1 Alliant 6.1 4.6 XPEDX 2.9 2.2 Total 48.3 37.0 Top U.S. Supermarkets Company Wal Mart 2000 Sales 2000 (B $) Market Share 57.2 11.1 1993 Market Share 0.00 Kroger 49.2 9.6 6.0 Albertson’s 36.4 7.1 3.0 Safeway 33.2 6.4 4.0 Ahold USA 27.5 5.3 0.0 Total 203.5 40.0 13.0 Private label dominates the fluid milk business. • Percent Private Label White Milk 70.1% Flavored Milk 23.3% Natural Cheese • Cheese pricing relies on the Chicago Mercantile Exchange (CME) • CME operates 5 business days a week • CME prices change due to - A SALE at a different price - A BID at a higher price - AN OFFER at a lower price • About 2% of cheese actually sold on CME Number of U.S. Cheese Plants & Cheese Plant Capacity Year 1980: Plants Capacity 1999: Plants Capacity Total American Total Italian Total Natural Cheese Processed Cheese 483 4,918,750 187 5,255,000 737 62 27,640,200 197 153 376 18,155,100 20,540,000 52 46,705,300 Capacity is annual pounds of cheese per plant Distribution of Cheese Retail Food Service Food Processing 17% 40% 43% Unlike fluid milk, branded cheese dominates retail sales. • About 68% is brand cheese and 32% private label. • Kraft brand has 45% retail market share • Cooperatives not major brand sellers, but Land O’ Lakes brand is significant in delli sales. • In Food service, Leprino’s is world largest manufacture of mozzarella • Schreiber is major player in processed cheese-more than 50% sold to fast food chains, some to retail as private and brand. Butter: • The butter/powder industry that existed in the 1950’s and 1960’s no longer exists. • 50% of the butter produced in Wisconsin and California • 1975, 366 butter plants, today less than 100 • 36 dairy cooperatives make butter, 61% share. • Butter pricing like cheese is based off of the Chicago Mercantile Exchange. Retail accounts for about a 36% of butter sales • Some strong brand • Land O’Lakes maintains a 31% market share at retail. Ingredient Markets; • Nonfat dry milk - Very little retail sales - About 60% is used in other dairy and food products - A surplus dairy product • Dry whey: - Dry whey and whey protein concentrates. - Used in dairy and food products - Competitive on the export market Summary of Private Label Dairy Products in Supermarkets, 1999 Product Cheese Cottage cheese White milk Flavored milk Dips Sour cream Yogurt Ice cream Frozen novelties Volume share that is private label 35.2% 44.8% 70.1% 23.3% 15.7% 37.0% 20.8% 33.2% 26.7% Concern over farm-retail price spread: Fluid Milk: • Farm value and retail value move together over time. • Margin has increased , retail margin is about 25% - Not used as loss leader as much - Reduced competition at both wholesale and retail • Inverse relationship between change in Class I price and margin--when Class I increases both wholesale and retail margins decrease and vice versa. Butter: • Retail margin has widened, but highly variable. - Retail margin is about 20% • In 1980’s butter price stable due to federal price support. But support price reduced and since 1993 wholesale butter prices well above support. • Changes in farm value of milk and retail margins inversely related. Cheese: • Retail cheese prices and farm value of milk have been less closely related. - Reduced federal support price - Also time required for raw milk to be transformed into cheese and eventually sold at retail. - A lot of value-added---640 pound cheddar blocks need to to cut and wrapped for consumer sales. • Changes in farm value of milk and changes in retail margin inversely related. • Retail margin about 36% Ice Cream: • Farm value of milk and retail price not closely related. • Retail price has increased significantly past 5 years (up 40%) General comments on Retail Margins: Retail margins have increased due to: • Increased labor cost - However, output per employee in fluid plants increase more than 140% since 1970 and 150 % in dairy manufacturing firms. • Increased packaging costs • Increased fuel/energy cost • Changes in product packaging, composition-consumers demand convenience Continuation on changes in retail margin: • New product development • Reduced competition • Retailers have changed pricing strategy--now look to more profit from dairy case. Changes in farm-retail spread and farmer’s share of retail dollar: • Farm-retail spread increased 117.7% between 1982-84 and 2000. • Farmer’s share of retail dollar: - all dairy products: 36.0% in 1986 29.5% in 2000 - 1/2 gallon of milk 39% - Cheddar cheese 32% Summary Comments: • Wholesale and retail prices respond more quickly to farm level price increases than decreases. • Farm to retail spreads will likely widen due to more value added activities. • Retail concentration is putting pressure on wholesalers that serve them--need to get bigger in order to have market clout. • Retail food business is a low margin and high volume business. Retail Food and Beverage Firms Consolidating: • 1972 1997 218,300 firms 110,900 firms • Market share of top 4 firms: 1972 = 16.2% 1997 = 18.3% What do these large food customers want? On time delivery 100% fill rate Competitive price Safe/insured food Undamaged products More convenience products New leading edge products More & more fresh products Product information Marketing tools Knowledgeable sales people U.S. consumer will influence the structure of the U.S. food system from farm to consumer. • Moving to partnering relationships - seemless system - supply chain driven • Retail consolidation is resulting in lower returns to food manufacturers & marketers - manufacturers and marketers need to get more efficient, lower costs - need to get bigger Cooperatives wishing to compete in this rapidly changing food system must: • Get better, more efficient, cut cost • Be a reliable supplier • Have sufficient volume to have market clout • Consider strategic alliances with other cooperatives, with IOFs Summary continued: • Retail prices of dairy products have increased less than retail prices for all food. 1982-84 = 100 retail price index For 2000: All food = 167.8 Dairy products = 160.7